Embarking on the journey to open a new restaurant is an exhilarating prospect, filled with visions of culinary delights, bustling dining rooms, and happy customers. Yet, beneath the excitement lies a complex web of financial considerations that can make or break your venture before the first dish is ever served. It’s a common misconception that passion alone is enough; the reality is, successful restaurants are built on meticulous planning, especially when it comes to money.

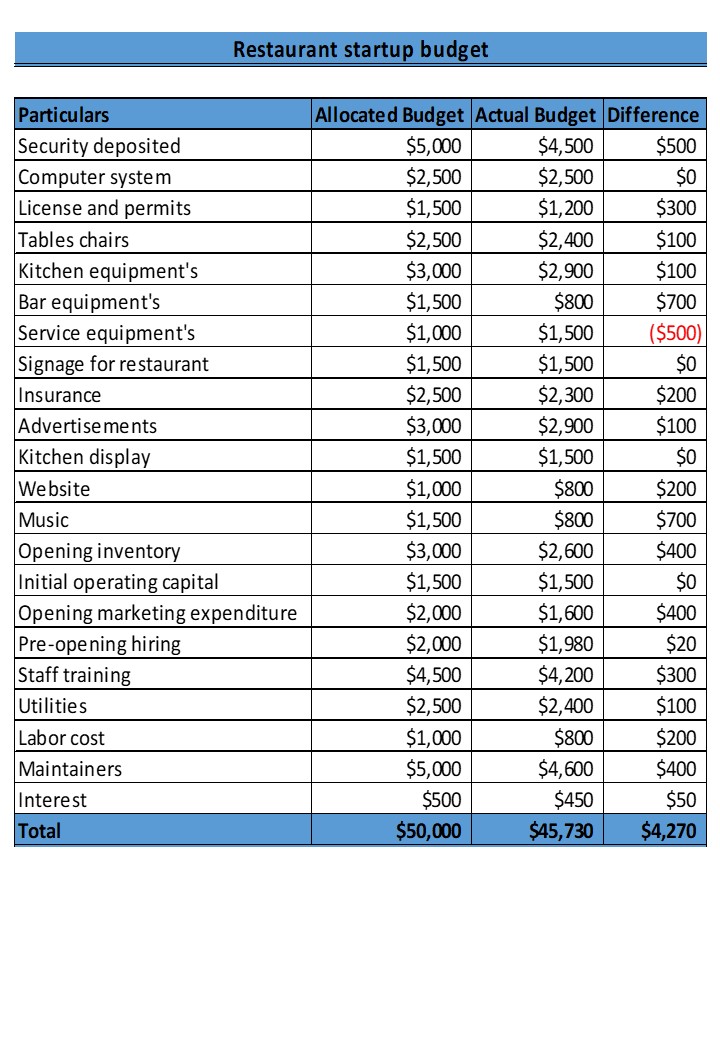

This is precisely where a robust Restaurant Startup Budget Template becomes your most invaluable tool. It’s not just a spreadsheet; it’s a detailed financial blueprint that illuminates every potential cost, from securing your prime location to the very first day of operations. Without a clear understanding of your initial outlay and ongoing expenses, you’re navigating uncharted waters, vulnerable to unforeseen expenditures that can quickly deplete your capital and derail your dreams.

Why a Meticulous Financial Plan is Your Secret Ingredient

Many aspiring restaurateurs underestimate the sheer volume of costs involved in launching a food establishment. From permits and licenses to kitchen equipment and initial inventory, the expenses pile up rapidly. A comprehensive financial plan allows you to anticipate these costs, allocate funds wisely, and secure the necessary financing with confidence. It transforms guesswork into calculated projections.

Moreover, a well-defined budget serves as your financial compass, guiding decisions and preventing overspending in critical areas. It helps you prioritize expenditures, distinguishing between essential investments and desirable but deferrable upgrades. This foresight is crucial for maintaining financial stability during the often-turbulent initial months of operation, ensuring you have the runway needed to achieve profitability.

