In an era where financial stability feels like a constant pursuit, many individuals and families are searching for tools to gain real control over their money. Traditional budgeting methods often leave gaps, allowing “miscellaneous” expenses to swallow hard-earned income without accountability. This is where a more intentional approach, one that assigns a job to every single dollar, becomes not just helpful but transformative.

Imagine a world where you know exactly where every penny of your income goes before the month even begins. This isn’t wishful thinking; it’s the core principle behind an incredibly powerful financial strategy. By adopting a system that requires you to allocate every dollar of your income to a specific category, you eliminate financial ambiguity and empower yourself to make conscious spending decisions. This proactive stance is exactly what a robust zero based monthly budget template helps you achieve.

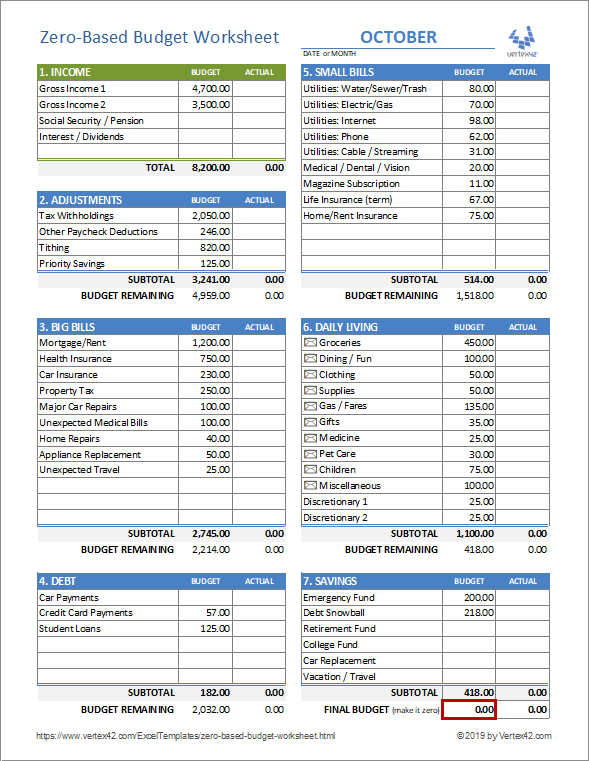

What Exactly is a Zero-Based Budget?

At its heart, zero-based budgeting is a method of financial planning where every dollar of your income is assigned a purpose—be it an expense, savings, or debt repayment—until your income minus your expenses equals zero. Unlike traditional budgets that might leave a “buffer” or unassigned funds, this philosophy demands that you give every penny a name and a job. It means consciously deciding where all your money will go, rather than simply tracking where it went.

This approach doesn’t mean you spend all your money; quite the opposite. It means you proactively decide to save a certain amount, invest another portion, and assign specific funds for bills and discretionary spending. The "zero" balance isn’t about being broke, but about being fully aware and in control of your financial destiny. It’s a powerful tool for clarity and intentionality in your personal finance.

Why Embrace This Budgeting Philosophy?

The benefits of adopting a zero-based approach extend far beyond simply tracking your spending. It’s a proactive mindset that reshapes your relationship with money, fostering greater awareness and accountability. This systematic allocation of funds can unlock significant financial progress and reduce stress.

By consciously planning for every dollar, you are less likely to overspend in categories that don’t align with your goals. It fosters a sense of empowerment, transforming you from a passive observer of your bank account into an active manager of your wealth. This method naturally highlights areas where you might be able to reallocate funds to achieve long-term aspirations faster, whether that’s saving for a down payment, paying off student loans, or building an emergency fund.

Key Components of an Effective Zero-Based Monthly Budget

A successful monthly spending plan isn’t about complexity; it’s about clarity and consistency. While the core principle is simple, a well-structured framework ensures you cover all your financial bases. Having a clear outline of what to include will make the process much smoother and more effective.

Here are the essential elements you’ll need to define and track:

- Income Sources: List all your take-home pay for the month. This includes salaries, side hustle earnings, passive income, or any other funds you anticipate receiving. Be as accurate as possible to ensure your budget is built on a realistic foundation.

- Fixed Expenses: These are costs that typically remain the same each month. Examples include your rent or mortgage, car payments, insurance premiums, and loan repayments. These are usually easy to identify and account for.

- Variable Expenses: This category encompasses costs that fluctuate. Think groceries, utilities (which can vary seasonally), gas, and dining out. These often require more careful estimation and tracking throughout the month.

- Savings Goals: Crucially, savings aren’t an afterthought; they are a line item with a purpose. Whether it’s an emergency fund, a down payment, or retirement contributions, allocate a specific amount.

- Debt Repayment: Beyond minimum payments, this method encourages you to assign extra funds to accelerate debt payoff, if that’s a goal. Identify specific debts you want to tackle.

- Discretionary Spending: This covers non-essential items like entertainment, hobbies, personal care, and gifts. It’s important to allocate funds here to ensure your budget is sustainable and enjoyable, rather than overly restrictive.

Building Your Personalized Monthly Spending Plan

Creating your own financial blueprint using a zero-based approach is a straightforward process once you understand the steps. It involves a bit of upfront work, but the clarity and control you gain are well worth the effort. Think of it as mapping out your financial journey for the upcoming month.

