In the evolving landscape of modern commerce, where recurring payments form the backbone of countless businesses, the efficiency and reliability of financial transactions are paramount. Direct debits have emerged as a critical mechanism for collecting scheduled payments, offering convenience to customers and predictable revenue streams for businesses. From subscription services and utility providers to SaaS companies and financial institutions, the ability to automate these transactions is a cornerstone of operational success.

However, the seamless automation of payments rests upon a foundation of clear understanding and mutual consent. This is precisely where a meticulously crafted direct debit agreement template becomes indispensable. It serves not merely as a formality but as a vital legal instrument that delineates the terms, conditions, and authorizations governing recurring financial interactions. For any entity engaged in regular billing, or indeed for customers seeking transparency in their financial commitments, such a template provides clarity, reduces ambiguity, and safeguards the interests of all parties involved.

The Imperative for Formalized Payment Mandates

In today’s complex regulatory environment, informal agreements simply no longer suffice. The increasing scrutiny from consumer protection agencies and financial oversight bodies demands that businesses operate with utmost transparency and adherence to established legal frameworks. A clearly written agreement is your first line of defense against misunderstandings, disputes, and potential legal challenges.

Beyond legal compliance, a well-defined document fosters trust. When customers understand exactly what they are agreeing to – including payment amounts, frequencies, and cancellation procedures – they are more likely to feel secure and valued. This transparency builds stronger customer relationships and reduces churn often associated with opaque billing practices.

Unlocking the Advantages of a Standardized Document

Implementing a robust direct debit agreement template offers a multitude of benefits that extend far beyond mere compliance. For businesses, it provides a consistent, legally sound framework for every transaction, ensuring uniformity and reducing the administrative burden associated with creating bespoke agreements for each customer.

One of the primary advantages is significant risk mitigation. By clearly outlining the obligations and rights of both the payer and the payee, the template helps prevent disputes before they arise. It establishes clear protocols for issues like payment failures, changes in terms, or cancellation requests, offering a roadmap for resolution rather than escalating conflict. Furthermore, a standardized contract ensures that your operations align with industry best practices and legal requirements, protecting your business from potential penalties or reputational damage.

Adapting Your Agreement Across Sectors

While the core principles of a direct debit authorization remain consistent, the specific details and supplementary clauses can vary significantly depending on the industry and the nature of the service provided. A versatile agreement template is designed to be highly customizable, allowing businesses to tailor it to their unique operational context without having to start from scratch every time.

Consider a gym membership, for instance. The agreement would likely include clauses related to membership tiers, facility access rules, and perhaps health disclaimers. In contrast, a software-as-a-service (SaaS) provider’s document would focus more on licensing terms, service level agreements (SLAs), data privacy, and intellectual property. Utility companies might incorporate details about meter readings and service interruptions. The key is to leverage the template’s structure while injecting industry-specific terms and conditions that are directly relevant to the service or product being offered.

Anatomy of a Robust Payment Mandate

Every effective direct debit agreement, regardless of its industry application, must contain several essential clauses to ensure clarity, legal enforceability, and comprehensive protection for all parties. These elements form the backbone of a reliable recurring payment system.

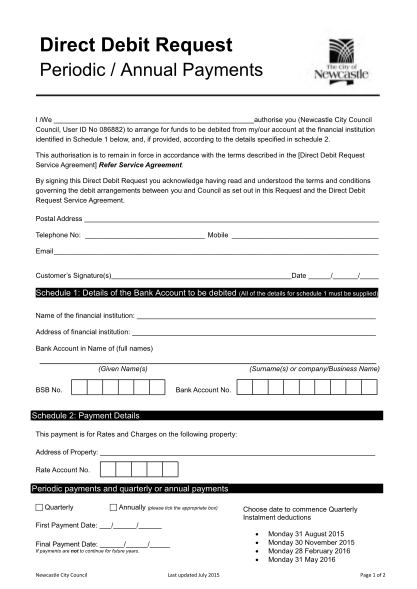

- Identification of Parties: Clearly name and provide contact information for both the payee (the business collecting the payment) and the payer (the customer or client authorizing the payment). This includes legal names, addresses, and any relevant account numbers.

- Payment Authorization Statement: A clear, unambiguous statement by the payer authorizing the payee to debit their designated bank account for specific amounts and frequencies. This is the cornerstone of the entire agreement.

- Payment Details: Specify the exact amount to be debited (or a clear method for calculating variable amounts), the frequency of payments (e.g., weekly, monthly, quarterly, annually), and the agreed-upon payment date or period.

- Bank Account Information: Securely collect the payer’s bank name, account number, and routing number. Emphasize the importance of accurate information for successful transactions.

- Amendment and Variation Clause: Outline the process for how changes to the agreement (e.g., changes in payment amount, frequency, or terms) will be communicated to the payer and how their consent will be obtained.

- Cancellation/Termination Procedures: Detail how either party can cancel the direct debit authorization, including required notice periods, methods of notification, and any implications for outstanding payments or service termination.

- Dispute Resolution Mechanism: Establish a clear process for handling disputes or queries related to payments, including contact information for customer service and steps for resolving discrepancies.

- Liability and Indemnity: Define the responsibilities of each party and specify conditions under which one party may be held liable or indemnify the other. This often covers issues arising from erroneous payments or unauthorized debits.

- Governing Law: State the jurisdiction whose laws will govern the interpretation and enforcement of the agreement, typically the state where the business operates or where the contract is entered into.

- Confidentiality and Data Protection: Acknowledge the handling of sensitive financial information and include clauses regarding data security, privacy, and compliance with relevant regulations like GDPR or CCPA, if applicable.

- Full Terms and Conditions Reference: If the direct debit relates to a larger service agreement, ensure a clear reference or integration of those overarching terms and conditions.

- Signature Blocks: Spaces for authorized representatives of both parties to sign and date the document, indicating their full understanding and acceptance of the terms.

Best Practices for Document Presentation and Usability

An agreement is only effective if it’s understood and easily accessible. Beyond its legal content, the presentation and usability of your direct debit agreement template play a crucial role in its efficacy. Prioritizing readability ensures that customers can quickly grasp key terms, fostering a sense of transparency and reducing the likelihood of future disputes.

Employ clear, concise language, avoiding unnecessary legal jargon wherever possible. Utilize headings, subheadings, bullet points, and numbered lists to break up dense text, making the document easy to scan and comprehend. A professional layout with ample white space, legible fonts, and a logical flow enhances the user experience, whether the document is presented digitally or in print. For digital versions, consider interactive elements or clear navigation. Always ensure that the document is easy to save, print, and refer back to, and implement a robust version control system to track any updates or revisions.

In the dynamic world of automated payments, a well-structured direct debit agreement template is more than just a piece of paperwork; it’s a strategic asset. It underpins financial stability, secures customer trust, and ensures operational compliance. By investing time in customizing and implementing a comprehensive agreement, businesses can streamline their payment processes, minimize legal exposure, and focus on delivering exceptional value to their clients.

Embracing such a professional, time-saving solution empowers organizations to navigate the complexities of recurring billing with confidence. It allows for the proactive management of customer expectations and the robust protection of financial interests, making it an indispensable tool for sustainable growth in any sector reliant on automated transactions.