In the vital world of philanthropy and community service, a robust financial strategy isn’t just a good idea—it’s the bedrock of sustainable impact. Nonprofit organizations, driven by mission rather than profit, face unique financial complexities, from navigating diverse funding streams to ensuring strict compliance and transparent reporting. Without a clear financial roadmap, even the most passionate initiatives can falter, underscoring the critical need for meticulous fiscal planning and oversight.

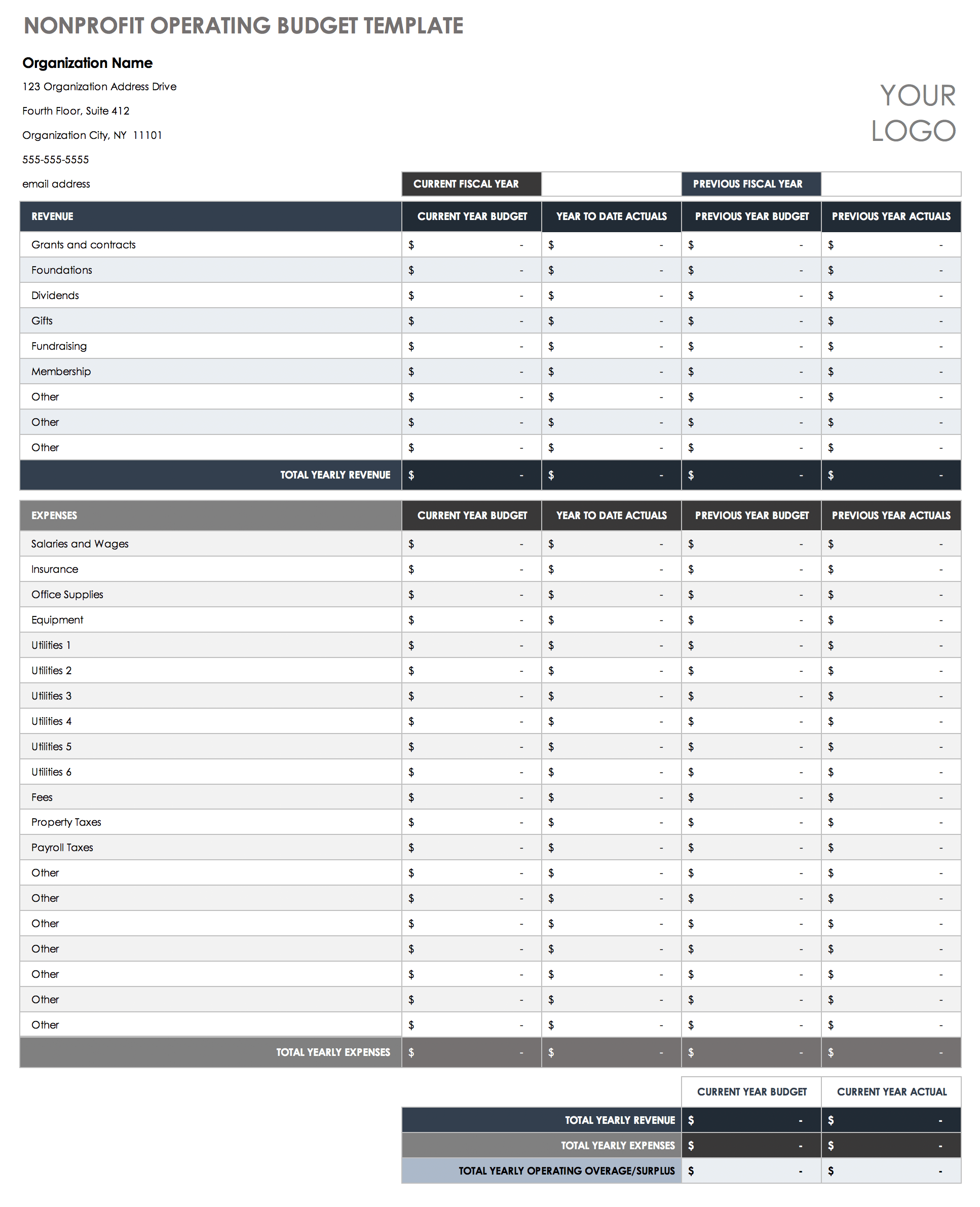

This is where a dedicated Budget Template For Non Profit Organization becomes an indispensable asset. Far more than a simple spreadsheet, it serves as a dynamic financial blueprint, guiding every dollar earned and spent towards achieving the organization’s noble goals. It’s the tool that transforms abstract visions into tangible, measurable outcomes, fostering trust among donors, securing future grants, and empowering leaders to make informed decisions that amplify their reach and effectiveness in the communities they serve.

