Life as a single mother is a testament to strength, resilience, and boundless love. You’re not just a parent; you’re often the sole provider, the chauffeur, the chef, the tutor, and the chief financial officer of your household. Juggling these myriad responsibilities, especially with two children relying on you, can feel like an Olympic sport where the finish line constantly moves. Amidst this beautiful chaos, one area that frequently causes stress, yet offers immense power, is financial management.

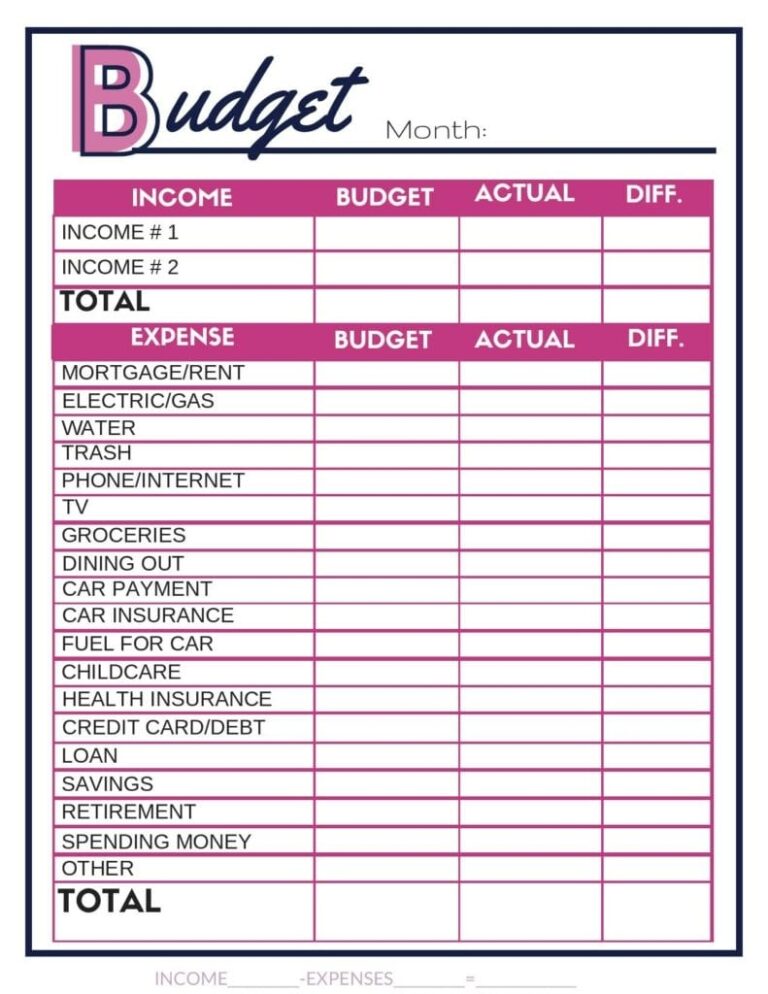

Understanding where every dollar goes and planning for both immediate needs and future aspirations is not just about numbers; it’s about peace of mind, stability, and creating a secure environment for your children. That’s where a structured approach, like utilizing a Single Mom Budget For Two Kids Numbers Template, becomes an invaluable tool. It transforms the overwhelming task of managing family finances into a clear, actionable plan, empowering you to navigate economic challenges with confidence and pave the way for a brighter financial future.

Why a Dedicated Budgeting Tool is Crucial for Single Mothers

The financial landscape for single mothers is often uniquely challenging. You’re typically operating on a single income, which must stretch to cover all household expenses, childcare, education, and unexpected costs, all while trying to build savings. Without a clear financial roadmap, it’s easy to feel like you’re constantly reacting to money issues rather than proactively managing them. This reactive approach can lead to increased stress, missed opportunities for saving, and sometimes, accumulating debt.

A specialized budgeting tool provides the clarity and control you need. It helps you see the full picture of your income and expenditures, identify areas where you can save, and allocate funds intentionally. Beyond just tracking money, it’s a strategic framework that helps you make informed decisions, prioritize needs, and work towards financial goals, ensuring that every dollar you earn is working as hard as you do for your family’s well-being.

Understanding the Core Elements of Your Family’s Financial Plan

Building an effective financial blueprint begins with a comprehensive understanding of your income and expenses. A robust budgeting system allows you to categorize and track every financial transaction, providing invaluable insights into your spending habits and financial health. This level of detail empowers you to make informed adjustments and ensures your resources are aligned with your family’s priorities.

When you’re ready to fill in the numbers, think broadly about all aspects of your financial life. Every dollar coming in and going out needs a place. This comprehensive approach ensures nothing is overlooked and helps create a realistic, sustainable budget that truly reflects your family’s needs and aspirations.

-

Income Sources: List all regular income, including salary, child support, government benefits (like WIC or SNAP), tax credits, or any supplemental income. Be realistic about net income after taxes and deductions.

-

Housing: This is typically your largest expense. Include rent or mortgage payments, property taxes (if applicable), and homeowner’s insurance. Don’t forget utilities like electricity, gas, water, and internet.

-

Childcare & Education: A significant category for single parents. Account for daycare costs, after-school programs, school supplies, uniforms, tutors, and any college savings contributions.

-

Transportation: Car payments, insurance, fuel, maintenance, and public transport fares. Factor in unexpected repairs, which can quickly derail a budget.

-

Food & Groceries: A flexible category that often allows for significant savings. Include groceries, dining out, school lunches, and snacks. Meal planning is key here.

