Navigating the complexities of capital project management can often feel like steering a ship through a storm without a compass. Stakeholders demand clarity, finance teams require precision, and project managers yearn for a tool that bridges the gap between ambitious plans and day-to-day realities. In this environment, the ability to articulate financial projections and performance is not just a nice-to-have; it’s a critical skill that can make or break a project’s success.

That’s where a well-conceived Template Capital Project Budget Powerpoint Actual becomes an indispensable asset. It’s more than just a collection of slides; it’s a strategic communication tool designed to present financial data—both planned and actual—in a clear, compelling, and actionable format. This article will explore why such a comprehensive template is vital for modern capital projects, how it empowers better decision-making, and what key elements ensure its effectiveness in driving projects forward successfully.

The Indispensable Role of Robust Capital Project Budgeting

At the heart of every successful capital project lies a meticulously crafted budget. This isn’t merely a list of anticipated expenses; it’s a strategic roadmap that allocates resources, sets financial boundaries, and defines the economic viability of the entire endeavor. Without a solid financial foundation, projects can quickly spiral out of control, leading to cost overruns, delays, and a significant drain on organizational resources.

Accurate capital expenditure planning helps an organization visualize the financial trajectory of its investments. It enables proactive risk identification, allowing teams to develop contingency plans for potential financial hurdles before they become critical issues. Furthermore, a well-defined project financial plan provides a clear benchmark against which actual performance can be measured, ensuring accountability and transparency throughout the project lifecycle.

Unpacking the “Powerpoint Actual” Advantage

The power of a capital project budgeting template is amplified when it’s designed for presentation and incorporates actual performance data. PowerPoint offers a universally accessible and flexible platform for distilling complex financial figures into easily digestible visuals and narratives. It transforms raw data into a story, allowing project managers to communicate effectively with diverse audiences, from technical teams to executive leadership and external investors.

Incorporating "actuals" into this presentation framework is crucial for several reasons. It moves beyond theoretical projections, offering a real-time snapshot of the project’s financial health. This dynamic comparison between the approved budget and actual spending facilitates immediate identification of variances, prompting timely adjustments and course corrections. Such a budget tracking spreadsheet or presentation isn’t just a reporting mechanism; it’s a tool for continuous improvement and strategic adaptation. By regularly updating the budget report with current financial data, project teams can demonstrate control, address challenges proactively, and maintain stakeholder confidence.

Key Elements of an Effective Capital Project Budget Template

A high-quality capital project budgeting template should be comprehensive yet intuitive, providing a clear and structured framework for financial management. Its design should encourage both detailed record-keeping and high-level strategic overview. The most effective templates for project financial planning incorporate several critical components, ensuring all stakeholders have access to the necessary information for informed decisions.

Essential sections within a robust capital expense budget presentation often include:

- **Executive Summary:** A concise overview of the project, its total budget, current spending, and key financial highlights. This provides a quick understanding of the project’s financial status.

