In the intricate world of finance and business, the transfer of debt obligations is a common yet often complex transaction. Whether a financial institution sells a loan portfolio, a business factors its receivables, or an individual transfers a personal loan, the underlying mechanism for legal and clear conveyance is paramount. Without precise documentation, these transfers can quickly devolve into ambiguity, legal disputes, and significant financial liabilities.

This is where a robust debt assignment agreement template becomes an indispensable asset. It provides the structured legal framework necessary to execute such transfers with clarity and confidence. Professionals in legal departments, corporate finance, debt collection, and M&A will find immense value in a well-drafted template, enabling them to navigate these transactions efficiently, mitigate risks, and ensure full compliance with legal requirements.

The Indispensable Role of Formal Debt Transfer Documentation

In today’s fast-paced commercial environment, relying on informal arrangements or verbal understandings for debt transfers is an invitation to future complications. The legal landscape surrounding financial obligations is highly regulated, and any ambiguity can lead to severe consequences for all parties involved: the assignor (original creditor), the assignee (new creditor), and the debtor. A comprehensive written agreement clarifies all terms, conditions, and expectations.

Such documentation serves as a definitive record, preventing misunderstandings about the exact nature of the debt being transferred, the consideration exchanged, and the rights and responsibilities of each party post-assignment. It solidifies the transaction in a legally binding manner, offering undeniable proof of the transfer and its terms, which is critical in case of disputes or litigation. This clarity is not just a matter of good practice; it’s a fundamental requirement for sound business operations and legal compliance.

Key Benefits and Protections of a Standardized Contract Form

Utilizing a meticulously designed contract form for debt transfers offers a multitude of advantages beyond mere documentation. Primarily, it instills legal certainty, clearly delineating who owes what to whom, and under what conditions. This proactive approach significantly reduces the potential for future disputes by preemptively addressing common points of contention.

A well-crafted debt assignment agreement template acts as a crucial safeguard, protecting the interests of both the assignor and the assignee. For the assignor, it confirms the release of their interest in the debt, while for the assignee, it validates their newly acquired rights to pursue collection. Furthermore, it streamlines the entire transfer process, saving valuable time and resources that would otherwise be spent drafting bespoke agreements for each transaction, thereby enhancing operational efficiency and reducing legal costs.

Customizing the Agreement for Diverse Business Scenarios

While a standardized agreement provides an excellent starting point, its true strength lies in its adaptability. The context of debt assignment can vary wildly, from the bulk sale of delinquent accounts to the transfer of a single commercial loan as part of an acquisition. Each scenario may present unique requirements that necessitate specific adjustments to the base template.

For instance, a template used for factoring accounts receivable will need different clauses than one for the transfer of a secured mortgage loan. Businesses involved in different sectors—such as healthcare, technology, or real estate—may also have specific regulatory considerations that must be reflected in the document. Engaging legal counsel to tailor the underlying terms and conditions ensures that the agreement accurately reflects the transaction’s specifics and remains compliant with all applicable state and federal laws, offering robust protection in various industry-specific contexts.

Essential Clauses for Comprehensive Debt Transfer Agreements

A robust debt transfer document must contain several critical sections to ensure legal enforceability and clarity. These clauses form the backbone of the agreement, outlining the rights, obligations, and specifics of the debt being assigned. Missing or unclear clauses can expose parties to significant risk.

Every comprehensive agreement should contain, at a minimum, the following essential elements:

