Embarking on a journey toward financial stability can feel like navigating uncharted waters, especially when the destination involves the well-being of your entire family. Many households grapple with the ebb and flow of income and expenses, often leading to stress, uncertainty, and missed opportunities for growth. The dream of saving for a child’s education, planning that dream vacation, or simply achieving a sense of security can seem out of reach without a clear roadmap.

That’s where a structured approach to managing your money becomes not just helpful, but essential. A well-designed Family Monthly Budget Planner Template serves as your compass, guiding you through the complexities of household finances. It transforms abstract financial goals into concrete, achievable steps, empowering families to take control of their economic future and build a foundation for lasting prosperity. This isn’t just about cutting costs; it’s about understanding where your money goes, aligning spending with your values, and making informed decisions that benefit everyone.

The Power of a Household Financial Plan

Establishing a robust household financial plan is one of the most impactful steps a family can take towards long-term security and peace of mind. It’s more than just a spreadsheet; it’s a living document that reflects your family’s priorities and financial reality. When you consistently track your income and outgoings, you gain invaluable insights into your spending habits, identifying areas of strength and opportunities for improvement.

The benefits extend far beyond simply knowing your numbers. A clear financial blueprint reduces stress by replacing guesswork with knowledge, helping to prevent those "where did all the money go?" moments. It facilitates open communication within the family about money matters, fostering shared goals and collective responsibility. Moreover, it accelerates debt repayment, builds emergency savings, and brings significant financial milestones, like homeownership or retirement, within closer reach.

Key Components of an Effective Spending Plan

A comprehensive monthly budget planner is built upon several fundamental elements that, when tracked consistently, provide a holistic view of your financial situation. Understanding these components is the first step toward creating a truly effective financial management system for your household. Each section plays a vital role in balancing your income with your expenditures.

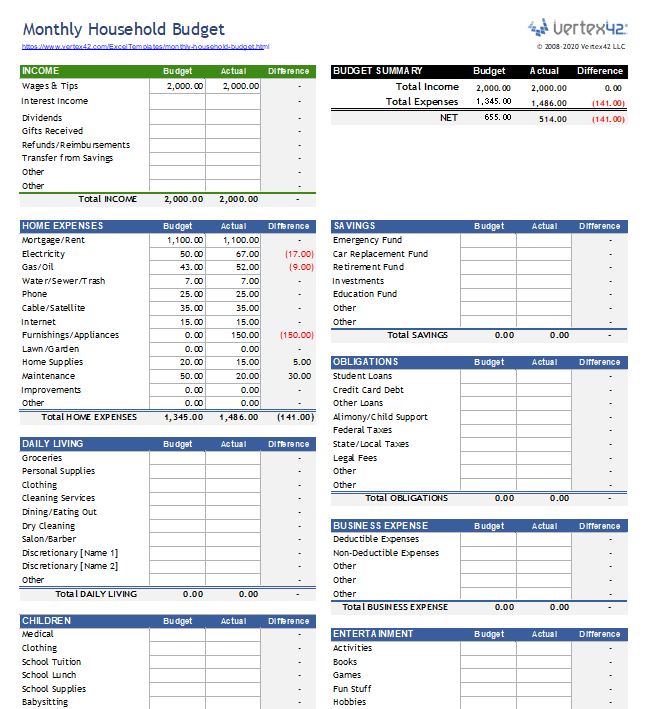

At its core, any family budget planner will require you to detail all sources of income. This includes salaries, freelance earnings, rental income, benefits, or any other money flowing into your household. It’s crucial to capture all streams to get an accurate total of available funds. Following income, the next critical element is distinguishing between different types of expenses.

- **Fixed Expenses:** These are predictable costs that typically remain the same each month. Examples include **mortgage or rent payments**, car loans, insurance premiums, and subscription services. They are relatively easy to plan for as their amounts are consistent.

- **Variable Expenses:** Unlike fixed costs, these fluctuate from month to month. Categories such as **groceries**, utilities, transportation (gas, public transport), and entertainment fall into this group. Managing variable expenses often requires more active tracking and adjustment.

- **Discretionary Spending:** This refers to non-essential expenditures that you can choose to cut back on if needed. This might include **dining out**, hobbies, shopping for non-essentials, or vacations. Identifying this category is key for finding areas to save.

- **Savings and Debt Repayment:** A crucial component often overlooked, dedicated allocations for savings (emergency fund, retirement, specific goals) and targeted debt repayment (credit cards, personal loans) should be integrated directly into your monthly spending tracker. Treating these as essential “expenses” ensures they are prioritized.

Getting Started with Your Family’s Financial Blueprint

Embarking on the journey of creating a tailored household budget worksheet can seem daunting, but breaking it down into manageable steps makes the process straightforward and effective. The goal is to build a practical and sustainable financial strategy that your family can consistently follow. Dedicate some focused time to gather all necessary information before you begin populating your chosen budgeting tool.

Start by collecting all financial documents from the past month or two. This includes bank statements, credit card statements, pay stubs, and any receipts for cash purchases. This comprehensive review will give you an accurate picture of your income and, more importantly, where your money is currently being spent. Often, simply seeing these numbers in black and white can be an eye-opening experience.

Next, input all your income sources into your family’s financial management system. Once income is established, meticulously list all your fixed expenses. These are the non-negotiables that come out consistently each month. Then, dive into your variable expenses, using your collected statements and receipts to categorize everything from groceries to entertainment. Be honest and thorough; accurate data is the foundation of a successful monthly spending guide.

