Securing grant funding is often a pivotal moment for non-profits, educational institutions, research teams, and community organizations across the United States. It’s the fuel that transforms innovative ideas into tangible impact, allowing vital projects to move from concept to execution. While compelling narratives and clear objectives are undoubtedly crucial, one element often determines the success or failure of a grant application long before the project even begins: the budget.

A meticulously crafted budget isn’t just a numerical spreadsheet; it’s a strategic roadmap that demonstrates financial foresight, fiscal responsibility, and a deep understanding of your project’s operational needs. It assures potential funders that their investment will be managed efficiently and effectively, directly contributing to the stated goals. For many, developing this comprehensive financial plan can feel daunting, a complex maze of direct costs, indirect costs, and in-kind contributions. This is where a structured approach, often guided by a reliable budget template, becomes an invaluable asset.

Why a Robust Budget is Your Grant Proposal’s Backbone

Think of your grant budget as the financial narrative of your project, complementing the programmatic narrative you’ve already so carefully constructed. It’s the quantitative evidence that supports your qualitative claims, illustrating precisely how every dollar requested will be put to work. A well-presented financial outline doesn’t just list numbers; it tells a story of careful planning, resource allocation, and a clear path to achieving your objectives.

Funders scrutinize budgets with an eagle eye, not just to identify potential inefficiencies but also to gauge the applicant’s professionalism and attention to detail. An unclear or poorly justified budget can raise red flags, signaling a lack of preparedness or an underestimation of project costs, even if the project idea itself is brilliant. Conversely, a transparent, detailed, and realistic financial proposal builds trust, demonstrating that you’ve done your homework and understand the true cost of bringing your vision to life.

Decoding the Essential Components of a Comprehensive Grant Budget

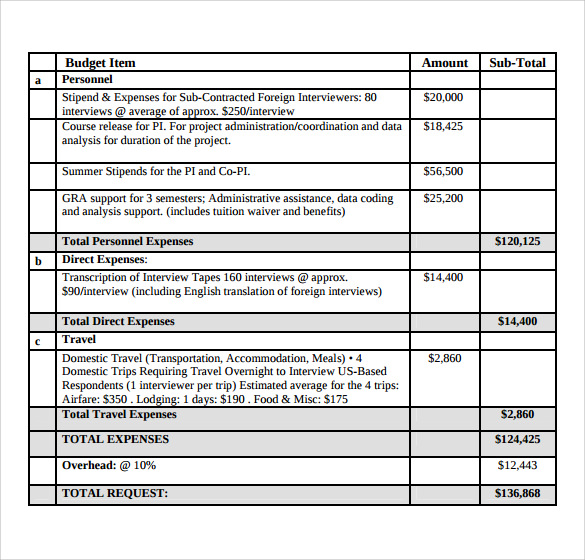

A high-quality financial plan for grants typically breaks down all anticipated expenses into logical, justifiable categories. This level of detail allows both the applicant and the funder to clearly see where resources will be allocated. Understanding these core components is the first step toward effectively utilizing any budget planning tool.

Here are the key elements typically found in a robust grant budget template:

- **Personnel Costs:** This covers salaries, wages, and fringe benefits for staff directly involved in the project. Be sure to specify FTE (Full-Time Equivalent) percentages for each role.

- **Fringe Benefits:** Includes employer-paid benefits like health insurance, retirement contributions, FICA, and unemployment insurance. These are often calculated as a percentage of salaries.

- **Consultant & Professional Services:** Funds allocated for external experts, contractors, or specialized services not performed by your organization’s direct staff.

- **Travel:** Expenses related to project-specific travel, including mileage, airfare, accommodation, and per diem for staff or beneficiaries.

- **Equipment:** Costs for new or leased equipment essential for the project, such as computers, specialized machinery, or software licenses.

- **Supplies:** Consumable materials directly used in the project, like office supplies, educational materials, lab reagents, or program specific supplies.

- **Other Direct Costs:** A catch-all for any direct expenses not fitting into other categories, such as printing, postage, communication costs, or specific event expenses.

- **Subawards/Subcontracts:** Funds passed through to partner organizations or institutions for specific portions of the project.

- **Indirect Costs (F&A – Facilities & Administrative):** Also known as overhead, these are costs not directly tied to a specific project activity but necessary for the organization’s operation (e.g., administrative salaries, utilities, rent). These are often calculated as a percentage of direct costs, based on a federally negotiated rate or a de minimis rate.

- **Program Income:** Any revenue generated directly from the project activities (e.g., fees for services, product sales).

- **In-Kind Contributions:** Non-cash contributions, such as donated volunteer time, donated space, or donated materials. While not part of the requested funds, they demonstrate community support and increase the project’s overall value.

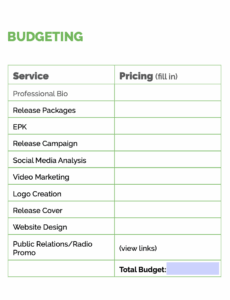

Practical Steps to Utilizing Your Budget Template

When you’re ready to put a Sample Grant Proposal Budget Template to use, the process involves more than just plugging in numbers. It requires thoughtful planning and realistic projections. This structured financial plan should be developed in tandem with your project work plan, ensuring every activity has an associated cost.

