Navigating the complexities of business partnerships can often feel like charting a course through uncharted waters. While the initial excitement of launching an enterprise with co-founders or securing investment is exhilarating, the long-term success of any company hinges significantly on the clarity and foresight embedded in its foundational agreements. Disagreements, shifts in strategy, or unforeseen circumstances can quickly erode trust and threaten the very existence of a venture if the rules of engagement aren’t clearly defined from the outset.

This is precisely where a well-crafted unanimous shareholder agreement becomes not just beneficial, but indispensable. It serves as the bedrock of corporate governance, establishing a clear framework for how shareholders will interact, make decisions, and resolve potential conflicts. For startups, small to medium-sized enterprises (SMEs), family businesses, and even seasoned corporations looking to streamline their legal documentation, leveraging a robust unanimous shareholder agreement template offers a strategic advantage, providing a professional, time-saving, and comprehensive solution for establishing these crucial parameters.

The Imperative of Documented Partnership Terms

In today’s fast-paced business environment, the need for explicit and written agreements has never been more critical. Verbal understandings, even among the most trusted partners, are notoriously prone to misinterpretation and recollection errors, especially when significant financial or operational decisions are at stake. As companies grow, new shareholders may join, ownership structures can evolve, and the initial informalities that characterized early stages become unsustainable.

A meticulously documented agreement transcends these vulnerabilities, providing a definitive reference point for all parties. It protects against ambiguity, minimizes the likelihood of costly legal disputes, and ensures that everyone is operating from the same understanding of their rights, responsibilities, and the established decision-making protocols. Without such a document, businesses leave themselves exposed to potential stalemates, power struggles, and even the forced dissolution of the company, diverting valuable resources and attention away from core business objectives.

Safeguarding Interests: Benefits of a Structured Framework

The strategic adoption of a high-quality unanimous shareholder agreement template offers a multitude of benefits, extending far beyond mere legal compliance. Primarily, it acts as a preventative measure, identifying and addressing potential areas of conflict before they escalate into serious issues. By clearly outlining shareholder obligations and rights, it fosters transparency and accountability among all equity holders.

This structured framework provides vital protections for both minority and majority shareholders. It can prevent majority shareholders from unilaterally making decisions that could disadvantage minority investors, while also safeguarding the company from potential disruptions caused by a minority shareholder. Furthermore, it establishes clear mechanisms for events like a shareholder’s exit, sale of shares, or the company’s valuation, thereby reducing uncertainty and facilitating smoother transitions. The peace of mind that comes from having these complex eventualities thoroughly addressed in a formal contract allows business leaders to focus their energy on growth and innovation, knowing their foundational governance is secure.

Tailoring Your Governance: Customization and Adaptability

One of the most powerful features of a comprehensive unanimous shareholder agreement template is its inherent flexibility and adaptability. While the core structure provides a solid foundation, every business has unique dynamics, industry-specific considerations, and specific shareholder relationships that require bespoke adjustments. A well-designed template anticipates this need for customization, offering placeholders and optional clauses that can be refined to suit individual circumstances.

For instance, a tech startup might prioritize intellectual property rights and vesting schedules, while a family-owned business might focus on succession planning and dispute resolution specific to familial relationships. Similarly, a company seeking external investment will have different requirements for share transfer restrictions than one with a closed group of founders. The template acts as a sophisticated starting point, allowing legal professionals and business owners to efficiently tailor voting rights, capital call provisions, exit strategies, and corporate governance rules without having to draft every clause from scratch, saving considerable time and legal fees.

Core Components of a Robust Shareholder Pact

While the specific details will vary, every effective unanimous shareholder agreement should contain several essential clauses to ensure comprehensive coverage and enforceability. These provisions form the backbone of sound corporate governance:

- Parties and Recitals: Clearly identifies all shareholders involved and provides background on the company’s formation and purpose of the agreement.

- Share Ownership and Capital Structure: Details the number and class of shares held by each shareholder, capital contributions, and any future capital requirements or share issuances.

- Share Transfer Restrictions: Outlines specific rules governing the sale or transfer of shares, including rights of first refusal, tag-along rights (protecting minority shareholders), and drag-along rights (facilitating a sale by majority shareholders).

- Board of Directors and Management: Specifies the composition of the board, appointment and removal processes, voting rights, and the scope of authority for both the board and executive management.

- Decision-Making Processes: Establishes thresholds for various corporate actions, indicating which decisions require unanimous consent, supermajority, or simple majority approval. This often includes significant transactions, changes to the business, and dividend policies.

- Share Valuation: Defines the method for valuing shares, particularly important for buy-sell provisions or transfers upon triggering events (e.g., death, disability, termination).

- Dividends and Distributions: Sets out the policy for distributing profits, whether through dividends, reinvestment, or other means.

- Dispute Resolution: Mandates a structured process for resolving shareholder disagreements, typically starting with negotiation, escalating to mediation, and potentially culminating in binding arbitration, to avoid costly litigation.

- Confidentiality and Non-Compete/Non-Solicitation: Protects proprietary information and prevents shareholders from competing with the company or poaching employees/customers, especially after their departure.

- Buy-Sell Provisions (Shotgun Clauses, Russian Roulette Clauses): Specifies conditions under which shares must or may be bought or sold (e.g., death, disability, termination of employment, deadlock), and how these transactions will be funded.

- Deadlock Resolution: Provides mechanisms for breaking impasses in decision-making that could otherwise paralyze the company, such as a "Texas Shootout" or appointment of an independent third-party director.

- Amendments: Outlines the process and required consents for modifying the terms of the agreement.

- Governing Law: States which jurisdiction’s laws will govern the interpretation and enforcement of the contract.

