Embarking on a journey, whether it’s a weekend getaway or an epic international adventure, often begins with the thrill of imagining new sights, tastes, and experiences. Yet, amidst the excitement of choosing destinations and activities, one crucial element often gets overlooked or given insufficient attention: the financial groundwork. Without a clear understanding of potential expenses, even the most meticulously planned trip can quickly turn stressful, leading to unexpected debts or compromises that diminish the overall enjoyment.

This is where a structured approach to your travel finances becomes indispensable. Far from being a rigid constraint, a well-thought-out financial travel blueprint acts as your compass, guiding your spending and ensuring your wanderlust doesn’t lead to buyer’s remorse. It transforms the daunting task of managing trip costs into an empowering exercise, giving you control and peace of mind before, during, and after your travels.

Why a Dedicated Travel Budget Matters More Than You Think

Many people approach travel budgeting with a simple "estimate and hope for the best" method, which rarely proves effective. The reality is that travel involves numerous moving parts, each with its own cost implications, from flights and accommodations to local transport, food, activities, and unforeseen emergencies. A comprehensive travel budget template provides a framework to account for all these variables, ensuring you don’t miss any critical financial details.

Having a clear vacation budget planner enables proactive decision-making. Instead of reacting to mounting costs, you can make informed choices about where to save and where to splurge, aligning your spending with your travel priorities. This foresight prevents that sinking feeling when you check your bank balance mid-trip, allowing you to fully immerse yourself in the experience without financial worries lingering in the background. It also helps in identifying potential savings, perhaps by booking flights during off-peak seasons or choosing alternative accommodation options.

Key Elements of an Effective Travel Expense Planner

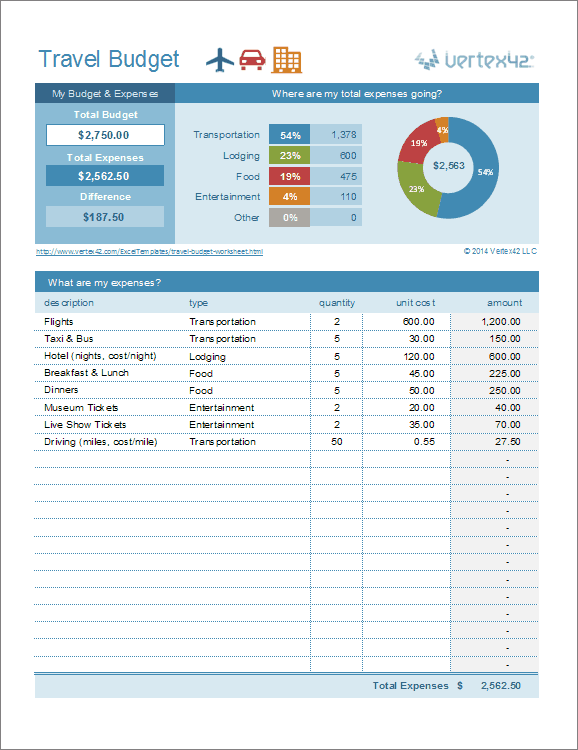

A truly useful Trip Planning Budget Template isn’t just a list of numbers; it’s a dynamic tool that categorizes every potential cost. By breaking down your trip into distinct financial components, you gain clarity and control, making it easier to allocate funds appropriately. Here are the core categories every robust travel expense planner should include:

- **Transportation:** This often constitutes a significant portion of the budget. Think beyond just flights. Include trains, rental cars, gas, tolls, taxis, ride-shares, and public transport at your destination.

- **Accommodation:** Whether it’s hotels, Airbnb, hostels, or camping, detail your nightly rates. Don’t forget potential resort fees, cleaning fees, or early check-in/late check-out charges.

- **Food and Drink:** This category can be surprisingly variable. Budget for dining out, groceries for cooking, snacks, coffee, and any special culinary experiences you plan to indulge in. Consider a daily average for this.

- **Activities and Entertainment:** Entry fees for museums, tours, theme parks, shows, concerts, excursions, and any other planned paid activities fall here. Research these costs in advance.

- **Shopping and Souvenirs:** Even if you plan minimal shopping, it’s wise to allocate a small amount for gifts, personal items, or mementos.

- **Travel Insurance:** A non-negotiable for many, especially for international travel or expensive trips. This covers medical emergencies, trip cancellations, and lost luggage.

- **Miscellaneous/Contingency:** Always include a buffer for unexpected costs. This could be anything from a forgotten essential item to an emergency medical visit or an unplanned splurge. A good rule of thumb is 10-15% of your total budget.

- **Pre-Trip Expenses:** Don’t forget costs incurred before you even leave, such as passport renewals, visa fees, vaccinations, new luggage, or travel gear.

