Navigating personal finances can often feel like a complex puzzle, especially when paychecks arrive every two weeks. For many households, the traditional monthly budget doesn’t quite align with this income rhythm, leading to potential confusion, stress, and a feeling of always being a step behind. Imagine a world where your financial planning naturally syncs with your earnings, providing clarity and confidence without the constant scramble.

This alignment is precisely what a bi-weekly approach offers. It’s not just about tracking money; it’s about gaining genuine control over your cash flow, making informed decisions, and proactively steering your financial ship. Whether you’re aiming to pay down debt, save for a down payment, or simply understand where every dollar goes, adopting a well-structured bi-weekly budget can transform your financial outlook, empowering you to achieve your monetary goals with greater ease and precision.

Why a Bi-Weekly Approach Makes Sense for Many Households

The rhythm of bi-weekly paychecks is incredibly common, yet many budgeting tools are still designed around a monthly cycle. This mismatch can create unnecessary hurdles, as funds received at the beginning of the month might need to stretch over a longer, uneven period to cover expenses. A bi-weekly budget, however, naturally synchronizes with how you receive your income, offering a more immediate and realistic snapshot of your financial health.

This frequent check-in fosters better financial discipline. Instead of waiting an entire month to assess your spending, you get to review and adjust every two weeks. This tighter feedback loop allows for quicker course corrections, preventing small overspends from snowballing into significant problems. It also reduces the mental load of trying to project a whole month’s worth of expenses, making your financial planning feel more manageable and less daunting. Embracing this cadence transforms budgeting from a chore into a regular, empowering habit, providing a consistent lens through which to view your financial progress.

