In the intricate world of international commerce, businesses often rely on specialized financial instruments to facilitate cross-border transactions. Trade finance, a critical component of global trade, provides the necessary capital and risk mitigation tools that enable buyers and sellers to operate with confidence. Central to these arrangements is the loan agreement, a legally binding document that defines the terms and conditions under which financing is extended. Without a robust and clear framework, the complexities of diverse jurisdictions, fluctuating currencies, and varied credit risks can quickly lead to misunderstandings, delays, and costly disputes.

For financial institutions, corporations, and legal professionals navigating this dynamic landscape, a well-structured trade finance loan agreement template is not just a convenience; it’s an indispensable asset. Such a template serves as a foundational blueprint, streamlining the drafting process, ensuring compliance, and providing a standardized yet adaptable framework for various financing scenarios. Its value lies in offering both efficiency and legal certainty, empowering users to execute trade finance deals with precision and peace of mind. This resource is particularly beneficial for those frequently engaged in global trade, seeking to standardize their legal documentation and mitigate the inherent risks of international transactions.

The Imperative of Documented Transactions

In today’s fast-paced global economy, the volume and velocity of international trade demand impeccable documentation. A clear, written agreement transcends mere formality; it is the bedrock of trust and enforceability in cross-border dealings. Oral agreements or loosely defined understandings are precarious, especially when disputes arise across different legal systems and business cultures.

A precisely articulated contract ensures that all parties—borrower, lender, and any intermediaries—have an unambiguous understanding of their rights, obligations, and the specific terms of the financial arrangement. This clarity is vital for legal enforceability, providing a solid basis for recourse should a breach occur. Furthermore, regulatory compliance is paramount in trade finance, with an increasing focus on anti-money laundering (AML), sanctions, and anti-bribery regulations. A comprehensive document ensures that all necessary disclosures and covenants are embedded, safeguarding parties against regulatory penalties and reputational damage.

Streamlining Operations and Mitigating Risk

The adoption of a specialized agreement template offers a multitude of benefits that extend beyond basic legal protection. Foremost among these is the significant boost in operational efficiency. Instead of drafting each agreement from scratch, a proven template allows legal teams and business units to quickly customize a document, drastically reducing preparation time and associated legal fees. This standardization also minimizes the risk of overlooking critical clauses or introducing inconsistencies that could weaken the agreement’s integrity.

Moreover, a well-designed template is a powerful tool for risk mitigation. It systematically addresses common pitfalls in trade finance, such as currency fluctuations, political risks, performance risks, and default scenarios. By clearly defining events of default, remedies, and governing law, it provides a predictable framework for resolving issues, reducing uncertainty, and protecting the financial interests of all involved parties. The consistency provided by using a reliable trade finance loan agreement template builds a more resilient and secure operational environment for all stakeholders.

Adapting Your Agreement for Specific Needs

One of the greatest strengths of a robust loan agreement template lies in its inherent adaptability. While providing a standardized foundation, it must be flexible enough to accommodate the diverse array of trade finance products and unique transactional requirements. International trade is not monolithic; it encompasses various financing structures such as letters of credit, supply chain finance, forfaiting, factoring, and export credit agency-backed loans, each with its own nuances.

A well-crafted template allows for easy customization to reflect these specific product types. It should enable users to insert specific details pertaining to the underlying goods or services, adjust repayment schedules to align with cash flow cycles, and modify collateral requirements based on the risk profile of the transaction. Furthermore, the template must be scalable to different industries—from manufacturing and agriculture to technology and commodities—and adaptable to various geographical regions, taking into account local legal requirements and market practices. This flexibility ensures that the document remains relevant and effective across a broad spectrum of commercial activities, making the trade finance loan agreement template a truly versatile asset.

