The journey to “I do” is often envisioned as a romantic fairytale, a mosaic of dreamy details culminating in a joyous celebration. Yet, beneath the surface of tulle, flowers, and champagne lies a significant, often daunting, reality: the financial investment. Planning a wedding can feel like navigating a beautiful, yet expensive, maze, with costs escalating faster than you can say “fiancé.” Without a clear roadmap, couples can easily find themselves overwhelmed, stressed, and potentially over budget, transforming excitement into anxiety.

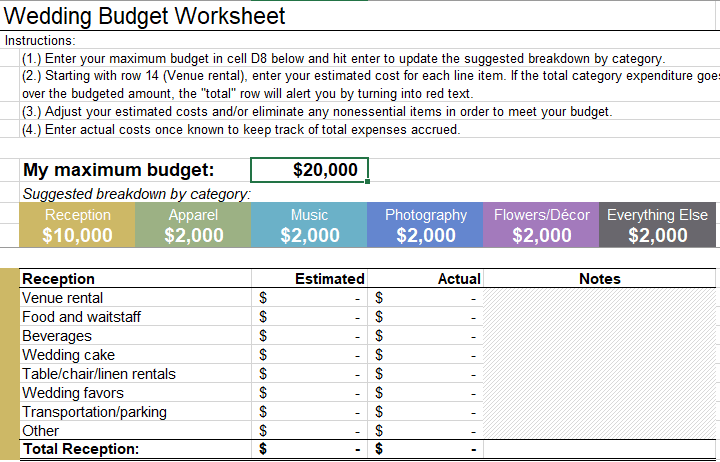

This is where a robust financial plan for your wedding becomes not just helpful, but absolutely essential. It’s more than just a spreadsheet; it’s a strategic guide that empowers you to make informed decisions, prioritize spending, and maintain peace of mind throughout the planning process. By providing a structured framework for every anticipated expense, a well-organized Wedding Budget Breakdown Template ensures that your special day reflects your vision without compromising your financial future. It transforms abstract dreams into concrete, manageable steps, allowing you to focus on the joy of getting married, not the stress of how to pay for it.

Why a Dedicated Wedding Budget is Your Best Ally

Embarking on wedding planning without a clear financial plan is akin to setting sail without a compass. You might eventually reach your destination, but the journey will likely be fraught with uncertainty, detours, and unexpected storms. A detailed wedding budget tool offers clarity and control, serving as your reliable compass in the vast ocean of wedding expenses. It’s the foundational element that dictates every subsequent decision, from selecting a venue to choosing your floral arrangements.

One of the primary benefits of a comprehensive wedding spending plan is its ability to prevent overspending. By setting clear limits for each category, you gain a tangible boundary, curbing impulse purchases and ensuring that every dollar spent aligns with your overall financial capacity. This proactive approach helps you avoid the dreaded post-wedding financial hangover, allowing you to start your married life on solid economic footing. Furthermore, a shared financial plan for your wedding fosters crucial communication between partners and any contributing family members. It creates a transparent platform for discussing financial priorities, expectations, and contributions, minimizing potential misunderstandings and fostering a sense of shared responsibility. Ultimately, this transparency strengthens relationships and ensures everyone is on the same page regarding the financial scope of the celebration.

Navigating the Core Components of Your Wedding Spending Plan

A truly effective wedding financial management system breaks down the monumental task of budgeting into manageable, understandable categories. While every wedding is unique, there are universal elements that almost every couple will consider. Understanding these core components is the first step in constructing a realistic and comprehensive budget. These categories serve as placeholders for your estimated costs, which you’ll then refine with actual quotes and invoices.

The following list represents the typical main expenditures that should be accounted for in any detailed cost breakdown for a wedding:

- Venue & Catering: This often represents the largest portion of your budget, encompassing ceremony and reception spaces, food, beverages, service charges, and sometimes basic rentals.

- Attire & Accessories: Wedding gown, suit/tuxedo, alterations, shoes, veil, jewelry, and any attire for wedding party members if you’re covering those costs.

- Photography & Videography: Capturing your special moments is paramount, so factor in the photographer’s package, videographer’s services, engagement shoot, and albums.

- Music & Entertainment: DJ, live band, ceremony musicians, sound equipment, and any unique entertainment elements.

- Floral & Decor: Bouquets, boutonnières, centerpieces, altar arrangements, ceremony decor, reception decorations, lighting, and rentals like linens and chairs.

- Stationery: Save-the-dates, invitations (including postage), RSVPs, thank you cards, programs, place cards, and any custom signage.

- Rings & Gifts: Engagement ring, wedding bands, gifts for the wedding party, parents, and each other.

- Officiant: Fees for your ceremony officiant, including any required counseling or administrative costs.

- Hair & Makeup: Professional services for the bride and bridal party, including trials.

- Transportation: Limo or car service for the couple, shuttle services for guests, and any travel for out-of-town vendors.

- Wedding Cake: The cost of your wedding cake, including design, flavors, and delivery fees.

- Favors & Welcome Bags: Small gifts for guests, and welcome bags for out-of-towners.

- Contingency Fund: An absolutely crucial allocation for unexpected costs or unforeseen circumstances, typically 5-10% of your total budget.

Setting Your Overall Wedding Financial Limit

Before diving into the intricate details of each category, the most critical step is establishing your overall wedding financial limit. This overarching figure will serve as the anchor for all subsequent decisions within your wedding expense sheet. Begin by having an open and honest conversation with your partner about what you can comfortably afford, considering your current savings, future financial goals, and any potential contributions from family members. It’s essential to differentiate between what you *want* to spend and what you *can* realistically spend without causing undue financial strain.

