Living independently offers incredible freedom, but it also means taking full financial responsibility for every expense. Without a partner to share costs or bounce ideas off, managing your money effectively becomes paramount. For many single individuals, the journey to financial stability can feel overwhelming, especially when navigating rent, utilities, groceries, and personal expenses all on one income.

This is precisely where a well-crafted Single Person Budget Template comes into play. It’s more than just a spreadsheet; it’s your personalized roadmap to financial empowerment, designed to help you understand where your money goes, identify areas for savings, and achieve your financial goals. Whether you’re just starting out, navigating career changes, or planning for a robust retirement, having a clear financial framework can transform uncertainty into confidence.

Why a Dedicated Budget Matters for Singles

Many budgeting guides are written with couples or families in mind, often overlooking the unique financial dynamics of living alone. While the core principles of income minus expenses remain universal, single individuals often face a higher per-person cost for housing, utilities, and even groceries compared to households that can split these expenses. A budget tailored for one acknowledges these realities, providing a more accurate reflection of your financial landscape.

A personalized financial plan for singles offers several compelling benefits. It illuminates your spending habits, allowing you to make informed decisions about discretionary expenses. It empowers you to build an emergency fund faster, secure your retirement, and pursue personal aspirations like travel or further education without the added complexity of coordinating with another person’s financial goals. In essence, a Single Person Budget Template can provide the clarity and control you need to shape your financial destiny.

Moreover, without a secondary income to fall back on, the importance of robust savings and an emergency fund is amplified. A dedicated individual budget framework ensures these critical components are prioritized, creating a vital safety net. It’s about taking proactive control of your financial destiny, rather than letting it control you.

Core Components of Your Personalized Financial Plan

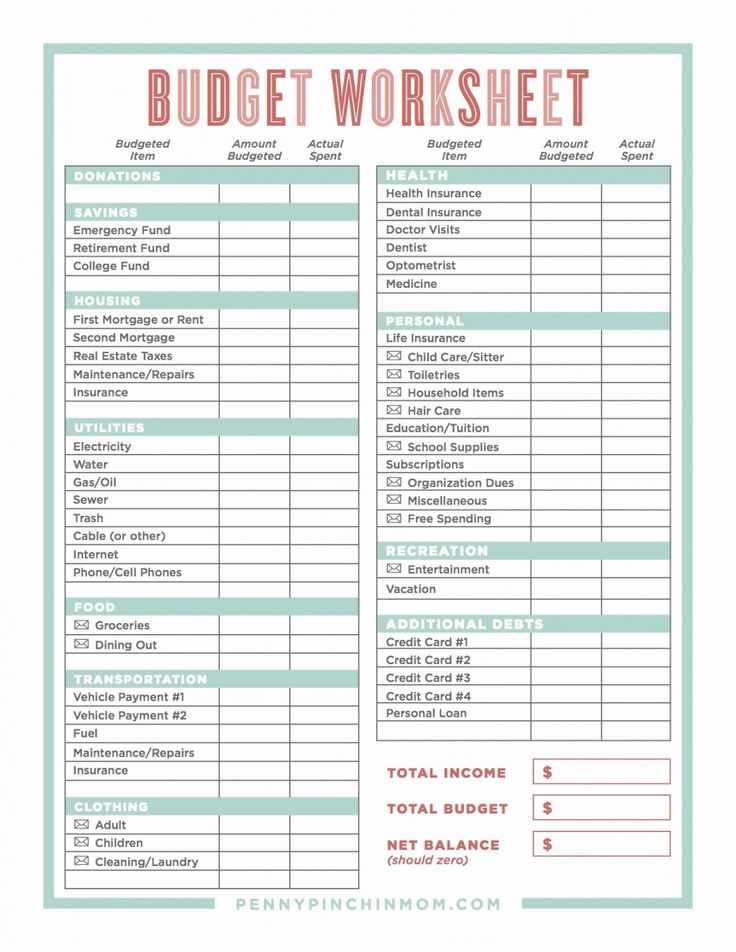

A robust individual budget framework isn’t just about cutting expenses; it’s about intelligent allocation. Understanding the key categories of your income and outflow is the first step toward building a sustainable financial strategy for solo living. Think of these as the fundamental building blocks that will make your personal spending blueprint effective and truly useful.