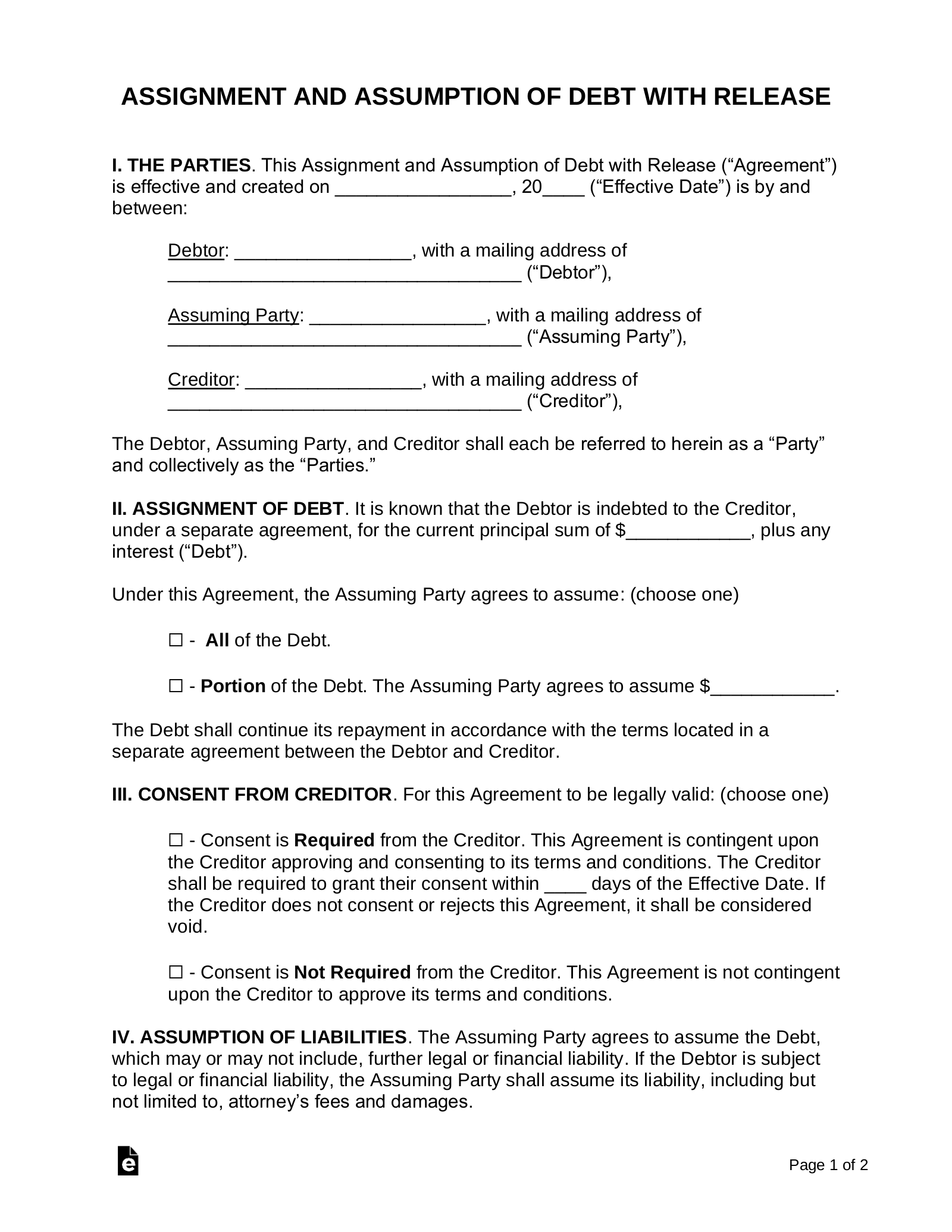

- Identification of Parties: Clearly name and identify the Assignor (the current creditor), the Assignee (the new creditor), and the Debtor (the party owing the debt). Include full legal names and addresses.

- Description of Debt: Provide a precise and detailed description of the debt being assigned. This includes the original amount, current outstanding balance, any applicable interest rates, the original date of the debt, maturity date, and any underlying collateral or security interests. Reference to original loan agreements or promissory notes is crucial.

- Assignment Clause: A clear and unambiguous statement that the Assignor irrevocably assigns, transfers, and conveys all its rights, title, and interest in the described debt to the Assignee.

- Consideration: Specify the value exchanged for the assignment of the debt. This could be a monetary payment, a reciprocal agreement, or other valuable consideration, clearly stating the amount and terms of payment.

- Representations and Warranties: Statements from the Assignor guaranteeing certain facts about the debt, such as its validity, enforceability, the absence of any prior assignments, and that no defenses or set-offs exist to the Assignor’s knowledge.

- Covenants: Obligations and promises made by both the Assignor and Assignee that must be performed after the agreement is executed. This might include the Assignor’s promise to notify the Debtor of the assignment or the Assignee’s agreement to certain collection practices.

- Indemnification: Clauses that protect one party from potential liabilities or losses arising from the actions or omissions of the other party, particularly concerning the debt’s history or future collection efforts.

- Governing Law and Jurisdiction: Designate the specific state or federal law that will govern the interpretation and enforcement of the agreement, as well as the jurisdiction where any disputes will be resolved.

- Notice Provisions: Outline how and when formal communications and notices between the parties will be delivered effectively.

- Confidentiality: If sensitive information is exchanged, a clause to protect its confidentiality and restrict its use to the purposes of the assignment.

- Signatures and Execution Date: The physical signatures of authorized representatives of the Assignor and Assignee, along with the date the agreement is entered into force.

- Exhibits and Schedules: Attachments that provide further detail, such as a comprehensive list of assigned accounts, original loan documents, or other relevant supporting materials.

Enhancing Usability and Readability for Professional Documents

Beyond the legal substance, the presentation of a debt assignment agreement significantly impacts its usability and overall effectiveness. A document that is difficult to read or navigate can lead to confusion, errors, and wasted time, even if its legal content is sound. Therefore, attention to formatting, language, and structure is crucial for any professional legal document.

Employing clear, concise language free of unnecessary legalese helps ensure that all parties, including non-legal personnel, can understand their obligations. Logical organization with distinct headings and subheadings, short paragraphs (typically 2-4 sentences), and appropriate use of bullet points or numbered lists improves readability. Consistent formatting, including font choices, spacing, and bolding for emphasis, contributes to a polished and professional appearance. For digital use, ensuring the document is easily searchable and accessible across different platforms is also a key consideration, facilitating quick reference and efficient document management for all stakeholders.

The strategic deployment of a comprehensive debt assignment agreement template is more than just a legal formality; it is a critical business decision that underpins financial stability and operational efficiency. It serves as a bulwark against potential disputes, clarifies complex financial transfers, and ensures adherence to the regulatory demands of the modern financial landscape. By offering a structured, reliable, and adaptable framework, such a template empowers businesses and legal professionals to execute debt assignments with confidence and precision.

Embracing this professional, time-saving solution allows organizations to streamline their debt management processes, minimize legal exposure, and allocate valuable resources to core business activities. While the template provides an invaluable foundation, it is always prudent to seek legal review for specific, complex transactions to ensure absolute compliance and protection. In essence, a well-implemented debt assignment agreement template is not just a document; it’s an essential tool for robust and responsible financial governance.