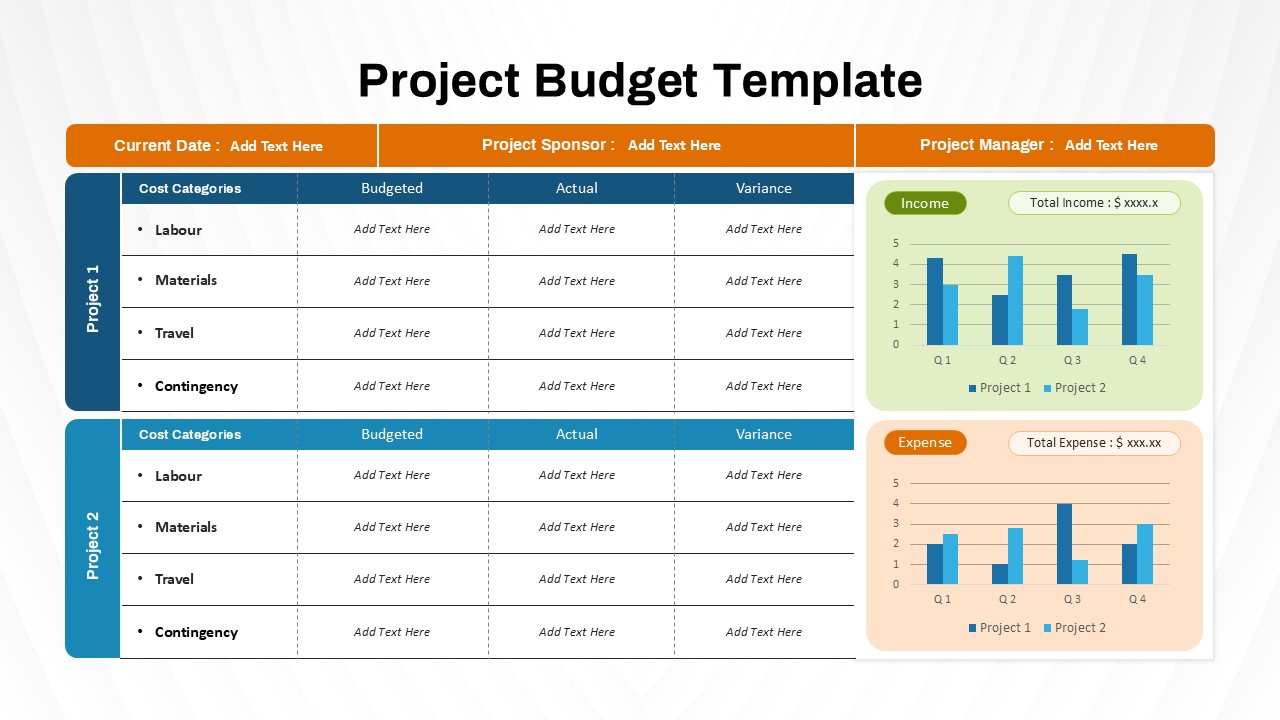

- **Budget Overview by Category:** A breakdown of the budget into major cost categories, such as labor, materials, equipment, permits, and contingencies. This allows for clear visualization of where funds are allocated.

- **Budget vs. Actuals Comparison:** Detailed tables and charts comparing planned expenditures against actual spending for each category and time period. This is vital for **budget variance analysis**.

- **Variance Analysis and Explanation:** Identification of significant deviations from the original plan, along with explanations for these variances and proposed corrective actions.

- **Cash Flow Projections:** A forecast of cash inflows and outflows over the project timeline, ensuring liquidity and financial stability.

- **Key Performance Indicators (KPIs):** Metrics such as **CPI (Cost Performance Index)** and **SPI (Schedule Performance Index)**, providing quantitative measures of project financial health and progress.

- **Risk Register (Financial):** A list of identified financial risks, their potential impact, and mitigation strategies.

- **Future Projections/Forecasts:** Revised financial forecasts based on current actuals and anticipated future costs, offering a dynamic view of the project’s financial trajectory.

- **Assumptions and Disclaimers:** Clarification of the underlying assumptions used in the budget and any limitations to the financial data presented.

These components collectively form a powerful project budget presentation that supports transparent reporting and effective cost control template implementation.

Leveraging Your Capital Project Budget Presentation for Success

Simply having a capital project budgeting template isn’t enough; knowing how to use it strategically is paramount. An effective project budget presentation goes beyond merely displaying numbers; it communicates insights and drives action. Here are several tips for maximizing the impact of your financial presentations:

- Tailor to Your Audience: Adapt the level of detail and language based on who you’re presenting to. Executives might prefer high-level summaries and key metrics, while project team members may need more granular data.

- Focus on Visuals: Utilize charts, graphs, and infographics to make complex data easier to understand. Visual representations of budget vs. actuals, for instance, can quickly highlight trends and variances more effectively than raw tables.

- Tell a Story with Data: Don’t just present numbers; explain what they mean. Highlight successes, identify challenges, and propose solutions. Use the financial data to tell the narrative of the project’s progress.

- Be Prepared for Questions: Anticipate potential questions about variances, future forecasts, and risk mitigation strategies. Having answers ready demonstrates preparation and builds confidence.

- Maintain Consistency: Regular updates and consistent formatting build trust and make it easier for stakeholders to track progress over time. This enhances the utility of the budget tracking spreadsheet.