Start by clearly defining your project activities and deliverables. For each activity, identify the resources needed: who will do the work (personnel), what materials are required (supplies, equipment), and if any external expertise is necessary (consultants). Once you have a comprehensive list of needs, you can begin to assign realistic costs to each item. Research current market rates for salaries, supplies, and services to ensure your projections are accurate and defensible. Remember that some expenses, like salaries, will include fringe benefits, so factor those in.

It’s also crucial to distinguish between direct costs—those directly attributable to the project—and indirect costs, which support the overall functioning of your organization. Understanding how to correctly categorize these can significantly impact your funding request and how it’s perceived by reviewers. A well-designed budget proposal template will guide you through these distinctions, ensuring all costs are appropriately classified and justified.

Customizing Your Budget for Specific Grant Opportunities

No two grant opportunities are exactly alike, and neither should be your budget. While a general grant budget template provides an excellent starting point, successful applicants always tailor their financial plans to align perfectly with the specific requirements and priorities of each funder. This often means adjusting categories, providing different levels of detail, or highlighting certain cost centers.

Review the Request for Proposals (RFP) or funding guidelines meticulously. Pay close attention to:

- **Allowable vs. Unallowable Costs:** Some funders explicitly state what they will and will not cover.

- **Format Requirements:** Specific tables, categories, or justifications might be mandated.

- **Cost Share/Matching Requirements:** If matching funds are required, clearly show how your organization will meet this obligation, whether through cash or in-kind contributions.

- **Specific Reporting Periods:** Ensure your budget aligns with the funder’s grant period, not just your fiscal year.

Customization doesn’t just involve compliance; it’s also about strategic alignment. If a funder prioritizes community engagement, ensure your budget clearly reflects significant investment in outreach, event coordination, or volunteer support. If they value sustainable outcomes, show how resources are allocated to capacity building or long-term operational planning. This strategic customization demonstrates not only your attention to detail but also your understanding of the funder’s mission.

Avoiding Common Budgetary Pitfalls

Even with a solid project budget outline, missteps can occur. Being aware of common pitfalls can save you significant time and increase your proposal’s chances of success. One frequent error is underestimating costs. It’s better to slightly overestimate and re-negotiate down than to run out of funds mid-project. Always factor in potential inflation or unexpected expenses.

Another common mistake is providing insufficient justification for expenses. Every line item in your financial plan needs a clear, concise rationale explaining why it’s necessary for the project and how the cost was derived. "Miscellaneous" or "Other" categories should be minimized and, if used, thoroughly explained. Vague categories signal a lack of detailed planning.

Finally, ensure consistency between your narrative and your budget. If your narrative emphasizes a new technology, but the project budget outline doesn’t show any allocation for purchasing or leasing that technology, it creates a disconnect that undermines credibility. The financial details must directly support and reflect the activities described in your proposal’s programmatic sections.

Frequently Asked Questions

Do I need a separate budget for each grant application?

Yes, absolutely. While a master budget for your entire project can be helpful for internal planning, each grant application requires a budget specifically tailored to the funder’s guidelines, allowable costs, and the scope of work they are interested in supporting. Using a flexible grant budget template allows for easy adaptation.

What’s the difference between direct and indirect costs?

Direct costs are expenses directly attributable to your project (e.g., project staff salaries, supplies, equipment directly used). Indirect costs, also known as overhead or Facilities & Administrative (F&A) costs, are general operating expenses necessary for your organization to function but not easily tied to a specific project (e.g., rent, utilities, administrative salaries). Funders often have specific rules on how indirect costs can be calculated and recovered.

How do I justify personnel costs effectively?

For each personnel position, clearly state the role, the specific tasks they will perform for the project, their annual salary, and the percentage of their time (FTE) dedicated to the grant. Include a breakdown of fringe benefits as a separate line item. Justification should link their expertise directly to project objectives.

Should I include in-kind contributions in my budget request?

In-kind contributions (donated services, materials, space) are typically not part of the cash funds you are requesting. However, they are often crucial to include in a separate section of your budget or as an addendum to demonstrate your organization’s commitment and community support. Many funders see these contributions as a valuable indicator of project sustainability and shared investment.

What if my actual project costs change after the grant is awarded?

It’s common for project costs to shift slightly. Most funders have specific procedures for budget modifications or reallocations. You typically need to formally request approval from the funder for significant changes. Always refer to your grant agreement and communicate proactively with your grant officer to ensure compliance.

A carefully developed and thoroughly justified budget is more than just a requirement; it’s a powerful tool that enhances your grant proposal’s overall strength and credibility. It demonstrates your organization’s commitment to financial stewardship and its capacity to deliver on its promises. By investing time and effort into this critical component, you not only improve your chances of securing funding but also lay a solid foundation for successful project implementation.

Embracing a systematic approach to budget creation, guided by the principles outlined here, will empower your organization to present its financial needs with clarity and confidence. The journey from an innovative idea to a funded project is intricate, but with a robust financial plan at its core, your path to making a significant impact becomes considerably clearer and more attainable.