Every small business owner dreams of growth, stability, and the freedom to innovate. Yet, for many, the day-to-day realities of managing finances can feel like navigating a dense fog without a compass. You’re pouring your passion and effort into your venture, but without a clear financial roadmap, even the most promising ideas can get lost in unexpected expenses, fluctuating revenues, and overlooked opportunities.

This is where a robust financial planning tool becomes not just helpful, but essential. It transforms abstract financial data into actionable insights, providing clarity on where your money truly goes and where it can work harder for you. It’s the difference between guessing your financial future and actively shaping it, allowing you to make informed decisions that propel your business forward.

Why a Monthly Budget is Your Business’s North Star

Navigating the dynamic landscape of small business finance requires more than just tracking transactions; it demands a strategic overview. A well-constructed monthly financial plan acts as your strategic command center, offering unparalleled visibility into your company’s fiscal health. It allows you to anticipate challenges, capitalize on opportunities, and maintain control over your financial destiny, rather than simply reacting to events.

Implementing a consistent budgeting framework helps you move from a reactive stance to a proactive one. It empowers you to allocate resources wisely, identify areas for cost reduction, and set realistic revenue targets. Ultimately, this foundational piece of financial management contributes directly to sustainable growth and long-term viability for any small enterprise, regardless of its size or industry.

Key Components of an Effective Small Business Budget

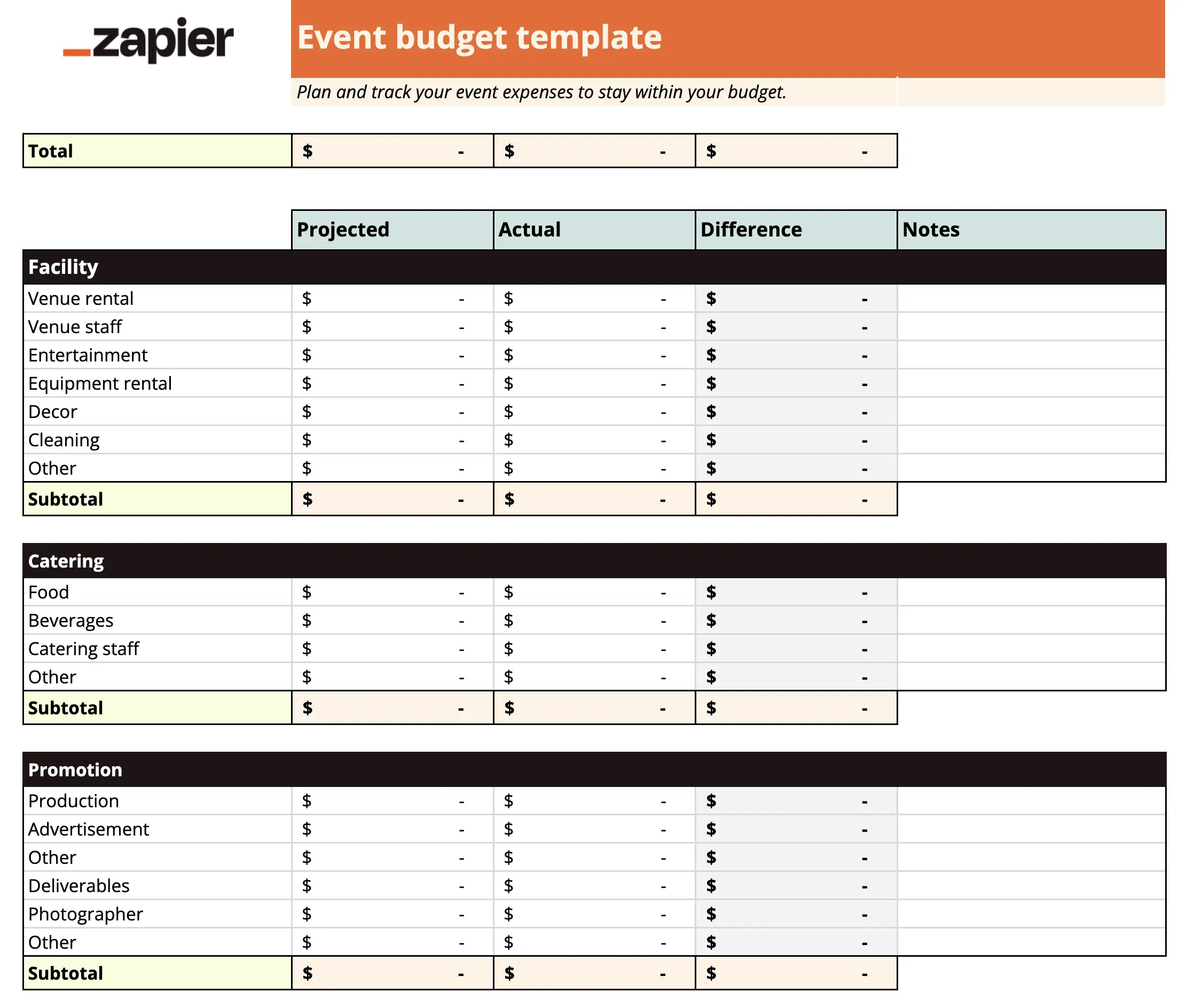

A comprehensive budget for a small business isn’t just a list of numbers; it’s a dynamic tool that reflects the intricate financial ecosystem of your company. Understanding its core elements is crucial for building a document that truly serves your needs. Each section plays a vital role in painting a complete picture of your financial inflows and outflows.

