Embarking on the entrepreneurial journey is often characterized by innovation, passion, and a whirlwind of activity. Amidst the excitement of launching a new venture, the foundational legal documents often get less attention than they deserve, yet they are crucial for long-term stability. A shareholder agreement stands as one of the most vital of these documents, serving as the definitive blueprint for how a company’s owners will interact, make decisions, and manage their equity stakes.

For founders, investors, and legal professionals navigating the dynamic startup ecosystem, understanding and implementing a robust shareholder agreement is not merely a formality—it’s an absolute necessity. This comprehensive document clarifies rights, responsibilities, and protective measures for all parties involved, mitigating potential conflicts down the line. Leveraging a sample shareholder agreement for startup provides an invaluable starting point, offering a structured framework that can be adapted to the specific nuances of any emerging business.

The Cornerstone of Startup Governance

In today’s fast-paced business environment, where partnerships and capital infusions are commonplace, the clarity provided by a written agreement is more important than ever. Startups, in particular, face unique challenges, from rapid growth and fluctuating valuations to the entry and exit of key personnel. Without a meticulously drafted agreement, disputes can escalate quickly, threatening the company’s very existence.

A formally documented shareholder agreement preempts misunderstandings by setting out clear terms and conditions. It outlines how shares can be bought, sold, or transferred, defines voting rights, and establishes procedures for conflict resolution. This foresight ensures that the company’s focus remains on innovation and growth, rather than getting entangled in costly legal battles that could otherwise be avoided.

Safeguarding Your Equity and Vision

Utilizing a well-structured sample shareholder agreement offers a multitude of benefits and robust protections for all stakeholders. It creates a predictable framework for governance, ensuring that decision-making processes are transparent and fair. This clarity is especially appealing to potential investors, who seek assurance that their capital will be managed within a stable and legally sound structure.

The protections extend to individual shareholders, particularly founders, by safeguarding their equity against dilution or forced buyouts under unfavorable conditions. It also includes provisions that protect minority shareholders, ensuring their voices are heard and their interests considered. By establishing rules upfront, the agreement helps preserve the original vision and mission of the startup, even as its ownership structure evolves. This proactive approach cultivates trust and fosters a more collaborative environment among all parties, setting the stage for sustainable success.

Tailoring the Framework for Your Unique Enterprise

While a sample shareholder agreement for startup provides a solid foundation, its true value lies in its adaptability. Every startup has its own unique structure, industry, growth trajectory, and investor base, necessitating specific modifications to a generic template. The beauty of starting with a comprehensive sample is that it allows you to identify critical areas that need customization without reinventing the wheel.

Whether your startup is in fintech, biotech, SaaS, or a consumer-facing market, the core principles remain, but the specific application of clauses might differ significantly. For instance, a tech startup with multiple rounds of venture capital funding will require more intricate provisions regarding share classes and liquidation preferences than a bootstrapped lifestyle business. The template serves as a checklist, guiding you through the considerations needed to align the legal document perfectly with your operational realities and strategic goals.

