In the intricate world of finance, where every transaction carries significant weight and potential risk, the clarity and precision of legal documentation are paramount. Businesses, from burgeoning startups to established corporations, frequently engage in borrowing and lending activities to fuel growth, manage cash flow, or fund strategic initiatives. These financial partnerships, while essential, are built on trust and a robust understanding of mutual obligations.

This is precisely where a well-crafted commercial loan agreement becomes indispensable. Far from being just a formality, this critical document serves as the bedrock of the lending relationship, outlining the terms, conditions, and expectations for both borrower and lender. For anyone navigating the complexities of commercial finance – be it a business owner seeking capital, a financial institution extending credit, or a legal professional drafting crucial contracts – having access to a reliable commercial loan agreement template offers immense value, streamlining the process and fortifying the agreement against future challenges.

The Imperative of Written Agreements in Modern Business

In today’s fast-paced business environment, verbal agreements, no matter how well-intentioned, are simply not enough when it comes to significant financial undertakings. The absence of a clear, written contract leaves both parties vulnerable to misunderstandings, misinterpretations, and costly disputes down the line. A properly documented agreement provides an undeniable record of what was agreed upon, protecting all stakeholders.

A written agreement ensures legal enforceability. Should a disagreement arise, or if one party fails to uphold its end of the bargain, the contract serves as the primary evidence in a court of law. It explicitly details the rights, responsibilities, and remedies available, significantly reducing ambiguity and the need for protracted negotiations or litigation. This foundational security is vital for maintaining healthy business relationships and safeguarding financial assets.

Moreover, regulatory compliance often mandates comprehensive documentation for commercial lending. Financial institutions operate under strict guidelines that require detailed records of loan terms, security interests, and borrower information. A clear and robust document aids in meeting these regulatory requirements, preventing potential penalties and ensuring operational integrity.

Unpacking the Protections and Efficiencies a Template Offers

Utilizing a comprehensive framework for your lending arrangements brings a multitude of benefits, extending far beyond mere convenience. A commercial loan agreement template serves as a formidable risk mitigation tool, proactively addressing potential issues before they escalate. It clearly defines parameters like the principal amount, interest rate, repayment schedule, and any collateral involved, leaving no room for guesswork.

The structured nature of such a document also provides invaluable legal protection. For lenders, it secures their investment by outlining events of default and the remedies available, such as acceleration of the loan or enforcement of security interests. For borrowers, it protects against unfair or arbitrary changes to terms, ensuring predictability in their financial obligations and preventing predatory practices.

Beyond protection, the efficiency gained from using a pre-vetted form is substantial. Instead of drafting each agreement from scratch, which can be time-consuming and prone to omissions, a template provides a professional starting point. This saves considerable legal fees and administrative effort, allowing businesses to focus their resources on core operations while still ensuring legal soundness. It standardizes the documentation process, ensuring consistency across multiple transactions.

Adapting the Framework: Customization Across Sectors

While a foundational commercial loan agreement template provides an excellent baseline, its true power lies in its adaptability. Commercial lending is not a one-size-fits-all endeavor; loans vary widely depending on the industry, the purpose of the financing, the nature of the borrower, and the type of collateral. A versatile template can be tailored to meet these diverse requirements effectively.

For instance, a loan for real estate development will require specific clauses related to property liens, construction schedules, and environmental due diligence, differing significantly from an equipment finance agreement that focuses on machinery ownership and depreciation. Similarly, working capital loans might emphasize covenants tied to accounts receivable and inventory, while a revolving credit facility demands provisions for drawdowns, repayments, and re-advances.

Customization extends to the parties involved too. A loan from a private individual or a venture capital firm may have different reporting requirements and equity considerations compared to a traditional bank loan. The template acts as a flexible blueprint, allowing for the insertion, modification, or removal of clauses to align perfectly with the unique contours of each specific transaction, ensuring that every agreement is robust and contextually appropriate.