Deconstructing the Costs: What Goes Into Your Initial Outlay

Opening a restaurant involves a diverse array of expenditures that must be accounted for. These aren’t just the obvious costs like rent and food supplies; they extend to less apparent but equally vital investments. Understanding these categories is the first step toward building an accurate Restaurant Startup Budget Template.

The initial investment can typically be broken down into several major categories:

- Real Estate & Build-Out: This includes security deposits, first and last month’s rent, leasehold improvements, architectural designs, and construction. Whether you’re renovating an existing space or building from scratch, these costs are often substantial and can vary wildly.

- Kitchen Equipment: From commercial ovens and refrigeration units to fryers, dishwashers, and smallwares, outfitting a professional kitchen is a significant expense. Don’t forget installation costs and potential maintenance contracts.

- Dining Room & Front-of-House: Furnishings, décor, point-of-sale (POS) systems, lighting, and sound systems all contribute to the ambiance and functionality of your dining area. Consider the initial setup of technology.

- Licenses & Permits: This can be a complex and costly area. You’ll need health permits, food handler licenses, liquor licenses (if applicable), business licenses, and potentially many more depending on your state and local regulations. Factor in application fees and legal assistance.

- Initial Inventory: Stocking your pantry, refrigerator, and bar with food, beverages, and supplies before opening day is essential. This includes everything from produce and meat to spices and cleaning products. Supplier relationships are key here.

- Marketing & Branding: Developing your brand, creating a website, social media setup, grand opening promotions, signage, and menu design all fall under this category. Pre-opening buzz is vital.

- Staffing & Training: Wages for your initial team during training, uniform costs, and onboarding expenses. Even before opening, you’ll incur labor costs. Consider recruitment fees.

- Working Capital: This is perhaps the most overlooked but crucial item. It’s the cash reserve needed to cover operating expenses for the first few months until the restaurant achieves consistent positive cash flow. This buffer protects you against unexpected dips in revenue.

Building Your Own Financial Roadmap: Key Elements of a Startup Budget

A well-structured budget for a new eatery will itemize every potential cost, allowing you to track expenses meticulously. While the specific line items will vary based on your concept and location, a robust restaurant financial planning tool will typically include sections for:

- One-Time Capital Expenditures: These are significant, non-recurring costs like property acquisition or leasehold improvements, major equipment purchases, and initial build-out expenses. These investments typically have a long lifespan.

- Pre-Opening Operating Expenses: Costs incurred before you open your doors, such as initial inventory purchases, staff training wages, utility deposits, and marketing campaigns to generate buzz.

- First 3-6 Months of Operating Expenses: This section projects your recurring monthly costs once you’re open, including rent, utilities, labor, food costs, marketing, insurance, and administrative expenses. It’s critical for determining your working capital needs.

- Revenue Projections: While not strictly an expense, a comprehensive startup budget for a restaurant will also include realistic revenue forecasts to understand when you anticipate breaking even and becoming profitable.

Leveraging Your Budgeting Tool for Success

Once you’ve developed your comprehensive Restaurant Startup Budget Template, its utility extends far beyond securing funding. It becomes a living document, a dynamic tool to guide your business decisions and ensure financial discipline. Regular review and adjustment are paramount. As you progress through the build-out phase and approach opening, actual costs may deviate from your initial estimates.

Using this initial restaurant costs estimator allows you to quickly identify areas where you might be over budget and make necessary adjustments. Perhaps one piece of equipment was more expensive than anticipated; your budget helps you find cost savings elsewhere, or adjust your working capital needs. This proactive approach prevents small discrepancies from snowballing into significant financial challenges. It’s also an invaluable resource for discussions with investors, demonstrating your thorough understanding of the business’s financial requirements.

Beyond the Initial Setup: Ongoing Financial Health

While the focus of a Restaurant Startup Budget Template is on getting your doors open, its underlying principles are vital for long-term success. The meticulous cost analysis and forecasting abilities cultivated during the startup phase will serve you well as you transition into daily operations. Regularly comparing your actual spending against your budget projections helps you spot inefficiencies, control food and labor costs, and maintain healthy profit margins.

