Navigating the financial landscape of a homeowners association can often feel like steering a ship through uncharted waters. Board members, often volunteers, are entrusted with significant fiscal responsibilities, from managing daily operational costs to planning for future capital expenditures. Without a clear financial roadmap, an HOA can quickly encounter turbulence, leading to missed opportunities, resident dissatisfaction, and even legal complications. This is where a robust and well-structured budget becomes not just a helpful tool, but an absolute necessity for successful community management.

A well-crafted financial plan ensures transparency, accountability, and the long-term solvency of the association. It serves as a living document that guides decision-making, communicates financial health to residents, and prevents unwelcome surprises. For many HOAs, especially those without professional financial staff, the idea of creating such a comprehensive document from scratch can be daunting. This article aims to demystify the process, highlighting the core elements and strategic advantages of utilizing a structured approach to community financial planning.

The Indispensable Tool for Fiscal Health

At its core, an HOA budget is more than just a list of numbers; it’s a strategic blueprint for the community’s financial future. It reflects the board’s commitment to responsible governance, ensuring that funds are allocated efficiently to maintain property values, enhance common areas, and provide essential services. A clear homeowners association budget provides a framework for setting realistic expectations for both current and future expenditures, allowing the board to anticipate needs and proactively plan for them. This foresight is crucial for maintaining a healthy reserve fund, which is vital for funding major repairs and replacements without resorting to special assessments that can burden residents.

Moreover, a transparent community budget fosters trust among residents. When homeowners understand where their dues are going and why, they are more likely to support the board’s decisions and feel confident in the association’s management. It allows for open discussions during annual meetings, ensuring that everyone has a voice in the financial direction of their community. This proactive financial management leads to greater stability, better decision-making, and ultimately, a more harmonious living environment for everyone involved.

Deconstructing the HOA Budget: Key Components

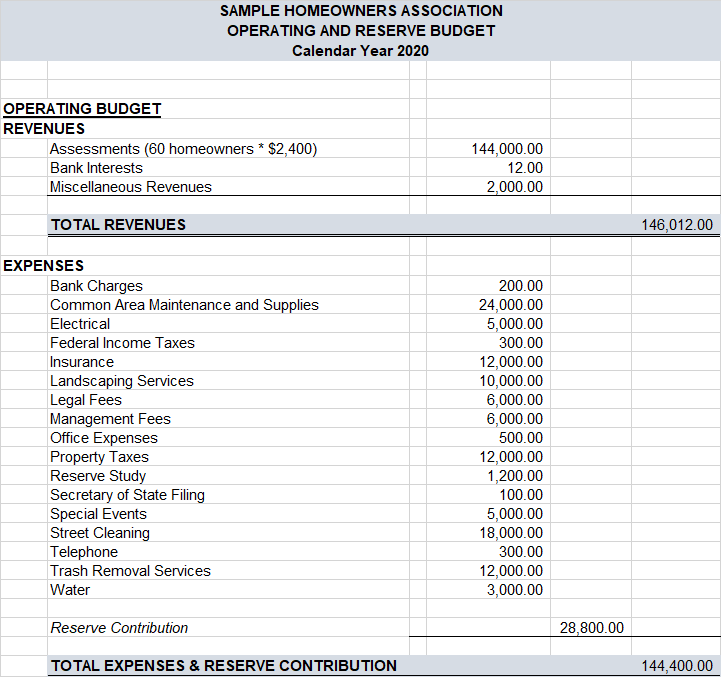

A comprehensive budget for a homeowners association typically includes two main sections: operating expenses and reserve funds. Each plays a distinct yet interconnected role in the financial well-being of the community. Understanding these components is the first step toward building a sound financial structure.

-

Operating Budget: This section covers the day-to-day costs required to run the association. These are typically recurring expenses that keep the community functioning smoothly.

- Administrative Expenses: Costs related to managing the HOA, such as:

- Management fees for professional HOA management companies.

- Legal fees for consultations, document reviews, or litigation.

- Accounting and auditing fees for financial oversight.

- Office supplies and communication costs.

- Insurance premiums (liability, property, D&O).

- Utilities: Expenses for common areas, including:

- Electricity for lighting, clubhouses, and gates.

- Water and sewer for irrigation, pools, and shared facilities.

