Embarking on an entrepreneurial journey, especially when structuring your business as an S Corporation, brings with it a unique blend of excitement and complexity. While the allure of pass-through taxation and limited liability is clear, the long-term success and harmony among shareholders often hinge on a single, critical document: the shareholder agreement. Having a well-drafted s corp shareholder agreement template is not just a best practice; it’s a proactive measure designed to safeguard your business, define relationships, and prevent future disputes from derailing your vision.

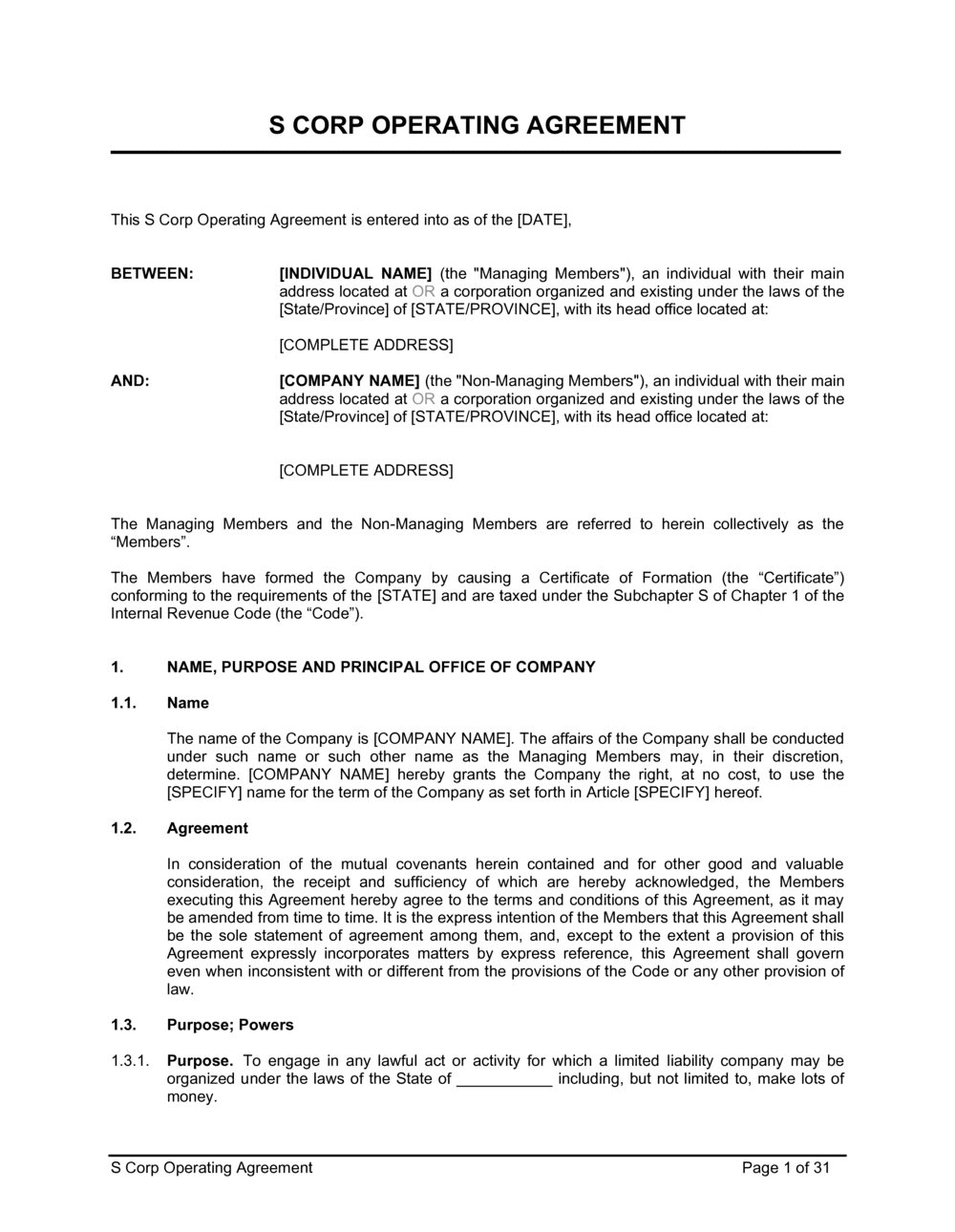

For any business owner, legal professional, or entrepreneur navigating the intricacies of corporate governance, understanding the profound value of this agreement is paramount. An s corp shareholder agreement template serves as the foundational legal document that clarifies the rights, responsibilities, and restrictions of each shareholder, ensuring that all parties are aligned on operational procedures, financial expectations, and potential exit strategies. It’s an indispensable tool for maintaining stability, especially in scenarios involving multiple owners or family businesses, providing a clear roadmap for handling unforeseen circumstances and fostering a cohesive corporate environment.

Why a Robust Corporate Agreement is Indispensable Today

In today’s fast-paced business landscape, ambiguity can be a silent killer. Without clear, written terms governing the relationship between shareholders, even minor disagreements can escalate into costly legal battles, eroding trust and diverting valuable resources away from core business objectives. A robust corporate agreement provides the necessary framework to navigate these challenges proactively, establishing a clear line of communication and a defined resolution path.

For S Corporations specifically, the importance of such an agreement is amplified by stringent IRS regulations. Maintaining S Corp status requires adherence to specific rules regarding shareholder eligibility and share classes, and a well-drafted agreement ensures legal compliance, protecting the entity from inadvertent disqualification. This level of clarity fosters confidence among all parties, allowing them to focus on growth and innovation rather than potential internal conflicts or regulatory headaches. It effectively mitigates risk by anticipating common points of contention and providing an agreed-upon mechanism for their resolution.