Your financial roadmap for singles should clearly delineate your gross and net income, ensuring you know exactly how much money you have available after taxes and deductions. On the expense side, categories should be granular enough to provide insights but not so detailed that they become cumbersome. This balance is crucial for maintaining consistency and avoiding budget fatigue, which can derail even the best intentions.

- **Income Sources:** List all your take-home pay from your primary job, side hustle earnings, freelance income, or any other regular influx of cash after taxes and deductions.

- **Fixed Expenses:** These are costs that typically stay the same or are highly predictable each month, such as your **rent or mortgage**, car loan payments, student loan payments, insurance premiums, and recurring subscriptions (Netflix, gym membership).

- **Variable Expenses:** These fluctuate monthly based on your usage and choices. Examples include **groceries**, dining out, transportation (gas, public transit), utilities (which can vary seasonally), and entertainment. These are often the easiest areas to adjust if needed.

- **Savings & Investments:** Crucial categories for your future financial security. This includes contributions to your **emergency fund**, retirement accounts (401k, IRA), and any specific goal-oriented savings (down payment on a house, vacation fund, new car).

- **Debt Repayment:** Beyond minimum payments for loans, this category tracks any extra payments you make to accelerate debt reduction, such as aggressively paying down **credit card debt** or personal loans.

- **Discretionary Spending:** This is often referred to as your “fun money” for hobbies, personal care products, shopping, gifts, and other non-essential items that contribute to your quality of life. While important for well-being, this is usually the first area to trim if you need to find extra cash.

Building Your Budget: A Step-by-Step Approach

Creating an effective budget for one doesn’t have to be intimidating. By following a clear, methodical process, you can transform your financial aspirations into a tangible plan. This step-by-step guide will walk you through the essential actions needed to set up your personal spending blueprint, ensuring it’s both realistic and empowering.

Remember, the goal is not perfection on the first try, but rather progress and understanding. Your initial budget framework for individuals will likely evolve as you gain more insight into your spending habits and financial priorities. Consistency and regular review are far more important than a flawless start, as life is dynamic and your financial plan should be too.

- **Gather Your Financial Data:** Collect all relevant financial documents from the past 1-3 months. This includes bank statements, pay stubs, credit card statements, and utility bills. This provides a clear, data-driven picture of your actual income and expenses.

- **Calculate Your Net Income:** Determine your total take-home pay each month after taxes, 401k contributions, health insurance premiums, and any other deductions. If your income varies, use a conservative average or plan based on your lowest expected monthly income.

- **List All Fixed Expenses:** Methodically write down every expense that is the same or nearly the same each month. This includes rent or mortgage, loan payments, insurance premiums, and recurring monthly subscriptions. These are the non-negotiables that form the base of your budget.

- **Track Your Variable Expenses:** This is often the trickiest part, but it’s crucial for an accurate budget. For at least one month, diligently track *every dollar* you spend in categories like groceries, dining out, gas, clothing, and entertainment. Many budgeting apps or even a simple notebook can simplify this process.

- **Categorize and Total Your Expenses:** Group your tracked spending into logical categories (as outlined above). Sum up both your fixed and variable expenses to get a total monthly outflow. This gives you a clear picture of where your money is currently going.

- **Allocate Funds for Savings & Debt:** Decide how much you can realistically contribute to your emergency fund, retirement accounts, and extra debt repayment *before* considering discretionary spending. This is the “pay yourself first” principle in action, securing your future.

- **Review and Adjust:** Subtract your total expenses (including savings/debt contributions) from your net income. If you have money left over, great! Allocate it towards savings goals or debt. If you’re in the red, identify areas to cut back, usually starting with variable and discretionary spending. This is where you bring your income and outflow into balance.

- **Monitor Regularly:** Your individual budget framework isn’t a one-time setup; it’s an ongoing commitment. Check in weekly or bi-weekly to ensure you’re sticking to your plan, and make minor adjustments as life happens. Quarterly or annual reviews are good for bigger picture adjustments.

Common Challenges and How to Overcome Them

Managing finances alone presents its own unique set of hurdles. The pressure of sole responsibility can sometimes feel isolating, and there’s no one else to share the burden of unexpected costs or financial setbacks. Understanding these challenges is the first step toward developing resilient strategies that empower your financial journey.

