Embarking on university life is an exhilarating adventure, filled with new experiences, academic challenges, and personal growth. Amidst the excitement of dorm life, campus events, and demanding coursework, one crucial aspect often gets overlooked until it becomes a pressing concern: managing your finances. For many students, this marks their first foray into independent financial responsibility, and without a clear roadmap, the journey can quickly become stressful.

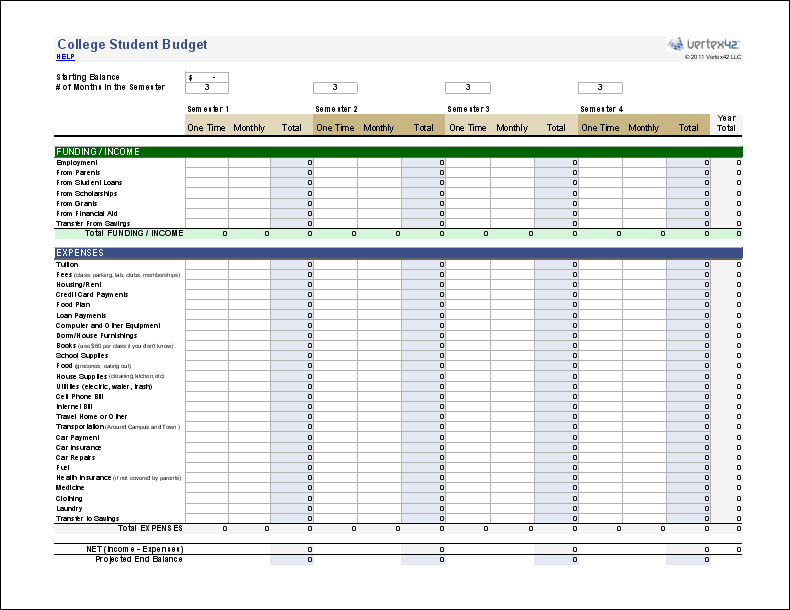

Navigating tuition fees, housing costs, textbooks, and daily expenses requires more than just careful spending; it demands a strategic approach. That’s where a well-structured financial plan comes into play. A comprehensive University Student Budget Template isn’t just a spreadsheet; it’s a powerful tool designed to bring clarity to your income and expenditures, empowering you to make informed decisions and avoid common financial pitfalls throughout your academic career.

Why Every Student Needs a Financial Roadmap

For many university students, financial independence arrives alongside their acceptance letter. Suddenly, they’re responsible for more than just pocket money; they’re managing significant expenses like rent, groceries, transportation, and, of course, tuition. Without a clear plan, money can disappear faster than expected, leading to stress, missed payments, and even academic difficulties. A well-designed student budgeting tool provides a bird’s-eye view of your financial landscape, transforming abstract numbers into actionable insights.

The benefits of adopting a robust financial plan extend far beyond simply tracking your spending. It cultivates essential life skills, teaching discipline, foresight, and problem-solving – all invaluable traits for future success. By understanding where your money comes from and where it goes, you can identify areas for saving, prioritize needs over wants, and build a foundation for long-term financial health. This proactive approach helps mitigate financial anxiety, allowing you to focus more on your studies and enjoy your college experience.

Understanding Your Income Streams

Before you can effectively manage your money, you need to know exactly how much you have coming in. For university students, income can be multifaceted and often less consistent than a traditional salary. It’s crucial to meticulously list all potential sources of funds to get an accurate picture of your total available resources. This foundation is key to creating a realistic personal budget for students.

Consider all possibilities, from regular allowances to occasional windfalls. Be honest and realistic about the amounts and frequency. Overestimating your income can lead to overspending, while underestimating might mean you miss opportunities to put more towards savings or debt repayment.

- Parental Contributions: Regular allowances or lump sum payments from family members.

- Financial Aid: Loans, grants, and scholarships. Differentiate between aid that directly covers tuition/housing and funds disbursed to you for living expenses.

- Part-Time Job: Wages from on-campus jobs, local businesses, or freelance work. Account for varying hours and paychecks.

- Savings: Any personal savings you’ve set aside specifically for university expenses.

- Gifts: Birthday money, holiday gifts, or other occasional financial support.

- Veteran Benefits: If applicable, educational or housing benefits from military service.

Deconstructing Student Expenses

Once you have a clear picture of your income, the next critical step is to identify and categorize your expenses. This is often the most revealing part of the budgeting process, as many students are surprised by how quickly small purchases add up. A comprehensive college financial plan breaks down spending into fixed and variable categories, allowing for better control and adjustment.

Fixed expenses are those that generally stay the same each month, providing a predictable base for your spending. Variable expenses, however, fluctuate and offer the most flexibility for adjustment. Tracking both types is essential for an effective student money management guide.

Fixed Expenses

- Tuition and Fees: Often paid per semester or annually, but crucial to factor into your monthly financial plan if you’re setting money aside.

- Rent/Housing: Monthly rent for off-campus apartments, dorm fees, or housing contributions.

- Utilities: Electricity, gas, internet, and water (if not included in rent).

- Phone Bill: Your monthly mobile phone service cost.

- Student Loan Payments: If you have existing loans, these are non-negotiable.

- Insurance: Health insurance, renter’s insurance, or car insurance premiums.

- Subscription Services: Streaming services, gym memberships, or software subscriptions.

Variable Expenses

- Groceries/Food: A significant category that often offers the most opportunity for saving. Include dining out, coffee runs, and snacks.

