In the intricate dance of modern life, managing personal and household finances often feels like an overwhelming task. From tracking daily expenses to anticipating future needs, the sheer volume of financial decisions can leave many feeling lost, stressed, or simply reactive. Yet, achieving financial peace of mind and making meaningful progress toward your goals doesn’t have to be a mystery. The key lies in strategic planning and consistent oversight.

This is precisely where a well-structured approach to financial planning becomes invaluable. It’s more than just a list of numbers; it’s a living document that reflects your financial reality and aspirations. By taking a proactive stance with your money, you gain clarity, reduce stress, and empower yourself to make informed choices that align with your long-term objectives. For anyone looking to take control of their financial destiny, understanding and utilizing a comprehensive financial plan is the first crucial step.

Why an Annual Approach Matters for Your Finances

While monthly budgeting is a common practice, focusing solely on a 30-day cycle can often lead to financial blind spots. Many significant expenses and income fluctuations don’t fit neatly into a single month. Think about annual insurance premiums, property taxes, holiday spending, vehicle registration, or even planned vacations—these are often large, infrequent costs that can derail a monthly budget if not anticipated.

Adopting an annual household budget template allows for a broader, more strategic perspective. It encourages you to look beyond the immediate and plan for the entire year, factoring in those irregular but inevitable expenses. This yearly financial plan helps smooth out the financial roller coaster, preventing unexpected bills from becoming crises and enabling a more consistent path toward your savings and investment goals. It transforms reactive spending into proactive financial management, giving you a clearer picture of your money’s journey throughout the year.

The Core Benefits of Using a Comprehensive Budget Tool

Implementing a dedicated household budget planning strategy offers a myriad of advantages that extend far beyond simply knowing where your money goes. It’s a powerful tool for financial empowerment and clarity, helping you sculpt a more secure future for yourself and your family.

Firstly, it provides unparalleled insight into your financial landscape. By meticulously detailing all income and expenses, a yearly financial roadmap helps you see precisely how much money is coming in and going out. This transparency is the foundation for all sound financial decisions, allowing you to identify spending patterns you might not even realize exist.

Secondly, a robust family spending tracker enables you to pinpoint areas where you can save. Once you have a clear overview of your expenditures, it becomes easier to spot unnecessary costs, recurring subscriptions you no longer use, or categories where overspending is rampant. This awareness is the first step toward optimizing your spending and freeing up funds for more meaningful pursuits, such as debt reduction or savings.

Finally, and perhaps most importantly, a personal finance blueprint reduces financial stress and anxiety. When you have a clear plan for your money, you replace uncertainty with confidence. You’re no longer guessing if you can afford a particular expense or worrying about unexpected bills because you’ve already allocated funds for them. This proactive approach fosters a sense of control, leading to greater financial stability and peace of mind.

Key Components of Your Household Financial Plan

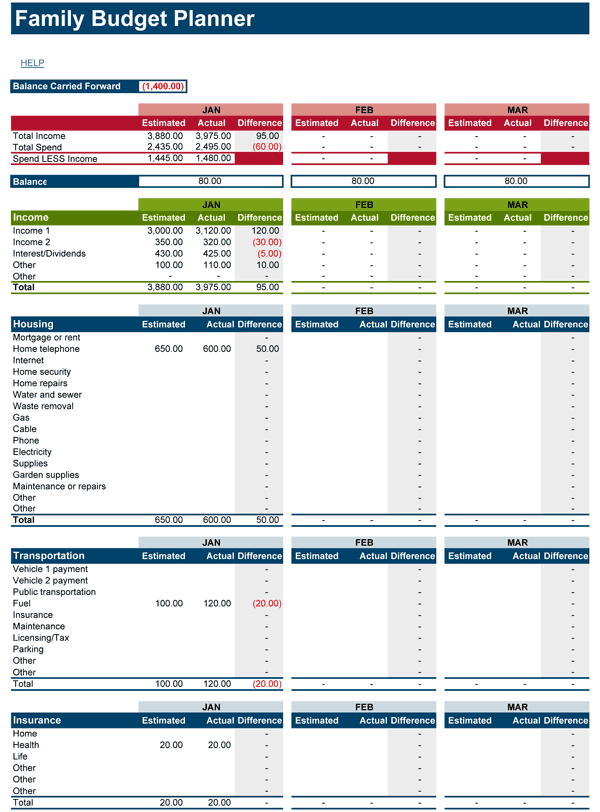

A truly effective annual household budget template is built upon several foundational components, each playing a crucial role in providing a complete financial picture. By meticulously tracking these elements, you gain a holistic understanding of your money’s flow and can make informed decisions.