- Gas for heating common areas or amenities.

- Trash and recycling collection services.

- Maintenance and Repairs (Routine): Regular upkeep of common elements:

- Landscaping services (mowing, pruning, irrigation).

- Pool maintenance and cleaning.

- Snow removal (seasonal).

- Pest control.

- Minor repairs to common property (e.g., fence mending, light fixture replacement).

- Amenities: Costs associated with community facilities:

- Clubhouse upkeep.

- Gym equipment maintenance.

- Playground inspections and repairs.

- Security services or monitoring.

- Administrative Expenses: Costs related to managing the HOA, such as:

-

Reserve Fund Budget: This critical component is for anticipated major repairs, replacements, or improvements of common assets that have a long lifespan but will eventually require significant capital investment. A well-funded reserve helps avoid sudden, large special assessments.

- Major Roof Replacement for common buildings.

- Resurfacing Roads or Parking Lots.

- Replacing HVAC Systems in common facilities.

- Upgrading Community Amenities (e.g., pool, clubhouse).

- Exterior Painting of common structures.

- Drainage system overhauls.

By meticulously detailing each item, an HOA budget template provides a clear picture of where money is coming from (assessments, late fees, etc.) and where it needs to go.

Crafting Your HOA Budget: A Step-by-Step Guide

Developing a sound financial plan for a community association involves a systematic approach, whether you’re starting from scratch or refining an existing document. Using a structured budgeting guide for community boards can streamline this process considerably.

-

Gather Historical Data: Begin by reviewing past financial statements, previous budgets, and expense reports for the last 2-3 years. This historical context is invaluable for identifying recurring costs, seasonal variations, and potential areas for cost savings. Look at actual expenditures versus budgeted amounts to understand variances.

-

Estimate Income: The primary source of income for most HOAs comes from homeowner assessments (dues). Calculate the total annual revenue based on the number of units and the current assessment rate. Also, factor in any other income sources like late fees, amenity usage fees, or interest earned on reserve funds.

-

Project Operating Expenses: Go through each line item in your operating budget. Obtain quotes from vendors for services like landscaping, management, and insurance. For utilities, look at historical usage and consider any anticipated price increases. Don’t forget smaller, often overlooked costs like postage, bank fees, and software subscriptions.

-

Conduct a Reserve Study (or Update an Existing One): This is perhaps the most crucial step for long-term fiscal health. A reserve study identifies all major common area components, estimates their useful life, and determines the cost to repair or replace them. It then calculates the amount that should be contributed annually to the reserve fund to ensure sufficient capital when these projects become necessary. This foresight prevents the need for large, unexpected special assessments.

-

Factor in Contingencies: Even the most meticulously planned budget can face unforeseen circumstances. Allocate a reasonable percentage (e.g., 5-10% of operating expenses) for a contingency fund to cover unexpected repairs, emergency services, or sudden increases in costs.

-

Draft and Review: Compile all the data into a preliminary annual HOA budget. Review it thoroughly with the entire board. Challenge assumptions, identify potential savings, and ensure all essential items are included. This collaborative review is essential for achieving consensus and a shared understanding of the association’s financial direction.

-

Seek Professional Review: If possible, have your drafted budget reviewed by an accountant specializing in community associations or your HOA management company. Their expertise can catch potential errors, ensure compliance with state regulations, and offer valuable insights.

-

Present to Homeowners: Once finalized by the board, present the proposed budget to the homeowners for their review and approval (as required by your governing documents). Provide clear explanations for significant changes and be prepared to answer questions transparently.

Maximizing the Value of a Template Budget For Homeowners Association

Effectively leveraging a Template Budget For Homeowners Association goes beyond mere data entry; it involves integrating it into the ongoing financial management and communication strategy of your community. A well-utilized budget becomes a dynamic tool that adapts to the evolving needs of the association.

Firstly, customization is key. While a template provides a fantastic starting point, it must be tailored to the specific characteristics of your community. Every HOA is unique, with different amenities, property types, and resident expectations. Adjust the line items to reflect your association’s actual expenditures and income streams. For instance, an HOA with a large swimming pool will have significantly different maintenance costs than one with just basic landscaping.

