Navigating the complexities of business sales, particularly when traditional financing isn’t straightforward, often requires creative solutions. One such powerful tool is the Vendor Take Back (VTB) agreement, where the seller finances a portion of the purchase price, essentially becoming a lender to the buyer. This arrangement can bridge financing gaps, make a deal more attractive to prospective buyers, and even facilitate a quicker sale, benefiting both parties involved.

However, the simplicity of the concept belies the intricate legal and financial details that must be meticulously documented. Without a clear, comprehensive, and legally sound framework, what begins as a mutually beneficial arrangement can quickly devolve into misunderstandings, disputes, and significant financial risk. This is precisely where a robust, well-structured vendor take back agreement template proves invaluable for businesses, entrepreneurs, legal professionals, and anyone engaging in these pivotal transactions.

The Indispensable Nature of Formal Agreements

In today’s fast-paced business landscape, the adage "get it in writing" has never been more relevant. Relying on verbal agreements or vague understandings, especially for substantial financial arrangements like a VTB, is a recipe for disaster. A written agreement clarifies expectations, outlines responsibilities, and provides a legally enforceable framework that protects the interests of both the vendor and the buyer.

Furthermore, a detailed contract serves as a reference point for all parties, minimizing ambiguity and proactively addressing potential points of contention before they escalate. It establishes clear terms for repayment, defines events of default, and specifies remedies, ensuring that all parties operate from a shared understanding of their obligations and rights. This formalization is crucial for maintaining transparency and trust throughout the duration of the agreement.

Unlocking Value: Benefits of a Prepared Framework

Utilizing a high-quality vendor take back agreement template offers a multitude of advantages beyond mere documentation. Firstly, it provides a significant time-saving solution. Instead of drafting a complex legal document from scratch for each transaction, a template offers a pre-vetted foundation that requires only customization, not creation. This efficiency allows dealmakers to focus on the commercial aspects of the transaction rather than the minutiae of legal drafting.

Secondly, a well-designed template ensures consistency and completeness. It acts as a checklist, ensuring that all critical legal and commercial considerations are addressed, reducing the risk of oversight that could lead to future disputes or legal challenges. For legal professionals, it streamlines their review process, enabling them to efficiently tailor the document to specific client needs while upholding professional standards. Ultimately, this structured approach helps to mitigate risk for both the seller, who is extending credit, and the buyer, who is incurring debt.

Adapting the Agreement for Diverse Scenarios

One of the most powerful features of a comprehensive VTB agreement template is its inherent flexibility. While the core principles remain constant, the specific terms and conditions must be adaptable to suit a vast array of industries and unique transactional nuances. Whether you’re selling a manufacturing plant, a retail store, a service-based business, or a piece of commercial real estate, the underlying structure can be tailored.

Customization might involve adjusting the repayment schedule to align with seasonal business cycles, specifying unique collateral requirements based on asset types, or incorporating industry-specific representations and warranties. For a software company, intellectual property protection would be paramount, while for a restaurant, equipment and lease assignments would take center stage. The template provides the scaffold upon which these specialized provisions can be securely built, ensuring the agreement accurately reflects the particular circumstances of the deal.

Fundamental Clauses for Any VTB Arrangement

A robust vendor take back agreement template must contain several essential clauses to adequately protect both parties and ensure the smooth execution of the arrangement. These components form the backbone of the contract, defining the rights and responsibilities of each signatory.

