In the intricate world of business finance, clarity and precision are not just virtues; they are necessities. This is particularly true when dealing with loans between related parties, such as a company and its shareholders or associated entities. While the term "Division 7a" specifically references an Australian tax measure designed to prevent private company profits from being distributed tax-free to shareholders or their associates as disguised loans, the underlying principles it enforces—the critical need for formal, legally binding loan agreements for related-party transactions—resonate globally. For US businesses and their legal and financial advisors, understanding the rigor required in such arrangements, even if under different regulatory frameworks, is paramount.

Creating a robust, comprehensive, and legally sound loan agreement template for these scenarios isn’t merely good practice; it’s a strategic imperative. Such a template serves as a foundational document, providing a standardized yet adaptable framework for detailing the terms and conditions of these crucial financial dealings. It mitigates risks, prevents disputes, ensures compliance with various legal and accounting standards, and ultimately protects the interests of all parties involved. This article explores the profound value of employing a meticulously crafted division 7a loan agreement template, highlighting its benefits for anyone in the business and legal documentation niche seeking to professionalize their inter-entity financial arrangements.

The Imperative of Documented Financial Arrangements

The business landscape is fraught with potential pitfalls, and informal financial arrangements between related parties are among the riskiest. Without a clear, written agreement, the intent behind a cash transfer can be misconstrued, leading to significant legal, financial, and tax complications. Imagine a situation where a shareholder "borrows" funds from their company without any formal terms. Years later, a dispute arises, or an audit flags the transaction, and without documentation, proving it was a legitimate loan rather than an unrecorded distribution or an income event becomes exceedingly difficult.

A formal loan agreement eliminates ambiguity. It sets out the exact nature of the transaction, defining the roles and responsibilities of each party. This clarity is crucial for maintaining corporate governance, ensuring transparency, and providing an undeniable record for regulatory bodies or during due diligence. In the absence of such documentation, even well-intentioned transactions can collapse into contentious legal battles, erode trust, and incur substantial financial penalties or unforeseen tax liabilities, underscoring why robust documentation is universally vital, whether under Division 7a or any other regime governing related-party transactions.

Unlocking Protection and Efficiency with a Robust Framework

The strategic deployment of a pre-vetted loan agreement template offers a multitude of benefits, extending far beyond simple record-keeping. Firstly, it provides undeniable legal enforceability. Should a default occur or a dispute arise over repayment terms, a properly executed agreement serves as the bedrock of any legal recourse, clearly outlining the obligations and rights of both lender and borrower. This foundational protection is invaluable for safeguarding corporate assets and ensuring financial commitments are honored.

Moreover, such a template significantly enhances efficiency. Instead of drafting a new agreement from scratch for each related-party loan, a meticulously designed template streamlines the process. It ensures consistency in language, clauses, and structure across all similar transactions, saving considerable time and legal fees. This standardized approach also minimizes the risk of overlooking critical provisions, thereby bolstering compliance and reducing exposure to regulatory scrutiny. A well-constructed framework, like a division 7a loan agreement template, acts as a preventative measure, protecting against the unforeseen by laying out clear expectations from the outset.

Adapting Your Agreement for Diverse Business Needs

While the core principles of a loan agreement remain consistent, the specifics often need to be tailored to suit various industries, business structures, and unique scenarios. A highly effective loan agreement template isn’t rigid; it’s designed with flexibility in mind, allowing for easy customization to meet these diverse requirements. For instance, a loan to fund a new startup venture might require different repayment terms or collateral clauses than an inter-company loan for operational cash flow within an established group.

Consider the variables that might require adjustment: the specific loan amount, whether the interest rate is fixed or variable, the frequency and method of repayments (e.g., principal and interest vs. interest-only for a period), the type of security or collateral provided, and specific default triggers. The template should offer placeholders and guidance for these modifications. Whether it’s a loan for property acquisition, working capital, or a personal advance to a shareholder, the ability to adapt the underlying framework ensures that the agreement accurately reflects the unique commercial understanding and legal requirements of each transaction, providing a foundational yet adaptable document for various contexts.