Secondly, treat the annual HOA budget as a living document. It shouldn’t be created once a year and then forgotten. Regular monthly or quarterly reviews are essential to track actual spending against budgeted amounts. This allows the board to identify discrepancies early, take corrective action if expenses are running high, or reallocate funds if savings are identified. These regular check-ins ensure that the financial plan remains relevant and effective throughout the fiscal year.

Thirdly, transparent communication surrounding the association financial planning is paramount. Present the budget in an easily understandable format to homeowners, perhaps with charts or graphs that illustrate key spending categories. Explain the rationale behind major allocations, especially for reserve contributions or significant projects. When residents feel informed and understand the reasons behind their assessments, they are more likely to be engaged and supportive of the board’s efforts. This clarity strengthens community cohesion and mitigates potential disputes over finances.

Navigating Common Budgetary Challenges

Even with a robust financial roadmap for HOAs, boards often face specific challenges that require careful navigation. Understanding these common hurdles can help proactively prepare and mitigate their impact.

One significant challenge is adequate reserve funding. Many HOAs historically underfunded their reserves, leading to a scramble for funds when major components (like roofs or roads) needed replacement. A comprehensive reserve study, updated regularly, is the best defense against this. It provides a clear, data-driven plan for contributions, ensuring the association has the necessary capital when required, avoiding burdensome special assessments.

Another common issue is dealing with unexpected expenses. While a contingency fund helps, major unforeseen events like storm damage or a sudden spike in utility costs can still strain a budget. In such cases, the board must act decisively, prioritizing essential repairs, exploring insurance claims, and transparently communicating the situation to residents. Flexibility and a willingness to adjust are crucial here.

Balancing current needs with future planning can also be tricky. Sometimes, boards are pressured to keep assessments low in the short term, which often comes at the expense of adequate reserve contributions or deferring necessary maintenance. This short-sighted approach can lead to larger problems and costs down the road. It’s the board’s fiduciary duty to find a balance that supports both immediate operational needs and the long-term financial health of the community. Educating homeowners on the importance of reserves is a key part of this balance.

Frequently Asked Questions

Why is a budget so important for an HOA?

A budget is crucial for an HOA because it provides a clear financial roadmap, ensures transparency and accountability for resident funds, allows for proactive planning of expenses (especially major future repairs through reserve funding), and ultimately helps maintain property values and resident satisfaction within the community.

How often should an HOA budget be reviewed and updated?

The annual HOA budget should be formally adopted each fiscal year. However, it’s best practice for the board to review budget-to-actual reports monthly or quarterly to monitor spending, identify variances, and make minor adjustments if necessary. Reserve studies, which inform the reserve portion of the budget, should be updated every 3-5 years.

What is the difference between an operating budget and a reserve budget?

An **operating budget** covers the recurring, day-to-day expenses of running the HOA, such as landscaping, utilities, insurance, and management fees. A **reserve budget** is specifically for funding the repair and replacement of major common elements that have a long lifespan but will eventually wear out, like roofs, roads, or significant amenity upgrades.

Can homeowners influence the HOA budget?

Yes, homeowners can and should influence the HOA budget through various avenues. They typically have the opportunity to review the proposed budget before it’s adopted, attend annual meetings where the budget is discussed, and provide feedback or ask questions. Some governing documents may even require homeowner approval for the annual budget. Active participation ensures the budget reflects community priorities.

What if our HOA budget consistently runs a deficit?

A persistent deficit in your HOA budget is a serious concern that requires immediate attention. It means the association is spending more than it collects. The board must analyze where the overspending occurs, consider reducing non-essential expenses, and critically, evaluate if an increase in homeowner assessments is necessary to ensure the long-term financial stability and operational capacity of the community.

Embracing a structured financial framework, especially one guided by a well-designed template, empowers HOA boards to manage their communities with confidence and foresight. It transforms the often-complex task of financial oversight into a clear, manageable process that benefits all residents. From ensuring daily operations run smoothly to safeguarding future property values, sound financial management is the cornerstone of a thriving community.

By diligently applying the principles outlined here, customizing your approach to fit your unique association, and committing to ongoing review and transparent communication, your HOA can achieve remarkable fiscal health. The journey to a financially secure and harmonious community begins with that first, well-planned step, making the Template Budget For Homeowners Association an indispensable asset for every board.