Taking control of your finances might feel like a daunting New Year’s resolution that often fades by February, but it doesn’t have to be. Imagine having a clear, actionable roadmap for your money throughout the entire year, allowing you to anticipate expenses, save for dreams, and navigate financial twists with confidence. This isn’t just wishful thinking; it’s the tangible benefit of embracing a well-crafted annual financial plan.

For many, the idea of budgeting conjures images of restrictive spreadsheets and endless calculations. However, a robust Yearly Personal Budget Template is more than just a ledger; it’s a powerful tool for self-discovery, financial clarity, and ultimate freedom. Whether you’re a recent graduate navigating your first independent expenses, a growing family planning for significant milestones, or an individual striving for early retirement, understanding and implementing an annual financial plan is the cornerstone of sustainable wealth building and peace of mind.

Why a Long-Term Financial Roadmap Matters

Shifting from a monthly budget to an annual financial plan offers a broader perspective that can transform your financial outlook. While monthly budgeting is crucial for day-to-day management, a longer-term view allows you to account for less frequent but significant expenditures. Think about annual insurance premiums, holiday spending, vehicle registration, or even planned vacations – these are often overlooked in a strictly month-to-month approach, leading to unexpected financial strain.

By plotting your financial course for the entire year, you gain an invaluable sense of foresight. This proactive stance helps mitigate financial stress, reduces the likelihood of relying on credit for irregular costs, and empowers you to make informed decisions about your income and expenses. It moves you from a reactive financial posture to one of deliberate control, providing a clearer path to achieving your personal financial goals.

Key Elements of an Effective Annual Financial Plan

A comprehensive annual financial plan isn’t about rigid deprivation; it’s about thoughtful allocation. To build an effective framework, you need to identify and track several key components that represent the ebb and flow of your money throughout the year. This involves a clear-eyed assessment of where your money comes from and where it goes.

Understanding these elements is the first step towards constructing a financial blueprint that genuinely reflects your life and aspirations. It’s about creating a living document that empowers you to prioritize spending, accelerate savings, and systematically tackle debt, all while ensuring you still have room for life’s enjoyable moments. The more accurately you detail these components, the more effective your overall budgeting system will become.

Setting Up Your Personalized Financial Framework

Creating your own Yearly Personal Budget Template doesn’t require a finance degree; it simply demands a commitment to understanding your money. The initial setup phase is crucial for establishing a solid foundation. Start by gathering all your financial statements from the past year: bank statements, credit card bills, pay stubs, loan documents, and investment summaries. This data will provide a realistic snapshot of your historical income and expenditure patterns.

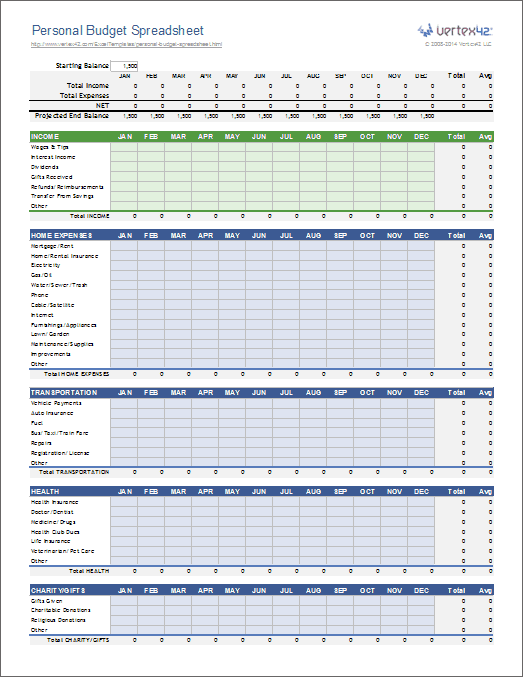

Next, choose a format that works for you. Many find a digital spreadsheet (like Excel or Google Sheets) ideal for its flexibility and calculation capabilities, allowing for easy customization and year-over-year comparison. Others prefer dedicated budgeting apps that automate much of the tracking. Regardless of your tool, the goal is to create a clear, organized system that allows you to input your data and visualize your financial position easily. Remember, this framework should be tailored to your unique financial situation and goals, not a generic, one-size-fits-all solution.

Categorizing Your Spending and Income

The heart of any successful budgeting system lies in its ability to accurately categorize where every dollar goes and where it originates. This breakdown provides the insights needed to identify spending patterns, areas for potential savings, and opportunities for financial growth. A robust annual financial plan will typically include:

- **Income Sources:** Detail all expected annual income, including salaries, bonuses, freelance earnings, investment dividends, and any other regular infusions of cash.

- **Fixed Expenses:** These are costs that generally stay the same each month or year and are non-negotiable. Examples include **rent or mortgage payments**, loan repayments, insurance premiums, and subscription services.

- **Variable Expenses:** These costs fluctuate month-to-month based on usage or choice. Common examples are **groceries**, utilities, transportation (gas, public transit), and clothing.

