In the intricate world of finance and lending, clarity is not just a preference; it’s a fundamental necessity. Navigating the legal and financial obligations of a loan arrangement requires a robust framework that meticulously outlines every term and condition. For businesses, financial institutions, and even private lenders, the absence of such a framework can lead to ambiguity, disputes, and significant legal and financial repercussions.

This is precisely where a well-crafted, comprehensive consumer loan agreement template becomes an invaluable asset. It serves as the bedrock of transparent and legally sound lending practices, ensuring that all parties involved understand their rights, responsibilities, and the precise nature of the financial commitment. Those operating within the business and legal documentation niche, from in-house legal teams to independent financial advisors and startup founders, will find immense value in a standardized yet adaptable document that streamlines the lending process while mitigating inherent risks.

The Imperative of Documented Agreements in Modern Lending

In today’s fast-paced financial environment, marked by evolving regulations and increased consumer protection laws, relying on verbal agreements or loosely defined terms is a gamble no serious lender should take. A clearly written agreement stands as the primary evidence of the loan’s terms, protecting both the lender’s investment and the borrower’s rights. It helps preempt misunderstandings that often escalate into costly legal battles.

The digital transformation of financial services further underscores this need. As more loan applications and approvals happen online, the ability to generate and execute legally sound documents quickly and efficiently becomes critical. A precise loan agreement ensures compliance with state and federal usury laws, truth-in-lending regulations, and fair debt collection practices, all while providing a clear record for auditing and dispute resolution purposes. Without such a document, enforceability becomes questionable, and the risk of litigation rises exponentially.

Unlocking Advantages Through a Robust Template

The strategic adoption of a high-quality agreement template offers a multitude of benefits, extending far beyond mere legal compliance. Firstly, it provides unparalleled consistency across all lending operations. Every borrower receives the same foundational terms, which not only streamlines the process but also reinforces a professional and equitable brand image. This consistency minimizes the chances of errors or omissions that could compromise the agreement’s enforceability.

Furthermore, a detailed consumer loan agreement template acts as a powerful risk mitigation tool. It explicitly defines events of default, remedies available to the lender, and the consequences of non-payment. For the borrower, it ensures transparency regarding interest rates, repayment schedules, and any associated fees, fostering trust and preventing predatory lending practices. This clarity reduces potential for future disputes by setting clear expectations from the outset, safeguarding both parties’ interests effectively.

Adapting Your Contract for Diverse Scenarios

One of the most significant advantages of a well-designed template is its inherent flexibility. While the core framework of a consumer loan agreement template remains consistent, detailing essential elements like loan amount, interest, and repayment terms, it must also be adaptable to various lending scenarios. This customization is crucial for meeting the specific needs of different industries and borrower types without having to draft a new contract from scratch every time.

For instance, a template used for an unsecured personal loan will require different clauses than one for a secured auto loan, which needs provisions for collateral, title transfer, and repossession. Similarly, loans for small businesses might include specific covenants related to business performance or asset management. The ability to modify sections for variable interest rates, balloon payments, or specific guarantor requirements ensures that the template remains a versatile tool, capable of addressing the unique intricacies of each financial product.

