In an era where financial stability feels more elusive than ever, the desire for clarity and control over one’s money has never been stronger. Many Americans find themselves caught in a cycle of earning and spending, often without a clear understanding of where their hard-earned dollars truly go. This lack of insight can lead to stress, missed financial goals, and a persistent feeling of being behind the curve.

Fortunately, taking charge of your finances doesn’t require a finance degree or complicated software. Often, the most powerful tools are the simplest: a structured approach to tracking your income and expenses. This is precisely where a carefully designed, yet flexible, financial planning template comes into play, offering a clear path to understanding and optimizing your spending habits for a more secure future.

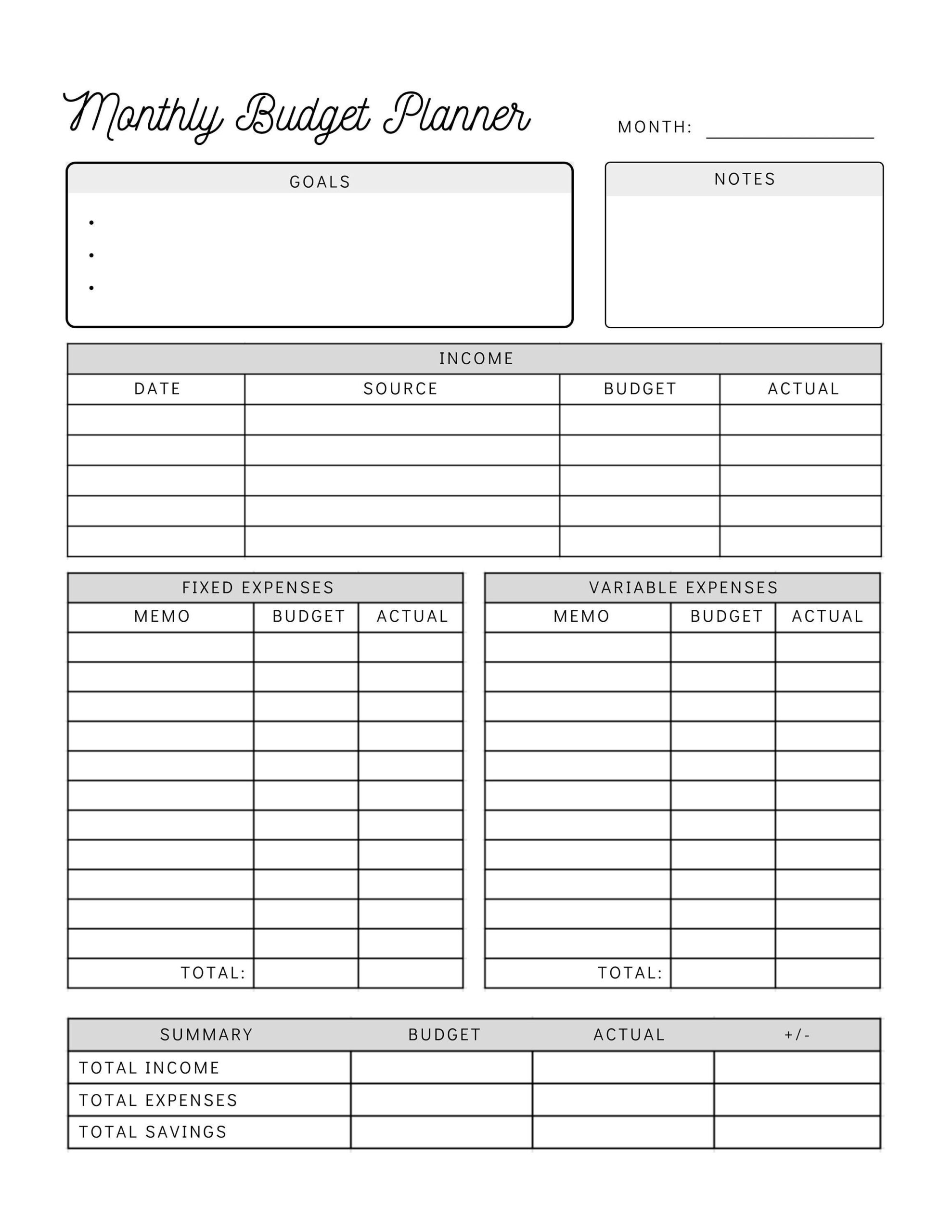

Why a Blank Budget Template is Your Financial Game Changer

A blank personal monthly budget template is more than just a sheet of numbers; it’s a foundational tool for financial empowerment. It transforms abstract anxieties about money into concrete data points you can analyze and act upon. By meticulously detailing your income and outgoings, you gain an unprecedented level of insight into your spending patterns, revealing where your money is truly flowing each month. This transparency is the first crucial step towards making informed decisions about your financial future.

