Embarking on the college journey is an exhilarating experience, filled with new freedoms, academic challenges, and unforgettable social interactions. Yet, amidst the excitement of campus life, many students quickly realize that managing their finances can be one of the most significant hurdles. From tuition and textbooks to daily coffee runs and weekend outings, money seems to vanish faster than a pizza at a dorm party.

This is where a solid financial plan becomes not just helpful, but essential. A well-structured College Student Monthly Budget Template isn’t just about restricting your spending; it’s about empowering you to make informed decisions, avoid unnecessary stress, and even build positive financial habits that will serve you well beyond graduation. It’s a roadmap that helps you navigate the often-tricky landscape of student finances, ensuring you stay on track toward your academic and personal goals without the constant worry of an empty bank account.

Why a Budget is Your Best College Companion

For many students, college marks their first foray into true financial independence. Suddenly, you’re responsible for more than just your allowance; you’re managing rent, utilities, groceries, and entertainment, all while balancing classes and a social life. Without a clear understanding of where your money comes from and where it goes, it’s easy to feel overwhelmed and, worse, to fall into debt.

A personal monthly spending plan helps you gain control. It provides clarity on your financial situation, revealing potential areas for savings and highlighting where you might be overspending. This proactive approach to money management can significantly reduce financial stress, allowing you to focus more on your studies and enjoy your college experience without constant worry. Moreover, developing these budgeting skills now will lay a strong foundation for future financial success.

Laying the Foundation: Essential Budget Categories for Students

To create an effective budget, you need to categorize your income and expenses. This helps you see the bigger picture of your financial flow. Think of it as mapping out all the financial roads your money travels down each month. Understanding these categories is the first step toward building a comprehensive and useful student budget template.

Here are the critical categories you should include when outlining your monthly finances:

- **Income Sources:** This includes all the money you expect to receive. Think about your part-time job wages, student loan disbursements (only the portion for living expenses, not tuition), scholarships, grants, parental contributions, or any freelance gigs. Be realistic about what you can consistently rely on.

-

**Fixed Expenses:** These are the non-negotiable costs that generally stay the same each month. They are often contractual and predictable, making them easier to plan for. Examples include:

- **Rent** or dorm fees

- **Utilities** (if not included in rent): electricity, gas, internet

- **Tuition** and fees (if paying monthly or a portion)

- **Loan repayments** (if applicable, e.g., car loan)

- **Insurance** (car, health, renter’s)

- **Subscriptions** (streaming services, gym memberships – assess if these are truly fixed or can be cut)

-

**Variable Expenses:** These costs fluctuate from month to month and are often where students have the most control. Careful tracking and mindful spending in these areas can lead to significant savings. Consider:

- **Groceries** and dining out

- **Transportation** (gas, public transit passes, ride-shares)

- **Textbooks** and school supplies

- **Personal care** (toiletries, haircuts)

- **Entertainment** and social activities

- **Clothing** and shopping

- **Savings & Debt Repayment:** Even as a student, it’s wise to allocate funds here. Building an **emergency fund** is crucial, and chipping away at any high-interest debt can save you money in the long run. Even small, consistent contributions make a difference.

How to Build Your Personalized Monthly Spending Plan

Creating your own student budget template isn’t about fitting into a rigid box; it’s about tailoring a financial tool to your unique circumstances. Whether you use a spreadsheet, a budgeting app, or simply a notebook, the process remains the same. The key is consistency and honesty about your financial habits.

Step 1: Track Your Income

Begin by listing all your expected income for the month. This includes wages from a part-time job, any regular allowances from family, scholarship money designated for living expenses, or income from freelance work. Be conservative with your estimates; it’s always better to underestimate income and be pleasantly surprised than to overestimate and fall short. If your income varies, use an average from the past few months or plan for your lowest expected income.

Step 2: List Your Fixed Expenses

Next, identify and list all your fixed expenses. These are the bills that arrive like clockwork and are generally the same amount each month. Rent, internet, phone bill, and loan payments are common examples. Write down the exact amount for each and the due date. These are your non-negotiables, so allocating funds for them first is crucial.

Step 3: Estimate Your Variable Costs

This is often the trickiest part, but also where you have the most flexibility. Think about your spending habits for groceries, dining out, transportation, entertainment, and personal care. Look at your bank statements from the previous month or two to get a realistic idea of what you typically spend. Don’t forget to budget for occasional school supplies or textbook purchases. Be honest with yourself about your habits, even if they aren’t ideal.

Step 4: Don’t Forget Savings and Debt Repayment

Even if it’s just a small amount, try to allocate funds for savings. An emergency fund can be a lifesaver for unexpected costs like a broken laptop or an urgent trip home. If you have any credit card debt or other high-interest loans, make sure you’re allocating more than just the minimum payment to accelerate repayment. Building these habits early is incredibly beneficial.

Step 5: Calculate and Adjust

Now, the moment of truth: subtract your total expenses (fixed + variable + savings) from your total income.

* If you have money left over, congratulations! You can allocate it to savings, debt repayment, or a bit more discretionary spending.

* If your expenses exceed your income, it’s time to make adjustments. Look closely at your variable expenses first. Can you cook more meals at home? Reduce your social outings? Find cheaper transportation? This part of the process often involves tough choices, but it’s essential for achieving financial stability. This comprehensive monthly budget template approach ensures you’re always in the black.