When you sit down to develop your operational budget outline, consider these fundamental categories. They represent the pillars upon which sound financial decisions are made, enabling you to manage cash flow and plan for the future with greater confidence. This structured approach helps ensure no critical financial detail is overlooked.

- Revenue Projections: This is your estimated income from all sources. Be realistic and consider historical data, current sales trends, and any upcoming marketing initiatives. Differentiate between recurring revenue and one-time sales.

- Fixed Operating Expenses: These are costs that typically don’t change month-to-month, regardless of your business activity. Examples include your **rent**, **insurance premiums**, **loan payments**, and **salaries** for permanent staff.

- Variable Operating Expenses: These costs fluctuate based on your business activity or sales volume. Think about your **raw materials**, **shipping costs**, **hourly wages** for part-time staff, **marketing spend** based on campaign needs, and **utilities** that vary with usage.

- One-Time or Seasonal Expenses: Account for costs that occur infrequently or during specific periods, such as **annual software subscriptions**, **holiday marketing campaigns**, **equipment maintenance**, or **tax preparation fees**.

- Cash Flow Management: This section helps you visualize the actual movement of cash in and out of your business. It’s about timing – ensuring you have enough cash on hand to meet obligations, even if revenue is technically higher than expenses for the month.

- Profit and Loss (P&L) Summary: While a budget looks forward, a monthly P&L summary within or alongside it helps track actual performance against your projections. This comparison is vital for identifying discrepancies and making adjustments.

- Contingency Fund/Savings: Always allocate a portion of your budget for unexpected events or future investments. This financial buffer is critical for weathering economic downturns or seizing new opportunities.

Building Your Monthly Financial Blueprint: A Step-by-Step Guide

Creating a practical budgeting framework doesn’t have to be an overwhelming task. By breaking it down into manageable steps, you can construct a powerful financial management resource that serves as a living document for your business. This systematic approach ensures accuracy and usability.

The goal is to develop a clear, easy-to-understand monthly financial plan that you can consistently refer to and update. Starting with a structured methodology will set you up for success, providing a solid foundation for all your fiscal planning needs.

1. Gather Your Financial Data: Before you can build anything, you need your raw materials. Collect bank statements, credit card statements, past income and expense reports, and any outstanding invoices or bills from the last 3-6 months. This historical data provides a realistic baseline for your projections.

2. Project Your Monthly Income: Start by estimating all the money you expect your business to bring in for the coming month. Be realistic, even conservative, especially if your income fluctuates. Break it down by product, service, or client if possible.

3. List All Your Fixed Expenses: Go through your financial records and list every expense that is consistent month after month. Rent, insurance, subscription services, salaries, loan payments – don’t miss a single one. This is usually the easiest part as these numbers are often predictable.

4. Estimate Your Variable Expenses: This step requires more careful estimation. Look at your historical data for things like utilities, supplies, marketing costs, and hourly wages. Consider upcoming projects or changes that might impact these figures. It’s often helpful to take an average of the last few months, adjusting for any known increases or decreases.

5. Account for One-Time and Seasonal Costs: Don’t let annual fees or seasonal spikes catch you off guard. If you have an annual software subscription due in March, divide that cost by 12 and allocate that amount each month, or save for it specifically in the months leading up to it. Plan for holiday inventory boosts or slower summer sales periods.

6. Calculate Your Net Cash Flow: Subtract your total projected expenses (fixed + variable + one-time allocated) from your total projected income. This gives you your estimated net cash flow for the month. A positive number means you expect to have money left over; a negative number indicates a potential shortfall.

7. Allocate for Savings and Contingencies: If your net cash flow is positive, allocate a portion of that surplus to a savings account or a specific contingency fund. Aim for at least 3-6 months of operating expenses in an emergency fund. This vital step safeguards your business against unforeseen challenges.

8. Review and Adjust Regularly: A monthly budget isn’t a static document; it’s a living guide. At the end of each month, compare your actual income and expenses against your budget. Identify where you were accurate and where you diverged. Use these insights to refine your budget for the following month. This iterative process is key to effective financial management.

Customizing Your Budget for Unique Business Needs

While the core components of a small business financial planning tool remain consistent, its application must be tailored to your specific industry, business model, and growth stage. A freelancer’s cash flow projection sheet will look different from a restaurant’s or an e-commerce store’s, primarily in the granularity and categories of their variable expenses and revenue streams.

For instance, a service-based business might focus heavily on client acquisition costs and billable hours, whereas a product-based business will dive deep into inventory management, cost of goods sold, and supply chain expenses. The essence of a good budgeting tool is its adaptability, allowing you to create a personalized financial blueprint for your company.