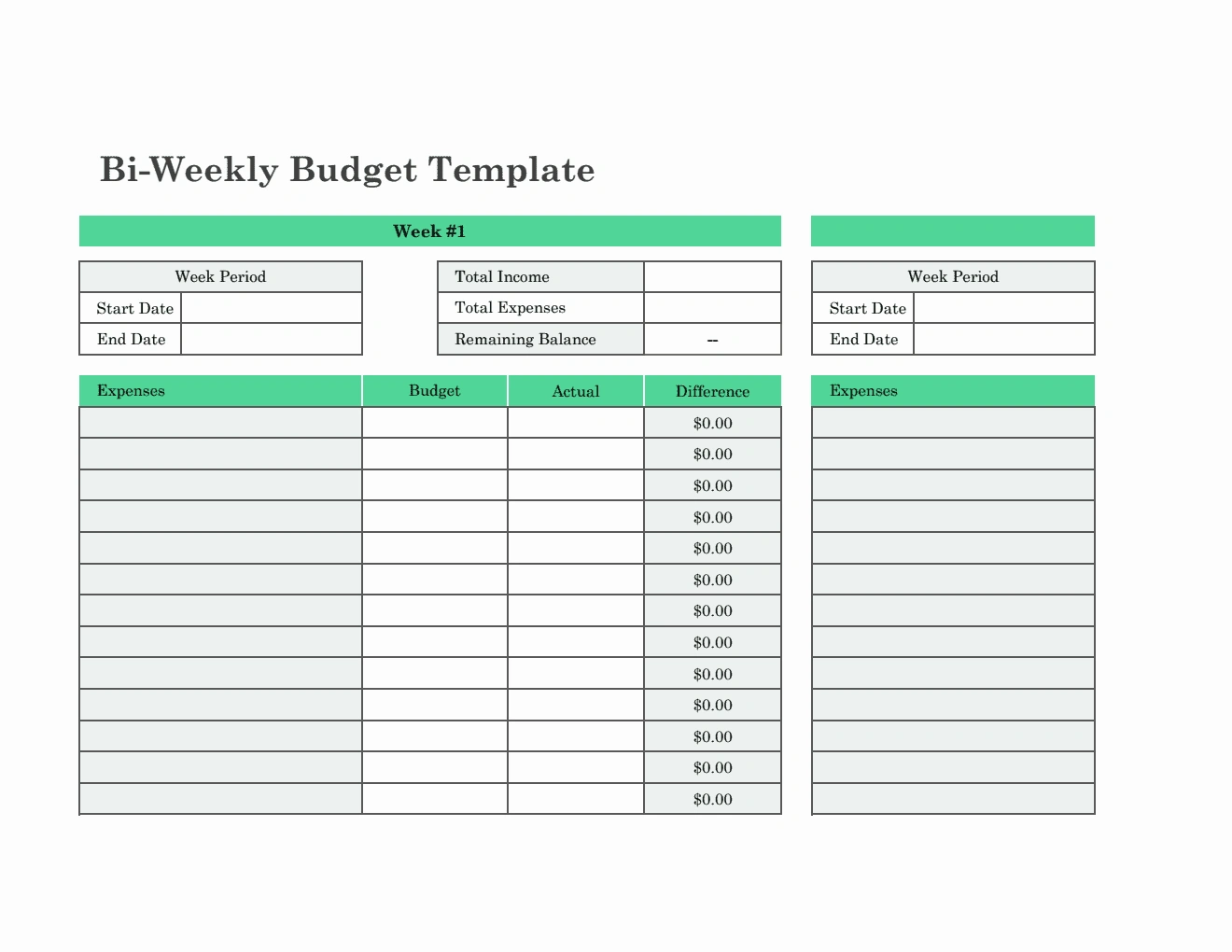

Decoding the Elements of an Effective Bi-Weekly Financial Plan

A robust bi-weekly financial plan isn’t just about tracking income; it’s about allocating every dollar with intention. To build a comprehensive and usable framework, you need to identify and categorize all monetary inputs and outputs that occur within a two-week period. This meticulous approach ensures that no expense is overlooked and that your funds are strategically distributed across your priorities.

The core components of any reliable household budget plan include both your earnings and your expenditures, broken down into manageable categories. Understanding these elements is the first step toward creating a powerful financial roadmap that reflects your reality and supports your goals. A clear breakdown helps you see where your money truly goes, enabling smarter decisions about saving and spending.

Here are the essential elements to include in your two-week financial tracker:

- Income Sources: Clearly list all funds you expect to receive during the two-week period. This includes your primary paycheck, side hustle earnings, government benefits, or any other predictable income streams.

- Fixed Expenses: These are costs that typically don’t change from period to period. This might include a prorated portion of your monthly rent or mortgage payment, loan installments (car, student), insurance premiums, or subscription services. Break down monthly fixed costs into two halves if they span the bi-weekly period.

- Variable Expenses: These are expenses that fluctuate. Common examples include groceries, dining out, entertainment, gas, personal care, and shopping. This category often requires the most diligent tracking and adjustment.

- Savings & Investments: Designate specific amounts to transfer to your savings accounts, emergency fund, or investment portfolios. Making this a fixed “expense” ensures you’re always paying yourself first.

- Debt Repayment: Beyond minimum payments, allocate funds towards accelerating high-interest debt, if that’s a financial goal. This dedicated focus can significantly impact your debt-free journey.

- Miscellaneous/Buffer: Always include a small buffer for unexpected costs or minor discretionary spending that doesn’t fit neatly into other categories. This prevents budget blowouts from minor surprises.

By meticulously filling out each of these sections, you create a dynamic and actionable bi-weekly plan that provides clarity and control over your money. This detailed approach is fundamental for turning abstract financial goals into concrete, achievable steps.

How to Implement Your Bi-Weekly Household Budget Template

Implementing a new financial system might seem daunting at first, but with a structured approach, you can seamlessly integrate a bi-weekly budget into your routine. The key is to start with accuracy, maintain consistency, and embrace the iterative nature of financial planning. Your Bi Weekly Household Budget Template is a living document, designed to evolve with your financial life.

