The journey to “I do” is often envisioned as a picturesque path paved with dreams, flowers, and joyous celebrations. While the romance is undeniably central, the practicalities of bringing that dream to life frequently involve navigating a complex landscape of expenses. Without a clear roadmap, what should be an exciting planning phase can quickly devolve into a stressful scramble, overshadowed by financial anxieties. This is precisely where a robust Sample Wedding Budget Spreadsheet Template becomes not just helpful, but absolutely essential for any couple embarking on their wedding planning adventure.

Imagine having a crystal-clear overview of every dollar, every deposit, and every remaining balance, all neatly organized and easily accessible. This isn’t just about saving money; it’s about saving sanity. A well-structured financial planning tool empowers you to make informed decisions, prioritize spending, and ensure that your wedding day perfectly reflects your vision without breaking the bank. It serves as your personal financial compass, guiding you through vendor quotes, payment schedules, and those inevitable last-minute additions, ensuring your special day is memorable for all the right reasons.

Why a Wedding Budget Spreadsheet is Your Best Friend

Planning a wedding is an undertaking with numerous moving parts, and managing the associated costs can feel like a full-time job. A dedicated wedding budget spreadsheet simplifies this intricate process by centralizing all your financial information. It offers unparalleled clarity, transforming abstract figures into concrete, manageable data.

This digital budget assistant helps you establish realistic financial goals from the outset, preventing overspending before it even begins. It provides a comprehensive picture of where your money is going, allowing you to allocate funds strategically across various categories like venue, catering, attire, and entertainment. By having everything laid out, you can easily identify areas where you might be able to save or areas where you might want to splurge a little more.

What Makes an Effective Wedding Budget Spreadsheet

A truly useful budgeting tool for weddings goes beyond a simple list of expenses. It incorporates features that allow for dynamic tracking, comparison, and analysis. Its structure should be intuitive, making it easy for even spreadsheet novices to navigate and utilize effectively. The best templates balance detail with usability, ensuring you capture all necessary information without feeling overwhelmed.

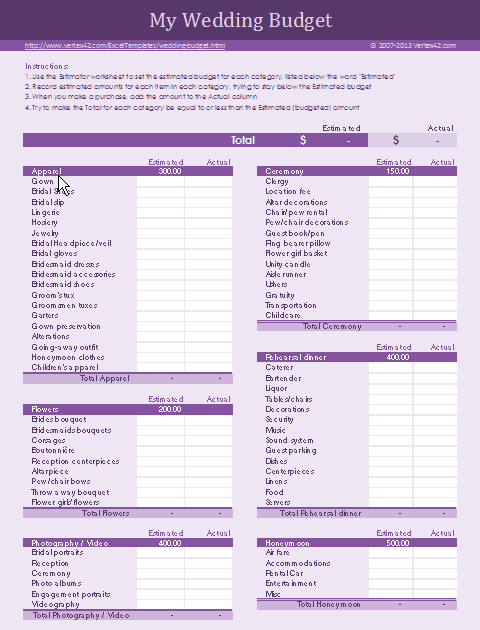

Key components of a robust wedding financial planning tool include:

- **Categorized Expenses:** Break down costs into logical groups such as venue, food & beverage, photography, music, attire, rings, invitations, decor, and transportation.

- **Estimated vs. Actual Costs:** Track initial estimates against the final amounts paid, highlighting any discrepancies. This helps in understanding where your initial projections might have been off.

- **Payment Status:** Clearly mark items as paid, deposit paid, or outstanding. This is crucial for managing cash flow and avoiding late payments.

- **Due Dates:** Include columns for when payments are due, ensuring you never miss a deadline. This prevents additional fees and keeps vendor relationships smooth.

- **Vendor Information:** Keep contact details for each vendor directly associated with their service cost. This streamlines communication and organization.

- **Contingency Fund:** Allocate a portion of your overall budget (typically 5-10%) for unexpected expenses or last-minute changes. This is a vital buffer.

- **Total Overview:** A summary section that automatically calculates totals for estimated costs, actual costs, amount remaining, and overall budget health.

This detailed approach to expense management for your big day ensures every financial aspect is accounted for.

Getting Started with Your Wedding Budget Tool

Launching your wedding financial planning journey with a spreadsheet is straightforward. The first step is to establish your overall budget – the maximum amount you are comfortable spending. Be realistic and discuss this openly with your partner, and any contributing family members. This anchor figure will guide all subsequent decisions and allocations within your wedding cost tracker.

