Understanding Shareholder Certificates

A shareholder certificate is essentially your official proof of ownership in a company. It’s a fancy piece of paper (or digital document these days) that states how many shares of the company you own. Think of it like a deed for your house, but instead of land, you own a piece of a business.

Why are Shareholder Certificates Important?

Proof of Ownership: This is the big one. Without a certificate, it’s tough to prove you actually own those shares. This is crucial if you ever want to sell your shares, transfer them, or even vote in company matters.

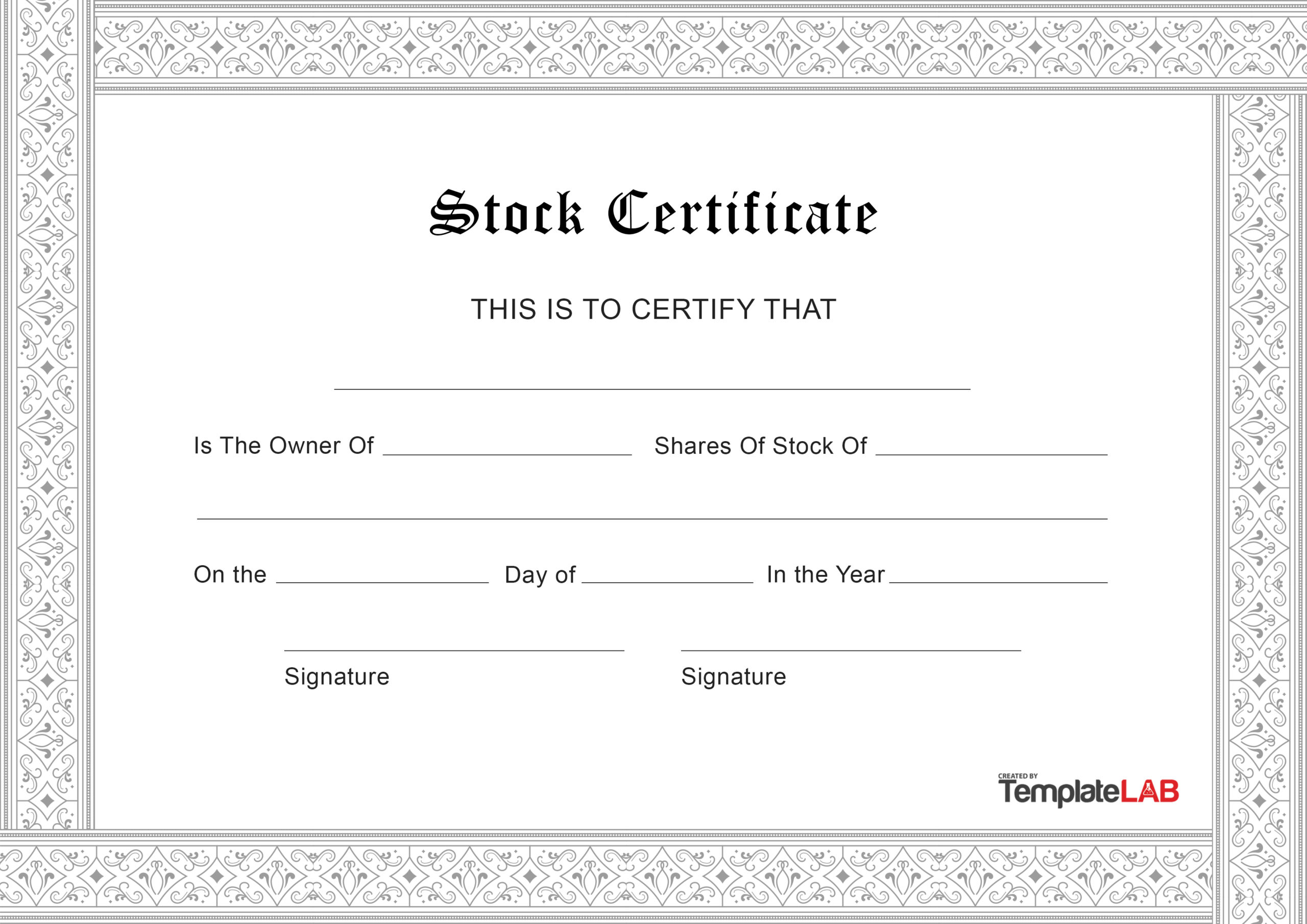

What Does a Typical Shareholder Certificate Look Like?

Image Source: templatelab.com

While the exact format can vary, most certificates include the following information:

Company Name: The name of the corporation issuing the shares.

Where to Find Shareholder Certificate Samples

Online Resources: A quick search on Google Images will yield numerous examples of shareholder certificates.

Tips for Creating Your Own Shareholder Certificate

If you’re starting a company and need to create your own shareholder certificates, here are a few tips:

Keep it Simple: Avoid overly complex designs. A clean and professional look is best.

Digital Shareholder Certificates

In today’s digital age, many companies are moving towards digital shareholder certificates. These electronic certificates offer several advantages:

Increased Security: Digital certificates are more difficult to counterfeit and easier to track.

Conclusion

Shareholder certificates are essential documents for any company with shareholders. They provide proof of ownership, outline shareholder rights, and serve as a valuable record of investment. Whether you’re a shareholder or a company founder, understanding the importance and purpose of shareholder certificates is crucial.

FAQs

What happens if I lose my shareholder certificate?

If you lose your physical certificate, you can usually request a replacement from the company. The process may vary depending on the company’s policies.

Can I sell my shares without a shareholder certificate?

While it may be more challenging, you can typically still sell your shares without the physical certificate. You will need to provide proof of ownership through other means, such as electronic records or a letter from the company registrar.

Do I need to pay taxes on my shareholder certificates?

You generally don’t pay taxes on the certificates themselves. However, you may be liable for capital gains taxes if you sell your shares for a profit.

What are the different types of shareholder certificates?

There are various types of shares, such as common stock, preferred stock, and class A or class B shares. Each type may have different voting rights, dividend payouts, and other rights associated with it.

Can I transfer my shareholder certificate to someone else?

Yes, you can typically transfer your shares to another person. The process may involve filling out a stock transfer form and following the company’s procedures for transferring ownership.

I hope this article provides a helpful overview of shareholder certificates!

Shareholder Certificate Sample