One frequent issue for solo financial planning is the temptation to overspend on discretionary items, perhaps as a compensatory mechanism for working hard or a desire to treat oneself. Another common pitfall is underestimating variable expenses or neglecting to factor in periodic large costs like annual subscriptions, car maintenance, holiday gifts, or even a biannual trip to the dentist. Overcoming these requires both discipline and foresight, as well as an honest appraisal of your spending habits.

To tackle these, consider setting up separate “sinking funds” for those irregular large expenses, so the money is already set aside when the bill arrives. Automate savings transfers immediately after payday to “pay yourself first,” removing the temptation to spend it. Find a supportive financial community or a trusted mentor who can offer advice and accountability, helping you stay on track with your solo budgeting tool. Remember, consistency beats intensity when it comes to long-term financial success.

Maximizing Your Money: Advanced Strategies for Solo Savers

Once you’ve mastered the basics of your personal spending blueprint, it’s time to explore strategies that can accelerate your financial growth as a single individual. The beauty of managing money as a single person is the agility you have to make quick, impactful decisions without needing consensus from others, allowing for a more focused approach to wealth building.

Consider the “mini-retirement” concept: saving aggressively for a shorter period to take an extended break, travel, or pursue a passion project. Your single income budget allows for this kind of focused saving, offering flexibility that larger households might find challenging. Look into optimizing your tax situation – contributing to a Roth IRA, for example, can offer tax-free growth in retirement, a significant advantage for long-term wealth building, especially if you anticipate being in a higher tax bracket later in life.

Another powerful strategy is to continuously evaluate and reduce your fixed costs. Can you refinance student loans for a lower interest rate? Shop for better insurance rates for your car or home? Consider a more affordable housing situation if your current one is a major burden on your budget? Even small reductions in fixed expenses can free up significant funds for savings or debt repayment, making your individual budget framework even more robust and capable of achieving your ambitious financial goals.

Frequently Asked Questions

How often should I review my budget for one?

Ideally, you should review your budget at least once a month, typically at the beginning or end of your pay cycle. This allows you to track your spending, make necessary adjustments, and ensure you’re aligned with your financial goals. A quick weekly check-in can also be beneficial for keeping a closer eye on variable expenses like groceries and dining out.

What’s the best tool for creating a solo budgeting tool?

The “best” tool depends largely on your personal preference and comfort level. Many find simple spreadsheets (Excel, Google Sheets) highly effective for their personal financial planning due to their flexibility and customization options. There are also numerous popular budgeting apps like YNAB (You Need A Budget), Mint, or Personal Capital that offer automated tracking, categorization, and goal setting, which can make the process easier and more engaging. Start with what feels most comfortable and least intimidating for you.

How much should a single individual put into an emergency fund?

A good rule of thumb for anyone, including single individuals, is to have 3-6 months’ worth of essential living expenses saved in an easily accessible, high-yield savings account. For solo living, where there’s no secondary income to fall back on, aiming for the higher end (6 months or more) can provide greater peace of mind and security, especially in unpredictable times like job loss or unexpected medical emergencies.

Is it okay to adjust my individual budget framework regularly?

Absolutely! Budgeting is not a rigid, one-time setup; it’s an iterative and dynamic process. Life changes – your income might increase, expenses could shift, or your financial goals might evolve. Regularly adjusting your budget framework for individuals ensures it remains a realistic and effective tool for your current financial situation, adapting as your life circumstances change and grow.

Embracing a dedicated financial strategy for solo living empowers you in ways you might not have imagined. It moves you from a reactive stance to a proactive one, giving you clarity and control over your money. This individual budget framework isn’t about restriction; it’s about freedom – the freedom to make choices that align with your deepest values and aspirations, whether that’s early retirement, extensive travel, or significant charitable giving.

By consistently applying the principles outlined here and leveraging your personal spending blueprint, you’ll build not just a healthy bank account, but also a profound sense of security and accomplishment. The journey to financial mastery as a single individual is a powerful one, full of learning and growth, allowing you to achieve a level of financial independence that many only dream of.

The power to transform your financial future is entirely in your hands. Start today. Take the first step in creating your own unique financial roadmap for singles, and watch as your discipline and foresight lay the foundation for a prosperous and secure tomorrow. With a well-designed budget, you’re set to achieve remarkable things.