Unlocking Key Advantages with a Comprehensive Document

The immediate benefit of leveraging an s corp shareholder agreement template is the unparalleled level of protection it offers to all stakeholders. This contract acts as a preventive shield, addressing potential conflicts before they arise by clearly delineating ownership percentages, voting rights, and the allocation of profits and losses. It removes ambiguity regarding shareholder obligations and ensures equitable treatment, laying the groundwork for a harmonious working relationship.

Beyond basic definitions, a comprehensive agreement provides vital mechanisms for navigating complex scenarios. It establishes protocols for selling shares, including crucial right-of-first-refusal clauses that prevent undesirable third parties from acquiring ownership. Furthermore, it outlines specific buy-sell provisions, which dictate how shares will be handled upon a shareholder’s death, disability, or departure, thereby ensuring business continuity and fair valuation. These proactive measures not only protect individual investments but also preserve the long-term viability and stability of the S Corporation itself.

Tailoring the Blueprint for Diverse Business Needs

While an effective shareholder agreement template provides a solid foundation, its true power lies in its adaptability. Every business, regardless of industry or size, possesses unique operational dynamics, ownership structures, and strategic objectives. A one-size-fits-all approach to legal documentation rarely suffices, making customization an absolute necessity.

Whether you’re operating a burgeoning tech startup with venture capitalists, a multi-generational family enterprise, or a professional services firm with multiple partners, the template can be meticulously tailored. Specific clauses can be adjusted to reflect unique capital contribution structures, varying levels of active involvement from shareholders, or particular requirements imposed by industry-specific regulations. This flexibility ensures that the final document accurately mirrors the specific vision and operational realities of your S Corporation, making it a truly bespoke and effective legal instrument.

Essential Provisions for Your Shareholder Contract

While every business is unique, an effective s corp shareholder agreement template will invariably include a set of core provisions vital for comprehensive protection and operational clarity. These clauses form the backbone of the agreement, addressing the most common areas of shareholder interaction and potential dispute. Diligent attention to each of these sections ensures a robust and enforceable contract.

- Identification of Parties: Clearly names all shareholders and the corporation itself, establishing who is bound by the agreement’s terms.

- Purpose of Agreement: States the overarching goal of the document, typically to govern the relationships among shareholders and with the corporation.

- Share Capitalization and Issuance: Details the number of shares authorized, issued, and held by each shareholder, including the class of shares.

- Management and Decision-Making: Outlines voting rights, the process for electing directors (if applicable), and the types of corporate actions requiring unanimous or supermajority consent.

- Transfer Restrictions: Crucial for S Corps, these clauses prevent shareholders from selling or transferring shares to unqualified parties, which could jeopardize the S Corp status. This often includes a Right of First Refusal for other shareholders or the corporation.

- Buy-Sell Provisions: Defines the circumstances (e.g., death, disability, retirement, termination, divorce) under which shares must be offered for sale or purchase, including the method for valuing shares and funding mechanisms (e.g., life insurance).

- S Corporation Status Preservation: Explicitly states the shareholders’ commitment to maintaining S Corp election, including restrictions on who can become a shareholder and prohibitions against issuing a second class of stock.

- Dispute Resolution: Establishes a structured process for resolving disagreements, typically starting with mediation and escalating to binding arbitration before litigation.

- Confidentiality and Non-Compete: If applicable, these clauses protect proprietary information and prevent shareholders from competing with the company during or after their tenure.

- Default Provisions: Specifies what constitutes a breach of the agreement and the remedies available to the non-defaulting parties.

- Amendments and Waivers: Describes the process required to modify the agreement’s terms, usually requiring unanimous written consent.

- Governing Law: Identifies the state whose laws will govern the interpretation and enforcement of the agreement.

- Signatures: Requires the signatures of all shareholders and, often, a representative of the corporation, along with the effective date.

Optimizing Your Agreement’s Presentation and Accessibility

Beyond its legal substance, the practical usability of your shareholder agreement is paramount. A well-formatted, easy-to-read document ensures that all parties can understand their rights and obligations without unnecessary legal jargon or confusing layouts. This focus on presentation enhances clarity and reduces the likelihood of misunderstandings down the line.

Consider using clear, concise language throughout, avoiding overly complex sentences where simpler alternatives exist. Employ logical headings and subheadings to break down the text, making it easy for readers to navigate to specific sections. Utilizing bullet points and numbered lists for itemized provisions, such as buy-sell triggers or voting procedures, significantly improves readability. For digital use, ensure the document is searchable and formatted for various screen sizes, while for print, use appropriate font sizes and margins. Regularly review and update the document, keeping version control in mind, and always ensure all shareholders have ready access to the most current iteration.

Ultimately, the strategic implementation of an s corp shareholder agreement template represents a significant investment in your business’s future stability and growth. It’s not merely a bureaucratic requirement but a living document that defines the very essence of your corporate partnerships. By proactively addressing potential areas of friction, you create a foundation of clarity and trust that empowers all shareholders to focus on collective success.

Far from a generic document, an s corp shareholder agreement template, properly customized, becomes an invaluable asset for conflict prevention, legal compliance, and strategic planning. It offers the peace of mind that comes from knowing all parties understand the rules of engagement, safeguarding your S Corp status and ensuring business continuity for years to come. Investing time and effort into this critical document is a testament to sound business judgment and a commitment to professional excellence.