Embarking on a new business venture, especially with partners, is an exciting journey filled with promise and potential. However, the initial enthusiasm can often overshadow the critical need for clear, foundational agreements that define the roles, responsibilities, and future direction of the company. Without a robust framework in place, even the most promising partnerships can crumble under the weight of unforeseen disagreements, leading to costly legal battles, operational paralysis, and ultimately, business failure.

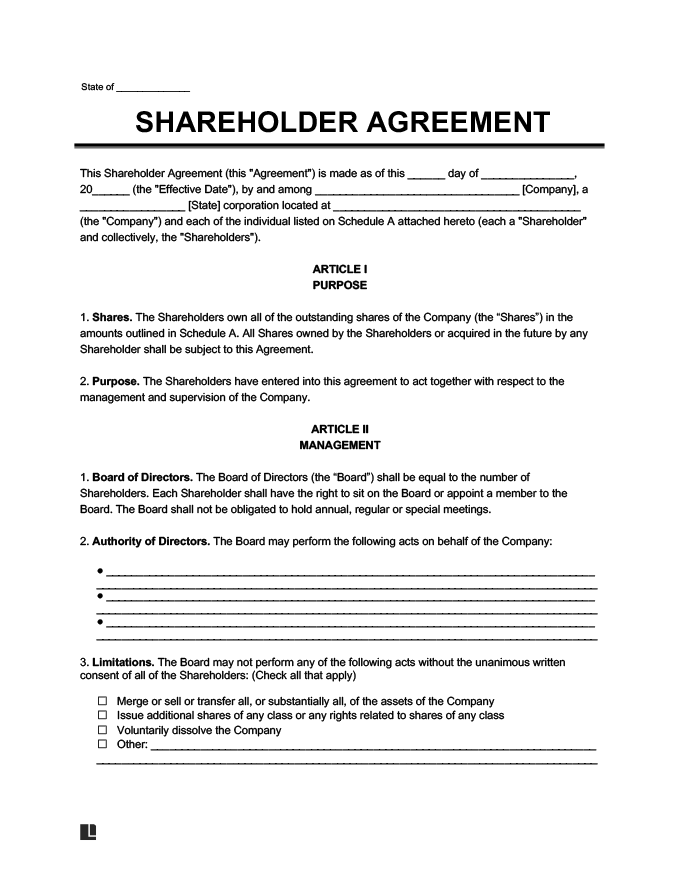

This is where a carefully crafted shareholders agreement becomes indispensable, acting as the corporate constitution that governs the relationship among owners. It clarifies expectations, establishes decision-making processes, and provides a roadmap for handling future eventualities, from disputes to a partner’s departure. For small businesses, where personal relationships often intertwine with professional ones, having such a document isn’t just a best practice; it’s a vital safeguard for both the business’s longevity and the integrity of its founding relationships.

The Indispensable Value of Formalizing Your Partnership

In today’s fast-paced business landscape, ambiguity is a silent killer of promising ventures. While handshake deals might feel appropriate among trusted friends or family, they offer no legal protection when misunderstandings inevitably arise. A formal, written agreement transcends informal understandings by legally codifying the terms of ownership, ensuring all parties are on the same page from the outset.

This proactive approach minimizes the risk of costly disputes down the line, saving significant time, money, and emotional strain. It signals professionalism not only to internal stakeholders but also to potential investors, lenders, and key employees who seek stability and clarity in a company’s governance. Establishing these foundational rules provides a clear operating manual for how the business will function and how its owners will interact, paving the way for sustained growth.

Safeguarding Your Investment and Relationships

A comprehensive shareholders agreement template for small business offers a multitude of benefits, extending far beyond simply documenting ownership percentages. It acts as a protective shield for each shareholder’s investment, providing mechanisms to address scenarios that could otherwise derail the company. By preemptively outlining various contingencies, the agreement ensures that the business can navigate challenges with a predefined course of action.

This critical document safeguards relationships by providing a neutral, agreed-upon framework for conflict resolution, preventing personal grievances from escalating into corporate crises. It fosters an environment of trust and transparency, where every shareholder understands their rights and obligations. Ultimately, a well-defined pact protects the business’s operational continuity and enhances its overall resilience in the face of change.

Adapting the Agreement for Diverse Business Needs

The power of a high-quality shareholders agreement template for small business lies in its adaptability. While it provides a robust structural foundation, it’s designed to be a starting point, not an inflexible dictate. Every small business is unique, with distinct operational models, growth trajectories, and shareholder dynamics. Therefore, the template must be customized to reflect these specific characteristics.