Core Components of a Robust Loan Document

Every effective loan agreement, particularly one designed for the complexities of trade finance, must incorporate several essential clauses and sections to ensure clarity, enforceability, and comprehensive risk coverage. These components form the structural backbone of the agreement:

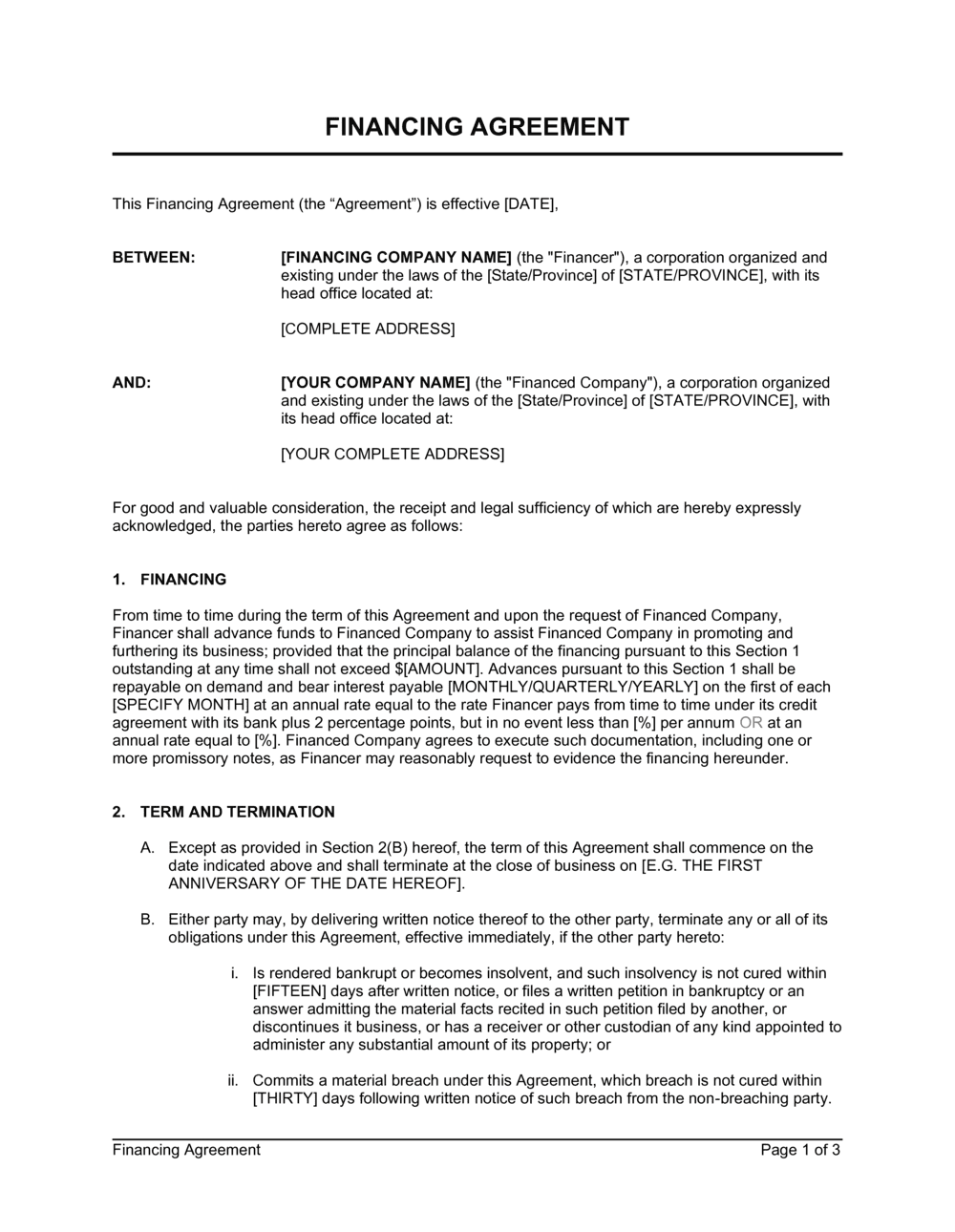

- Identification of Parties: Clearly states the full legal names and addresses of all involved parties, including the lender, borrower, and any guarantors.