Utilizing a customizable budget sheet brings a multitude of benefits. It helps you identify unnecessary expenditures, highlight areas where you can save, and allocate funds more strategically towards your goals, whether that’s building an emergency fund, paying off debt, or saving for a down payment on a home. This proactive approach fosters a sense of control and reduces financial stress, replacing guesswork with a clear, actionable spending plan that aligns with your personal aspirations. It’s about consciously directing your money, rather than wondering where it went.

The Core Components of an Effective Personal Budget

Crafting a robust personal budget framework begins with understanding the essential categories that need to be tracked. While the goal is to provide an empty budget spreadsheet for you to customize, every effective money management sheet must account for certain fundamental elements. These components ensure a comprehensive overview of your financial landscape, allowing for accurate tracking and informed decision-making.

Here are the key elements your blank personal monthly budget template should include:

- **Income Sources:** Begin by listing all your incoming funds. This includes your net pay (after taxes and deductions), freelance income, rental income, side hustle earnings, or any other regular influx of cash. Be sure to calculate the total monthly income accurately.

- **Fixed Expenses:** These are costs that generally stay the same month to month and are often contractual. Examples include:

- **Rent or mortgage** payments

- **Loan payments** (car loans, student loans, personal loans)

- **Insurance premiums** (health, auto, life)

- **Subscription services** (streaming, gym memberships)

- **Variable Expenses:** These are costs that fluctuate each month, offering more flexibility for adjustment. Tracking these closely is crucial for finding savings. Common variable expenses include:

- **Groceries and dining out**

- **Utilities** (electricity, water, gas – which can vary)

- **Transportation** (gas, public transit fares)

- **Entertainment and recreation**

- **Personal care** (haircuts, toiletries)

- **Clothing**

- **Savings and Investments:** Treat savings as a non-negotiable expense. Allocate funds for an emergency fund, retirement accounts (401k, IRA), investment accounts, or specific short-term goals like a vacation or a new appliance.

- **Debt Repayment (beyond minimums):** If you have credit card debt or other high-interest loans, a dedicated portion of your budget should focus on accelerating these repayments. This can free up significant funds in the long run.

By organizing your finances into these clear categories, your expenditure tracker becomes a powerful tool, providing a granular view of your financial health.

How to Use Your Customizable Budget Template

Once you have your personal finance template set up with the necessary categories, the real work—and reward—begins. Using a monthly budget template effectively is an ongoing process, not a one-time task. It involves consistent input, diligent tracking, and regular review. Think of it as a living document that evolves with your financial situation and life changes.

First, gather all your financial statements: pay stubs, bank statements, credit card statements, and any records of recurring bills. This initial data collection phase is crucial for accurately filling in your estimated income and expenses. Next, transfer these figures into your chosen blank budgeting tool. Be as realistic as possible with your estimates for variable expenses, perhaps using an average from the last few months. As the month progresses, diligently record every transaction. This could be done daily or a few times a week, depending on your preference. Many people find linking bank accounts to digital tools helpful for automation, but manually entering data into a physical sheet or spreadsheet can also foster a stronger connection to your spending.

At the end of the month, or at a set review period, compare your actual spending against your budgeted amounts. This comparison is the most insightful part of the process. Did you overspend in certain categories? Under-spend in others? Identify trends and areas for improvement. This analysis informs adjustments for the following month, making your spending plan more accurate and effective over time. Remember, the goal isn’t perfection from day one, but continuous improvement and greater financial awareness.

Tailoring Your Budget for Your Unique Life

The beauty of a blank personal monthly budget template lies in its adaptability. While the core components remain consistent, how you fill out and utilize your financial control document should reflect your unique circumstances, income, and financial goals. A college student’s budget will look vastly different from that of a single parent or a retiree, and the template should be flexible enough to accommodate these variations.