Tips for Budgeting Success in College

Successfully managing your money as a student goes beyond just having a financial template; it requires discipline, flexibility, and smart strategies. Here are some actionable tips to help you make your budget work for you:

- Track Everything: For the first month or two, meticulously track every dollar you spend. This can be an eye-opening exercise, revealing where your money truly goes. Many budgeting apps can automate this by linking to your bank accounts.

- Review Regularly: Your financial situation in college is dynamic. New expenses pop up, income might change, and your priorities shift. Make it a habit to review your student budget at least once a month, making adjustments as needed.

- Be Flexible: A budget isn’t a straitjacket; it’s a guide. Life happens, and sometimes you’ll go over budget in one category. Don’t get discouraged. Instead, identify where you can cut back in another category the following month to compensate.

- Cook at Home: Eating out, even fast food, adds up quickly. Learning to cook simple meals can save you a significant amount of money and is often healthier. Meal prepping for the week can be a game-changer.

- Utilize Student Discounts: Always ask if there’s a student discount! Many stores, restaurants, and entertainment venues offer special pricing for college students. Your student ID is a powerful tool.

- Find Free Fun: Campus events, local parks, free museums, and movie nights with friends are all ways to have fun without breaking the bank. Get creative with your entertainment choices.

- Avoid Lifestyle Creep: As your income or available funds increase (e.g., after receiving a scholarship disbursement), resist the urge to immediately increase your spending. Stick to your existing budget and put extra money towards savings or debt.

- Build an Emergency Fund: Aim to save at least a few hundred dollars specifically for emergencies. This prevents unexpected costs from derailing your entire financial plan.

- Use Cash for Variable Spending: If you struggle with overspending in certain categories, try withdrawing cash for your weekly allowance for those items (like food or entertainment). Once the cash is gone, you’re done spending for the week.

Frequently Asked Questions

Why can’t I just keep track in my head?

While some people might try, keeping a detailed and accurate mental tally of all income and expenses is extremely difficult, if not impossible. A written or digital budget provides a clear, objective overview, highlighting patterns and revealing where adjustments are needed, preventing overlooked expenses and surprise shortfalls. It removes the guesswork and provides accountability.

How often should I review my student budget?

Ideally, you should review and adjust your budget at least once a month, typically before the start of a new spending cycle. This allows you to account for any changes in income, new expenses, or shifts in your spending habits from the previous month. Regular check-ins ensure your financial template remains relevant and effective.

What if my income changes frequently?

If your income is inconsistent, budget based on your lowest expected monthly income. Treat any additional income as a bonus that can go directly into savings or be used for non-essential treats, rather than being built into your core budget. This conservative approach provides a safety net and helps manage unexpected fluctuations in your earnings.

Is it okay to spend money on fun?

Absolutely! A sustainable budget isn’t about deprivation; it’s about intentional spending. You should definitely allocate a reasonable amount for entertainment and social activities. The key is to budget for it proactively, rather than letting “fun money” become an unmonitored expense that derails your financial goals. Your monthly spending plan should include a “fun fund.”

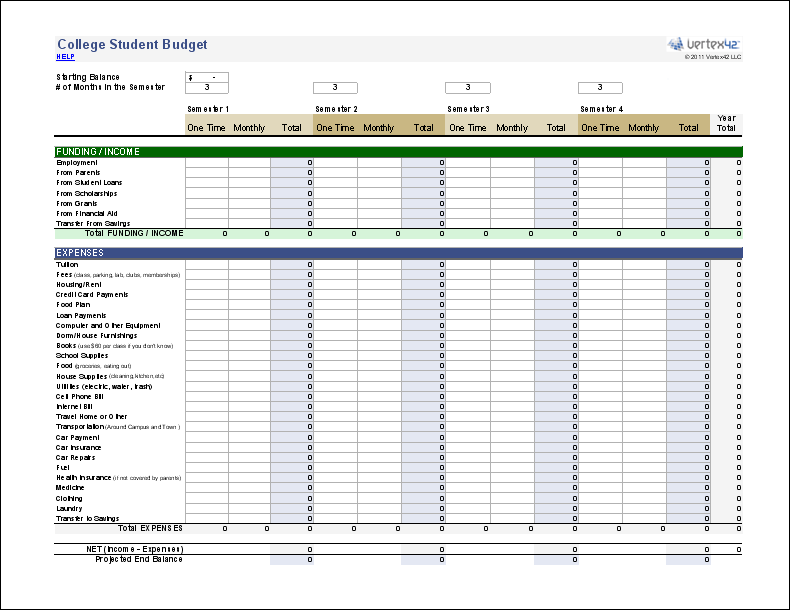

Where can I find an actual template?

Many resources offer ready-to-use templates. You can find free spreadsheet templates through Google Sheets or Microsoft Excel, dedicated budgeting apps like Mint or YNAB, or even printable PDF versions online. Choose a format that you find easy to use and stick with. The best College Student Monthly Budget Template is the one you actually use consistently.

Taking control of your finances during college isn’t just about surviving the semester; it’s about thriving and setting yourself up for a future of financial confidence. By embracing the principles of budgeting and actively managing your money, you’re investing in a skill set that will pay dividends far beyond your academic years. It teaches you responsibility, foresight, and the power of intentional choices.

Don’t let the complexities of student life overshadow the simplicity and power of a well-crafted budget. Start today by outlining your income and expenses, even if it feels daunting at first. The peace of mind and financial freedom that comes with knowing exactly where your money stands is an invaluable asset, allowing you to fully engage in your education and enjoy every moment of your college adventure.