In the dynamic world of commercial real estate finance, the role of a skilled mortgage broker is often indispensable. These professionals act as crucial intermediaries, connecting property owners and developers with the diverse capital sources required to fund their ventures. From securing financing for a new office complex to refinancing an existing industrial facility, the expertise a broker brings can significantly streamline complex transactions and uncover optimal funding solutions. However, the intricacies of these financial arrangements necessitate absolute clarity regarding the broker’s compensation and responsibilities.

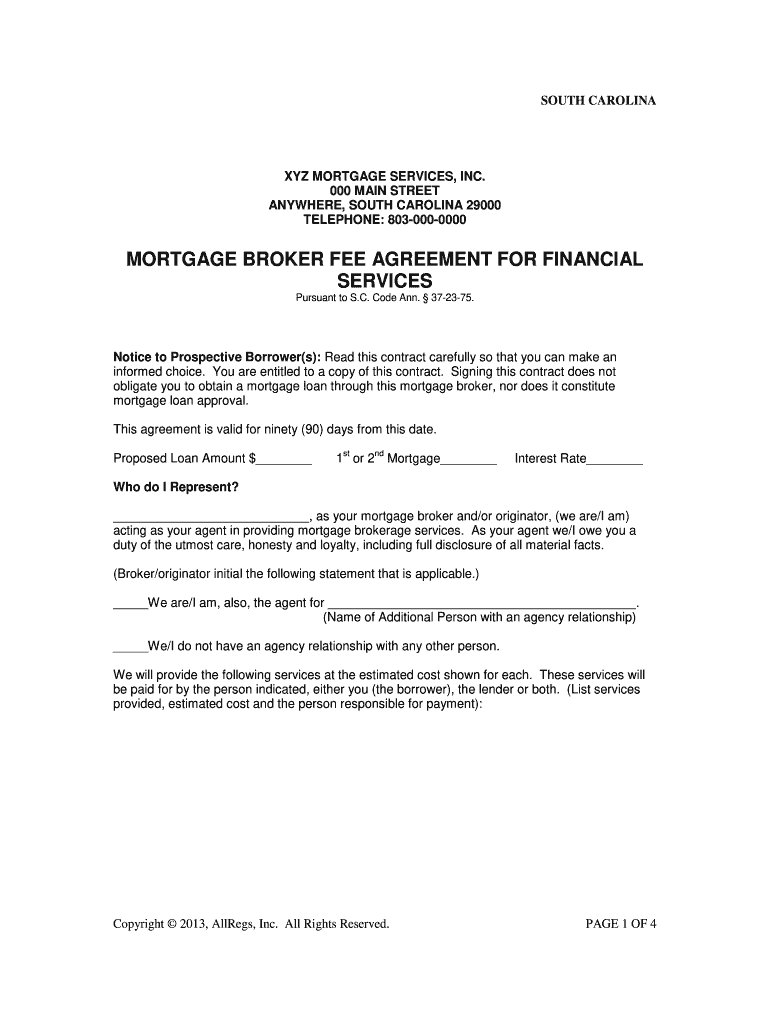

This is precisely where a robust commercial mortgage broker fee agreement template becomes invaluable. More than just a simple contract, it serves as a foundational document that meticulously outlines the terms of engagement between the broker and their client. For brokers, it ensures their efforts are properly compensated, providing a clear roadmap for payment and reducing potential disputes. For clients, it offers transparency, detailing the scope of services, fee structure, and expectations, thereby building trust and fostering a professional relationship from the outset. Professionals in the commercial finance sector, property owners, developers, and even legal advisors involved in real estate transactions will find immense benefit in understanding and utilizing such a comprehensive template.

The Imperative of Written Understanding in Today’s Market

The commercial finance landscape is characterized by its complexity, involving significant capital, multiple stakeholders, and often intricate legal frameworks. In such an environment, relying on verbal agreements is a perilous gamble that can lead to misunderstandings, eroded trust, and costly legal battles. A clear, written agreement mitigates these risks by leaving no room for ambiguity regarding the broker’s role, the scope of their services, and, most importantly, their compensation structure.

Furthermore, regulatory scrutiny in financial services continues to evolve, emphasizing transparency and documented processes. A well-drafted fee agreement demonstrates a commitment to professional standards and ethical conduct, protecting both parties should any questions arise regarding the transaction. It acts as a definitive record, providing a verifiable account of the agreed-upon terms, which is critical for compliance and dispute resolution. In essence, it transforms vague expectations into concrete, actionable commitments, serving as a cornerstone of professionalism in every commercial real estate financing endeavor.

Unlocking Protection and Efficiency with a Structured Document

Utilizing a comprehensive commercial mortgage broker fee agreement template offers a multitude of benefits, extending far beyond merely documenting a fee. For the broker, it provides crucial legal protection by clearly defining the services they are expected to provide, the conditions under which their fees are earned, and the timeline for payment. This minimizes the risk of clients disputing fees or attempting to circumvent the broker once a financing source has been identified. It also helps manage client expectations, preventing scope creep and ensuring that the broker’s efforts align with the client’s understanding of the engagement.

For the client, the template fosters transparency and predictability. They gain a clear understanding of the costs involved, the services they can expect, and the specific deliverables from the broker. This clarity empowers clients to make informed decisions and budget effectively, avoiding unpleasant surprises down the line. Moreover, a standardized template brings efficiency to the contracting process, saving valuable time and legal fees that would otherwise be spent drafting bespoke agreements for each transaction. It provides a reliable framework that can be adapted quickly, ensuring consistency and professionalism across all client engagements. A robust commercial mortgage broker fee agreement template serves as a foundational element for any successful and ethical brokerage operation.