Once you have a preliminary total, explore all potential funding sources. Will you be drawing primarily from personal savings, or will family members be contributing? If so, clarify the exact amounts and whether these contributions are earmarked for specific categories or are general funds. Next, create a “wish list” of everything you envision for your big day, followed by a “must-have” list that prioritizes the non-negotiable elements. This exercise helps to ground your aspirations in reality and provides a basis for making trade-offs when necessary. Remember, this initial total isn’t set in stone, but it provides a vital starting point that will guide the allocation of funds across all categories in your comprehensive financial framework for your big day.

Customizing Your Financial Planning Tool

While a general Wedding Budget Breakdown Template provides an excellent starting point, its true power lies in its adaptability. No two weddings are exactly alike, and neither should be their accompanying budget. Your financial plan for your wedding needs to be a living document that reflects your unique priorities, cultural traditions, and personal style. For instance, a couple passionate about gourmet food might allocate a higher percentage to catering, while another prioritizing photography might shift funds in that direction. The key is to understand that the typical percentage allocations found in generic templates are merely suggestions, not rigid rules.

Take the time to adjust the percentages within each category based on what matters most to you as a couple. If live music is a non-negotiable dream, be prepared to reduce spending in another area, such as stationery or favors. Regularly revisit your wedding cost tracker as you receive quotes and book vendors. Compare actual costs against your estimated figures. This continuous reconciliation is vital; if you find yourself over budget in one category, identify where you can trim expenses in another. Customization also involves adding unique categories relevant to your wedding, such as destination wedding travel, visa fees, or specific cultural attire. This dynamic approach ensures that your financial guide remains a precise and practical reflection of your evolving wedding plans.

Smart Strategies for Staying on Track

Creating a detailed wedding budget tool is a fantastic start, but the real challenge, and success, comes from sticking to it. Maintaining discipline and employing smart strategies throughout the planning process will ensure your financial plan remains intact and prevents unwelcome surprises. One of the most effective strategies is to schedule regular budget check-ins. Whether it’s weekly or bi-weekly, dedicate time with your partner to review expenses, update actual costs, and assess your remaining funds. This proactive approach allows you to identify potential overruns early and make necessary adjustments before they become significant issues.

Prioritization remains key; continuously ask yourselves what truly matters most. If a certain vendor or element exceeds your budget, explore alternatives or consider if cutting back in a less critical area is feasible. Don’t be afraid to negotiate with vendors – many are willing to tailor packages to fit your needs, especially if you’re flexible with dates or services. Building a robust contingency fund, typically 5-10% of your total budget, is also non-negotiable. This buffer acts as a financial safety net for unexpected costs like last-minute alterations, unforeseen vendor fees, or emergency repairs. Finally, be mindful of hidden costs that often get overlooked, such as taxes, service charges, gratuities, overtime fees, and postage for invitations. By being diligent and strategic, you can successfully manage your wedding expenses and ensure your big day unfolds as planned, without financial stress.

Frequently Asked Questions

How much should I allocate for a wedding contingency fund?

It is generally recommended to allocate 5-10% of your total wedding budget for a contingency fund. This buffer is crucial for covering unexpected expenses, last-minute changes, or unforeseen circumstances that inevitably arise during wedding planning.

What are common hidden wedding costs people forget?

Many couples overlook costs like taxes and service charges (which can add 20-30% to venue and catering bills), gratuities for vendors, overtime fees for venues or entertainment, alteration costs for attire, postage for invitations, vendor meals, and corkage fees if you bring your own alcohol.

Should I share my wedding budget with vendors?

It’s often beneficial to share your overall budget or budget range for a specific category with vendors. This helps them tailor their proposals to your financial comfort zone and allows them to suggest creative solutions or package options that fit your limits, saving both of you time.

When should I start planning my wedding finances?

Ideally, you should start planning your wedding finances as soon as you get engaged, or even before you begin researching venues and vendors. Establishing your overall budget and key allocations upfront will guide all subsequent decisions and prevent costly mistakes.

Can I really save money by using a financial plan for my wedding?

Absolutely. A detailed financial plan for your wedding helps you make intentional spending choices, prioritize what truly matters, avoid impulse purchases, and track actual expenditures against estimates. This active management almost always results in significant savings compared to planning without a structured budget.

Navigating the financial landscape of wedding planning doesn’t have to be a source of stress or conflict. By embracing a strategic approach with a well-structured wedding budget tool, you equip yourselves with the clarity and control needed to bring your dream day to life responsibly. This proactive financial management empowers you to make thoughtful choices, ensuring that every dollar spent aligns with your values and vision, not just fleeting trends or vendor pressures. It’s an investment in peace of mind, allowing you to enjoy the journey without the anxiety of financial strain.

Ultimately, your wedding day is a celebration of love, commitment, and the start of a beautiful future together. By leveraging a comprehensive approach to managing wedding expenses, you’re not just planning a party; you’re laying a strong financial foundation for your marriage. It’s about making conscious decisions that reflect your priorities, foster open communication, and allow you to savor every moment of your engagement and your special day, knowing your finances are in capable hands. So, take the first step, embrace the power of careful planning, and build the wedding you’ve always dreamed of, within a budget that brings comfort, not concern.