- **Savings Goals:** Allocate specific amounts towards your short-term and long-term savings objectives. This could include an **emergency fund**, a down payment for a house, retirement contributions, or a college fund.

- **Debt Repayment:** Beyond minimum payments, budget for accelerated debt repayment if applicable, focusing on high-interest debts like **credit cards**.

- **Discretionary Spending:** This category covers your wants, not your needs. It includes **entertainment**, dining out, hobbies, vacations, and personal care. This is often the most flexible category for adjustments.

- **Annual/Irregular Expenses:** Crucially, allocate funds for expenses that occur once or twice a year, like **property taxes**, car registration, holiday gifts, or annual memberships. This is where an annual plan truly shines.

Making Your Budget a Living Document

A financial planning template isn’t a static document; it’s a dynamic tool that requires ongoing attention to remain effective. Setting it up at the beginning of the year is an excellent start, but consistent review and adjustment are what truly make it powerful. Schedule regular check-ins – monthly is ideal for most – to compare your actual spending against your budgeted amounts.

These reviews are opportunities to identify discrepancies, understand why they occurred, and make necessary adjustments for the upcoming months. Did you overspend on dining out? Perhaps you found a new, more affordable subscription service. Life changes, and so should your personal finance roadmap. Quarterly deep dives allow for broader reassessments of your goals and larger-scale adjustments to your annual financial plan, ensuring it continues to serve your evolving needs and aspirations.

Beyond the Basics: Advanced Budgeting Strategies

Once you’re comfortable with the fundamentals of your annual financial plan, you can explore more sophisticated budgeting strategies to optimize your financial journey. Consider the **50/30/20 rule**, which allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Alternatively, **zero-based budgeting** ensures every dollar has a job, assigning it to an expense, saving goal, or debt, leaving no money unaccounted for.

Automating your savings and bill payments is another powerful technique to streamline your annual financial plan and reduce the mental load of money management. Setting up automatic transfers to savings accounts or investment portfolios ensures you pay yourself first, consistently moving closer to your long-term goals without conscious effort each month. Regularly tracking your net worth (assets minus liabilities) can also provide a broader perspective on your financial progress beyond just monthly cash flow.

Frequently Asked Questions

How often should I review my annual financial plan?

While an annual plan provides the overarching framework, it’s highly recommended to review your budget at least monthly. This allows you to track actual spending against your budget, make minor adjustments, and ensure you’re still on track for your yearly goals. A more comprehensive review quarterly can help reassess larger objectives and make significant changes if your financial situation or goals have shifted.

What if my income changes frequently?

If your income is variable, creating a flexible annual financial plan is even more crucial. Focus on establishing a baseline budget for your essential fixed expenses and minimum savings. For variable income, consider budgeting based on your lowest historical income, then allocating any excess earnings towards additional savings, debt repayment, or specific financial goals. Projecting a conservative estimate for the year can prevent overspending during lean months.

Is a digital spreadsheet or an app better for managing my yearly financial framework?

The best tool depends entirely on your personal preference and tech comfort. Digital spreadsheets (like Excel or Google Sheets) offer unparalleled customization and direct control, allowing you to build a system precisely to your needs. Budgeting apps, on the other hand, often provide automated transaction categorization, visual dashboards, and goal tracking, which can be convenient for those who prefer less manual input. Many people find a hybrid approach, using an app for daily tracking and a spreadsheet for broader annual planning, to be most effective.

How do I account for unexpected expenses in my budgeting system?

The most effective way to account for unexpected expenses is to build an emergency fund. This dedicated savings account should ideally cover 3-6 months of essential living expenses. Additionally, within your annual financial plan, you can create a small “miscellaneous” or “buffer” category each month to absorb minor unforeseen costs without derailing your entire budget. Regularly contributing to these funds is a cornerstone of financial resilience.

What’s the biggest mistake people make when creating their long-term spending plan?

One of the biggest mistakes is being too rigid or unrealistic. A budget that is too restrictive is difficult to stick to and often leads to burnout and abandonment. Another common error is failing to track actual spending consistently, making the budget theoretical rather than a practical guide. Lastly, not including annual or irregular expenses in the yearly overview is a major oversight that can lead to financial surprises and credit card debt when those large, infrequent bills arrive.

Embracing a robust annual financial plan is far more than just managing money; it’s about investing in your future self. It’s about replacing financial anxiety with confidence, vague aspirations with concrete plans, and endless worry with empowering clarity. By dedicating the time and effort to build and maintain this personal financial strategy, you’re not just tracking numbers; you’re actively shaping the life you want to live.

The journey to financial mastery begins with a single, deliberate step, and creating a personalized budgeting system is arguably the most impactful one you can take. It grants you the power to understand your financial landscape, identify opportunities for growth, and strategically navigate challenges. Start today, and discover the profound peace of mind and incredible freedom that comes with truly taking charge of your financial destiny.