Navigating the complexities of financial obligations, whether as a debtor seeking relief or a creditor aiming to recover funds, often leads to the critical juncture of debt settlement. This process, while offering a pragmatic path forward, is inherently fraught with potential misunderstandings and disputes if not meticulously documented. A clear, comprehensive agreement is not merely a formality; it is the bedrock upon which both parties can build a resolution, providing certainty and protecting their respective interests. Without a formal record, even the most well-intentioned verbal agreements can unravel, leaving both sides vulnerable to protracted legal battles and financial uncertainty.

For businesses dealing with collections, individuals facing overwhelming debt, or legal professionals facilitating these arrangements, the need for robust documentation is paramount. This is where a well-structured debt settlement agreement letter template becomes an invaluable asset. It standardizes the often-intricate process of formalizing a settlement, ensuring that all crucial terms are addressed systematically. More than just a boilerplate document, it serves as a powerful tool for clarity, compliance, and dispute prevention, empowering users to approach financial resolutions with confidence and professionalism.

The Indispensable Nature of Written Financial Agreements

In today’s fast-paced business and legal environments, the importance of committing financial arrangements to writing cannot be overstated. Verbal agreements, no matter how sincere, are notoriously difficult to prove and enforce. They leave ample room for misinterpretation, memory lapses, or outright denial, all of which can quickly escalate into costly litigation. A written document, conversely, provides an immutable record of the agreed-upon terms, offering a tangible reference point that defines the obligations and expectations of all parties involved.

Beyond mere proof, a formal written agreement instills a sense of professionalism and commitment. It signifies that both the creditor and the debtor are serious about resolving the debt and are willing to abide by the stipulated conditions. This formality can greatly reduce anxiety and foster trust, paving the way for a smoother, more efficient settlement process. For legal professionals, such documents are essential tools for due diligence, ensuring their clients’ interests are rigorously protected and that all legal requirements are met.

Advantages of a Standardized Agreement Framework

Utilizing a pre-designed agreement framework offers a multitude of benefits that extend beyond simply putting words on paper. Primarily, it significantly streamlines the drafting process. Instead of starting from scratch, users can leverage a professionally curated structure, saving considerable time and reducing the potential for oversight. This efficiency is particularly valuable for businesses handling multiple settlement cases or individuals seeking a clear path through a stressful situation.

Furthermore, a template acts as a protective shield. It incorporates essential legal language and clauses that might otherwise be overlooked, ensuring compliance with relevant laws and regulations. This reduces the risk of inadvertently creating an unenforceable agreement or exposing either party to future liabilities. The consistency provided by a standardized form also ensures that all critical aspects of the agreement are covered systematically, from the identification of parties to the specifics of payment and release. This comprehensive approach helps prevent future disputes by leaving no room for ambiguity, ultimately safeguarding the interests of both the debtor and the creditor with a solid, legally sound debt settlement agreement letter template.

Adapting the Framework Across Diverse Contexts

The versatility of a well-designed agreement framework is one of its most compelling features. While the core purpose of settling a debt remains constant, the specifics can vary wildly depending on the industry, the type of debt, and the unique circumstances of the parties involved. A robust template is built with flexibility in mind, allowing it to be easily adapted to a myriad of scenarios without sacrificing its fundamental legal integrity.

For instance, a template used for settling a personal credit card debt might be customized to include specific clauses related to consumer protection laws, whereas one for a commercial debt might emphasize lien releases or corporate guarantees. Healthcare providers settling patient bills, landlords resolving rental arrears, or suppliers negotiating outstanding invoices can all tailor a base debt settlement agreement letter template to reflect their particular operational realities and regulatory environments. This adaptability ensures that the document remains relevant and effective, whether dealing with a single individual or a complex corporate entity, providing a tailored yet reliable solution for diverse financial arrangements.