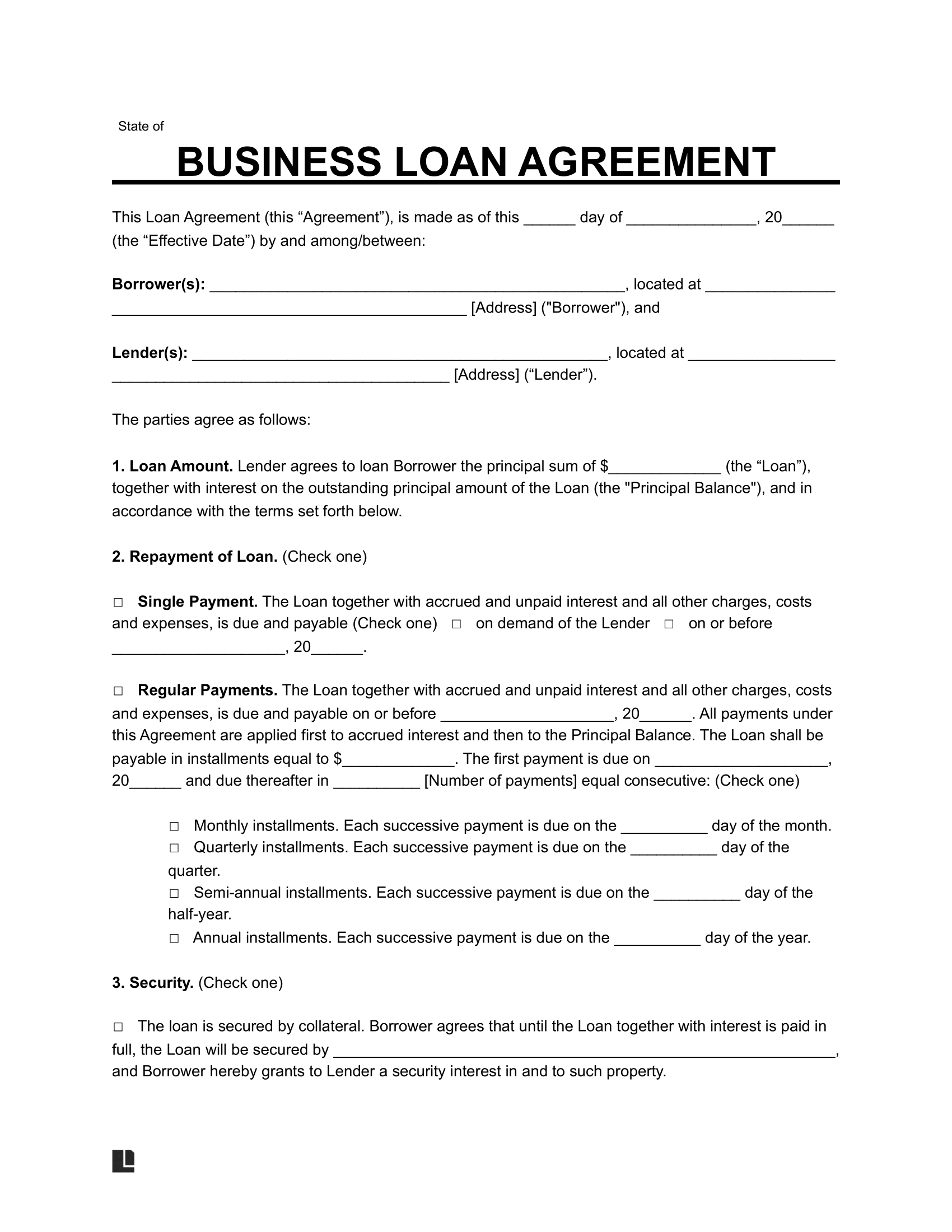

Anatomy of a Robust Loan Document: Essential Clauses

A comprehensive loan document is meticulously structured, with each section serving a vital purpose in defining the legal relationship. While specific provisions will vary based on the nature of the loan, certain fundamental clauses are indispensable to any effective commercial loan agreement. Understanding these core components is crucial for both drafting and reviewing.