Here’s a practical guide to get started:

- Calculate Your Total Monthly Income: Begin by tallying every dollar you expect to receive in the month. This is your starting point—the total amount you have available to allocate. Don’t forget any additional income streams.

- List All Expenses: Go through your bank statements and credit card bills from the last few months to identify all your regular expenses, both fixed and variable. Don’t leave anything out, no matter how small. This step is crucial for an accurate spending allocation tool.

- Assign Every Dollar: This is the core of a zero-based budget. For each expense, savings goal, or debt payment, assign a specific dollar amount from your total income. Continue until your income minus all your allocations equals zero. If you have money left over, assign it to savings or debt. If you’ve run out of money before covering all your needs, you’ll need to adjust your allocations.

- Track Your Spending: Once the month begins, actively track your expenditures against your assigned categories. This is vital to ensure you stick to your plan and make real-time adjustments if necessary. A simple spreadsheet or budgeting app can be incredibly helpful here.

- Review and Adjust: At the end of the month, review your performance. Did you stick to your limits? Where did you overspend or underspend? Use these insights to refine your financial planning tool for the following month. This iterative process is key to long-term success.

Tips for Success with Your Budget

Implementing a new financial system can feel daunting, but a few key strategies can significantly ease the transition and boost your chances of long-term success with your zero-based budgeting approach. Consistency and realistic expectations are paramount.

- Be Patient with Yourself: The first month, or even the first few months, might not be perfect. It’s a learning curve. Don’t get discouraged if you overspend in a category; simply adjust for the next cycle.

- Automate When Possible: Set up automatic transfers for savings and bill payments. This ensures your allocations are met before you even have a chance to touch the money.

- Build an Emergency Fund: Before tackling other goals, prioritize building a robust emergency fund. This buffer prevents unexpected expenses from derailing your carefully crafted monthly spending plan.

- Create a Buffer Category: While the goal is zero, consider a small "buffer" or "miscellaneous" category for unexpected small expenses that don’t fit anywhere else. This prevents constantly dipping into other categories.

- Communicate with Partners: If you manage finances with a partner, ensure both of you are on board and openly communicate about spending decisions and goals. Teamwork makes the budget work.

- Make it Enjoyable: Don’t cut out all fun. Include allocations for discretionary spending that brings you joy. A sustainable budget is one you can stick to, and that often means allowing for some indulgences.

- Utilize Technology: There are numerous apps and digital budget spreadsheets that can simplify tracking and categorization, making the process less manual and more intuitive.

Adapting Your Financial Blueprint Over Time

Life is dynamic, and your financial situation will undoubtedly change. A static budget is rarely an effective one. What makes a zero-based monthly budget template particularly powerful is its inherent flexibility and adaptability. It’s not a rigid set of rules but a living document that evolves with your circumstances.

As your income changes, whether through a raise, a new job, or a side hustle, your allocations will need to be revisited. Similarly, major life events such as buying a home, having a child, or facing unexpected medical expenses will necessitate a complete overhaul of your current financial framework. Regularly reviewing and adjusting your spending allocation tool, ideally once a month before the new cycle begins, ensures it remains relevant and effective. This proactive review allows you to redistribute funds to new priorities, whether that’s increasing your savings, tackling new debt, or simply adjusting for inflation. It’s this continuous adaptation that cements the zero-based method as a robust and long-term financial planning tool.

Frequently Asked Questions

What’s the main difference between zero-based budgeting and traditional budgeting?

The primary distinction lies in how unspent money is treated. Traditional budgets often leave a general “miscellaneous” category or unassigned funds. A zero-based approach requires every dollar of income to be assigned a specific job—to be spent, saved, or used for debt repayment—until the total allocated funds equal the total income, resulting in a “zero” balance.

Does a zero-based budget mean I can’t save money?

Absolutely not. In fact, it’s quite the opposite. With zero-based budgeting, savings become a conscious line item, just like any other expense. You proactively assign a specific amount of money to savings goals each month, ensuring that saving is prioritized rather than being an afterthought or what’s left over.

Is this budgeting method suitable for irregular incomes?

Yes, it can be highly effective for irregular incomes, though it requires more diligent planning. For those with variable income, it’s often recommended to budget based on your lowest anticipated income for the month and then allocate any excess income that comes in later to specific “extra” categories, like savings or debt acceleration.

How long does it take to get used to this system?

Like any new habit, it takes time. Most people find that after 2-3 months of consistent effort, they start to feel much more comfortable and proficient with the system. The first month is typically the hardest as you identify all your expenses and refine your categories.

Do I need special software to implement a zero-based budget?

While many excellent apps and digital tools exist to simplify the process, you don’t necessarily need special software. A simple spreadsheet (like Google Sheets or Excel) or even a pen and paper can be perfectly adequate to create and manage your expenditure tracker. The key is consistent tracking and adherence to the principle.

Adopting a meticulously planned zero based monthly budget template isn’t just about managing money; it’s about mastering it. It offers a profound sense of clarity and purpose for every dollar that flows through your hands, transforming financial anxiety into empowering control. By embracing this approach, you’re not just tracking expenses; you’re actively shaping your financial future, aligning your spending with your deepest values and most ambitious goals.

The journey to financial peace of mind begins with intention, and a well-crafted monthly spending plan provides that essential foundation. Take the first step today towards a more conscious, controlled, and ultimately more prosperous financial life. Your future self will thank you for making every dollar count.