Once your overall budget is set, begin populating the spreadsheet with estimated costs for each category. Research is your best friend here; look up average costs for venues, caterers, photographers, and other key vendors in your area. Don’t worry about being perfectly accurate at this stage; these are initial estimates that will be refined as you gather actual quotes. The goal is to get a preliminary financial overview for your wedding, providing a starting point for your planning.

Customizing Your Financial Planning Tool

While a Sample Wedding Budget Spreadsheet Template provides an excellent framework, true effectiveness comes from customizing it to fit your unique wedding. Every couple’s vision is different, meaning certain categories might be more important to you than others, or you might have unique expenses. Don’t hesitate to adapt the provided structure to mirror your specific needs and priorities.

Perhaps you’re planning a destination wedding, which will necessitate categories for travel and accommodation for guests, or you’re DIYing much of your decor, requiring specific lines for material costs. Conversely, if you’re eloping, many traditional categories might be irrelevant and can be removed. Add new rows for custom expenses or delete categories that don’t apply. You can also adjust the weighting of categories to reflect your priorities – if photography is paramount, allocate a larger percentage of your funds there and reduce spending elsewhere. This personalization transforms a generic template into your perfect planning tool for wedding expenses.

Tips for Mastering Your Wedding Spending Plan

Simply having a spreadsheet isn’t enough; you need to actively use and maintain it. Consistency is key to the success of any wedding budget organizer.

**Regular Reviews:** Make it a habit to review and update your cost management sheet regularly, at least once a week. This ensures all figures are current and helps you quickly identify if you’re veering off track.

**Communicate with Vendors:** Always get quotes and contracts in writing, and double-check all invoices against your spreadsheet. Transparency with vendors about your budget can sometimes lead to creative solutions.

**Be Flexible:** While the spreadsheet provides structure, wedding planning often involves unexpected twists. Be prepared to adjust your allocations. If one area costs more than anticipated, look for savings in another.

**Involve Your Partner:** Both partners should be actively involved in managing the wedding expense tracking. This fosters teamwork, shared responsibility, and ensures both are aware of the financial situation.

**Don’t Forget the Small Stuff:** Postage for invitations, tips for vendors, beauty treatments, and thank-you gifts can add up quickly. Ensure these smaller, often overlooked expenses are included in your digital budget assistant.

By following these tips, your spreadsheet for wedding costs will remain a powerful and accurate guide throughout your planning process.

Frequently Asked Questions

Why can’t I just use a notebook for my wedding budget?

While a notebook offers a basic way to list expenses, a digital spreadsheet provides significant advantages. It allows for automatic calculations, easy adjustments, the ability to sort and filter data, and immediate visualization of your budget’s health. You can also easily share and collaborate on a spreadsheet with your partner or planner, something a physical notebook can’t offer.

When should I start using a wedding budget spreadsheet?

You should start using your wedding budget spreadsheet as soon as you begin discussing your wedding, ideally before you book any vendors. Establishing your overall budget and initial estimates early on will guide all your subsequent decisions and prevent overspending from the very beginning.

How often should I update my wedding cost tracker?

It’s best practice to update your wedding cost tracker at least once a week, or immediately after any major financial transaction, such as paying a deposit or receiving a new quote. Consistent updates ensure your financial overview for your wedding remains accurate and relevant.

What if I find myself consistently going over budget in certain categories?

If you’re consistently exceeding your budget in particular areas, it’s a sign to reassess your priorities. Look for opportunities to cut back in less critical areas, or consider adjusting your overall budget if feasible. This is where the estimated vs. actual columns in your financial template for nuptials become invaluable, helping you identify spending patterns.

Can I share my wedding budget organizer with my wedding planner or family?

Absolutely! Most digital spreadsheet platforms (like Google Sheets or Microsoft Excel) allow for easy sharing and collaborative editing. This ensures everyone involved in the financial aspect of your wedding planning is on the same page, promoting transparency and efficiency.

Ultimately, a wedding is a celebration of love, commitment, and the start of a beautiful new chapter. By leveraging a robust financial planning tool, you’re not just managing money; you’re investing in peace of mind. You’re giving yourselves the freedom to focus on the joy, the romance, and the countless small moments that will make your wedding day uniquely yours, free from the shadow of financial stress.

So, take the reins of your wedding finances with confidence. Embrace the clarity and control that a well-maintained budget spreadsheet offers. It’s an invaluable asset that will empower you to create the wedding of your dreams, ensuring that the only surprises on your big day are delightful ones.