- Representations and Warranties: Assurances made by the parties regarding their capacity and authority to enter into the agreement.

Ensuring Clarity: Formatting and Usability Best Practices

Beyond the legal substance, the practical presentation and usability of a unanimous shareholder agreement are paramount for its effectiveness. A poorly formatted or confusing document can hinder comprehension, lead to misinterpretations, and ultimately undermine its purpose. Whether intended for print or digital distribution, clarity and readability should be prioritized.

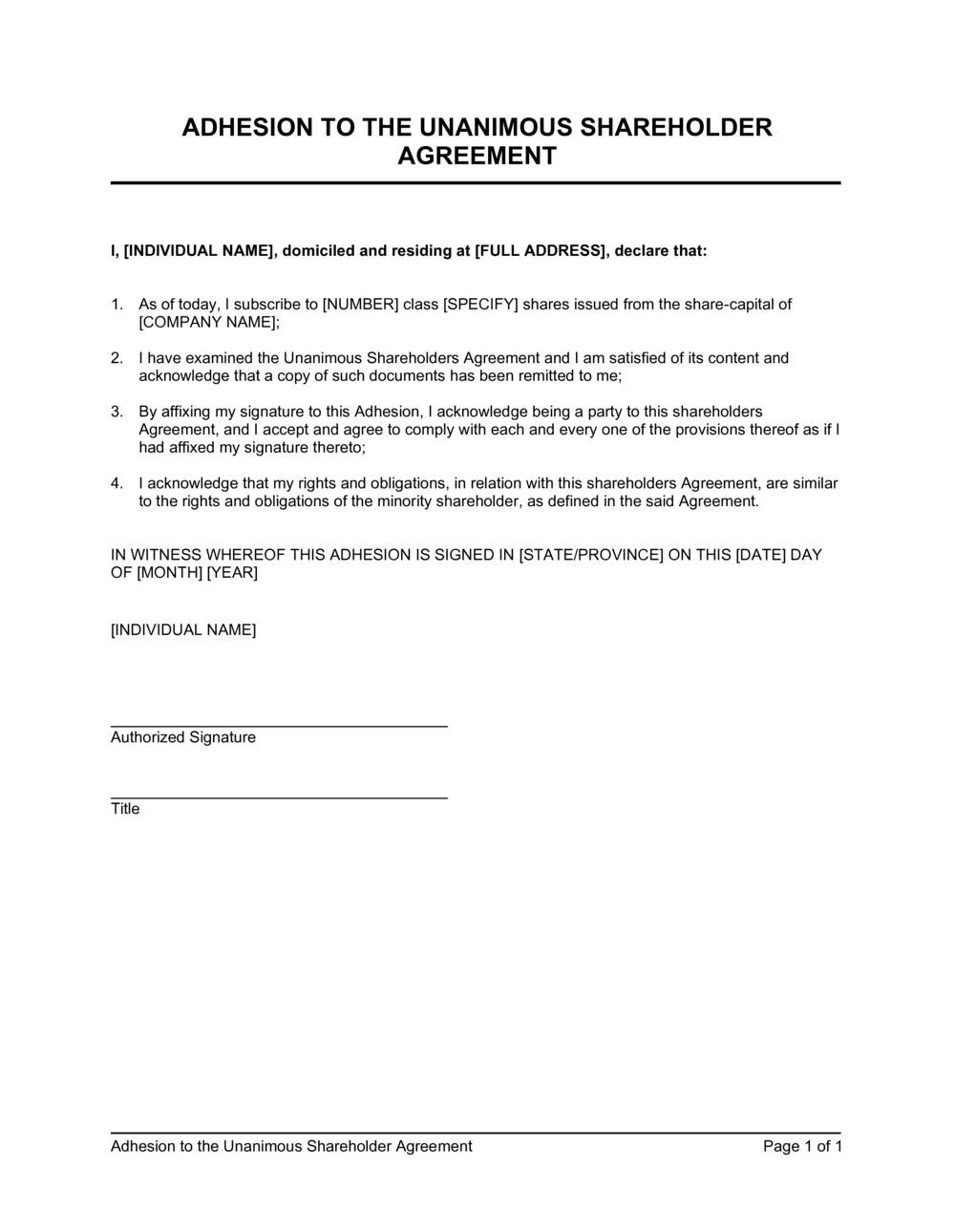

Start with a clear, concise title and logically organized sections, using distinct headings and subheadings. Employ consistent formatting for fonts, spacing, and paragraph structures to create a professional appearance. For long or complex clauses, consider breaking them down into digestible bullet points or numbered lists, as demonstrated above, to improve readability. Ensure that all defined terms are consistently capitalized and that a glossary of key terms is included if necessary. Digital versions should be easily navigable with a table of contents that links to specific sections. Finally, always include clear signature blocks for all parties and witnesses, ensuring proper execution and legal enforceability. A user-friendly design encourages all shareholders to actually read and understand the document, rather than just signing it.

The strategic deployment of a well-structured unanimous shareholder agreement template represents a proactive step towards building a resilient and well-governed enterprise. It’s an investment in clarity, stability, and the long-term health of your business relationships, preempting conflicts before they can derail progress. By leveraging such a template, businesses gain access to a professionally vetted framework, saving significant time and resources that would otherwise be spent on drafting from scratch.

Ultimately, this essential document provides peace of mind for all stakeholders, establishing a clear path for decision-making, dispute resolution, and future growth. For any business with multiple owners, embracing a robust unanimous shareholder agreement template is not merely a legal formality; it is a fundamental pillar of sound corporate governance, laying the groundwork for enduring success and harmonious partnership.