Whether you’re launching a tech startup with angel investors, a family-owned retail store, or a professional services firm, the underlying principles of a shareholders agreement remain constant, but the specific clauses and their nuances will vary. The process of adapting the document often involves thoughtful discussions among shareholders, which itself is a valuable exercise in aligning visions and expectations. This customization ensures that the final document is a living, breathing contract perfectly suited to your venture’s present state and future aspirations.

Core Provisions Every Agreement Must Include

While customization is key, certain fundamental clauses are non-negotiable for any effective shareholders agreement. These provisions form the backbone of the contract, addressing critical aspects of corporate governance, financial contributions, and dispute resolution. Missing any of these essential elements could leave your business vulnerable to significant legal and operational challenges.

- Share Capital and Issuance: Details the types of shares issued, their par value, the number of shares held by each shareholder, and procedures for issuing new shares.

- Voting Rights and Decision Making: Specifies how decisions are made, including majority thresholds for ordinary and special resolutions, and outlines which matters require unanimous consent.

- Board of Directors Composition: Defines the size of the board, how directors are appointed and removed, and their responsibilities.

- Transfer Restrictions (Buy-Sell Provisions): Crucial clauses that dictate how shares can be bought, sold, or transferred. This often includes:

- Right of First Refusal (ROFR): Gives existing shareholders the right to purchase shares from a selling shareholder before they are offered to external parties.

- Tag-Along Rights: Protects minority shareholders by allowing them to sell their shares alongside a majority shareholder in the event of a sale to a third party.

- Drag-Along Rights: Enables a majority shareholder to force minority shareholders to join in the sale of the company to a third party.

- Valuation Mechanisms: Establishes clear methods for valuing shares in various scenarios, such as a shareholder’s departure, death, or disability. This prevents disputes over company worth.

- Deadlock Resolution: Outlines procedures for resolving impasses in decision-making, such as mediation, arbitration, or a "shoot-out" clause.

- Exit Strategies: Addresses what happens when a shareholder wishes to leave the company, including buy-out terms, conditions for forced sales, and triggers for company dissolution.

- Confidentiality and Non-Compete: Protects proprietary information and prevents shareholders from competing with the business while involved or for a specified period after departure.

- Dispute Resolution: Specifies the preferred method for resolving conflicts between shareholders, typically starting with negotiation, then mediation, and finally arbitration or litigation.

- Amendments: Sets out the process for modifying the agreement, typically requiring written consent from a majority or all shareholders.

- Governing Law: Identifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Representations and Warranties: Statements of fact made by each shareholder upon signing, confirming certain conditions (e.g., they own their shares free and clear).

- Capital Contributions and Funding: Details initial and future capital requirements, how additional funding will be raised, and the consequences of failing to contribute.

- Distribution of Profits: Specifies how and when company profits (dividends) will be distributed among shareholders.

Best Practices for Document Formatting and Clarity

Beyond the legal substance, the presentation and readability of your shareholders agreement significantly impact its usability and effectiveness. A poorly formatted or overly convoluted document can lead to misunderstandings, even if its content is legally sound. Ensuring the agreement is clear, concise, and easy to navigate is paramount for all parties involved.

When formatting, prioritize a clean layout with ample white space, legible font choices, and consistent styling throughout. Use clear, descriptive headings and subheadings (e.g., employing an <h3> for sub-clauses within a larger <h2> section) to break down complex information into digestible segments. For print, consider a durable binding; for digital use, ensure it’s easily searchable and accessible across various devices. Moreover, employing plain language wherever possible, while maintaining legal precision, helps prevent misinterpretations. Avoid excessive legal jargon that obscures meaning and instead opt for clarity. Finally, always ensure version control is meticulously managed, so everyone is working from the most current and approved iteration of the contract.

In conclusion, the journey of building a small business is inherently challenging, yet incredibly rewarding. One of the most critical steps in laying a solid foundation for success is establishing clear governance through a well-defined shareholders agreement. Leveraging a robust shareholders agreement template for small business empowers entrepreneurs to anticipate future scenarios, formalize expectations, and mitigate potential conflicts before they arise, transforming what could be sources of friction into opportunities for structured growth.

This proactive approach not only safeguards the financial interests of all parties but also preserves the relationships that are so vital to a small business’s vitality. By investing the time and effort to tailor such a template, you’re not just creating a legal document; you’re crafting a blueprint for stability, trust, and enduring success. It provides the peace of mind necessary to focus on what truly matters: growing your business and achieving your collective vision.