Why a Dedicated Budget is Non-Negotiable for Nonprofits

Nonprofit entities operate under intense scrutiny, with every expenditure requiring justification and every revenue stream needing careful allocation. Unlike for-profit businesses, their success isn’t measured by profit margins but by social impact, which paradoxically relies heavily on sound financial management. A well-constructed organizational budget provides the framework for this accountability, ensuring resources are optimized to fulfill the mission.

This comprehensive financial planning tool allows nonprofits to clearly articulate their financial needs and demonstrate their capacity for responsible stewardship. It’s essential for applying for grants, assuring individual donors, and satisfying regulatory requirements. By outlining both projected income and expenses, it paints a clear picture of the organization’s financial health, enabling proactive management rather than reactive crisis control.

Key Elements of an Effective Nonprofit Budget

Developing a financial framework for your organization requires understanding its core components. A robust nonprofit budget template should capture all essential financial activities, providing a holistic view of resources and their deployment. This isn’t just about numbers; it’s about allocating resources strategically to maximize program delivery and administrative efficiency.

Here are the critical elements typically found in an effective financial planning tool for charities:

- **Revenue Sources:** This section details all anticipated income. For nonprofits, this might include diverse streams such as:

- **Grants:** From foundations, government agencies, and corporations.

- **Individual Donations:** One-time gifts, recurring donations, major gifts.

- **Fundraising Events:** Galas, runs/walks, online campaigns.

- **Program Service Fees:** Income generated from services provided (e.g., workshops, consultations).

- **Investment Income:** Earnings from endowments or reserves.

- **Merchandise Sales:** Revenue from branded goods.

- **Expenditures:** A clear breakdown of how funds will be spent, categorized for transparency and analysis:

- **Program Expenses:** Costs directly related to delivering the mission (e.g., salaries for program staff, supplies for direct services, event costs). This is often the largest category and should demonstrate impact.

- **Administrative Expenses:** Overhead costs necessary to run the organization (e.g., executive salaries, office rent, utilities, insurance, legal fees).

- **Fundraising Expenses:** Costs associated with soliciting contributions (e.g., development staff salaries, fundraising event costs, donor management software).

- **Restricted vs. Unrestricted Funds:** Clearly distinguishing between funds that can be used for any purpose (unrestricted) and those designated by donors for specific programs or projects (restricted) is crucial for compliance and transparency.

- **Cash Flow Projections:** A forward-looking analysis of cash inflows and outflows, vital for ensuring the organization has enough liquid assets to meet its obligations throughout the fiscal year.

- **Variance Analysis Column:** A space to compare budgeted amounts against actual expenditures and revenues, allowing for regular monitoring and adjustments. This helps identify areas where spending might be off track or where new funding opportunities arise.

Leveraging a Budget Template for Strategic Growth

Beyond mere compliance, an effective nonprofit budget template transforms into a powerful strategic tool. It helps organizations not just survive, but thrive, by enabling proactive planning and informed decision-making. Utilizing this framework effectively means integrating it into every aspect of organizational planning, from program development to staff hiring.

A well-crafted organizational budget template facilitates forecasting, allowing leaders to anticipate future financial needs and potential challenges. This foresight is invaluable for strategic expansion, new program launches, or even navigating economic downturns. It also strengthens grant applications by providing a clear, itemized account of how funding will be utilized, directly linking financial requests to program goals and measurable outcomes. When a charity can clearly show how it manages its money, it builds significant credibility with potential funders and partners.

Customizing Your Budget for Unique Organizational Needs

No two nonprofits are exactly alike, and neither should their financial models be identical. While a general Budget Template For Non Profit Organization provides an excellent starting point, customization is key to its effectiveness. The size, mission, funding structure, and operational complexity of your organization will dictate how you tailor this essential document.