-

Healthcare: Health insurance premiums, co-pays, prescription medications, dental, and vision care. Anticipate potential out-of-pocket medical costs for both you and your children.

-

Debt Repayment: Minimum payments on credit cards, student loans, personal loans, or medical bills. Prioritize high-interest debt for faster payoff.

-

Personal Care & Entertainment: Haircuts, personal hygiene products, gym memberships, family outings, hobbies, and digital subscriptions. These are often the first to be adjusted when funds are tight.

-

Savings & Emergency Fund: Crucial for long-term stability. Aim to contribute regularly to an emergency fund (3-6 months of expenses), retirement, and college funds, even if starting small.

-

Miscellaneous & Buffer: Always include a small buffer for unexpected expenses that don’t fit neatly into other categories. This prevents budget blowouts when surprises arise.

Building Your Personalized Financial Blueprint

A Single Mom Budget For Two Kids Numbers Template isn’t a rigid, one-size-fits-all solution; it’s a framework designed to be customized to your family’s unique circumstances. The power lies in making it your own, reflecting your income, expenses, and financial goals. The first step is to gather all necessary financial documents: pay stubs, bank statements, credit card statements, utility bills, and loan statements for the past few months. This will give you a realistic snapshot of your current financial situation.

Once you have your numbers, begin populating the template. Be honest and thorough about every dollar that comes in and goes out. Track your spending diligently for at least a month, if not two, to capture an accurate average of your variable expenses. Once your template is filled, review it critically. Are there areas where you can cut back? Are you allocating enough to savings? This process is dynamic; your financial blueprint should be a living document, reviewed and adjusted regularly as your life, income, or expenses change.

Smart Strategies for Maximizing Every Dollar

Optimizing your family’s finances involves more than just tracking; it requires smart strategies to make your money go further. As a single mother managing finances with two children, every dollar counts, and implementing thoughtful spending habits can yield significant results.

One of the most impactful strategies is meal planning. By planning your meals for the week, creating a grocery list, and sticking to it, you can drastically reduce impulse buys and food waste. Cooking at home is almost always cheaper and healthier than eating out. Look for sales, use coupons, and consider generic brands for staples. Another area for savings is energy consumption. Simple changes like unplugging electronics, using energy-efficient light bulbs, and adjusting your thermostat can reduce utility bills. Explore your local library for free entertainment and educational resources, and look for community events that offer low-cost family activities. Don’t shy away from second-hand shopping for clothing, toys, and even furniture; often, items are in excellent condition and cost a fraction of retail prices. Finally, consider automating your savings. Even small, regular transfers from your checking to your savings account can build a substantial emergency fund over time, creating a crucial safety net for your family.

Leveraging Resources and Support Systems

Navigating a single parent household budget can be made easier by understanding and utilizing the various resources available. In the United States, several programs and organizations are designed to support families, particularly single-parent households. Exploring these options can significantly lighten your financial load and provide critical assistance.

Government programs like the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, can help ensure your family has nutritious food. Temporary Assistance for Needy Families (TANF) may provide cash assistance for basic needs. Housing assistance programs, such as Section 8 vouchers, can help make housing more affordable. The Women, Infants, and Children (WIC) program offers nutritional support for pregnant women, new mothers, and young children. Furthermore, many states and counties offer childcare subsidies to help single parents afford quality daycare. Don’t overlook tax credits like the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC), which can provide substantial refunds or reduce your tax liability. Local non-profit organizations, community centers, and religious institutions often offer additional support, from financial literacy workshops to free clothing drives and food banks. Researching and applying for these resources is a proactive step toward building a more stable financial foundation for your family.

Frequently Asked Questions

How often should I review my family’s financial plan?

Ideally, you should review your budget monthly, especially in the first few months of implementing it, to ensure accuracy and make necessary adjustments. A more comprehensive review should be conducted quarterly or whenever there are significant life changes, such as a change in income, employment, or major expenses.

What if my income fluctuates?

If your income varies, consider basing your budget on your lowest estimated monthly income. When you earn more, allocate the surplus to savings, debt reduction, or a “buffer” fund for leaner months. This approach helps prevent overspending during high-income periods and builds resilience for low-income periods.

How do I involve my children in the budgeting process?

Age-appropriately, you can involve children by explaining the concept of needs versus wants, letting them help with grocery lists, or having them contribute to saving for a family goal. Older children can understand household bills and the value of money, fostering financial literacy from a young age.

Is it possible to save money on a tight budget?

Absolutely. Even saving small amounts consistently can make a big difference. Start by identifying one or two small areas to cut back on, such as bringing coffee from home instead of buying it, or reducing impulse purchases. Automate small transfers to a savings account as soon as you get paid, making it a non-negotiable “expense.”

Where can I find additional financial guidance?

Many non-profit credit counseling agencies offer free or low-cost financial advice and debt management plans. You can also find reputable resources through government websites (e.g., Consumer Financial Protection Bureau), university extension programs, and local community organizations. Financial literacy workshops are also commonly available.

Embarking on the journey of disciplined financial management as a single mother of two is a powerful act of self-care and love for your children. While the thought of a comprehensive budget might initially seem daunting, remember that it’s a tool designed to simplify, not complicate. It provides clarity, reduces stress, and transforms uncertainty into a clear path forward.

By leveraging a structured approach like the Single Mom Budget For Two Kids Numbers Template, you’re not just tracking expenses; you’re building a foundation of financial literacy and stability that will benefit your family for years to come. Take that first step today, even if it feels small. The empowerment and peace of mind that come with knowing you have a handle on your finances are invaluable, allowing you to focus more on creating joyful memories and less on financial worries.