In the dynamic landscape of modern compensation, restricted stock awards and restricted stock units (RSUs) have become foundational elements, particularly for startups, high-growth companies, and publicly traded corporations looking to align employee incentives with company performance. These equity grants offer a compelling way to reward employees, foster long-term commitment, and attract top talent by offering a tangible stake in the company’s future success. However, the intricacies of these agreements demand precise documentation to protect both the company’s interests and the employee’s rights.

Navigating the legal complexities, tax implications, and performance conditions associated with restricted stock requires more than just a handshake or a casual understanding. It necessitates a meticulously drafted legal document. This is where a robust restricted stock purchase agreement template becomes an invaluable asset, providing a standardized yet adaptable framework that ensures clarity, enforceability, and compliance with relevant regulations. Professionals in HR, legal departments, and corporate finance, as well as business owners and founders, stand to benefit immensely from such a well-structured resource.

The Indispensable Nature of Written Agreements Today

In an increasingly litigious and regulated business environment, the importance of clear, written agreements cannot be overstated. Ambiguity in compensation structures, especially those involving equity, can lead to significant disputes, costly litigation, and reputational damage. A formal document provides an undeniable record of mutual understanding and commitment, leaving no room for misinterpretation regarding expectations, obligations, and rights.

Beyond dispute prevention, a comprehensive written agreement ensures legal compliance. From federal securities laws to state contract regulations, the framework governing equity compensation is complex. A well-designed template helps companies adhere to these legal mandates, avoiding potential penalties and ensuring that the equity grants are valid and enforceable. This foresight protects both the grantor and the grantee from future complications.

Unlocking the Advantages of a Standardized Contract Form

Utilizing a restricted stock purchase agreement template offers a multitude of benefits, streamlining the process of issuing equity while safeguarding all parties involved. Firstly, it champions efficiency, allowing companies to quickly generate new agreements without starting from scratch, saving valuable time and legal fees. This standardization also ensures consistency across all employee grants, preventing arbitrary terms that could lead to internal fairness issues.

Secondly, such a template acts as a critical risk mitigation tool. By preemptively addressing common pitfalls—such as vesting schedules, forfeiture conditions, and transfer restrictions—it minimizes the likelihood of future misunderstandings or legal challenges. The explicit terms outline the consequences of various scenarios, providing a clear roadmap for both employer and employee. Indeed, the right restricted stock purchase agreement template can significantly mitigate these risks.

Tailoring Your Equity Agreement for Diverse Contexts

While a template provides a standardized foundation, its true power lies in its adaptability. A high-quality agreement form is designed with flexibility in mind, allowing for customization to suit various industries, company stages, and specific employee roles. For a tech startup, for instance, a template might need adjustments for accelerated vesting clauses tied to a liquidity event, whereas an established corporation might emphasize performance-based vesting or different tax election notices.

The level of customization extends to different types of restricted stock awards (RSAs) versus restricted stock units (RSUs), varying vesting schedules (e.g., cliff vesting vs. graded vesting), and specific performance criteria. Ensuring that the restricted stock purchase agreement template you use can be easily modified to reflect these nuances is crucial. This flexibility enables companies to design compensation packages that are precisely aligned with their strategic objectives and employee retention goals.

Essential Components of a Comprehensive Restricted Stock Agreement

Every robust restricted stock purchase agreement should encompass several critical clauses and sections to ensure its completeness and enforceability. These elements clarify the terms of the grant and protect the interests of both the company and the employee.