Think of it as the foundational training for ongoing financial management. A successful food establishment isn’t just about delicious food; it’s about efficient operations and smart financial stewardship. Your initial financial blueprint lays the groundwork for continuous financial monitoring, ensuring your restaurant remains viable and thrives in a competitive market.

Tips for Crafting a Robust Restaurant Financial Plan

Creating an accurate and effective financial blueprint for opening a restaurant requires careful attention to detail and a realistic perspective. Here are some actionable tips to ensure your budgeting process is thorough:

- Research Thoroughly: Don’t guess. Get multiple quotes for equipment, supplies, and services. Talk to other restaurateurs about their initial costs. This due diligence will make your cost analysis for a food establishment much more accurate.

- Factor in Unexpected Costs: Always add a contingency fund, typically 10-20% of your total estimated startup costs. Unexpected issues, from minor construction delays to unforeseen permit requirements, are almost guaranteed.

- Distinguish Between Fixed and Variable Costs: Understand which expenses remain constant (rent, insurance) and which fluctuate with sales volume (food costs, hourly wages). This distinction is crucial for cash flow management.

- Don’t Skimp on Working Capital: This is the lifeline of a new business. Many restaurants fail not because of poor sales, but because they run out of cash before they can achieve sustained profitability. Aim for at least 3-6 months of operating expenses.

- Update Regularly: Your new restaurant financial model is not static. As you gather more information and make decisions, update your figures. This iterative process ensures your budget remains relevant and accurate.

- Seek Professional Advice: Consider consulting with an accountant or a restaurant consultant. Their expertise can help you identify overlooked costs, optimize your tax strategy, and refine your overall financial strategy.

Frequently Asked Questions

Why is a budget so critical for a restaurant startup?

A budget is critical because it provides a clear financial roadmap, anticipating all costs from initial setup to ongoing operations. It helps prevent unforeseen expenses, secures financing, and ensures you have sufficient working capital to survive the initial, often challenging, months of business. Without it, financial instability is almost inevitable.

How often should I review and update my restaurant startup budget?

You should review and update your budget continuously during the pre-opening phase as you gather quotes and make purchasing decisions. Once your restaurant is open, it should be reviewed at least monthly, comparing actual expenses and revenues against your projections to make necessary operational adjustments.

What’s the most common mistake made in a new restaurant financial model?

The most common mistake is underestimating costs, particularly the amount of working capital needed to sustain operations through the initial slow period. Many owners focus too much on build-out and equipment, neglecting the cash reserves required to cover rent, payroll, and utilities for the first few months before consistent profits are achieved.

Can I create a useful restaurant cost estimation without prior experience?

Yes, with thorough research and the right tools. While experience helps, a detailed approach involves getting multiple quotes, consulting industry benchmarks, and utilizing comprehensive templates. Seeking advice from experienced mentors or financial professionals can significantly enhance the accuracy and robustness of your budgeting process.

Should I include my salary in the initial restaurant startup budget?

Absolutely. It’s crucial to factor in a reasonable owner’s salary or living expenses from day one, even if you defer taking a full salary initially. This helps create a realistic financial picture and prevents you from depleting your business’s vital working capital by drawing too heavily from it for personal needs.

Developing a comprehensive Restaurant Startup Budget Template is not just a recommended step; it is an indispensable foundation for anyone aspiring to open a successful food establishment. It empowers you with clarity, control, and confidence, transforming a daunting financial landscape into a manageable plan. By meticulously detailing every anticipated expense, you gain the foresight needed to navigate the challenges inherent in a new venture.

Embrace this essential tool as your guide, allowing it to illuminate the path to profitability and stability. With a robust financial plan in hand, you’re not just opening a restaurant; you’re building a sustainable business with the financial intelligence to thrive. Your culinary dream deserves a solid financial reality, and it all starts with a well-constructed budget.