In today’s fast-paced economic landscape, where financial transactions underpin nearly every aspect of personal and professional life, the importance of clear, legally binding documentation cannot be overstated. Whether you’re a small business owner extending a line of credit, an individual lending money to a friend or family member, or a startup securing initial funding, the foundation of a successful and conflict-free loan lies in a well-crafted agreement. This document serves as a blueprint, outlining the precise terms and conditions that govern the financial relationship between borrower and lender, ensuring mutual understanding and protection.

Navigating the complexities of legal language and drafting bespoke contracts can be daunting, time-consuming, and often expensive, particularly for those without a legal background. This is where the profound value of a reliable, easily accessible cash loan agreement template free of charge comes into play. It offers a professional, standardized starting point, empowering individuals and organizations to formalize their lending arrangements with confidence, safeguarding their interests and fostering transparency from the outset.

The Imperative of Documented Financial Agreements

In an era defined by increasing regulatory scrutiny and a greater emphasis on accountability, relying solely on verbal agreements for financial transactions is a perilous gamble. Even among parties with the closest relationships, memories can fade, interpretations can differ, and circumstances can change, leading to misunderstandings, disputes, and potentially significant financial losses. A written agreement transcends these limitations, providing an indisputable record of the agreed-upon terms.

Beyond preventing disagreements, a formalized loan document offers critical legal standing. Should a dispute escalate, or if either party fails to uphold their obligations, a comprehensive written agreement is the primary evidence recognized by courts. It clearly delineates responsibilities, repayment schedules, interest rates, and consequences for default, providing a clear path for resolution and enforcement. For businesses, this commitment to proper documentation also reinforces professionalism and builds trust with stakeholders and potential investors.

Unlocking the Advantages of a Standardized Loan Contract

Utilizing a pre-designed loan agreement template brings a host of benefits that extend far beyond mere convenience. Primarily, it offers peace of mind. Knowing that your financial arrangement is built upon a legally sound framework reduces anxiety for both the borrower and the lender, allowing them to focus on the core purpose of the loan rather than worrying about potential ambiguities.

A key advantage is cost-effectiveness. Engaging a legal professional to draft a custom agreement for every loan, especially for smaller, routine transactions, can be prohibitive. A robust cash loan agreement template free of charge significantly cuts down on legal expenses, making professional-grade documentation accessible to everyone. Furthermore, these templates are typically designed to comply with general legal principles, ensuring that essential clauses are not overlooked, thereby offering a baseline of protection that informal agreements simply cannot match. They streamline the documentation process, saving valuable time and enabling quicker execution of financial agreements.

Adapting Your Agreement for Diverse Scenarios

While a generic template provides a solid foundation, its true power lies in its adaptability. A high-quality cash loan agreement template free from restrictive jargon is designed to be customized, allowing users to tailor it precisely to the unique context of their lending situation. This flexibility is crucial because loan agreements vary widely depending on the parties involved, the purpose of the loan, and the specific terms desired.

For instance, a template used for a personal loan between family members might emphasize flexibility in repayment terms and grace periods, potentially even foregoing interest. Conversely, a business loan between two companies would require more stringent clauses regarding collateral, covenants, and detailed default provisions. Users can modify sections to reflect industry-specific regulations, incorporate unique collateral types (e.g., intellectual property for a tech startup), or adjust the complexity based on the loan amount and associated risk. This ensures that the final document accurately reflects the specific understanding and legal requirements of all parties involved, regardless of the industry—be it real estate, small business financing, or individual lending.

Core Elements of a Robust Loan Document

Every effective loan agreement, regardless of its specific application, must contain several essential clauses and sections to be comprehensive and legally enforceable. These elements clarify the intent, terms, and conditions, leaving no room for misinterpretation.