Once you have a clear understanding of your income versus your expenses, you can begin to allocate funds. The power of a monthly spending plan lies in its ability to help you make intentional choices about your money. If your expenses exceed your income, identify areas where you can trim discretionary spending. If you have a surplus, decide how to best utilize it – whether for savings, debt reduction, or investment.

Customizing Your Budget for Unique Family Needs

While the core principles of budgeting remain universal, every family’s financial landscape is distinct, necessitating a personalized approach to their financial planning for households. A standard budget worksheet provides a solid framework, but its true power is unleashed when it is adapted to reflect your specific circumstances, challenges, and aspirations. Flexibility is paramount in ensuring your budget remains a helpful tool, not a restrictive burden.

Consider families with fluctuating income, such as those relying on commissions, seasonal work, or self-employment. For these households, a "buffer" month of savings can be invaluable, or an approach where expenses are covered by the lowest expected income, with surpluses allocated to savings or irregular bills. Similarly, single-parent households may need to factor in unique childcare costs or additional support systems.

Families with specific long-term goals, like saving for a large down payment or extensive college funds, will need to heavily prioritize these categories in their income and expense planner. Those managing significant medical expenses or special needs will allocate more to healthcare. The key is to view your family monthly budget planner as a dynamic instrument that can be adjusted as life changes occur. Regularly revisit your allocations, especially after major life events such as a new job, a new baby, or unexpected expenses, to ensure it continues to serve your family effectively.

Tips for Budgeting Success

Achieving financial mastery through a personal finance template requires more than just filling in numbers; it demands dedication, discipline, and a willingness to learn and adapt. Implementing these practical tips can transform your budgeting efforts from a chore into a rewarding habit that benefits every member of your household. Consistency and communication are your best allies on this journey.

Here are some strategies to help your family thrive with its financial management system:

- **Make it a Family Affair:** Involve older children and your partner in the budgeting process. This fosters **financial literacy** and shared responsibility, making everyone aware of the family’s monetary goals and limits.

- **Be Realistic and Honest:** Don’t create an overly restrictive budget that sets you up for failure. Be **truthful about your spending habits** and allocate realistic amounts, especially for variable categories like food and entertainment.

- **Track Consistently:** The most effective expense tracker is one that’s used regularly. Whether daily or weekly, consistent monitoring helps you stay aware of your spending and **catch potential overspending early**.

- **Automate Savings:** Set up automatic transfers from your checking account to your savings accounts each payday. This “pay yourself first” strategy ensures you build your savings without even thinking about it, making **financial goals** easier to achieve.

- **Build an Emergency Fund:** Prioritize creating a dedicated fund to cover 3-6 months of living expenses. This crucial safety net protects your family from **unexpected financial shocks**, preventing debt from unforeseen circumstances.

- **Celebrate Milestones:** Acknowledge and celebrate budgeting successes, no matter how small. Reaching a savings goal or successfully sticking to a category budget can provide **motivation and positive reinforcement** for everyone involved.

- **Review and Adjust Regularly:** Your life is not static, and neither should your budget be. Schedule monthly or quarterly reviews to assess what’s working, what isn’t, and **make necessary adjustments** to keep your budget relevant and effective.

Frequently Asked Questions

How long does it take to set up a monthly budget?

The initial setup of a comprehensive monthly budget planner can take anywhere from a few hours to a full weekend, depending on how organized your financial documents are. The most time-consuming part is often gathering all necessary income and expense information. Once the initial framework is in place, subsequent monthly updates should take significantly less time, typically 30-60 minutes.

What if our income fluctuates significantly each month?

For families with fluctuating income, it’s recommended to budget based on your lowest expected monthly income. Any additional income received beyond that baseline can then be allocated to savings, debt repayment, or a “buffer” fund for leaner months. This approach ensures you can always cover your essential expenses and provides a sense of security during unpredictable financial periods.

Should children be involved in family budgeting?

Absolutely! Involving children, especially those of school age, in age-appropriate aspects of family financial planning can be highly beneficial. It teaches them valuable lessons about money management, saving, and making choices. You can start with simple concepts like differentiating needs from wants, or letting them allocate a small portion of a family fun budget.

How often should we review our budget?

While you might track expenses daily or weekly, a full review of your family’s financial blueprint should ideally happen once a month. This allows you to compare your actual spending against your planned budget, identify discrepancies, and make any necessary adjustments for the upcoming month. A quarterly or annual deep dive can also be beneficial for long-term goal assessment.

What’s the biggest mistake families make when budgeting?

One of the most common mistakes is creating an unrealistic or overly restrictive budget that is impossible to stick to, leading to frustration and abandonment. Another significant error is failing to consistently track spending and review the budget regularly. A budget is a tool that needs active engagement to be effective; simply creating it and forgetting it won’t yield results.

Taking control of your family’s finances with a dedicated budgeting tool is more than just an administrative task; it’s an investment in your collective future. It provides the clarity and direction needed to navigate the financial landscape with confidence, turning potential anxieties into opportunities for growth and stability. Imagine the peace of mind that comes from knowing exactly where your money stands, and the shared excitement of achieving your family’s most cherished financial dreams.

Embrace the discipline of managing your money, and watch as your family transforms its financial outlook. Whether you’re aiming to eliminate debt, build a substantial emergency fund, save for a down payment, or plan for a comfortable retirement, a well-implemented financial strategy is the cornerstone of success. Start today, harness the power of informed decision-making, and empower your family to build a legacy of financial freedom and security for generations to come.