Embarking on the entrepreneurial journey is exhilarating, filled with innovative ideas, boundless energy, and the dream of building something truly impactful. However, amidst the excitement of developing a product or service, securing a location, and planning your launch, there’s one foundational element that often gets overlooked or underestimated: a comprehensive financial plan. Without a clear understanding of where your money is coming from and, more importantly, where it’s going, even the most brilliant startup can quickly find itself adrift.

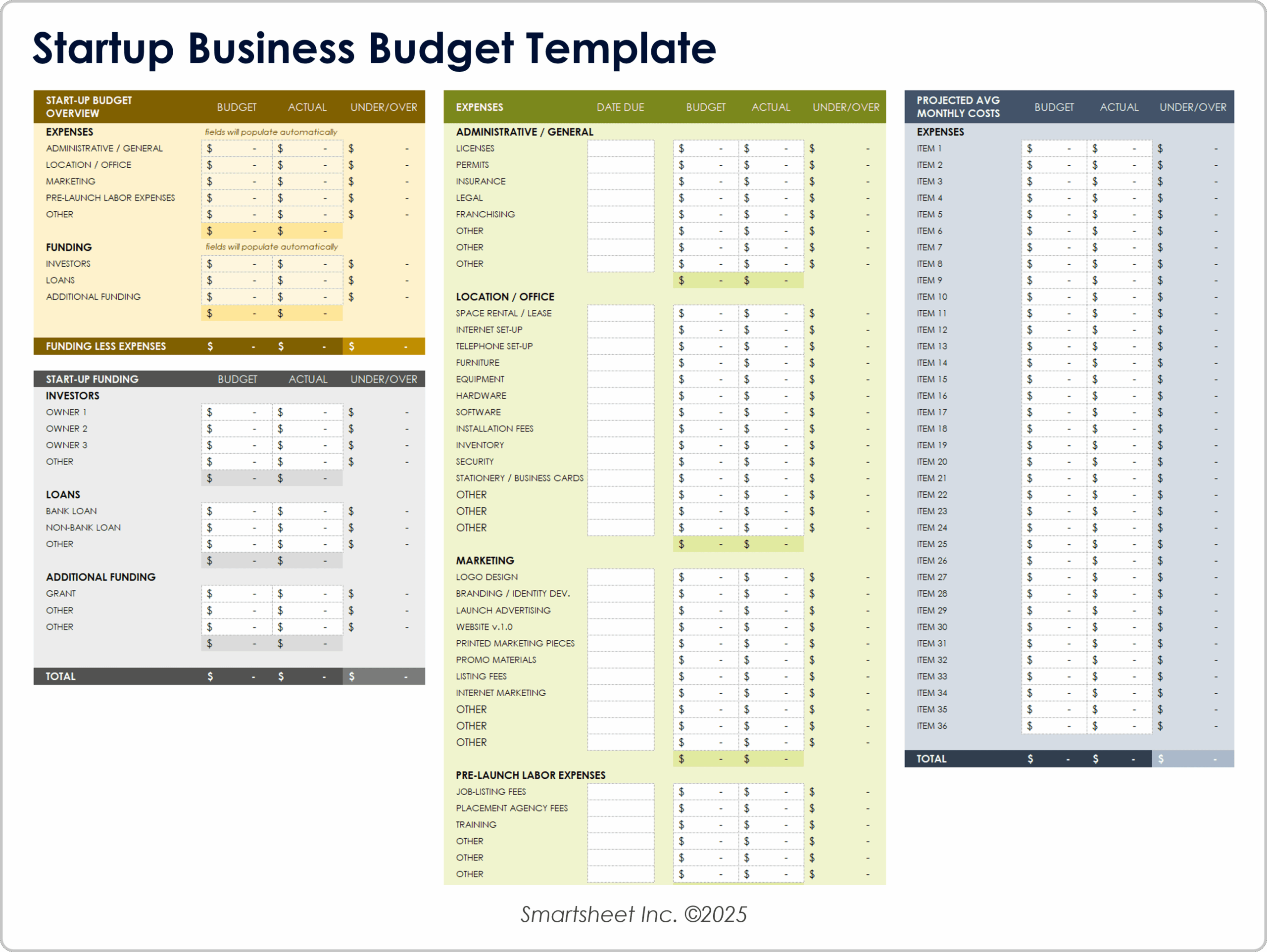

This is precisely where a robust Small Business Startup Business Budget Template becomes your most invaluable ally. It’s not just a collection of numbers; it’s a strategic roadmap, a foresight tool that transforms abstract business goals into actionable financial targets. Whether you’re a first-time entrepreneur or a seasoned veteran launching a new venture, establishing a detailed budget from day one is critical for making informed decisions, securing funding, and ultimately steering your nascent business towards sustainable growth and profitability.

Why a Startup Budget is Your Business’s North Star

A well-defined startup budget isn’t merely a financial exercise; it’s a strategic imperative. It acts as a compass, guiding your financial decisions, helping you anticipate challenges, and ensuring your resources are allocated efficiently. Many new businesses falter not due to a lack of vision, but due to poor financial management and an underestimation of initial costs.

An effective initial spending blueprint helps mitigate risks by forcing you to confront the realities of your operating environment. It provides a clear picture of how much capital you need to get off the ground, how long that capital will last, and what your break-even point looks like. This foresight is crucial for managing cash flow, avoiding sudden financial surprises, and maintaining the stability necessary for early-stage development. It also serves as a critical document when approaching investors or lenders, demonstrating that you have a well-thought-out plan and a realistic understanding of your financial needs and projections.

Key Elements of a Robust Startup Financial Plan

Creating an effective startup financial plan involves more than just listing anticipated expenses. It requires a systematic approach to identifying all potential costs and revenue streams, categorizing them, and making realistic projections. A comprehensive budget framework will typically break down into several core components, offering a holistic view of your financial landscape.