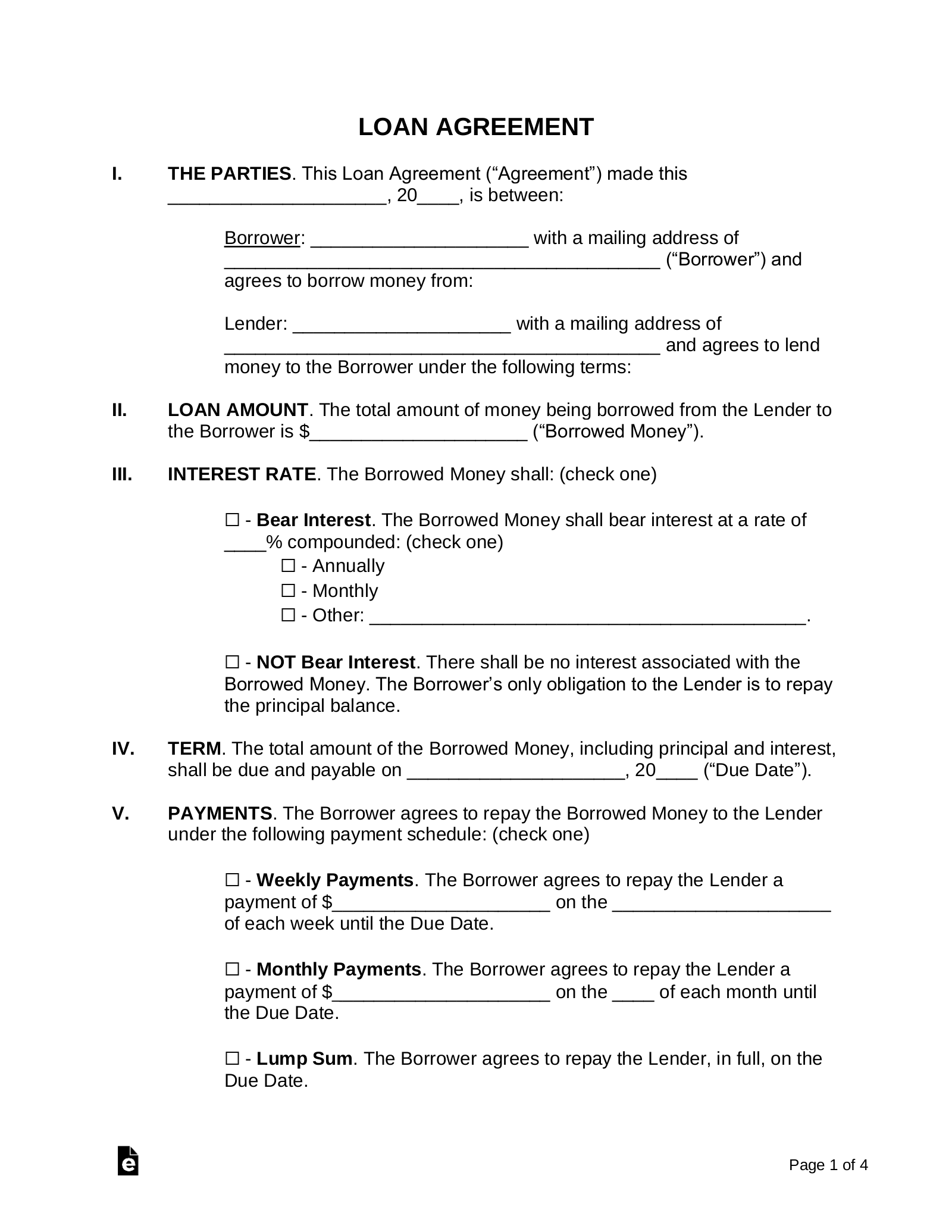

- Identification of Parties: Clearly states the full legal names, addresses, and contact information of both the borrower(s) and the lender(s).

- Loan Amount (Principal): Specifies the exact sum of money being loaned.

- Interest Rate: Details the annual interest rate applicable to the loan. This should clearly state if it’s fixed or variable, and how it will be calculated.

- Repayment Schedule: Outlines the frequency (e.g., monthly, quarterly), due dates, and amounts of each repayment instalment. It should also specify the method of payment.

- Term of Loan: Defines the total duration of the loan, from disbursement until final repayment.

- Promissory Note: Often incorporated or referenced, this is the borrower’s unconditional promise to repay the loan.

- Default Clause: Clearly defines what constitutes a default (e.g., missed payments, bankruptcy) and the immediate consequences, such as acceleration of the outstanding balance.

- Collateral (if applicable): Describes any assets pledged by the borrower to secure the loan, providing the lender with recourse if the borrower defaults.

- Prepayment Penalties/Options: States whether the borrower can repay the loan early without penalty, or if there are any associated fees.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for legal compliance.

- Dispute Resolution: Outlines the process for resolving disagreements, such as mediation or arbitration, before resorting to litigation.

- Amendments: Details the process by which the agreement can be modified, typically requiring written consent from all parties.

- Entire Agreement Clause: States that the document constitutes the complete and final agreement between the parties, superseding any prior oral or written discussions.

- Signatures: Requires the dated signatures of all parties involved, often with witness signatures or notarization, to attest to their consent and understanding.

Ensuring Legal Compliance and Clarity

Beyond these core elements, it’s vital that the language used is unambiguous and legally precise. Ambiguity can lead to costly legal battles. Utilizing a cash loan agreement template free from complex jargon, yet legally sound, is a strategic move to ensure both clarity for all parties and adherence to legal standards. This includes ensuring proper terminology for concepts like “obligations,” “indemnification,” and “confidentiality” where applicable.

Optimizing Your Agreement for Clarity and Accessibility

A well-drafted loan agreement is only effective if it is easy to understand and readily accessible to all parties. Thoughtful formatting and presentation play a crucial role in enhancing usability and readability, whether the document is intended for print or digital distribution.

Firstly, use clear and concise language. Avoid overly legalistic jargon where simpler terms suffice, but ensure precision. Employ headings and subheadings (like this article does) to break up large blocks of text, making the document easier to navigate and digest. Bullet points and numbered lists, as used for the essential clauses section above, are excellent for presenting detailed information in an organized, scannable format.

For digital use, ensure the template is compatible with common word processing software and ideally, can be converted to a PDF for secure distribution and e-signature capabilities. Maintain a consistent font style and size throughout the document, choosing a professional, legible typeface. Ample white space around text and between paragraphs improves visual appeal and reduces eye strain. Finally, consider including a table of contents for longer documents, allowing users to quickly jump to specific sections. These practical tips transform a mere collection of clauses into a user-friendly, professional legal tool.

In an increasingly interconnected world where financial dealings are a constant, the need for reliable, accessible legal documentation is paramount. A high-quality cash loan agreement template free of charge empowers individuals and businesses alike to manage their financial commitments with confidence and clarity. It eliminates the guesswork and mitigates the risks associated with informal arrangements, providing a robust framework for mutual trust and accountability.

By leveraging such a template, you’re not just saving time and money; you’re investing in the stability and integrity of your financial relationships. It’s a proactive step towards preventing disputes, ensuring legal compliance, and fostering transparent communication between borrowers and lenders. Embrace the simplicity and security offered by a well-structured loan agreement to safeguard your interests and pave the way for successful financial interactions.