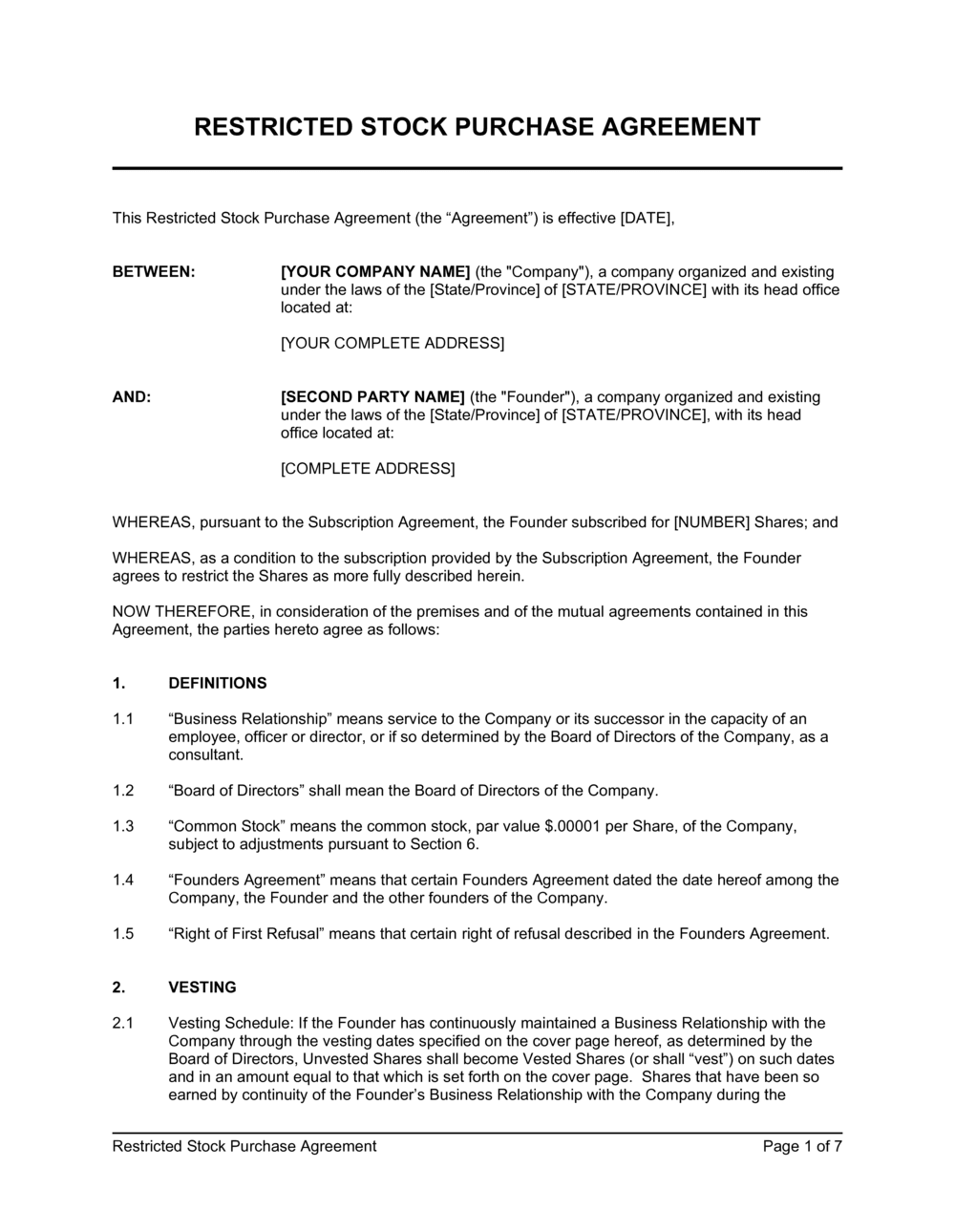

- Definition of Parties: Clearly identifies the company granting the stock and the employee receiving it, including their full legal names and addresses.

- Grant of Stock: Specifies the exact number of shares being granted, the type of stock (e.g., common stock), and any associated purchase price per share (often nominal).

- Vesting Schedule: Outlines the specific conditions under which the granted shares become fully owned by the employee, typically tied to time (e.g., four-year graded vesting) or performance milestones.

- Forfeiture Provisions: Details the circumstances under which unvested shares may be forfeited, such as termination of employment, resignation, or failure to meet performance targets.

- Transfer Restrictions: Explains any limitations on the employee’s ability to sell, assign, or transfer the shares, which are common for private companies to maintain control and comply with securities laws. These often lift after vesting or a liquidity event.

- Company Repurchase Rights (Call Rights): Specifies the company’s option to repurchase vested or unvested shares under certain conditions, such as an employee’s departure.

- Employee Repurchase Rights (Put Rights): Less common, but can grant the employee the right to sell shares back to the company under certain circumstances.

- Tax Implications and Section 83(b) Election: Clearly explains the tax treatment of restricted stock, including the importance of a Section 83(b) election for RSAs, which allows the employee to pay taxes on the fair market value of the stock at the time of grant rather than at vesting.

- Representations and Warranties: Statements made by both parties confirming facts relevant to the agreement, such as the company’s legal status and the employee’s acknowledgment of the terms.

- Confidentiality Clause: (Optional but often included) Protects proprietary company information.

- Governing Law: States which jurisdiction’s laws will govern the interpretation and enforcement of the agreement.

- Entire Agreement Clause: Confirms that the written agreement constitutes the complete understanding between the parties, superseding all prior oral or written communications.

- Amendments: Specifies how the agreement can be modified in the future.

- Notices: Details how formal communications between the parties should be delivered.

- Counterparts: Allows the agreement to be signed in multiple identical copies, each considered an original.

- Signatures: Spaces for authorized representatives of both the company and the employee to sign, along with the date.

Optimizing Agreement Design for Clarity and Accessibility

Beyond the legal substance, the presentation and structure of your restricted stock agreement significantly impact its usability and readability. For print or digital use, practical tips can enhance clarity and ensure smooth processing. Employ clear, concise language, avoiding overly verbose legal jargon where simpler terms suffice. Use active voice and well-structured sentences to improve comprehension.

Logical organization with distinct headings and subheadings (like those above) guides the reader through complex information. Short paragraphs (2-4 sentences) and ample white space improve visual appeal and reduce cognitive load. Bullet points, as used for the essential clauses, are excellent for presenting lists of conditions or requirements. For digital documents, consider hyperlinking to definitions or related policies, and ensure the document is easily searchable. Version control is also crucial, clearly labeling different iterations to prevent confusion.

In conclusion, the strategic use of a robust restricted stock purchase agreement template is a testament to professional due diligence and forward-thinking business practices. It transforms a complex equity grant process into a clear, compliant, and manageable operation, ensuring that both companies and their valued employees operate from a position of mutual understanding and legal security.

By minimizing ambiguities and establishing clear guidelines from the outset, such a template not only saves invaluable time and resources but also significantly reduces the potential for costly disputes down the line. The value a meticulously developed restricted stock purchase agreement template brings cannot be overstated; it is an essential investment in the stability and growth of any organization offering equity compensation, fostering trust and long-term success for all parties involved.