Core Components of a Comprehensive Loan Agreement

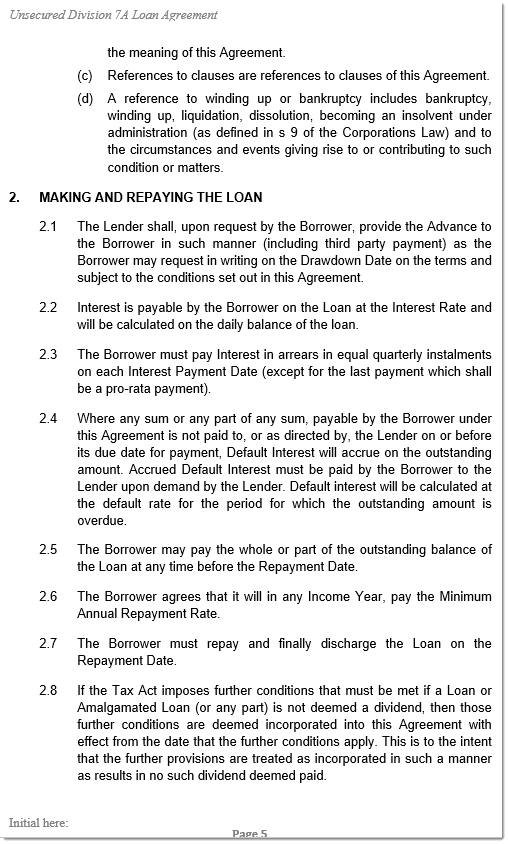

A robust loan agreement, especially one designed to meet the rigorous standards exemplified by regulations like Division 7a, must contain several essential clauses and sections to be complete and legally sound. These elements ensure all critical aspects of the loan are clearly defined and understood by all parties.

- Identification of Parties: Clearly state the full legal names, addresses, and other identifying information (e.g., company registration numbers) for both the Lender and the Borrower.

- Loan Amount and Currency: Specify the exact principal amount of the loan and the currency in which it is denominated.

- Interest Rate: Detail the annual interest rate, how it is calculated (e.g., simple, compound), how often it accrues, and any provisions for changes to the rate.

- Repayment Schedule: Outline the specific dates, amounts, and methods for principal and interest repayments. This includes whether payments are monthly, quarterly, or a lump sum at the end of the term.

- Term of the Loan: Define the duration of the loan, including the commencement date and the final repayment date.

- Representations and Warranties: Statements by both parties confirming certain facts (e.g., legal capacity to enter the agreement, accuracy of financial information).

- Covenants: Obligations or restrictions placed on the Borrower (e.g., maintaining certain financial ratios, not incurring further debt without consent). These can be affirmative (what the Borrower must do) or negative (what the Borrower must not do).

- Events of Default: Clearly list the circumstances under which the Borrower would be considered in default (e.g., non-payment, breach of covenants, insolvency).

- Remedies Upon Default: Specify the actions the Lender can take if a default occurs, such as demanding immediate repayment of the outstanding balance, enforcing security, or charging penalty interest.

- Security/Collateral: Describe any assets pledged by the Borrower to secure the loan, including details of the security interest granted and any perfection requirements.

- Governing Law and Jurisdiction: Identify the specific state or country’s laws that will govern the agreement and the jurisdiction for resolving any disputes.

- Confidentiality: Clauses protecting sensitive information shared during the loan process, if applicable.

- Assignment: Provisions regarding whether the rights and obligations under the agreement can be assigned to other parties.

- Entire Agreement: A clause stating that the document constitutes the entire agreement between the parties, superseding all prior discussions.

- Notices: Specifies how formal communications between the parties should be delivered.

- Signatures: Spaces for authorized representatives of both parties to sign and date the agreement, often with witness signatures if required by law or preference.

Designing for Clarity and Practical Application

A meticulously drafted loan agreement template is only effective if it is clear, easy to understand, and practical for both digital and print use. Beyond the legal accuracy of its clauses, its formatting and presentation play a critical role in its usability and readability. The goal is to create a document that legal professionals, accountants, and business owners can quickly grasp and execute without confusion.

Start with a logical flow. Sections should progress naturally from identifying the parties to defining the loan, outlining repayment, and detailing contingencies. Use clear, concise language, avoiding overly complex legal jargon where simpler terms suffice. Short paragraphs (2-4 sentences) and ample white space improve readability significantly. Headings and subheadings should be used judiciously to break up text and guide the reader through the document’s structure. For digital use, consider features like fillable fields, dropdown menus for standardized choices, and compatibility with electronic signature platforms. For print, ensure appropriate margins, font sizes, and consistent formatting throughout. Professionalism in presentation reinforces the seriousness and legal weight of the document, making it an effective and trustworthy tool for managing related-party financial obligations.

In the complex landscape of inter-entity financial transactions, the value of a well-structured and legally compliant loan agreement cannot be overstated. A comprehensive division 7a loan agreement template, though originating from a specific regulatory context, embodies the universal need for meticulous documentation in related-party dealings. It acts as a bulwark against disputes, a guarantor of transparency, and a powerful tool for maintaining fiscal and legal integrity.

By adopting such a template, businesses and their advisors gain more than just a document; they acquire a strategic asset. It represents a commitment to best practices, saving invaluable time and resources that would otherwise be spent on bespoke legal drafting or, worse, on resolving costly legal conflicts stemming from informal arrangements. Ultimately, leveraging a professional, adaptable, and clearly articulated loan agreement template is a foundational step towards robust financial governance and long-term business resilience.