- Income Sources: This section details all money flowing into your household. Include salaries, bonuses, commissions, freelance income, rental income, social security benefits, child support, and any other regular or irregular sources of funds. Be as comprehensive as possible to get an accurate total.

- Fixed Expenses: These are the predictable, often non-negotiable costs that remain relatively constant each month. Examples include rent or mortgage payments, loan payments (car, student, personal), insurance premiums (health, auto, life), and certain subscription services (internet, streaming). These are typically easy to budget for due to their consistency.

- Variable Expenses: Unlike fixed expenses, these costs fluctuate from month to month. This category includes groceries, utilities (electricity, water, gas), transportation (gas, public transit), dining out, entertainment, and personal care. Managing variable expenses often requires more attention and discipline, as they are prime areas for overspending.

- Savings & Investments: This crucial component should be prioritized. It includes contributions to emergency funds, retirement accounts (401k, IRA), college savings plans, down payments for a home, or any other long-term financial goals. Treating savings as a non-negotiable expense helps ensure your future financial security.

- Debt Repayment: Beyond minimum payments on loans, this section outlines any extra payments you plan to make to accelerate debt reduction. This could be credit card debt, student loans, or personal loans. A strategic approach here can save you significant interest over time.

- Discretionary Spending: Often referred to as “fun money,” this category covers expenses for hobbies, entertainment, gifts, vacations, and dining out that aren’t strictly necessary but contribute to your quality of life. Allocating a realistic amount here prevents feelings of deprivation and makes your budget sustainable.

- Irregular Expenses: These are the costs that don’t occur monthly but are predictable annually. Examples include vehicle registration, property taxes, holiday gifts, annual memberships, or school fees. Planning for these throughout the year prevents them from becoming sudden financial shocks.

By organizing your finances into these distinct components, your annual spending overview becomes a powerful tool. It allows you to visualize your financial landscape, identify patterns, and allocate resources strategically across an entire year, rather than just a month.

Setting Up Your Yearly Financial Roadmap

Embarking on the journey of creating your domestic financial plan might seem daunting, but by breaking it down into manageable steps, you can build a robust system that serves your unique needs. The goal is to create a dynamic financial budgeting framework that you can stick with and adjust as life evolves.

The first step is **gathering your financial data**. Collect all relevant documents: bank statements, pay stubs, credit card statements, loan statements, and bills from the past 12 months. This historical data is vital for accurately assessing your income and expenses. Don’t forget to include statements for any investments or savings accounts to get a full picture.

Next, **categorize and total your income and expenses**. Using the components outlined above, start inputting your data into your chosen annual household budget template. Be meticulous in classifying each transaction. This phase reveals where your money has actually gone over the past year, often highlighting surprising spending habits or overlooked recurring costs. This detailed breakdown forms the backbone of your comprehensive budget tool.

Then, **project and allocate your funds for the upcoming year**. Based on your historical data and any anticipated changes (e.g., a raise, new baby, retirement), set realistic targets for each spending category. This is where you decide how much you want to allocate to savings, debt repayment, and discretionary spending. Remember to factor in irregular expenses by dividing their annual cost into monthly savings targets (e.g., if car registration is $300 annually, set aside $25 each month).

Finally, **implement, monitor, and adjust**. A budget is not a static document; it’s a living guide. Begin tracking your spending against your plan as soon as it’s set up. Review your progress regularly—monthly or quarterly is ideal—and be prepared to make adjustments. Life happens, and your budget should be flexible enough to accommodate changes in income, expenses, or financial goals. This iterative process of review and refinement is crucial for successful long-term financial planning.

Tips for Maximizing Your Household Expense Management

Successfully managing household finances with your annual household budget template goes beyond just filling in numbers. It requires dedication, consistency, and a willingness to adapt. Here are some actionable tips to help you get the most out of your financial planning guide and ensure it becomes a powerful ally in your quest for financial well-being.