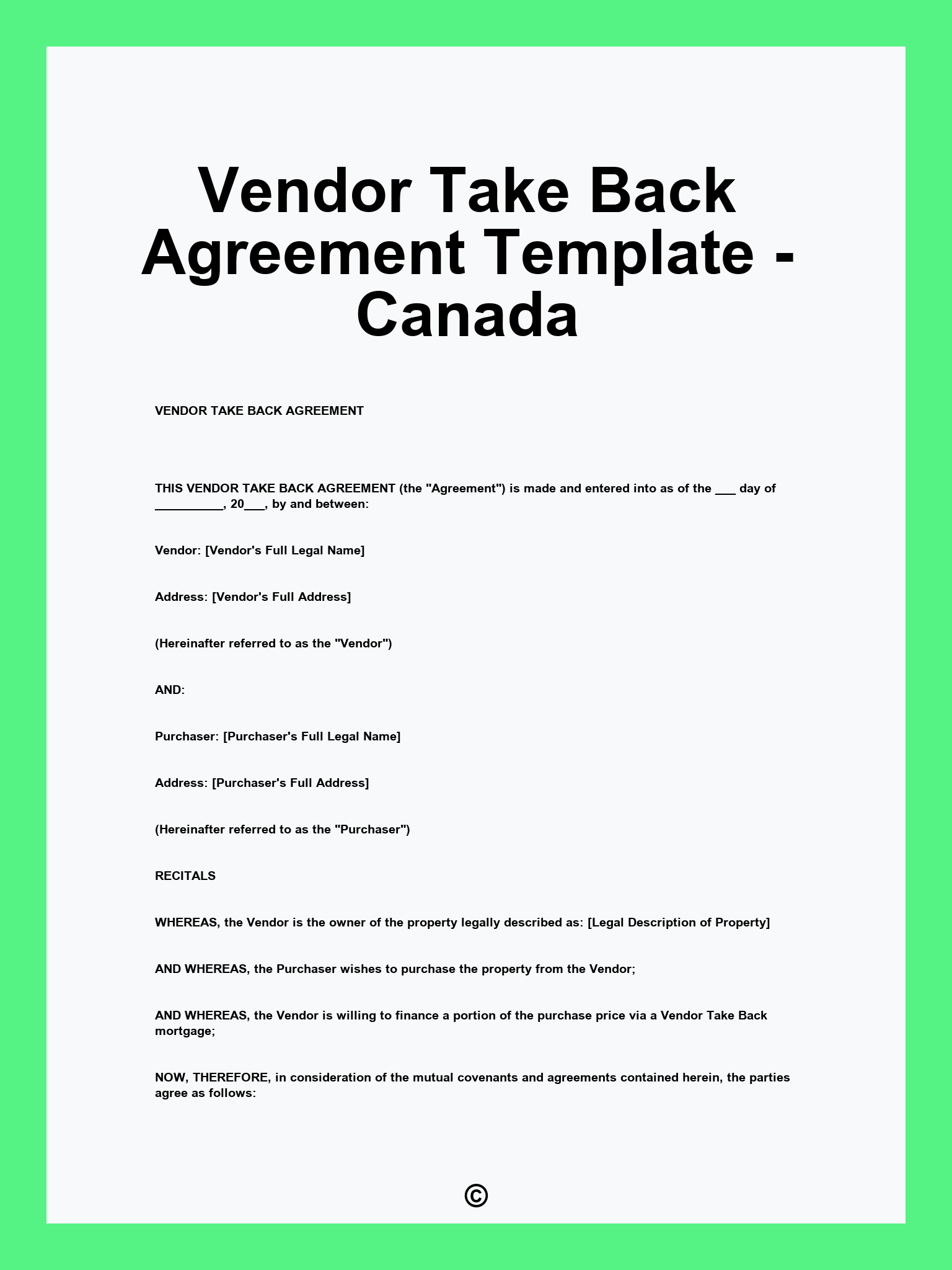

- Parties and Recitals: Clearly identify the seller (vendor) and the buyer, including their legal names and addresses. Recitals provide background context for the agreement.

- Purchase Price and VTB Amount: Detail the total purchase price of the business or asset, and explicitly state the portion that will be financed by the vendor take back.

- VTB Loan Terms: Outline the principal amount of the loan, the interest rate (fixed or variable), the repayment schedule (e.g., monthly installments, balloon payments), and the term of the loan.

- Security for the VTB: Specify what collateral, if any, the buyer is providing to secure the vendor’s loan. This could include assets of the acquired business, personal guarantees, or other forms of security.

- Representations and Warranties: Both parties make assurances about certain facts and conditions. The seller typically warrants the financial health and operational integrity of the business, while the buyer might warrant their financial capacity.

- Covenants: These are promises made by the parties to do or not do certain things during the term of the agreement. For instance, the buyer might covenant to maintain the value of the collateral or not incur excessive additional debt.

- Events of Default and Remedies: Clearly define what constitutes a default by the buyer (e.g., missed payments, breach of covenants) and outline the remedies available to the seller, such as acceleration of the loan or repossession of collateral.

- Prepayment: State whether the buyer can prepay the loan without penalty and any conditions associated with early repayment.

- Governing Law and Jurisdiction: Specify which state’s laws will govern the agreement and where any legal disputes would be resolved.

- Confidentiality: Include provisions to protect sensitive business information exchanged during the transaction.

- Notices: Detail how formal communications between the parties should be delivered.

- Entire Agreement: A clause stating that the written document constitutes the entire agreement between the parties, superseding all prior discussions.

- Assignment: Clarify whether the buyer or seller can assign their rights or obligations under the agreement to another party.

- Signatures: Spaces for all parties to sign and date the agreement, often with witness signatures or notarization, depending on legal requirements.

Enhancing Usability and Presentation

Beyond the legal substance, the practical presentation and formatting of any agreement significantly impact its usability and readability. For a vendor take back agreement template, clarity and logical flow are paramount, whether it’s intended for print or digital distribution.

Employ clear, concise language, avoiding unnecessary jargon where plain English suffices. Use consistent formatting for headings, subheadings, and bullet points to create visual breaks and improve navigation. Section numbering and a table of contents, especially for longer documents, can make it easier for parties to locate specific provisions quickly. Consider using modern tools for digital signatures and secure document sharing, which can expedite the execution process while maintaining legal validity. Ultimately, the goal is to create a document that is not only legally sound but also user-friendly and easy to understand for all stakeholders.

In an environment where complex transactions are becoming increasingly common, the strategic use of a well-crafted vendor take back agreement template is more than just a convenience; it’s a strategic imperative. It empowers both buyers and sellers to structure creative financing solutions with confidence, knowing that their interests are protected by a comprehensive legal framework. This proactive approach minimizes potential for disagreements and fosters a professional, secure environment for business dealings.

By providing a solid foundation that can be easily customized, this invaluable tool allows businesses to navigate sales with greater efficiency, clarity, and legal compliance. It stands as a testament to the power of meticulous preparation, transforming potentially risky ventures into streamlined, mutually beneficial outcomes for all involved.