Your financial management for startups should distinguish between one-time startup costs and recurring operational expenses. One-time costs might include legal fees, initial inventory, or equipment purchases, while recurring costs are items like rent, utilities, and salaries. Understanding this distinction is vital for accurate cash flow planning. Furthermore, categorizing expenses as fixed (e.g., rent) or variable (e.g., marketing spend tied to sales volume) allows for better financial flexibility and scenario planning.

Building Your Initial Spending Blueprint: A Step-by-Step Guide

Crafting your initial spending blueprint doesn’t have to be an overwhelming task. By breaking it down into manageable steps, you can systematically build a comprehensive and realistic budget for your new venture. This process ensures you account for all crucial aspects of your business launch and early operations.

Here’s a practical guide to creating your new business financial plan:

- **Estimate Startup Costs:** Begin by listing all the one-time expenses required to get your business operational. This includes everything from **business registration fees** and permits to initial equipment purchases, leasehold improvements, and website development. Don’t forget professional fees for lawyers or accountants.

- **Project Operating Expenses:** Next, identify all the recurring costs your business will incur on a monthly or quarterly basis. Think about **rent or mortgage payments**, utility bills, insurance premiums, marketing and advertising, salaries, software subscriptions, and raw materials. Be as detailed as possible.

- **Forecast Revenue Streams:** This is often the most challenging part, but it’s essential for a balanced budget. Base your revenue projections on market research, competitor analysis, and realistic sales estimates. Consider different pricing strategies and how quickly you expect to acquire customers. Start conservatively and build from there.

- **Determine Cash Flow Needs:** With estimated expenses and revenues, you can project your cash flow. This tells you how much money you’ll have coming in versus going out each month. This step is crucial for identifying potential cash shortfalls and understanding how much working capital you’ll need to sustain operations until profitability.

- **Allocate Emergency Funds:** Always factor in a contingency fund, ideally 3-6 months of operating expenses. Unexpected costs are inevitable in a startup, and having a buffer can prevent minor setbacks from becoming major crises. This provides a crucial safety net for your early-stage business budget.