**Make it a collaborative effort.** If you share finances with a partner or family, involve everyone in the budgeting process. Open communication about financial goals and spending habits can lead to greater collective responsibility and commitment. When everyone understands the yearly financial roadmap, it’s much easier to stick to it.

**Be realistic with your allocations.** It’s tempting to cut expenses drastically, but an overly restrictive budget is often unsustainable. Allocate reasonable amounts for discretionary spending to avoid feelings of deprivation, which can lead to budgeting fatigue and ultimately, abandonment. A sustainable budget is one you can comfortably live with.

**Automate your savings and bill payments.** Set up automatic transfers from your checking account to your savings and investment accounts on payday. Similarly, automate bill payments for fixed expenses whenever possible. This “set it and forget it” approach ensures you consistently meet your financial goals and obligations, making your financial budgeting framework work for you without constant manual effort.

**Track your spending regularly.** Whether you use an app, a spreadsheet, or pen and paper, consistently log your expenses. This real-time tracking allows you to see if you’re on target and make immediate adjustments if you’re veering off course. Regular financial check-ins are vital to keep your household expense management on track.

**Build an emergency fund.** One of the most critical aspects of long-term financial planning is having a safety net. Aim to save 3-6 months’ worth of essential living expenses in an easily accessible, separate savings account. This fund acts as a buffer against unexpected events like job loss, medical emergencies, or major home repairs, preventing you from going into debt.

**Celebrate your successes, no matter how small.** Achieving financial milestones, whether it’s paying off a small debt, hitting a savings goal, or simply sticking to your budget for a month, deserves recognition. Positive reinforcement keeps you motivated and reinforces the value of your efforts in managing household finances.

Frequently Asked Questions

Is an Annual Household Budget Template suitable for fluctuating incomes?

Yes, absolutely. While it requires a bit more planning, individuals with fluctuating incomes can benefit greatly. It’s recommended to budget based on your lowest expected income or use an average of the past 12-24 months. You can then allocate any “extra” income during higher-earning periods towards savings, debt repayment, or irregular expenses, building a buffer for leaner months. The yearly view inherently helps smooth out these variations.

How often should I review my yearly financial plan?

While it’s an annual plan, regular check-ins are essential. Most financial experts recommend reviewing your household budget planning at least monthly, and a more thorough review quarterly. Monthly check-ins allow you to track progress, make minor adjustments, and ensure you’re still on target. Quarterly reviews provide an opportunity to reassess larger goals, address significant changes in income or expenses, and adjust your annual spending overview as needed.

What if I consistently go over budget in certain categories?

If you find yourself consistently exceeding your budget in a specific area, it’s a signal to re-evaluate. First, check if your initial allocation was realistic; perhaps you underestimated actual costs. If it was realistic, then it’s time to identify why you’re overspending and explore ways to cut back, or reallocate funds from less critical areas. This might involve finding cheaper alternatives, reducing frequency, or adjusting your overall financial budgeting framework to better reflect your priorities.

Can I use this financial budgeting framework for business expenses too?

While the principles of tracking income and expenses are universal, an annual household budget template is specifically designed for personal and family finances. Business finances have different categories, tax implications, and reporting requirements. It’s generally best to keep personal and business finances separate and use a dedicated business budgeting system for professional expenditures to maintain clarity and compliance.

Where can I find an actual template to get started?

There are numerous resources available for an annual household budget template. You can find free templates online from financial institutions, personal finance blogs, and spreadsheet software providers (like Google Sheets or Microsoft Excel). Many budgeting apps also offer built-in templates. Look for one that is customizable and allows you to easily input your income, fixed expenses, variable expenses, and savings goals to create your personalized financial plan.

Embracing an annual household budget template is more than just an exercise in numbers; it’s an investment in your future self. It empowers you to move beyond simply reacting to your financial circumstances and instead, proactively design the life you envision. By understanding your money, you unlock the ability to make choices that align with your deepest values, whether that’s saving for a dream vacation, paying off debt, building wealth, or simply enjoying greater financial peace.

Take the first step today. Download a template, gather your statements, and begin the rewarding process of charting your financial course. The clarity and control you gain will not only transform your finances but also bring a profound sense of empowerment and security, paving the way for a more confident and financially resilient future.