The initial setup requires a bit of dedicated time, but the payoff in terms of clarity and control is immeasurable. Think of it as laying the foundation for a stronger financial future. Once the groundwork is laid, the ongoing maintenance becomes a quick and straightforward task, fitting naturally into your regular schedule.

Here are the practical steps to put your template into action:

Step 1: Gather Your Financial Data. Before you begin, collect all necessary documents. This includes recent pay stubs, bank statements, credit card statements, and bills for the past month or two. Having this information readily available will ensure your budget is based on real numbers, not guesswork.

Step 2: Input Your Bi-Weekly Income. Start by accurately listing all income you anticipate receiving within your chosen two-week budget cycle. If your pay varies, use a conservative estimate or average your last few paychecks to get a realistic figure.

Step 3: Categorize Your Expenses. Go through your bank and credit card statements. Identify and list all your expenses, separating them into fixed and variable categories as discussed previously. For monthly fixed expenses, divide them in half to allocate to each bi-weekly period. For example, if your rent is $1200 a month, allocate $600 to each bi-weekly budget period.

Step 4: Allocate Funds to Each Category. This is where you assign specific dollar amounts to each expense category. Be realistic. If you consistently spend $150 on groceries every two weeks, don’t budget only $100. This is also the stage to decide how much you’ll allocate to savings and debt repayment.

Step 5: Track and Adjust Regularly. Once your budget is set, the most crucial part is tracking your spending against it. Monitor your expenses daily or every few days. At the end of each two-week cycle, compare your actual spending to your budgeted amounts. This comparison is vital for identifying areas where you’re overspending or underspending, allowing you to make informed adjustments for the next cycle. Remember, the Bi Weekly Household Budget Template is a tool for understanding and control, not rigid restriction. Customization to fit your unique circumstances is always encouraged.

Maximizing Your Budget’s Impact: Practical Tips for Success

Creating a budget template is just the beginning; the real power comes from consistently using it and optimizing your financial habits. Making your bi-weekly budget a truly effective tool requires more than just filling in numbers; it demands a strategic approach to spending, saving, and financial review. These practical tips will help you move beyond basic tracking and transform your financial plan into a dynamic engine for wealth building and peace of mind.

Embracing these strategies will ensure your regular financial planning tool serves as a reliable guide, helping you navigate challenges and celebrate successes. It’s about building resilience and ensuring your financial future is as bright as possible.

- Be Realistic, Not Restrictive: Set achievable spending limits. An overly strict budget is hard to maintain and can lead to burnout or giving up. Factor in small indulgences to make it sustainable.

- Build a Buffer: Always include a “miscellaneous” or “buffer” category. This acts as a mini-emergency fund for small, unexpected costs, preventing you from dipping into your savings or derailing your main budget.

- Automate Savings & Bills: Set up automatic transfers for your savings and fixed bill payments right after your paycheck lands. This ensures you “pay yourself first” and don’t miss important due dates.

- Review Mid-Cycle: Don’t wait until the end of the two weeks. Briefly review your spending at the one-week mark. This allows for early adjustments if you’re trending towards overspending in a particular category.

- Involve the Household: If you share finances, ensure everyone in the household is aware of and contributes to the budget. Transparency and shared goals lead to greater collective success.

- Track Every Dollar: This might seem tedious, but it’s crucial, especially for variable expenses. Use an app, a small notebook, or your template’s tracking section. Awareness is the first step to control.

- Celebrate Small Wins: Did you stick to your grocery budget for the first time? Acknowledge it! Positive reinforcement helps build good habits and keeps motivation high for your expenditure tracker.

- Don’t Fear Adjustments: Life happens. If an unexpected expense arises or your income changes, don’t abandon your budget. Simply adjust it for the current or next cycle. Flexibility is key to long-term success.

Navigating Common Budgeting Challenges

Even with a solid bi-weekly budget in place, you’ll inevitably encounter bumps in the road. Budgeting is a skill that improves with practice, and facing challenges head-on is part of the learning process. Understanding common pitfalls and having strategies to overcome them can prevent minor setbacks from derailing your entire financial plan. It’s about building resilience and finding solutions that work for your unique circumstances.