Crafting Your Personalized Travel Spending Plan

The beauty of using a pre-designed travel budget template is its adaptability. While it provides a structured framework, you have the flexibility to customize it to your specific travel style and destination. Begin by estimating fixed costs like flights and accommodation, as these are often the largest and most predictable. Research average prices for dining, activities, and local transportation in your chosen location to set realistic expectations for variable expenses.

Consider your travel companions too. If you’re traveling solo, your budget will look different than if you’re with a partner, family, or a group of friends. For group travel, decide beforehand how shared expenses will be split and tracked. Will one person pay for everything and get reimbursed, or will everyone contribute to a communal fund? Your financial travel blueprint should reflect these decisions. Regular review and adjustment of your expense tracking for trips is also key, as initial estimates might need tweaking once you have more concrete bookings.

Tips for Sticking to Your Vacation Budget

Creating a detailed budget is only half the battle; the other half is adhering to it. Without discipline, even the most meticulous financial planning can unravel. Here are some strategies to help you stay on track and maximize your travel dollars:

- **Track Expenses Daily:** Use a budgeting app, a simple spreadsheet, or even a small notebook to record every dollar spent. This immediate tracking prevents overspending and provides a clear picture of your remaining funds.

- **Set Daily Limits:** Break down your overall spending plan into daily allowances for variable categories like food and activities. This makes it easier to manage spending in real-time.

- **Pre-Pay Where Possible:** Booking and paying for major expenses like flights, hotels, and tours in advance means fewer financial surprises during the trip.

- **Utilize Travel Rewards:** Leverage credit card points, airline miles, or hotel loyalty programs to offset costs for flights, accommodation, or even car rentals.

- **Cook Some Meals:** If your accommodation has kitchen facilities, buying groceries and preparing some of your own meals can significantly reduce food expenses compared to dining out for every meal.

- **Look for Free Activities:** Research free walking tours, public parks, free museum days, or local festivals that won’t cost you a dime but will enrich your experience.

- **Limit Souvenir Shopping:** Focus on experiences rather than accumulating trinkets. If you must buy souvenirs, set a strict limit for this category.

- **Review Your Budget Regularly:** Check in with your budget periodically throughout your trip, perhaps every few days. If you’ve overspent in one area, look for opportunities to cut back in another.

Leveraging Technology for Your Financial Travel Blueprint

In today’s digital age, numerous tools can simplify your expense sheets for journeys. While a simple spreadsheet (like Google Sheets or Excel) can serve as an excellent Trip Planning Budget Template, there are also dedicated travel budgeting apps that offer more sophisticated features. These apps often allow for real-time currency conversion, expense categorization, and even the ability to split costs among travel companions.

Many banking apps also offer spending insights that can be helpful for managing travel costs. Linking your travel-specific credit card or debit card to a budgeting app can automate much of the tracking process, reducing the need for manual entry. Explore options like Mint, YNAB (You Need A Budget), or specific travel expense trackers designed for group trips. These digital aids make monitoring your holiday financial guide a breeze, freeing you up to enjoy your adventures.

Frequently Asked Questions

Why is a Trip Planning Budget Template better than just estimating costs in my head?

Estimating costs mentally often leads to underestimation and overlooking smaller, but accumulating, expenses. A structured template ensures you account for all potential categories, from major bookings to daily incidentals, providing a more accurate and comprehensive financial overview for your trip. It acts as a concrete plan, reducing financial stress.

How early should I start using a travel budget template before my trip?

Ideally, you should start as soon as you begin planning your trip, even before making any bookings. This allows you to research and input estimated costs for flights, accommodation, and activities, helping you set realistic savings goals and make informed decisions about your destination and travel style well in advance.

What if I consistently go over budget in one category?

If you find yourself consistently exceeding your budget in a specific category, such as dining or activities, it’s a sign that your initial allocation might have been too low or your spending habits need adjustment. You can either reallocate funds from less-used categories, adjust your overall budget, or consciously cut back on spending in that area for the remainder of your trip.

Should I include a buffer for emergencies in my travel cost estimator?

Absolutely. Including a contingency fund, typically 10-15% of your total budget, is crucial. This buffer covers unexpected expenses like medical emergencies, flight delays, lost luggage, or even a sudden desire for an unplanned splurge, preventing these unforeseen costs from derailing your entire trip’s finances.

A carefully constructed travel budget template isn’t about stifling your travel dreams; it’s about empowering them. It transforms vague financial anxieties into clear, actionable steps, allowing you to maximize every dollar and every moment of your journey. By taking the time to plan your pre-trip financial planning with diligence, you’re investing in a smoother, more enjoyable, and ultimately more memorable travel experience.

So, as you dream of your next adventure, remember that the most exciting journeys are often those supported by the soundest financial foundations. Embrace the power of a dedicated financial travel blueprint, and set forth with confidence, knowing you’ve prepared for an incredible experience without any unwelcome surprises when you return home. Your future self (and your bank account) will thank you.