Navigating the complexities of temporary asset acquisition, particularly in situations where immediate payment isn’t feasible, has become an increasingly common scenario for businesses and individuals alike. Whether it’s a replacement vehicle after an accident, specialized equipment for an urgent project, or temporary machinery to maintain operations, the concept of credit hire bridges a critical gap. It allows the user to access necessary assets immediately, with the understanding that payment will be deferred, often pending an insurance claim or a project’s completion.

Understanding the nuances of a credit hire agreement template is crucial for ensuring smooth operations, mitigating risks, and protecting all parties involved. This comprehensive guide delves into the significance of such a document, exploring its core components, benefits, and how a meticulously crafted template can serve as an invaluable tool in the modern business and legal landscape. For anyone involved in providing or utilizing temporary assets on a credit basis, a robust, customizable agreement is not just a convenience—it’s a necessity.

The Indispensable Role of Written Agreements Today

In today’s fast-paced commercial environment, the value of a clear, legally sound written agreement cannot be overstated. Verbal agreements, while sometimes convenient, offer little protection when disputes arise, often leading to costly litigation, damaged reputations, and strained business relationships. A detailed contract serves as the bedrock of any professional transaction, laying out expectations, responsibilities, and remedies with precision.

This clarity becomes even more critical in credit hire scenarios, where the asset’s value, the duration of its use, and the eventual payment structure can be complex. A written document ensures that both the hirer (the party providing the asset) and the hirer (the party using it) have a transparent understanding of their obligations. It significantly reduces ambiguity, prevents misunderstandings, and provides a clear point of reference should any questions or disagreements emerge, thereby safeguarding the interests of all stakeholders.

Core Benefits and Safeguards This Template Offers

Leveraging a well-designed credit hire agreement template offers a multitude of advantages that extend far beyond mere legal compliance. Firstly, it provides unparalleled clarity, outlining all terms and conditions in an accessible format. This transparency fosters trust between parties, ensuring everyone is on the same page regarding the asset, hire period, costs, and responsibilities.

Secondly, the template acts as a powerful risk mitigation tool. By clearly defining liability for damage, loss, or misuse of the hired asset, it protects the asset provider from unforeseen financial burdens. For the hirer, it clarifies their responsibilities and limitations, preventing unexpected charges. Moreover, a standardized template ensures consistency across all your credit hire transactions, streamlining your processes and significantly reducing the time and legal expenses associated with drafting bespoke agreements for every single interaction. This efficiency allows businesses to operate more fluidly and focus on their core objectives.

Tailoring Your Agreement for Diverse Applications

One of the most significant strengths of a comprehensive agreement template is its inherent adaptability. While the fundamental principles of credit hire remain consistent, the specifics can vary wildly depending on the asset being hired, the industry, and the particular circumstances. A versatile template is designed with this flexibility in mind, allowing for easy customization to suit a broad spectrum of needs.

Consider, for instance, the difference between hiring a replacement luxury vehicle after an insurance incident versus securing heavy construction equipment for a short-term infrastructure project. The template can be adjusted to specify different insurance requirements, maintenance schedules, delivery and collection protocols, and even the calculation of credit charges. Businesses can modify clauses to reflect sector-specific regulations, integrate unique payment plans, or include specialized conditions pertinent to their operations, ensuring the document remains relevant and legally robust across various contexts.

Defining Essential Clauses for a Robust Contract

A strong credit hire agreement template is built upon a foundation of essential clauses, each addressing a critical aspect of the transaction. Omitting any of these key sections can leave significant gaps, potentially exposing parties to unnecessary risks and disputes. When customizing your template, ensure these core components are thoroughly addressed:

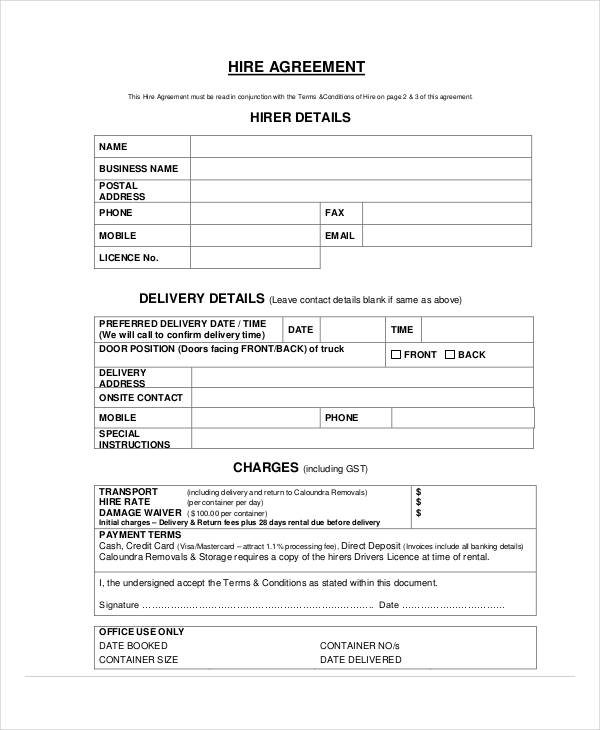

- Parties to the Agreement: Clearly identify the full legal names and contact details of both the hirer (provider) and the hirer (user).

- Description of the Hired Asset: Provide a detailed description of the asset, including make, model, year, VIN/serial number, and any specific features or accessories. Document its condition at the commencement of hire.

- Hire Period: Specify the start and end dates of the hire, including provisions for early termination or extension.

- Payment Terms and Credit Arrangement: Detail how and when the hire charges will be calculated and paid. This is crucial for a credit hire agreement template, as it outlines the deferred payment schedule, the basis for calculation (e.g., daily rate), and any late payment penalties or interest.

- Insurance Obligations: Clearly state which party is responsible for insuring the asset, the minimum coverage required, and any deductible amounts.

- Responsibilities of the Hirer: Outline the hirer’s duties, such as proper use, maintenance, reporting damage, and restrictions on use (e.g., geographic limitations).

- Liabilities and Indemnities: Define liability for damage, loss, theft, or third-party claims arising from the asset’s use, and specify indemnification clauses.

- Termination: Detail the conditions under which either party can terminate the agreement, including notice periods and consequences of termination.

- Return of Asset: Specify the condition in which the asset must be returned, the location for return, and any charges for late return or damage.

- Dispute Resolution: Outline the preferred method for resolving disputes, such as negotiation, mediation, or arbitration, before resorting to litigation.

- Governing Law and Jurisdiction: Identify the state laws that will govern the agreement and the jurisdiction for any legal proceedings.

- Force Majeure: Include a clause outlining what happens in the event of unforeseeable circumstances that prevent either party from fulfilling their obligations.

- Confidentiality: If applicable, include provisions regarding the handling of sensitive information exchanged during the agreement.

- Entire Agreement: State that the written document constitutes the entire agreement between the parties, superseding all prior discussions or understandings.

Enhancing Usability and Readability: Practical Tips

Beyond the legal substance, the practical presentation of your agreement template significantly impacts its effectiveness. A document that is difficult to read or navigate can lead to misunderstandings, even if its content is legally sound. Prioritizing usability and readability ensures that all parties can easily comprehend their commitments.

For both print and digital use, employ clear, concise language, avoiding excessive legal jargon wherever possible. When technical terms are necessary, provide clear definitions. Use consistent formatting throughout, including ample white space, legible font sizes, and well-organized headings and subheadings. Bullet points and numbered lists, as demonstrated for the essential clauses, are excellent for breaking down complex information into digestible segments. For digital templates, consider incorporating fillable fields for easy customization and electronic signature capabilities to streamline the agreement process. A user-friendly design enhances professionalism and encourages careful review by all signatories.

In the fast-evolving landscape of business transactions, the ability to quickly and reliably establish clear contractual terms is a significant competitive advantage. A professionally developed credit hire agreement template offers not just legal protection but also operational efficiency, saving invaluable time and resources that would otherwise be spent on bespoke drafting or dispute resolution. It empowers businesses to engage in credit hire arrangements with confidence, knowing that a robust framework supports every interaction.

Ultimately, leveraging a professional credit hire agreement template empowers parties to focus on their core objectives, secure in the knowledge that their temporary asset arrangements are underpinned by a transparent, legally sound, and mutually understood document. This proactive approach to documentation is a hallmark of diligent business practice, fostering trust and enabling seamless operations in an often complex environment.