Tailoring Your Agreement for Diverse Scenarios

While a core template provides a solid foundation, the diverse nature of commercial real estate transactions necessitates flexibility and customization. A generic agreement might not adequately address the specific nuances of a multi-family acquisition versus a ground-up industrial development project, for example. The template should be designed with sections that can be easily modified to reflect varying property types, such as office, retail, hospitality, or specialized industrial facilities, each potentially having unique financing requirements and fee structures.

Similarly, the type of financing sought will impact the agreement’s specifics. Whether the client is pursuing a conventional mortgage, construction loan, bridge loan, mezzanine financing, or a small business administration (SBA) loan, the scope of services and the broker’s responsibilities may shift. The template should allow for clear articulation of these differences. Furthermore, the nature of the broker’s engagement – whether it’s an exclusive agreement, a non-exclusive arrangement, or a success-fee-only mandate – must be explicitly defined. State-specific regulations and licensing requirements for commercial mortgage brokers also necessitate careful review and potential adaptation of clauses to ensure legal compliance across different jurisdictions.

Core Components of an Effective Fee Arrangement

Every robust commercial mortgage broker fee agreement template should be built upon several critical components to ensure clarity, fairness, and legal enforceability. These essential clauses protect both the broker and the client, setting clear expectations for their professional relationship:

- Identification of Parties: Clearly state the full legal names, addresses, and contact information for both the broker (or brokerage firm) and the client (individual, corporation, LLC, etc.).

- Recitals/Background: Briefly outline the purpose of the agreement, acknowledging the client’s need for financing and the broker’s expertise in securing it.

- Broker Services Scope: Detail the specific services the broker will provide, such as identifying lenders, preparing loan packages, negotiating terms, and assisting with closing. Be specific about what is included and, importantly, what is not.

- Fee Structure and Payment Terms: This is the heart of the agreement. Clearly define how the broker’s fee will be calculated (e.g., percentage of loan amount, fixed fee, retainer plus success fee), when it is earned, and when it is payable (e.g., at loan commitment, at closing, or upon funding). Include provisions for broken deals or if the client elects not to proceed.

- Exclusivity/Non-Exclusivity: State whether the broker has the exclusive right to represent the client for a defined period or if the client is free to work with other brokers or directly with lenders. If exclusive, specify the term.

- Term and Termination: Define the duration of the agreement and the conditions under which either party can terminate it (e.g., with written notice, for breach of contract). Include provisions for "tail periods" where fees are still due if the client closes a deal with a lender introduced by the broker post-termination.

- Confidentiality: Stipulate that both parties will maintain the confidentiality of sensitive financial information, deal terms, and client data.

- Indemnification: Outline clauses protecting the broker from client misrepresentations and the client from broker negligence.

- Governing Law: Specify which state’s laws will govern the interpretation and enforcement of the agreement. This is crucial for dispute resolution.

- Dispute Resolution: Include a clause detailing how disputes will be handled, such as mediation, arbitration, or litigation in a specific jurisdiction.

- Representations and Warranties: Both parties confirm they have the authority to enter the agreement and that information provided is accurate.

- Entire Agreement: State that the written document constitutes the complete and sole agreement between the parties, superseding all prior discussions or understandings.

- Notices: Specify how formal communications between the parties should be delivered.

- Signatures: Spaces for authorized representatives of both parties to sign and date the agreement, ideally with clear indications of their title.

Enhancing Readability and Practical Application

Beyond the legal substance, the practical presentation of a commercial mortgage broker fee agreement template significantly impacts its usability and effectiveness. For both print and digital applications, readability should be paramount. This means employing clear, concise language, avoiding overly jargony legalise where possible, and structuring the document with ample white space. Use distinct headings and subheadings (like the ones used in this article) to break up dense text, making it easier for readers to navigate and locate specific clauses.

Formatting elements such as bullet points and numbered lists, as demonstrated for the essential clauses section, greatly enhance clarity when detailing complex information or multiple conditions. For digital use, ensure the template is easily convertible to common formats like PDF for secure sharing and e-signatures. Consider features that facilitate digital signing platforms, which are increasingly common and efficient. Finally, always recommend that clients seek independent legal counsel to review the agreement. While a well-crafted template provides a strong starting point, individualized legal advice ensures it fully addresses unique circumstances and local regulatory requirements, offering an additional layer of protection for both the broker and the client. Maintain version control for your templates, ensuring you are always using the most current and legally sound iteration.

The thoughtful adoption of a comprehensive commercial mortgage broker fee agreement template is more than just a procedural step; it’s a strategic business decision. It underpins transparency, establishes clear expectations, and crucially, protects the interests of all parties involved in complex commercial real estate financing. By standardizing the terms of engagement, brokers can streamline their operations, project a highly professional image, and significantly reduce the likelihood of costly disputes.

Ultimately, a meticulously prepared and utilized agreement fosters trust and ensures that the valuable work performed by commercial mortgage brokers is properly recognized and compensated. In a market where clarity and professionalism are highly valued, the strategic adoption of a comprehensive commercial mortgage broker fee agreement template stands as a testament to best practices, enabling smoother transactions and more robust business relationships for years to come.