Navigating financial arrangements within a family can be a delicate dance, often fraught with good intentions that can, unfortunately, lead to misunderstandings or strain relationships. Whether it’s helping a sibling with a down payment, assisting a child with tuition, or supporting a parent through a difficult period, the decision to lend money to a loved one is usually driven by care and a desire to help. However, even the closest bonds require clarity when it comes to money, protecting both the lender’s generosity and the borrower’s future.

This is precisely where a robust, well-structured agreement becomes invaluable. Far from indicating a lack of trust, a formal document establishes a foundation of transparency and mutual understanding. For US readers immersed in the business and legal documentation niche, the concept of leveraging a professionally drafted solution like a family loan agreement template free of charge offers both peace of mind and significant practical advantages. It ensures that all parties are aligned on terms, expectations, and obligations, transforming a potentially ambiguous situation into a clear, legally sound transaction.

The Imperative of Formalizing Family Financial Arrangements

In today’s complex financial landscape, the notion that "blood is thicker than water" should not extend to blurring financial lines. Unwritten agreements, or those based solely on a handshake, are notoriously prone to misinterpretation. Memories fade, circumstances change, and what seemed clear at the outset can become a source of contention years down the line. A written loan agreement serves as an unambiguous record, detailing the specific commitments made by each party.

Furthermore, a formal document protects both the lender and the borrower from potential tax implications. Loans between family members can easily be misconstrued as gifts by the IRS if not properly documented with a clear repayment structure and, often, an appropriate interest rate. This can lead to unexpected tax liabilities for the lender, highlighting the critical importance of a clear, legally compliant contract.

Safeguarding Interests with a Defined Lending Framework

Utilizing a comprehensive agreement offers a multitude of benefits, extending far beyond simply outlining who owes what. It acts as a shield, protecting personal relationships from the erosion that financial disputes can cause. A well-drafted document provides a clear roadmap for repayment, anticipating potential issues and offering mechanisms for resolution.

The inherent value of a family loan agreement template free from cost is its ability to offer legal protection without the immediate expense of retaining an attorney for every single transaction. It empowers individuals to take control of their financial agreements, ensuring that all necessary clauses are present and understood. This structured approach fosters a professional demeanor in what is often a highly personal interaction, thereby strengthening the foundation of the loan itself.

Tailoring Your Agreement to Diverse Scenarios

A truly effective agreement template isn’t a one-size-fits-all solution; it’s a flexible framework designed for adaptation. While the core elements of any loan agreement remain consistent, the specifics will vary greatly depending on the nature of the loan and the parties involved. Consider the diverse range of scenarios: a parent lending money for a child’s business startup, a sibling providing short-term funds for a medical emergency, or an uncle assisting with a home renovation.

The ability to customize terms for varying industries or personal situations is crucial. For instance, a loan for a business venture might include clauses related to business performance or equity options, while a personal loan might focus more on flexible repayment schedules linked to future income. The template should allow for easy modification of interest rates, collateral requirements, default provisions, and more, ensuring it accurately reflects the unique agreement between the family members.

Key Components of a Robust Loan Document

Every sound loan agreement, regardless of its specific context, must include several fundamental clauses to ensure clarity, enforceability, and legal compliance. These provisions establish the groundwork for the loan, safeguarding the interests of both the lender and the borrower.