Consider your personal income structure. If you have a fluctuating income, like a freelancer or someone on commission, your approach to a monthly spending organizer might involve creating a "buffer" category or budgeting based on your lowest historical income to ensure you always have enough. For families, the template can be expanded to include shared household expenses and individual allowances. You might also want to add specific categories for large upcoming expenses, such as home repairs, car maintenance, or holiday spending, allowing you to save incrementally throughout the year.

The medium you choose for your personal finance template also offers customization. Some prefer the tactile experience of pen and paper, which can reduce screen time and increase mindfulness about spending. Others benefit from digital spreadsheets like Excel or Google Sheets, which allow for automated calculations, charts, and easy adjustments. There are also numerous budgeting apps that offer a structured digital framework with varying levels of automation and integration. The best choice is the one you’ll consistently use and feel comfortable adjusting to fit your evolving financial picture.

Beyond the Numbers: Making Your Budget a Habit

Implementing a blank personal monthly budget template is a powerful first step, but sustaining its effectiveness requires transforming it into a consistent habit. This goes beyond mere tracking; it involves a mindset shift and adopting strategies that integrate budgeting seamlessly into your daily life. Consistency is key, as sporadic efforts will yield sporadic results.

One effective strategy is to schedule regular "money dates" with yourself or your partner. This could be a weekly 15-minute check-in or a more comprehensive monthly review. During these sessions, you’ll update your figures, analyze your spending against your targets, and make any necessary adjustments for the upcoming period. Automation can also be a powerful ally. Set up automatic transfers to your savings and investment accounts immediately after you get paid. This "pay yourself first" approach ensures your financial goals are prioritized before discretionary spending. Another vital aspect is to be kind to yourself. There will be months where you overspend in a category, or unexpected expenses arise. The purpose of a budget is not to be a restrictive punishment, but a guiding tool. Learn from these instances, adjust your plan, and move forward without self-recrimination. Celebrate small wins, too – every successful month where you stick to your plan builds momentum and reinforces positive financial behavior.

Frequently Asked Questions

Is a blank budget template only for people struggling financially?

Absolutely not. While a customizable budget sheet is invaluable for those looking to get out of debt or gain control over their finances, it’s equally beneficial for individuals and families who are financially stable. It helps optimize spending, accelerate wealth building, and plan for future goals, ensuring your money is always working for you, regardless of your current financial standing.

How often should I update my personal monthly budget?

While you should track your expenses continuously throughout the month, a full review and update of your monthly budget template should typically happen once a month. This usually occurs at the beginning of each new month, allowing you to review the previous month’s actuals, adjust categories, and set new targets based on upcoming income and expenses.

What if my expenses exceed my income using this budget template?

If your initial financial blueprint reveals that your expenses are higher than your income, don’t panic. This is a common and critical insight that the empty budget spreadsheet provides. It’s an opportunity to identify areas where you can cut back, such as reducing variable expenses like dining out or entertainment, or exploring ways to increase your income. The budget highlights the problem, empowering you to find a solution.

Should I use an app or a physical budget sheet?

The choice between an app, a digital spreadsheet, or a physical budget sheet for your personal finance template depends entirely on your personal preference and what works best for your habits. Some prefer the tangible nature and focused approach of a physical sheet, while others appreciate the automation, analytics, and accessibility of digital tools. Experiment with both to see which method you’re more likely to stick with consistently.

Can I use this for business finances too?

While the principles of tracking income and expenses are universal, a blank personal monthly budget template is specifically designed for individual or household finances. Business finances typically require more complex accounting, tax considerations, and specialized categories for revenue, operating costs, and business-specific assets and liabilities. It’s best to use a dedicated business accounting system for those needs.

Taking the proactive step to implement a personal monthly budget is one of the most impactful decisions you can make for your financial well-being. It transforms vague financial anxieties into a clear, actionable plan, offering a roadmap to achieve your monetary goals, big or small. From building an emergency fund to saving for retirement or a down payment, every dollar has a purpose when guided by a thoughtful spending plan.

Don’t let the idea of budgeting feel daunting or restrictive. Instead, view your blank personal monthly budget template as a powerful ally, a tool for liberation that gives you true agency over your money. Start today, even if it’s just by sketching out your current income and a few key expenses. The journey to financial clarity and security begins with that single, intentional step.