Successfully navigating these hurdles reinforces your commitment and strengthens your financial discipline. With each challenge overcome, your ability to manage your finances bi-weekly grows, solidifying your path to financial stability.

Overspending on Variable Expenses: This is a common issue. If you consistently blow your budget on categories like dining out or entertainment, it might be due to unrealistic initial allocations or a lack of awareness of impulse spending.

Solution: Re-evaluate your budget numbers to be more realistic. Try the “cash envelope” system for these categories, or implement a “cooling-off” period before making non-essential purchases. Track every single penny in these areas to pinpoint where the money is truly going.

Unexpected Expenses Derailing the Budget: A car repair, a sudden doctor’s visit, or a broken appliance can throw off even the best-laid plans.

Solution: This highlights the critical importance of an emergency fund. Make contributing to your emergency fund a line item in every bi-weekly budget. Even small, consistent contributions build a safety net that protects your budget from unexpected shocks.

Inconsistent Income: For freelancers, commission-based earners, or those with seasonal work, a fixed bi-weekly income might not be the reality.

Solution: Adapt your budget. Instead of fixed income, budget based on your lowest historical income, or average your income over several months. You can also prioritize essential expenses when income is low and allocate surplus income from higher-earning periods to savings or a “buffer” for leaner times.

Loss of Motivation or Feeling Overwhelmed: Budgeting can feel tedious or restrictive, leading to a loss of interest.

Solution: Remind yourself of your financial goals. Break down big goals (like saving for a house) into smaller, achievable bi-weekly milestones. Find a budgeting buddy, use an engaging budgeting app, or reward yourself (within budget!) for sticking to your plan. Remember, it’s a marathon, not a sprint, and consistency is more important than perfection.

Frequently Asked Questions

Is a bi-weekly budget better than a monthly one?

It’s not necessarily “better” but often more aligned for individuals receiving bi-weekly paychecks. A bi-weekly budget provides more frequent check-ins, allowing for quicker adjustments and a clearer view of spending habits in real-time, which can be less overwhelming than a full monthly review.

How long does it take to set up this type of financial plan?

The initial setup of a detailed two-week financial tracker might take an hour or two as you gather all your financial information and categorize your expenses. After the first cycle, reviewing and adjusting your household budget plan typically takes only 15-30 minutes every two weeks, once you get into the rhythm.

What if my income is not exactly bi-weekly?

You can still adapt this budget structure. If you’re paid weekly, simply combine two weeks’ worth of income and expenses to create your bi-weekly budget. If your income varies, use an average of your recent paychecks or a conservative estimate, adjusting your budget mid-cycle if needed.

Can I use a spreadsheet for my household budget plan?

Absolutely, spreadsheets are excellent tools for managing finances bi-weekly. They offer flexibility for customization, allow for automatic calculations, and can be easily updated. Many free templates are available online, or you can create your own tailored to your specific needs.

What’s the best way to track variable expenses?

There are several effective ways. You can use a dedicated budgeting app that links to your bank accounts, keep a small notebook to jot down purchases, or simply log expenses directly into your spreadsheet or template daily. The key is to find a method you’ll stick with consistently to maintain your expenditure tracker.

Bringing your finances into focus with a dedicated bi-weekly system is a profound step towards financial empowerment. It’s about more than just numbers; it’s about peace of mind, informed decision-making, and the tangible progress towards your most significant aspirations. By aligning your budget with your pay cycle, you create a natural rhythm that simplifies tracking and amplifies your control.

The discipline cultivated by a Bi Weekly Household Budget Template isn’t a limitation; it’s a liberator. It frees you from the uncertainty of not knowing where your money goes and propels you toward a future where your financial goals are not just dreams, but clear, achievable targets. Take that vital step today, transform your financial habits, and embrace the clarity and confidence that a well-managed Bi Weekly Household Budget Template can bring to your life.