Planning a wedding is an exhilarating journey, filled with dreams of exquisite details and unforgettable moments. While the romance often takes center stage, the practicalities of financing such an event can quickly become a source of stress if not managed proactively. A well-structured approach to your finances is not just about saving money; it’s about ensuring your vision for the big day can come to life without unnecessary financial strain.

This is precisely where a robust wedding spending plan becomes indispensable. It serves as your financial compass, guiding every decision from venue selection to the last floral arrangement. By providing a clear, comprehensive overview of all potential expenditures, it empowers you to allocate resources wisely, prioritize what truly matters, and prevent those all-too-common budget overruns.

Why a Dedicated Budget Plan Is Your Best Wedding Ally

Embarking on the wedding planning process without a clear financial roadmap is akin to sailing without a destination. A detailed spending blueprint offers more than just numbers; it provides clarity, control, and peace of mind. It helps you understand where every dollar goes, allowing for informed choices that align with your financial comfort zone and your vision for the celebration.

This proactive approach prevents unpleasant surprises, like realizing too late that a significant portion of your funds has been inadvertently overspent on a single category. It fosters open communication between partners, aligning expectations and financial goals from the outset. Furthermore, it gives you the confidence to negotiate with vendors, knowing exactly how much flexibility you have.

Key Elements of an Effective Reception Spending Plan

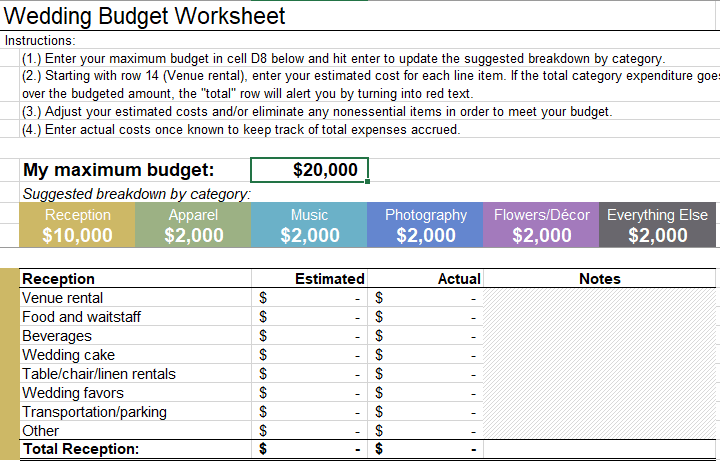

A comprehensive wedding reception budget template isn’t just a spreadsheet; it’s a dynamic tool that breaks down the vast expense of a wedding into manageable categories. While every couple’s needs are unique, certain core elements are universal. Understanding these components is the first step towards building a realistic and actionable financial framework.

Here are the essential categories that typically form the backbone of a successful event cost management guide:

- **Venue and Catering:** Often the largest expense, covering the space, food, beverages, service staff, and potentially rentals like tables and chairs.

- **Attire and Accessories:** The wedding dress, groom’s suit or tuxedo, shoes, jewelry, and any alterations.

- **Photography and Videography:** Capturing those precious memories requires professional talent, often including engagement shoots, full-day coverage, and albums.

- **Music and Entertainment:** DJs, live bands, sound systems, and any special performances to keep the party lively.

- **Floral and Decor:** Bouquets, centerpieces, ceremony decor, lighting, and other aesthetic enhancements.

- **Invitations and Stationery:** Save-the-dates, invitations, RSVP cards, menus, place cards, and thank you notes.

- **Wedding Cake:** A culinary centerpiece that can range from simple elegance to elaborate designs.

- **Officiant Fees:** The cost associated with the person who legally marries you.

- **Transportation:** Limo services for the couple, shuttle services for guests, or valet parking.

- **Hair and Makeup:** Professional styling for the bride and potentially the bridal party.

- **Favors and Gifts:** Small tokens of appreciation for guests and gifts for the wedding party.

- **Miscellaneous/Contingency:** An absolutely crucial line item, typically 5-10% of the total, for unexpected expenses or last-minute additions.

Navigating the Big-Ticket Items

Certain categories will inherently command a larger portion of your overall wedding financial template. These big-ticket items require careful consideration and often the most extensive research. Your approach to these categories can significantly impact your total spend, making them prime areas for strategic planning and potential savings.

The venue and catering, for example, can consume anywhere from 40-60% of a typical wedding spending plan. This is where you might decide between an all-inclusive package, which can offer convenience and sometimes savings, or an à la carte approach, allowing for more customization. Understanding per-person costs versus fixed site fees is also vital in this category.

Similarly, photography and videography are investments in preserving your memories. While seemingly expensive, cutting corners here often leads to regret. Research portfolios, read reviews, and consider different packages to find a professional whose style aligns with your vision and whose rates fit your budget for your wedding celebration.