Core Components of a Comprehensive Loan Document

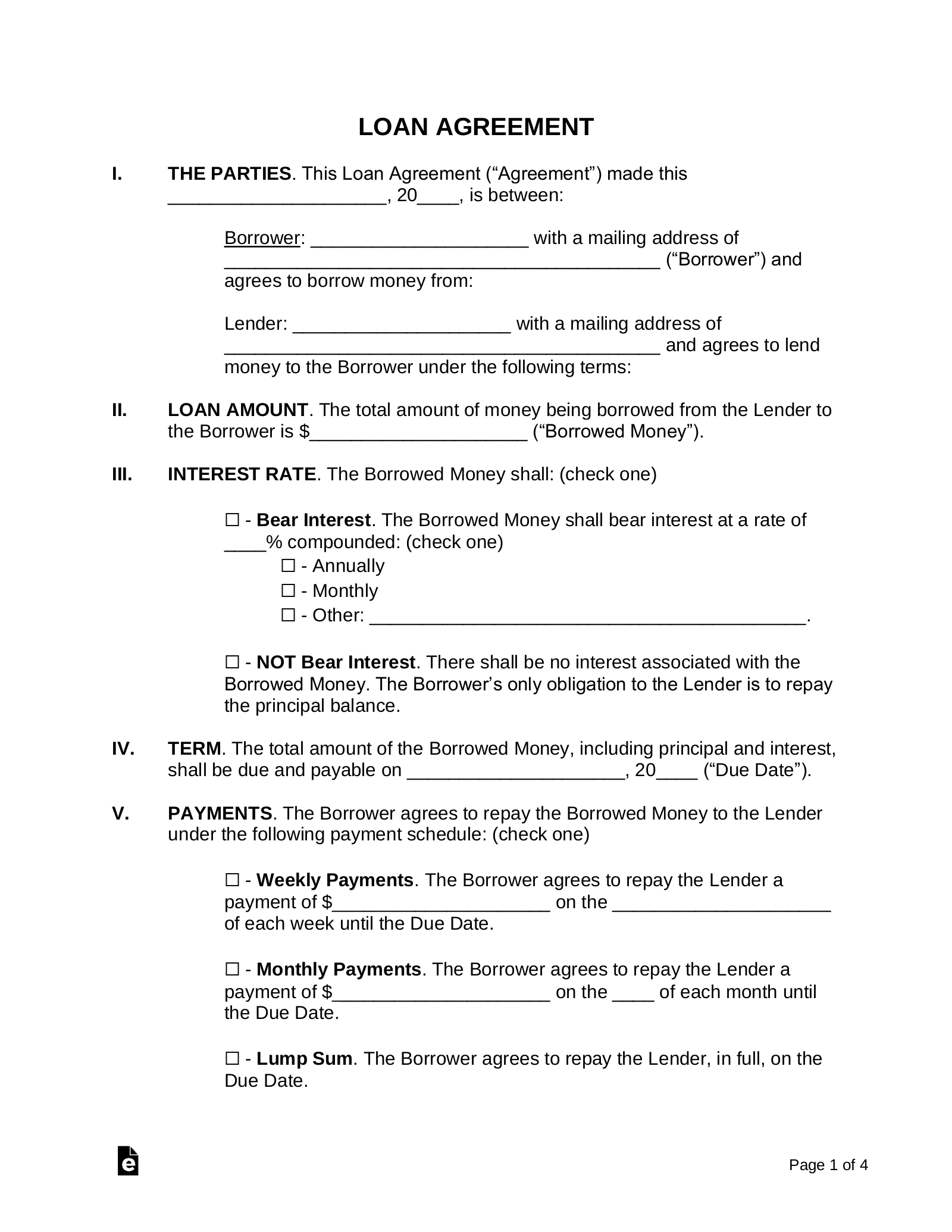

A robust loan agreement is characterized by its clarity and the exhaustive nature of its provisions. Each section serves a specific legal and operational purpose, building a complete picture of the financial relationship. When utilizing a consumer loan agreement template, ensure these essential clauses are meticulously covered:

- Identification of Parties: Clearly state the full legal names and addresses of the lender, the borrower, and any co-signers or guarantors involved. This foundational element ensures no ambiguity regarding who is bound by the terms.

- Loan Amount and Terms: Specify the principal amount borrowed, the annual interest rate (APR), the total loan term, and the frequency and amount of payments. Detailed amortization schedules or payment plan specifics should be included or referenced.

- Promissory Note Language: Include an unequivocal promise by the borrower to repay the loan according_to_the specified terms. This forms the core legal obligation.

- Collateral Details (if applicable): For secured loans, provide a precise description of the assets pledged as collateral (e.g., vehicle VIN, property address, item serial numbers). Outline the lender’s rights concerning the collateral.

- Representations and Warranties: Stipulations from both parties confirming facts relevant to the loan, such as the borrower’s legal capacity to enter the agreement, or the lender’s legal standing.

- Covenants: Affirmative covenants require the borrower to perform certain actions (e.g., maintain insurance on collateral), while negative covenants prohibit them from certain actions (e.g., selling collateral without consent).

- Events of Default: Clearly define circumstances under which the borrower is considered in default (e.g., missed payments, bankruptcy, breach of covenants). These triggers activate the lender’s rights to remedies.

- Remedies on Default: Outline the actions the lender can take if a default occurs, such as accelerating the loan’s maturity, repossessing collateral, or pursuing legal action.

- Late Fees and Penalties: Detail any charges for overdue payments, bounced checks, or other breaches, ensuring these comply with applicable usury laws and consumer protection acts.

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for resolving any legal disputes.

- Dispute Resolution: Include provisions for how disputes will be handled, such as mandatory arbitration, mediation, or the designated venue for litigation.

- Assignment: Clarify whether the lender can sell or assign the loan to another party and if the borrower can transfer their obligations.

- Notices: Establish the method and addresses for formal communications between the parties, ensuring proper legal notice is given.

- Entire Agreement Clause: States that the written document constitutes the complete and final agreement between the parties, superseding any prior discussions or understandings.

- Severability Clause: Ensures that if any part of the agreement is found to be unenforceable, the remaining provisions will still stand.

- Signatures: Include designated spaces for the dated signatures of all parties involved, typically with printed names and titles, and sometimes notarization requirements.

Enhancing Usability and Readability: Design and Digital Considerations

Even the most legally sound document will fall short if it’s difficult to understand or navigate. For a consumer loan agreement template, practical considerations for formatting, usability, and readability are paramount for both print and digital environments. A well-presented agreement enhances trust and reduces the likelihood of "I didn’t understand" claims.

Start with clear, concise language. While legal terminology is sometimes unavoidable, strive for plain English where possible, explaining complex terms. Employ logical section headings and subheadings, using a consistent font, size, and style hierarchy. Ample white space around text and between paragraphs significantly improves readability, preventing the document from appearing overly dense. For digital use, ensure the template is compatible with e-signature platforms and mobile devices, offering a seamless user experience. Consider adding a summary of key terms at the beginning of the document to provide a quick overview for borrowers, further reinforcing transparency.

Ultimately, a high-quality consumer loan agreement template is not just a document; it’s a strategic asset that underpins trust, facilitates compliance, and safeguards financial interests. Its professional presentation and comprehensive nature reflect positively on the lender, fostering stronger relationships with borrowers and minimizing legal vulnerabilities.

Embracing a meticulously designed consumer loan agreement template empowers businesses and financial professionals to streamline their lending operations, reduce administrative burden, and ensure legal soundness. It translates to significant time savings, allowing teams to focus on core business activities rather than extensive document drafting.

By providing a clear, concise, and legally robust framework, this template serves as an indispensable tool for anyone involved in consumer lending. It is a testament to professionalism, a bulwark against potential disputes, and a cornerstone of responsible financial practice, driving efficiency and confidence in every transaction.