- Textbooks & Supplies: Can be quite costly each semester; explore used books, rentals, or digital versions.

- Transportation: Gas, public transit passes, ride-sharing services, or bike maintenance.

- Personal Care: Toiletries, haircuts, laundry, and other hygiene products.

- Social & Entertainment: Movies, concerts, nights out, hobbies, and leisure activities.

- Clothing: New apparel, shoes, and accessories.

- Miscellaneous: Unexpected costs, small purchases, or emergency funds.

Building Your Personalized Financial Blueprint

With your income streams identified and expenses categorized, you’re ready to construct your very own financial blueprint. This is where the University Student Budget Template comes alive, transforming raw data into a functional plan. The goal is to allocate your incoming funds to cover your outgoing costs, ideally leaving a surplus for savings or unexpected events. Remember, this isn’t about deprivation; it’s about intentional spending that aligns with your financial goals and priorities.

Start by listing your total monthly income at the top. Then, subtract your fixed expenses. What remains is your discretionary income, which you can then allocate to your variable expenses. If your expenses exceed your income, it’s a clear signal that adjustments need to be made. This process might involve cutting back on non-essential spending, finding ways to increase income, or exploring cheaper alternatives for certain items.

Think of your budget as a living document. It’s not a set-it-and-forget-it tool. Life circumstances change, and your financial plan should evolve with them. Review it regularly – weekly or bi-weekly is ideal – to ensure it remains relevant and effective. An academic year budget requires flexibility, especially with semester-based costs.

Smart Strategies for Budgeting Success

Having a financial framework is one thing; sticking to it is another. Successful money management for students requires ongoing commitment and the implementation of smart strategies. These tips can help you stay on track and maximize the effectiveness of your campus finance organizer.

- Track Every Dollar: This is paramount. Use a budgeting app, a spreadsheet, or a simple notebook to record every single transaction. Knowing where your money goes is the first step to controlling it.

- Set Realistic Goals: Don’t aim for perfection right away. Start with achievable targets, whether it’s saving $50 a month or cutting your dining-out budget by 20%. Gradual improvements are more sustainable.

- Distinguish Needs vs. Wants: Before every purchase, ask yourself: Is this something I genuinely need, or is it a want? Prioritizing needs helps keep essential expenses covered.

- Automate Savings: Set up automatic transfers from your checking account to a savings account each payday. Even small amounts add up over time and build a crucial emergency fund.

- Cook at Home More: Eating out, especially frequently, is one of the biggest budgetbusters for students. Planning meals and cooking at home can save hundreds of dollars each month.

- Utilize Student Discounts: Many businesses offer discounts for university students. Always ask before making a purchase.

- Limit Credit Card Use: If you have a credit card, use it sparingly and always pay the full balance on time to avoid interest and debt accumulation. Credit card debt can quickly spiral out of control.

- Find Free Entertainment: Your campus likely offers numerous free events, clubs, and activities. Explore these options instead of always spending money on entertainment.

- Regularly Review and Adjust: Your income and expenses may change throughout the semester or academic year. Regularly review your financial plan to ensure it’s still accurate and effective. Don’t be afraid to make adjustments as needed.

- Emergency Fund: Aim to build a small emergency fund. Even $200-$500 can cover unexpected costs like a minor car repair or a medical co-pay without derailing your budget.

Frequently Asked Questions

How often should I update my student budget?

Ideally, you should review your budget weekly or bi-weekly to ensure you’re sticking to your spending limits and to catch any discrepancies early. A more thorough review and adjustment should be done monthly, or whenever there’s a significant change in your income or expenses.

What if my expenses consistently exceed my income?

If you find your expenses are regularly higher than your income, it’s a sign that immediate action is needed. Re-evaluate your variable expenses first, as these are the easiest to cut. Look for areas like dining out, entertainment, or subscriptions where you can reduce spending. If cuts aren’t enough, explore options for increasing your income, such as taking on more hours at a part-time job or seeking additional financial aid.

Should I include financial aid in my income?

Yes, but with caution. Differentiate between aid that goes directly to the university (like tuition payments) and funds that are disbursed to you for living expenses. Only include the disbursed funds as part of your usable income. Be mindful of how loans need to be repaid in the future, even if they provide immediate cash flow.

What’s the best tool for creating a University Student Budget Template?

There are many effective tools available. Simple options include a spreadsheet (like Google Sheets or Microsoft Excel) or even a notebook. Many free budgeting apps (e.g., Mint, YNAB, EveryDollar) can link to your bank accounts for automated tracking. The “best” tool is ultimately the one you will consistently use.

Is it okay to spend money on “fun” things in my budget?

Absolutely! A healthy budget isn’t about eliminating all enjoyable spending; it’s about allocating funds intentionally. Include a category for “fun” or “discretionary” spending in your university financial planning. This ensures you can still enjoy social activities and hobbies without feeling guilty or derailing your overall financial goals. The key is to set a realistic limit for this category and stick to it.

Taking control of your finances as a university student is one of the most empowering steps you can take for your future. It’s not just about surviving financially during your college years; it’s about laying the groundwork for a lifetime of responsible money management. By implementing a thoughtful student budgeting template, you gain clarity, reduce stress, and cultivate habits that will serve you well long after graduation.

Don’t let financial worries overshadow your academic journey. Embrace the challenge of managing your money with confidence and a clear plan. Start today by creating your personalized financial template for college, and unlock the peace of mind that comes with knowing you’re in command of your fiscal destiny. Your future self will thank you for the discipline and foresight you cultivate now.