The Art of Customization: Making Your Plan Work for You

A generic wedding reception budget template provides a solid starting point, but its true power lies in its adaptability. Every couple has unique priorities, preferences, and guest lists, meaning a one-size-fits-all approach simply won’t suffice. The key is to customize this financial planning tool for your big day to reflect your specific needs and values.

Start by discussing with your partner what aspects of the wedding are most important to you. Is it a gourmet dining experience, a live band that keeps everyone dancing, or a breathtaking floral display? Once your top priorities are identified, you can allocate a larger percentage of your funds to those areas, and then scale back on categories that are less crucial to your overall vision. This prioritization creates a personalized cost management guide that truly serves your unique celebration.

Smart Savings Strategies

Even with a robust event budget blueprint, finding opportunities to save without compromising your vision is always a welcome challenge. Thoughtful planning and creative solutions can significantly reduce overall expenditures. Remember, every dollar saved in one area can be reallocated to something that truly enhances your experience.

Consider these smart savings strategies:

Off-Peak Season: Opting for a wedding date during the off-season (typically January-March, July-August, or late November-early December) or on a weekday can lead to significant discounts on venues and vendors.

Guest List Management: The number of guests directly impacts catering, rentals, and stationery costs. A smaller, more intimate gathering can lead to substantial savings.

DIY Elements: For creative couples, taking on certain tasks like designing invitations, creating simple centerpieces, or assembling favors can save money, but be realistic about your time and skills.

Vendor Packages: Many vendors offer bundled services (e.g., photographer and videographer from the same studio, or a venue with in-house catering). These packages can sometimes be more cost-effective than hiring each service separately.

Rethink Favors: Instead of traditional favors, consider a charitable donation in guests’ names or a late-night snack bar that doubles as an interactive treat.

Digital Invitations: For certain pre-wedding events or even the main invitation, digital options can save on printing and postage, although traditional paper invites often remain popular for the main event.

Borrow or Rent: Instead of buying everything new, consider renting decor items, suits, or even a statement piece for your ceremony.

Beyond the Numbers: Managing Expectations and Stress

While a detailed reception cost breakdown is a powerful practical tool, its benefits extend beyond mere financial oversight. It also serves as a critical instrument for managing expectations and reducing pre-wedding stress. By having a clear picture of what’s financially feasible, couples can set realistic goals for their celebration, avoiding the disappointment of unfulfilled expensive dreams.

Open and honest communication about finances, facilitated by a shared planning tool for wedding expenses, strengthens a couple’s bond. It allows for compromises and joint decision-making, ensuring both partners feel heard and valued throughout the planning process. Ultimately, this approach fosters a more joyful and less stressful journey to the altar, allowing you to focus on the true meaning of your commitment.

Frequently Asked Questions

How often should we review our wedding spending plan?

It’s advisable to review your plan weekly or bi-weekly, especially as you get closer to the wedding date and more payments are due. Regularly checking in ensures you stay on track and can make adjustments as needed.

What if we go over budget in one category?

Don’t panic! The flexibility of a good financial template means you can reallocate funds. If you overspend in one area, look for opportunities to cut back in another that is less critical to your overall vision.

Should we include pre-wedding events like the rehearsal dinner in this template?

While this article focuses on the reception, it’s wise to either create a separate, smaller budget for pre-wedding events or add a specific line item within your main plan to account for them. This provides a holistic view of all wedding-related expenses.

Is it okay to start with a dream budget and then scale back?

Absolutely. Many couples begin by outlining their ideal wedding before confronting the financial realities. This “dream budget” can then be adjusted to align with your actual financial resources, helping you prioritize what’s most important and find creative solutions for areas where you need to scale back.

What’s the most common mistake couples make with their wedding financial template?

The most common mistake is underestimating the miscellaneous or “hidden” costs, such as taxes, service charges, tips for vendors, and last-minute emergency purchases. Always include a substantial contingency fund (5-10% of your total budget) to cover these unexpected items.

The journey to your wedding day is an incredibly special time, and while finances might not be the most romantic topic, they are undeniably foundational to a stress-free celebration. Utilizing a well-structured blueprint for reception costs provides the clarity and control needed to navigate the myriad of decisions with confidence and peace of mind. It transforms a potentially daunting task into an organized, manageable process.

By embracing this proactive approach, you not only ensure fiscal responsibility but also safeguard the joy and excitement of planning your dream event. With every expense accounted for and every decision aligned with your financial comfort, you are free to savor each moment, knowing that your special day will be everything you imagined, without any lingering financial worries. Let your financial planning be the silent architect of a truly magnificent and memorable wedding celebration.