- **Review and Refine:** Your first draft will likely not be perfect. Review all your assumptions, seek feedback from mentors or financial advisors, and be prepared to adjust your figures. A budget is a living document, especially for a startup, and continuous refinement is key to its effectiveness.

Customizing Your Financial Planning Tool

While a general Small Business Startup Business Budget Template provides an excellent starting point, its true power lies in its adaptability. No two startups are exactly alike, and your financial planning tool must be tailored to the specific nuances of your industry, business model, and growth strategy. A generic framework might miss critical expense categories unique to your niche or fail to adequately project revenue patterns characteristic of your market.

Consider, for instance, a software-as-a-service (SaaS) startup versus a retail storefront. The SaaS company might have significant initial development costs, ongoing cloud hosting fees, and subscription-based revenue, while the retailer will grapple with inventory management, point-of-sale systems, and foot traffic analysis. Your template for startup finances should be flexible enough to incorporate these distinct elements, allowing you to add or remove categories as needed. Regularly review your industry benchmarks and competitor financial statements (if publicly available) to ensure your estimates are realistic and competitive. This proactive approach ensures your early-stage business budget accurately reflects your unique operational realities.

Ongoing Management and Review

A common mistake among new entrepreneurs is treating their startup budget framework as a one-time setup task. In reality, a budget is a dynamic instrument that requires constant attention and regular review. The initial projections you make are based on assumptions, and as your business evolves, those assumptions will inevitably change. Market conditions shift, customer acquisition costs fluctuate, and unexpected opportunities or challenges arise.

Successful financial management for startups involves a commitment to frequently comparing actual financial performance against your budgeted figures. This ongoing analysis helps you identify discrepancies early, understand the root causes of any variances, and make timely adjustments to your strategy. Perhaps your marketing efforts are more expensive than anticipated, or your sales are exceeding projections. These insights allow you to reallocate resources, revise your spending plan for entrepreneurs, and update your revenue forecasts to maintain a realistic and effective financial roadmap. Schedule monthly or quarterly budget reviews, treating them as non-negotiable strategic meetings for your business.

Frequently Asked Questions

Why is a budget so crucial for a small business startup?

A budget is crucial because it provides a clear financial roadmap, helps you understand your cash flow, identifies potential shortfalls, and allows you to make informed decisions about resource allocation. It’s essential for managing risk, attracting investors, and achieving sustainable growth from day one.

How detailed should my initial startup financial plan be?

Your initial financial plan should be as detailed as possible, breaking down costs into specific categories (e.g., legal, marketing, equipment, salaries, rent, utilities). The more granular your estimates, the more accurate your budget will be, helping you avoid surprises and manage your resources effectively.

What if my actual expenses differ significantly from my budgeted amounts?

It’s common for actual expenses to vary from initial projections, especially in a startup. The key is to regularly review these variances. Identify why the differences occurred, learn from them, and adjust your future budgeting and operational strategies accordingly. This iterative process is a vital part of financial management.

Should I include my personal expenses in my business budget?

Generally, it’s best to keep personal and business finances separate. However, as a startup founder, you’ll need to budget for your own salary or “owner’s draw” within the business expenses to ensure your personal living costs are covered. This helps you understand the total financial demands on your business.

How often should I review and update my startup budget?

For a startup, it’s advisable to review your budget at least monthly, especially in the early stages. As your business matures and becomes more stable, a quarterly review might suffice. Regular reviews ensure your budget remains a relevant and effective tool for financial decision-making.

Establishing a solid financial foundation with a detailed budget is not merely an administrative chore; it’s a strategic investment in your startup’s future. It empowers you with clarity, instills confidence in potential investors, and provides the discipline needed to navigate the unpredictable waters of entrepreneurship. By diligently developing, implementing, and regularly reviewing your budget, you transform uncertainty into informed action.

So, take the time to build this essential strategic financial roadmap. It will serve as your beacon through the challenges and triumphs of launching and growing your small business, ensuring every dollar works towards achieving your entrepreneurial vision. Your commitment to sound financial planning today will undoubtedly pave the way for a more stable and successful tomorrow.