- Use for Decision-Making: Frame the presentation around key decisions that need to be made. Is additional funding required? Should a particular scope item be re-evaluated? The financial presentation template should serve as a basis for strategic discussions.

Customization and Adaptation: Making the Template Your Own

While a general project financial planning template provides a strong starting point, its true value often lies in its adaptability. No two capital projects are exactly alike, and the specific needs of an organization, industry, or individual project will dictate the finer points of its financial reporting. Customizing your template ensures it aligns perfectly with your internal processes, reporting standards, and specific project requirements.

This might involve adjusting category breakdowns to match your general ledger codes, incorporating specific compliance requirements, or integrating unique KPIs relevant to your sector. For example, a construction project might require detailed breakdowns for specific materials or subcontractor costs, while a software development capital project might emphasize research and development expenditure alongside infrastructure. The flexibility to modify the layout, add specific data fields, or include company branding turns a generic tool into a powerful, proprietary asset. Regularly reviewing and refining the capital expenditure planning tool based on lessons learned from past projects also ensures its continuous improvement and relevance.

Real-World Impact: From Plan to Profitability

The adoption of a disciplined approach to project cost management, underpinned by a robust financial presentation template, translates directly into tangible benefits. Consider a scenario where a manufacturing company embarked on a plant expansion. Initial projections were optimistic, but by regularly utilizing an “actual vs. budget reporting” template, the project manager identified significant overruns in the raw materials category within the first quarter. The detailed variance analysis revealed a supply chain issue that was quickly addressed, renegotiating contracts and averting a multi-million-dollar budget blow.

Similarly, a real estate developer using detailed financial forecasting for projects could proactively adjust their sales strategy when market conditions shifted, using the updated capital expense budget to present revised profitability forecasts to investors, maintaining transparency and trust. These aren’t just isolated incidents; they represent the systemic advantages of having a dynamic, transparent, and actionable project performance tracking system. By transforming raw financial data into clear, consumable insights, organizations can confidently move from initial planning to profitable execution, ensuring strategic capital allocation and maximizing return on investment.

Frequently Asked Questions

What is the primary benefit of using a PowerPoint template for capital project budgets?

The primary benefit is enhanced communication. PowerPoint allows for the visual presentation of complex financial data, making it easier for diverse stakeholders to understand the project’s financial health, track progress, and make informed decisions quickly.

How often should “actuals” be updated in a capital project budget presentation?

The frequency of updates for actuals depends on the project’s size, complexity, and internal reporting cycles. For large, dynamic projects, weekly or bi-weekly updates might be necessary, while smaller projects may suffice with monthly updates. The key is consistency and timeliness to ensure relevant data for decision-making.

Can this type of template be used for project cost control?

Absolutely. A template that integrates budget vs. actuals and variance analysis is a fundamental tool for project cost control. It highlights deviations from the planned budget, allowing project managers to investigate the causes and implement corrective actions proactively to keep the project on track financially.

Is it necessary to include future forecasts in addition to current actuals?

Yes, including future forecasts is highly beneficial. While current actuals show past performance, forecasts use that performance data to project future spending and financial outcomes. This provides a forward-looking view of the project’s financial trajectory, which is crucial for strategic planning and mitigating future risks.

What level of detail should be included in the budget sections?

The level of detail should be appropriate for the audience and the stage of the project. Early stages might focus on high-level categories, while later stages or detailed financial reviews will require granular breakdowns of costs. A good template allows for both summary and detailed views, facilitating different reporting needs.

In the dynamic world of capital projects, clarity, control, and effective communication are paramount. A robust Template Capital Project Budget Powerpoint Actual empowers project leaders to not only manage finances with precision but also to convey their project’s financial story with conviction. It transforms a potentially daunting task into a structured, manageable process, fostering transparency and accountability across all levels.

Embrace the power of a well-structured financial template to move beyond mere compliance and into strategic advantage. By leveraging a comprehensive project financial planning tool, you can ensure your capital investments are not just funded, but meticulously managed, rigorously tracked, and successfully delivered, ultimately contributing to your organization’s long-term prosperity and growth.