- Loan Amount and Currency: Specifies the principal sum being lent, the currency of the loan, and any relevant exchange rate mechanisms if multiple currencies are involved.

- Purpose of the Loan: Articulates the specific trade transaction or activity the financing is intended to support, ensuring alignment with the lender’s risk appetite and regulatory requirements.

- Interest Rate and Calculation: Details the applicable interest rate (fixed or floating), the basis for its calculation, and the frequency of interest payments.

- Repayment Schedule: Outlines the principal repayment terms, including dates, amounts, and methods of payment, which can be tailored to the trade cycle.

- Collateral and Security: Describes any assets pledged as security for the loan, including specifics on perfection of security interests and valuation.

- Representations and Warranties: Statements of fact made by the borrower regarding their financial health, legal standing, and the nature of the underlying trade transaction.

- Covenants: Ongoing promises made by the borrower to do (affirmative covenants) or not to do (negative covenants) certain things during the life of the loan, such as maintaining financial ratios or refraining from incurring additional debt.

- Events of Default: Defines specific occurrences that constitute a breach of the agreement, triggering the lender’s remedies (e.g., non-payment, insolvency, breach of covenants).

- Remedies on Default: Lays out the actions the lender can take if an event of default occurs, such as accelerating the loan or enforcing security interests.

- Indemnification: Provisions requiring one party to compensate the other for losses or damages incurred under specific circumstances.

- Governing Law and Jurisdiction: Specifies the legal system under which the agreement will be interpreted and the courts that will have authority over any disputes.

- Dispute Resolution: Outlines the preferred method for resolving disagreements, whether through negotiation, mediation, arbitration, or litigation.

- Confidentiality: Clauses protecting sensitive information shared between the parties.

- Assignment: Dictates whether and how rights and obligations under the agreement can be transferred to third parties.

- Notices: Specifies the methods and addresses for official communication between the parties.

- Amendments and Waivers: Describes the procedures for modifying the agreement or waiving any of its provisions.

Enhancing Readability and Practical Application

Beyond the legal substance, the presentation and usability of a trade finance loan agreement template significantly impact its effectiveness. A document that is difficult to navigate or understand can lead to errors, delays, and frustration, regardless of its legal accuracy. Practical considerations for formatting and readability are therefore crucial.

Start by ensuring a logical flow, with clear headings and subheadings that guide the reader through the document’s structure. Use concise, unambiguous language, avoiding overly verbose or overly technical jargon where simpler terms suffice. Bullet points and numbered lists, as demonstrated in the section above, are excellent tools for breaking down complex information into digestible segments, particularly for outlining obligations, conditions precedent, or events of default. For digital use, ensure the template is easily searchable and compatible with common word processing and PDF software. If intended for print, maintain adequate margins and a legible font size. Implementing version control is also critical; clearly label each iteration of the template to prevent confusion and ensure that all parties are working from the most current and approved document.

Utilizing consistent terminology throughout the agreement also aids comprehension and reduces ambiguity. A well-formatted document not only looks professional but also signals thoroughness and attention to detail, reinforcing trust among all stakeholders. Ultimately, a template designed with usability in mind facilitates smoother transactions and fewer legal queries, proving its worth far beyond its initial drafting.

Adopting a specialized and meticulously crafted trade finance loan agreement template is a strategic decision for any entity engaged in the global marketplace. It represents an investment in clarity, efficiency, and robust risk management. By standardizing the legal framework for complex international transactions, businesses can significantly reduce their administrative burden, mitigate potential legal exposure, and accelerate their deal-making processes.

This comprehensive approach ensures that every transaction is underpinned by a legally sound and commercially intelligent document, providing peace of mind to both lenders and borrowers. Ultimately, leveraging a well-designed template empowers organizations to navigate the complexities of trade finance with greater confidence and precision, fostering stronger relationships and facilitating sustainable growth in the international arena.