Core Components of an Effective Settlement Document

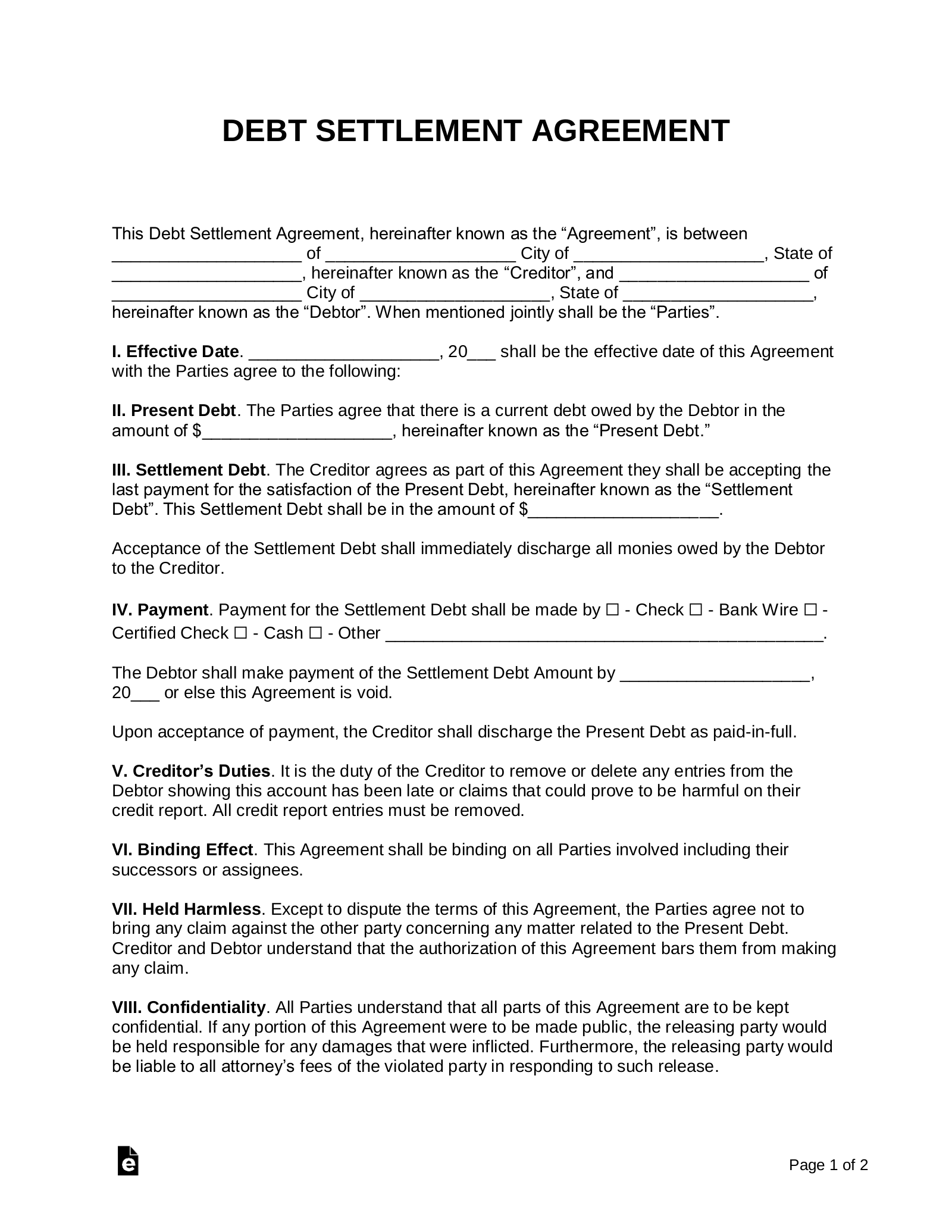

Every comprehensive agreement, regardless of its specific application, must contain certain fundamental elements to be legally sound and fully effective. These clauses ensure that all critical aspects of the settlement are clearly defined, leaving no room for doubt or subsequent disagreement. When drafting or customizing a debt settlement agreement letter template, pay close attention to the inclusion and precise wording of the following sections:

- Identification of Parties: Clearly state the full legal names and contact information of both the creditor and the debtor. If applicable, include details for any authorized representatives or legal counsel.

- Original Debt Details: Provide a precise description of the debt being settled, including the original amount, account numbers, and the date(s) the debt was incurred. This links the settlement directly to the specific financial obligation.

- Settlement Amount and Terms: Explicitly state the agreed-upon reduced settlement amount. Detail the payment schedule, including the total lump sum or installment plan, due dates, and acceptable payment methods.

- Release of Claims: This crucial clause outlines that upon full and timely payment of the settlement amount, the creditor releases the debtor from any further claims or obligations related to the original debt. It should specify that this release is contingent upon performance.

- Confidentiality Clause (Optional but Recommended): If desired by either party, include language that prevents the disclosure of the settlement terms to third parties, protecting the privacy of both the debtor’s financial situation and the creditor’s settlement practices.

- No Admission of Liability: Often included to clarify that entering into the settlement does not constitute an admission of fault or liability by the debtor regarding the original debt, especially in disputed cases.

- Governing Law: Specify the jurisdiction (state and/or country) whose laws will govern the interpretation and enforcement of the agreement.

- Entire Agreement Clause: States that the written agreement constitutes the complete and final understanding between the parties, superseding any prior verbal or written communications.

- Modification Clause: Outlines the requirements for any future amendments to the agreement, typically requiring a written instrument signed by both parties.

- Signatures and Dates: Ensure adequate space for the dated signatures of all parties involved, signifying their acceptance and understanding of the terms. If appropriate, include spaces for witness signatures or notarization.

Enhancing Readability and Usability for Professional Documents

Beyond the legal substance, the presentation and structure of any formal document significantly impact its usability and the perception of professionalism. A meticulously crafted settlement form should not only be legally sound but also easy to navigate and understand for all parties, whether it’s viewed on a screen or printed. Thoughtful formatting enhances clarity and reduces the likelihood of misinterpretation, which is vital when dealing with sensitive financial matters.

To maximize the effectiveness of a debt settlement agreement letter template, consider these practical tips: use clear, concise language, avoiding excessive legal jargon where simpler terms suffice. Employ headings and subheadings to break down the document into logical, digestible sections. Utilize bullet points or numbered lists for complex details or conditions, as demonstrated above, to improve scannability. Maintain consistent formatting for fonts, spacing, and alignment to project a polished and professional image. For digital use, ensure the document is easily editable and savable in common formats, while for print, confirm that page breaks are logical and margins are sufficient for binding or filing. A user-friendly design ultimately reinforces the document’s authority and facilitates its proper execution.

In an environment where financial agreements can dictate an individual’s future or a business’s solvency, the strategic use of a reliable debt settlement agreement letter template is an indispensable practice. It not only streamlines the often-onerous process of formalizing debt resolutions but also instills confidence through its inherent clarity and legal robustness. For legal and business professionals alike, this tool is more than just a convenience; it’s a foundational element for responsible and efficient financial management, ensuring that every agreement is well-defined and legally defensible.

Ultimately, investing in a high-quality, customizable template minimizes risks, saves valuable time, and fosters transparent communication between debtors and creditors. It transforms a potentially contentious negotiation into a structured, manageable process, culminating in a mutually understood and enforceable agreement. By providing a clear roadmap for financial resolution, a well-executed template empowers all parties to move forward with certainty and peace of mind.