For a small, volunteer-led charity, a simpler financial framework might suffice, focusing on core program costs and basic administrative overhead. Larger organizations with multiple programs, extensive staff, and diverse revenue streams will require a more granular and complex financial model, potentially including departmental budgets, project-specific allocations, and detailed cash flow statements. Consider your organization’s specific reporting requirements, grant structures, and internal accounting practices when adapting a template to ensure it reflects your unique operational realities and strategic objectives.

Best Practices for Budget Management

Effective budget management is an ongoing process, not a one-time event. It requires diligence, collaboration, and a willingness to adapt. By implementing a few best practices, nonprofits can ensure their financial blueprint remains a living, useful document that truly supports their mission.

- Regular Review and Adjustment: The annual financial plan should be reviewed monthly or quarterly against actual financial performance. This allows for timely adjustments to spending or fundraising strategies, preventing minor discrepancies from becoming major issues.

- Involve Key Stakeholders: Engage program managers, fundraising staff, and board members in the budget development and review process. Their insights into operational needs and funding realities are invaluable. This also fosters a sense of shared ownership and accountability.

- Scenario Planning: Develop multiple budget scenarios (e.g., best-case, worst-case, most likely) to prepare for unforeseen circumstances. This proactive approach enhances financial resilience and decision-making capabilities.

- Transparency and Communication: Clearly communicate the budget to all relevant internal and external stakeholders. Transparency builds trust with your board, staff, and most importantly, your donors and the public.

- Utilize Technology: Leverage accounting software and spreadsheet tools that allow for easy tracking, reporting, and integration with other financial systems. Automating processes can save time and reduce errors, enhancing operational efficiency.

- Align with Strategic Goals: Ensure every line item in your budget directly supports your organization’s strategic plan and mission. If an expenditure doesn’t contribute to your goals, question its necessity. This ensures resources are always channeled towards maximum impact.

- Segregate Funds Properly: Maintain strict separation between restricted and unrestricted funds to ensure compliance with donor stipulations and legal requirements. Mismanagement of restricted funds can lead to serious legal and reputational consequences.

Frequently Asked Questions

Do small nonprofits truly need a comprehensive budget template?

Absolutely. While a small organization’s budget might be less complex than a larger one, a structured financial framework is crucial regardless of size. It instills discipline, aids in grant applications, ensures financial transparency, and helps even the smallest teams make informed decisions about limited resources, safeguarding their mission and credibility.

How often should a nonprofit budget be updated or reviewed?

While an annual budget sets the financial blueprint for the year, it should be reviewed and compared against actual performance at least quarterly, if not monthly. This regular monitoring allows for necessary adjustments due to unforeseen changes in revenue or expenses, ensuring the organization remains on track and can respond proactively to financial shifts.

What’s the difference between an operational budget and a program budget?

An operational budget covers all the day-to-day costs of running the entire organization, including administrative and fundraising expenses, alongside program costs. A program budget, however, is a specific financial plan tailored to a single program or project, detailing its unique revenues and expenditures. Both are essential components of a holistic financial strategy for NPOs.

How does a budget template help with grant applications?

A well-prepared financial planning tool is invaluable for grant applications as it demonstrates to funders that your organization has a clear, responsible plan for utilizing their funds. It allows you to present a detailed breakdown of projected expenses and revenues, aligning financial needs directly with program objectives and showcasing your capacity for sound fiscal management.

What about handling unexpected expenses or revenue shortfalls?

This is where scenario planning and a dedicated contingency fund within your budget become vital. By anticipating potential challenges and allocating a reserve for unexpected costs or shortfalls, your organization can absorb financial shocks without disrupting critical services. Regular budget reviews also help in early detection, allowing for quicker adjustments to spending or fundraising efforts.

In the dynamic landscape of nonprofit work, sound financial stewardship is not merely an administrative task; it is a fundamental pillar of impact. A thoughtfully implemented Budget Template For Non Profit Organization transcends its basic function as a financial document, evolving into a living strategic tool that empowers organizations to achieve their missions with greater efficiency, transparency, and long-term sustainability. It is the roadmap that guides every dollar, ensuring it contributes meaningfully to the change you seek to create.

By embracing this powerful financial framework, your nonprofit can foster deeper trust with donors, secure vital funding, and make more informed decisions that amplify your reach and solidify your legacy. It’s an investment in your mission, your community, and the countless lives you touch, transforming financial planning from a daunting task into a strategic advantage that drives real-world change.