The lifecycle of any business relationship, much like life itself, includes beginnings, middles, and often, an end. While much attention is rightly paid to drafting a robust shareholders’ agreement at the inception of a venture, the process of bringing that agreement to a close often receives less thought, yet it is equally critical. A well-structured exit strategy isn’t merely good practice; it’s a foundational element of sound corporate governance, safeguarding the interests of all parties involved when their paths diverge.

Navigating the complexities of dissolving or terminating an existing shareholder relationship without a clear framework can lead to significant disputes, financial repercussions, and even legal battles that can cripple a business. This is where a comprehensive termination of shareholders agreement template becomes an invaluable asset. It serves as a pre-planned, mutually agreed-upon blueprint for an orderly separation, minimizing ambiguity and providing a predictable pathway out for shareholders, whether due to a sale, a buy-out, a strategic shift, or a disagreement.

Why a Documented Protocol is Indispensable in Modern Business

In today’s fast-paced business environment, clarity and precision are paramount, especially when dealing with equity, ownership, and partnership dynamics. Relying on verbal understandings or informal arrangements when a significant shareholder departs is a recipe for disaster. Such an approach often invites misinterpretations, creates unnecessary tension, and can significantly delay crucial business operations or even a successful acquisition.

A clear, written protocol for ending shareholder relationships establishes certainty and reduces the emotional stress often associated with such transitions. It ensures that all parties understand their rights and obligations during and after the termination process. This proactive approach not only mitigates future risks but also projects an image of professionalism and foresight to potential investors, lenders, and future partners, demonstrating a company’s commitment to robust governance.

Safeguarding Interests: The Benefits of a Structured Off-Ramp

Utilizing a meticulously crafted template for the termination of a shareholders agreement offers a multitude of benefits, extending far beyond mere legal compliance. Primarily, it provides a clear roadmap for disengagement, protecting the financial and operational integrity of the company. It ensures that the value of the business is preserved and that the transition is as smooth as possible for remaining shareholders and employees.

Such a document helps to prevent stalemates or prolonged negotiations that can drain resources and management time. By pre-defining the terms of exit, it reduces the likelihood of costly litigation, allowing parties to resolve their differences according to an established framework. Furthermore, it often includes provisions for the orderly transfer of shares, settlement of outstanding debts, and adherence to post-termination covenants, which are vital for business continuity.

Adapting the Framework: Customization for Diverse Scenarios

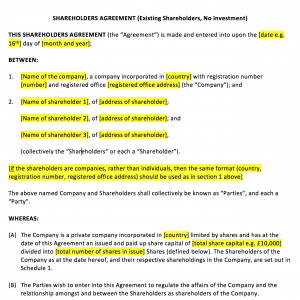

No two businesses or shareholder relationships are identical, which underscores the importance of a flexible termination of shareholders agreement template. While core principles remain constant, the specifics must be tailored to the unique circumstances of each company and the particular reasons for the agreement’s conclusion. For instance, the exit of a founder will likely involve different considerations than the departure of a minority investor.

The template should be adaptable to various industries, from technology startups to established manufacturing firms, and to different termination triggers, such as a buy-out, a breach of contract, a change of control event, or the mutual agreement of all parties. Customization might involve specific provisions for intellectual property rights, industry-specific regulatory compliance, or tailored formulas for share valuation and buy-back mechanisms relevant to particular business models. Legal counsel should always review customizations to ensure they align with local laws and the specific intentions of the parties.

Core Components of an Effective Exit Document

A comprehensive agreement for concluding shareholder relations must be robust, anticipating potential issues and addressing them pre-emptively. While specific details will vary, certain clauses are universally essential to ensure a clear, legally sound, and equitable termination process.

Here are the critical sections every such document should contain:

- Recitals and Background: Briefly state the purpose of the document, referencing the original shareholders’ agreement and the intent to terminate it.

- Conditions for Termination: Clearly outline the specific events or circumstances that trigger the termination (e.g., mutual agreement, sale of the company, breach of the original agreement, specific dates).

- Effective Date of Termination: Precisely state when the original shareholders’ agreement officially ceases to be in effect.

- Release of Claims: A crucial clause where parties mutually agree to release each other from any and all claims, demands, or liabilities arising from or related to the original agreement, except as explicitly stated in the termination document.

- Continuing Obligations: Identify any provisions from the original agreement that will survive termination (e.g., confidentiality, non-compete, non-solicitation, indemnification, dispute resolution).

- Confidentiality: Reiterate the ongoing obligation to protect confidential information, often a critical concern for businesses.

- Non-Compete and Non-Solicitation: If applicable, restate or establish new post-termination restrictions on competition and employee/customer solicitation.

- Share Transfer and Buyout Provisions: Detail the mechanics for the transfer or repurchase of the departing shareholder’s equity, including valuation methods, payment terms, and timelines.

- Return of Company Property: Mandate the return of all company assets, documents, and intellectual property by the departing shareholder.

- Representations and Warranties: Parties may confirm they have the authority to enter into the termination agreement and that they have not engaged in any actions that would impair its validity.

- Indemnification: Clauses specifying which party will bear responsibility for certain liabilities or losses post-termination.

- Dispute Resolution: Outline the preferred method for resolving any disputes arising from the termination agreement itself (e.g., mediation, arbitration, litigation).

- Governing Law: Specify the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Notices: Provide clear instructions on how formal communications between the parties should be delivered.

- Entire Agreement: State that the termination document constitutes the complete and final agreement between the parties regarding its subject matter, superseding all prior understandings.

- Amendments: Outline the procedure for any future modifications to the termination agreement itself.

- Severability: A clause ensuring that if any part of the agreement is found unenforceable, the remainder remains valid.

- Counterparts: Allows the agreement to be signed in multiple identical copies, each considered an original.

- Signatures: Essential for all parties involved, confirming their agreement to the terms.

Ensuring Practicality: Design and Readability Considerations

Even the most legally robust document can fall short if it’s difficult to read or navigate. For a termination agreement, clarity and user-friendliness are paramount, especially during what can be a stressful period for shareholders. Thoughtful design and formatting enhance readability and ensure that all parties fully comprehend their commitments.

Keep paragraphs concise, ideally two to four sentences, to avoid overwhelming the reader. Use clear, simple language, avoiding excessive legal jargon where possible, or defining complex terms within the document. Employ headings and subheadings (like the <h2> and <h3> tags in HTML) to break up the text and guide the reader through different sections. Incorporate bullet points and numbered lists for itemized information, such as obligations or conditions, making them easy to scan and understand. For digital use, ensure the document is accessible and responsive across various devices. For print, consider font size, line spacing, and adequate margins to create a professional and legible appearance.

The process of terminating a shareholders’ agreement doesn’t have to be fraught with uncertainty and conflict. By leveraging a comprehensive termination of shareholders agreement template, businesses and their legal advisors can proactively manage shareholder transitions with clarity, fairness, and legal compliance. It stands as a testament to foresight, transforming a potentially disruptive event into a structured, manageable process that safeguards the company’s future and honors the contributions of all parties.

Ultimately, investing in a robust and adaptable termination of shareholders agreement template is an investment in the long-term stability and resilience of any enterprise. It provides a professional, time-saving solution that minimizes the potential for disputes and ensures a smooth, predictable winding down of shareholder relationships, allowing businesses to move forward with confidence and clarity.