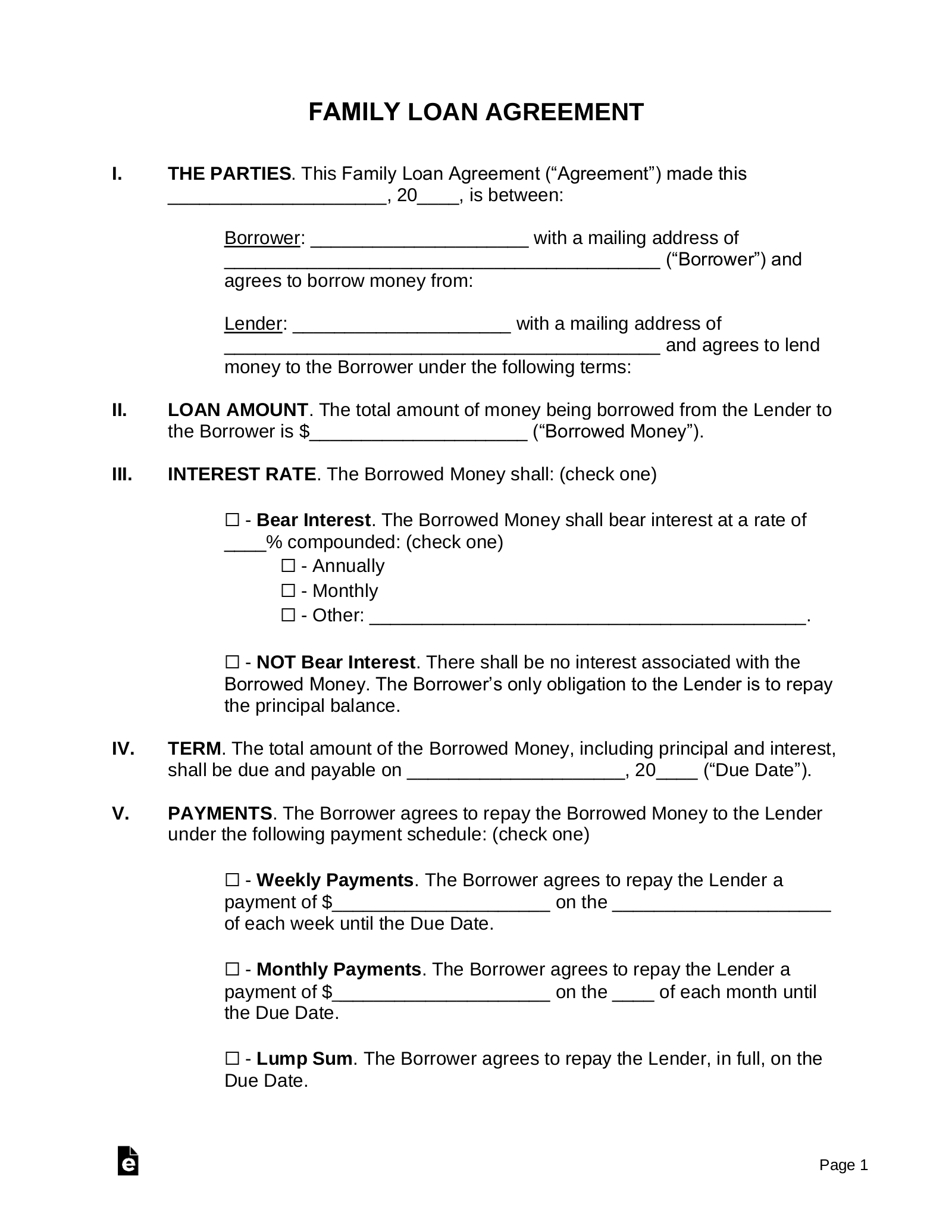

- Identification of Parties: Clearly state the full legal names and addresses of both the lender (creditor) and the borrower (debtor). This establishes who is bound by the agreement’s terms.

- Loan Amount and Terms: Specify the exact principal sum being loaned. Detail the interest rate (or state if it’s interest-free, noting potential IRS implications), the repayment schedule (e.g., monthly installments, lump sum, balloon payment), and the loan’s duration.

- Repayment Schedule: Outline the specific dates and amounts of each payment. Include details about how payments should be made (e.g., bank transfer, check).

- Default Clause: Define what constitutes a default (e.g., missed payments, bankruptcy). Crucially, specify the consequences of default, which might include acceleration of the loan, collection efforts, or the right to seize collateral.

- Collateral (if applicable): If the loan is secured, clearly describe the asset being used as collateral. Detail the conditions under which the lender can take possession of the collateral in case of default.

- Prepayment Option: State whether the borrower has the right to repay the loan early without penalty. This offers flexibility to the borrower.

- Governing Law: Specify the state laws that will govern the agreement. For US readers, this will typically be the state where the loan is initiated or where the parties reside.

- Signatures and Dates: Both the lender and the borrower must sign and date the document. It’s often advisable to have witnesses present or to notarize the signatures for added legal weight.

- Entire Agreement Clause: A statement affirming that this document represents the complete and final agreement between the parties, superseding any prior discussions or understandings.

- Severability Clause: If any part of the agreement is found to be unenforceable, this clause ensures the rest of the agreement remains valid.

Ensuring Clarity, Usability, and Accessibility

When preparing any legal document, particularly one intended for personal use by individuals who may not have extensive legal backgrounds, practical considerations for formatting and readability are paramount. A document’s effectiveness is not solely in its content but also in its presentation. Whether destined for print or digital distribution, it must be easy to understand and navigate.

Keep paragraphs short and concise, ideally two to four sentences, to avoid overwhelming the reader. Use clear, straightforward language, avoiding excessive legal jargon where possible. Headings and subheadings, like those in this article, are essential for breaking up text and guiding the reader through complex information. Bullet points, as demonstrated for essential clauses, can effectively highlight key information. For digital use, ensure the document is easily downloadable in common formats (e.g., PDF, Word) and compatible with various devices. If printing, use a legible font size and sufficient margins. A well-organized, visually appealing document enhances trust and ensures all parties fully grasp their obligations.

A family loan agreement template free to use stands as a testament to proactive planning and responsible financial stewardship. It transforms a potentially awkward or contentious situation into a structured, transparent process that respects the boundaries and financial well-being of all involved. By providing a clear framework for lending and repayment, it reinforces trust rather than diminishing it, offering a professional solution for personal circumstances.

Ultimately, leveraging such a resource is an investment in both financial security and familial harmony. It offers a professional, time-saving solution that mitigates risks, clarifies expectations, and provides a legally sound foundation for financial transactions within your closest circles. Embrace the power of documentation to safeguard your relationships and ensure peace of mind for everyone involved.