Consider your industry-specific metrics. A retail business might track average transaction value and foot traffic conversions, while a SaaS company will emphasize recurring revenue and customer churn rates. Integrate these unique performance indicators into your budget review process to gain deeper insights into your financial health. This level of customization ensures your budget isn’t just a generic template but a powerful, personalized instrument for fiscal planning.

Leveraging Your Budget for Growth and Stability

A comprehensive financial management resource does more than just track numbers; it becomes a strategic asset for decision-making. By consistently reviewing your monthly financial plan, you gain clarity on your business’s current standing and its potential trajectory. This insight is invaluable for making informed choices that support both immediate stability and future expansion.

Understanding your expense patterns allows you to identify areas for cost control or efficiency improvements. Spotting trends in revenue helps you refine sales strategies and forecast future income with greater accuracy. This proactive approach to fiscal planning empowers you to allocate capital strategically, whether it’s for investing in new equipment, expanding your team, or launching innovative products and services. An effective budgeting framework is the bedrock of intelligent growth.

Common Pitfalls and How to Avoid Them

Even with the best intentions, small businesses often encounter challenges when implementing and maintaining their operational budget outline. Being aware of these common pitfalls can help you navigate them effectively, ensuring your efforts in fiscal planning are not in vain.

1. Unrealistic Projections: Overestimating revenue or underestimating expenses is a common trap. It leads to frustration and a budget that’s quickly abandoned.

Avoid it: Base your projections on historical data, market research, and a healthy dose of conservatism. It’s better to be pleasantly surprised by extra income than caught off guard by unexpected shortfalls.

2. Lack of Regular Review: Creating a budget once and forgetting about it defeats its purpose. Business conditions change, and your budget needs to reflect those shifts.

Avoid it: Schedule a dedicated time each month (e.g., the first Monday) to review your actuals against your budget. This consistency builds good habits and keeps you informed.

3. Not Accounting for Irregular Expenses: Many small businesses get tripped up by annual subscriptions, quarterly taxes, or seasonal inventory buys that aren’t factored into their monthly tracking business expenses and income.

Avoid it: Create a separate section for these “lumpy” expenses and divide them by 12, setting aside a small amount each month. Or, create a savings goal specifically for them.

4. Over-Complication: Trying to make your initial budget too detailed or complex can be overwhelming and lead to abandonment.

Avoid it: Start simple. Focus on major income and expense categories. You can always add more granularity as you become more comfortable and your business grows. The key is to start and maintain momentum.

5. Treating the Budget as a Restriction, Not a Tool: Viewing your budget as a straitjacket rather than a guide can make it feel punitive and discourage adherence.

Avoid it: Embrace your budget as a strategic tool that gives you financial freedom through clarity and control. It helps you say “yes” to smart investments and “no” to wasteful spending.

Frequently Asked Questions

How often should I update my small business budget?

You should review your budget at least once a month, comparing actual income and expenses against your projections. This monthly check-in allows you to make timely adjustments and keeps your financial planning relevant to your current business operations.

What if my actuals consistently differ from my budget?

Consistent discrepancies indicate that your projections might be unrealistic or that there are underlying operational issues. Use these differences as learning opportunities to refine your forecasting methods, identify areas for cost savings, or adjust your revenue strategies for the future. Don’t be afraid to adjust your budget mid-month if significant changes occur.

Do I need specialized software for my business’s monthly financial plan?

While specialized accounting software can be helpful, especially for complex businesses, it’s not strictly necessary to get started. Many small businesses begin with a simple spreadsheet (like Excel or Google Sheets) or even dedicated small business budgeting apps. The most important thing is consistency and accuracy, not the tool itself.

How does a monthly budget help with tax planning?

A well-maintained budget for a small business provides a clear overview of your income and expenses throughout the year. This makes tax preparation much simpler, as you’ll have organized records of all financial transactions. It also helps you anticipate taxable income and plan for estimated tax payments, preventing year-end surprises.

Can a budget help me secure a loan or investment?

Absolutely. Lenders and investors look for businesses that demonstrate strong financial management and a clear understanding of their fiscal health. A detailed, well-thought-out small business monthly budget template showcasing your financial projections and how you plan to manage cash flow provides concrete evidence of your business acumen and stability, significantly improving your chances of securing funding.

Embracing the discipline of a well-structured budget is one of the most empowering steps a small business owner can take. It moves you from a position of uncertainty to one of confident control, allowing you to see beyond the immediate demands and strategically plan for the future. This essential financial discipline isn’t about restriction; it’s about liberation – freeing you from financial anxieties so you can focus on what you do best: growing your business and pursuing your entrepreneurial vision.

Start today by taking that first step to formalize your financial planning. Whether you choose a simple spreadsheet or a sophisticated software, the act of actively engaging with your money and creating a clear financial blueprint will pay dividends, literally and figuratively. Your business deserves this level of clarity, and you deserve the peace of mind that comes with knowing your financial house is in order.