Anatomy of a Robust Agreement: Key Provisions

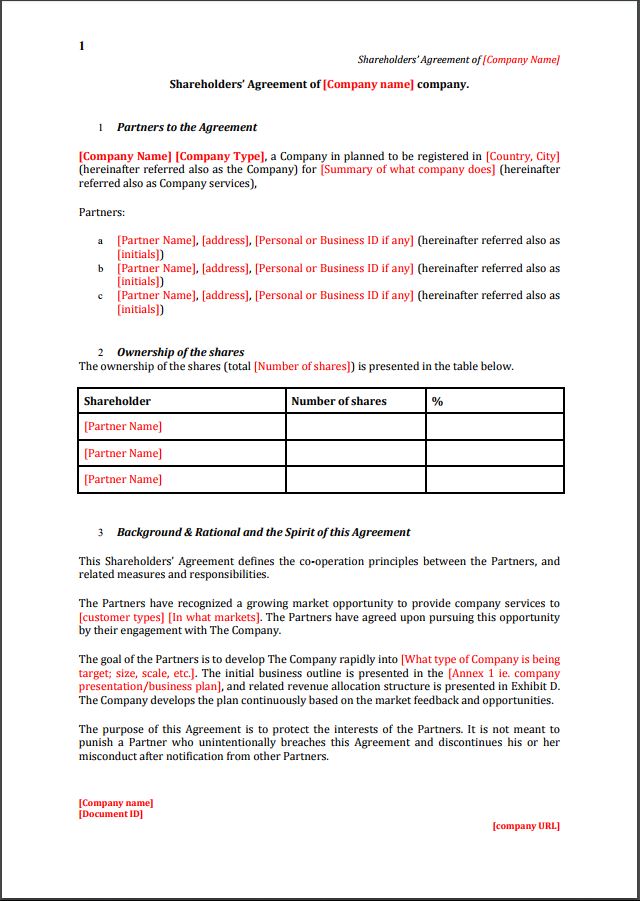

An effective shareholder agreement is comprehensive, covering all foreseeable scenarios regarding ownership and company governance. While the exact wording and depth will vary, certain essential clauses form the backbone of nearly every such document. These provisions ensure clarity, protect interests, and provide a roadmap for managing the company’s equity structure.

- Share Capital and Issuance: This section details the types and classes of shares, their nominal value, and the authorized number of shares. It specifies the conditions under which new shares can be issued, including pre-emptive rights for existing shareholders to maintain their proportional ownership.

- Share Transfer Restrictions: To prevent unwanted third parties from acquiring shares and to maintain control, these clauses restrict the ability of shareholders to freely sell or transfer their shares. Common restrictions include a right of first refusal for the company or other shareholders, and sometimes lock-up periods.

- Voting Rights and Decision-Making: This outlines how shareholder votes are conducted, what matters require shareholder approval (and at what threshold—simple majority, supermajority), and how board members are elected. It clarifies the balance of power among different shareholder groups.

- Drag-Along and Tag-Along Rights: Drag-along rights protect majority shareholders by allowing them to force minority shareholders to sell their shares if a third-party offer for the entire company is received. Tag-along rights (or co-sale rights) protect minority shareholders by allowing them to join in on a sale of shares by a majority shareholder, ensuring they receive the same terms.

- Valuation Methodology: This clause establishes a clear and agreed-upon method for valuing shares in specific events, such as a shareholder’s exit, death, or disability. This pre-agreed formula helps prevent disputes during critical transitions.

- Deadlock Resolution: In cases where shareholders are equally divided and cannot reach a decision, a deadlock resolution clause provides a structured mechanism to break the stalemate, such as mediation, arbitration, or even a buy-sell arrangement.

- Confidentiality and Non-Compete: These provisions protect the company’s proprietary information and prevent shareholders (especially founders or key employees) from competing with the business for a specified period after their departure.

- Dispute Resolution: This outlines the process for resolving conflicts among shareholders, often starting with negotiation, escalating to mediation, and finally, if necessary, binding arbitration or litigation. Clearly defined steps can save significant time and legal costs.

- Liquidation Preferences: Particularly relevant for venture-backed startups, these clauses specify which shareholders get paid first, and how much, in the event of a company sale or liquidation. This often gives preferred shareholders a multiple of their investment back before common shareholders receive anything.

Enhancing Document Utility and Clarity

Beyond the legal substance, the practical presentation and formatting of your shareholder agreement significantly impact its usability and readability. A well-formatted document is not only easier to comprehend but also projects professionalism and attention to detail, which can instill greater confidence in all parties. Whether for print or digital distribution, consider these practical tips.

Employ clear, concise language, avoiding overly dense legal jargon where possible, or providing definitions for complex terms. Use consistent headings and subheadings to create a logical flow and allow readers to quickly navigate to relevant sections. Ample white space, readable font sizes, and well-structured paragraphs enhance visual appeal and reduce cognitive load. For digital use, ensure the document is easily searchable and accessible across various devices, perhaps by providing a table of contents with internal links. These small details collectively contribute to a more user-friendly and effective legal instrument.

By thoughtfully designing the layout and presentation, you transform a complex legal text into an accessible and practical tool for ongoing governance. This commitment to clarity reflects a wider organizational dedication to transparency and good management practices, traits highly valued by partners and investors alike.

In the intricate world of startup development, anticipating challenges and laying robust legal groundwork is paramount. A meticulously prepared shareholder agreement serves as a fundamental pillar, providing clarity, protecting interests, and fostering a stable environment for growth. Leveraging a strong sample shareholder agreement for startup empowers founders and investors to focus on innovation, secure in the knowledge that their collective vision is safeguarded by a comprehensive legal framework.

By carefully customizing the template to fit your specific enterprise, addressing all pivotal provisions, and ensuring the document is user-friendly, you establish a solid foundation for enduring success. This professional, time-saving solution not only streamlines the legal process but also instills confidence among all stakeholders, setting your startup on a clear path towards achieving its full potential.