Key elements every agreement should contain include:

- Identification of Parties: Clearly names and identifies the lender(s) and borrower(s), including their legal entity names and addresses.

- Loan Amount and Terms: Specifies the principal loan amount, interest rate (fixed or variable), payment schedule, and the loan’s maturity date.

- Promissory Note Reference: Often references or includes a separate promissory note detailing the borrower’s unconditional promise to repay.

- Representations and Warranties: Statements of fact made by the borrower, affirming their legal capacity, good standing, and the accuracy of financial information provided.

- Covenants: Promises made by the borrower to perform (affirmative covenants, e.g., maintain insurance) or not to perform (negative covenants, e.g., incur additional debt beyond a certain limit) specific actions during the loan term.

- Events of Default: Clearly defines circumstances under which the borrower is considered in breach of the agreement, such as failure to make payments, bankruptcy, or breach of a covenant.

- Remedies on Default: Outlines the lender’s rights and actions upon an event of default, including acceleration of the loan, foreclosure on collateral, or pursuit of legal action.

- Security Interest and Collateral: If the loan is secured, this section describes the collateral pledged by the borrower and grants the lender a security interest in it, often referencing a Uniform Commercial Code (UCC) financing statement.

- Guarantees: If applicable, details any personal or corporate guarantees provided by third parties, outlining their liability.

- Prepayment Provisions: Specifies whether the borrower can prepay the loan and if any prepayment penalties apply.

- Governing Law and Jurisdiction: Designates the state laws that will govern the agreement and the specific courts that have jurisdiction over any disputes.

- Confidentiality: Clauses protecting sensitive financial or business information shared between the parties.

- Miscellaneous Provisions: Includes boilerplate clauses such as notices, assignments, amendments, waivers, severability, and attorneys’ fees.

- Signatures: Requires authorized signatures from all parties involved, often with notarization, to attest to their agreement.

Crafting Clarity: Practical Tips for Document Presentation

A legally sound agreement is only effective if it’s comprehensible and easy to navigate. The presentation and formatting of your loan documentation significantly impact its usability and readability, whether for print or digital consumption. Prioritizing clarity and organization ensures that all parties can easily understand their rights and obligations.

Begin by using clear, descriptive headings and subheadings that break the document into logical sections. This improves scannability and allows readers to quickly locate specific clauses. Employ consistent formatting, including font types, sizes, and paragraph spacing, to maintain a professional appearance and enhance readability. Adequate white space is crucial; dense blocks of text are intimidating and can lead to overlooked details.

For ease of review, especially in complex agreements, consider adding a table of contents. Numbered paragraphs and bullet points, as demonstrated above, are excellent tools for itemizing lists, conditions, or definitions, making intricate details more digestible. Ensure that the language used is precise, unambiguous, and avoids overly convoluted legal jargon where simpler terms suffice. When a commercial loan agreement template is easy to read, it minimizes misinterpretations and fosters greater trust between the parties involved, ultimately leading to a smoother transaction process.

In the digital age, consider how the document will be viewed on various devices. Ensure it’s responsive or optimized for digital reading, perhaps using PDF formats that preserve layout integrity. Always implement version control, clearly dating and numbering drafts to avoid confusion, especially when multiple revisions are made.

The journey of securing or extending a commercial loan is complex, fraught with legal intricacies and financial implications. However, the right tools can transform this challenging process into a structured, transparent, and legally sound endeavor. A robust commercial loan agreement template stands out as one such indispensable asset.

By providing a solid framework that encapsulates all critical legal and financial provisions, this foundational document not only saves significant time and resources but also instills confidence. It acts as a professional, time-saving solution that empowers businesses and lenders alike to engage in secure financial transactions, ensuring that every agreement is meticulously documented and legally resilient. Embracing such a template is not just about convenience; it’s about investing in the clarity, protection, and long-term success of your commercial ventures.