Running a restaurant is an intricate dance of culinary artistry, exceptional service, and razor-sharp financial management. In an industry renowned for its tight margins and high rate of failure, surviving – let alone thriving – often hinges on more than just a stellar menu or a charming ambiance. It demands foresight, control, and a clear understanding of every dollar that comes in and goes out. Without a robust financial roadmap, even the most promising culinary ventures can quickly lose their way amidst unexpected costs and fluctuating revenues.

This is precisely where a well-crafted operating budget becomes an indispensable tool. Far from being a rigid, cumbersome document, it’s a dynamic blueprint that empowers restaurant owners and managers to navigate the complex financial landscape of their business. Whether you’re a budding entrepreneur sketching out your first venture or a seasoned restaurateur looking to optimize profitability, understanding and utilizing a Restaurant Operating Budget Template is not just good practice—it’s a critical component of sustainable success. It provides the clarity needed to make informed decisions, identify potential pitfalls, and seize opportunities for growth.

Why a Solid Operating Budget is Non-Negotiable

In the fast-paced world of hospitality, predictability is a luxury. Market trends shift, ingredient prices fluctuate, and customer preferences evolve. A comprehensive operating budget offers a vital anchor in these turbulent waters, providing a structured approach to financial planning and control. It transforms vague financial aspirations into concrete, actionable targets.

The benefits extend far beyond mere number-crunching. A well-constructed budget allows restaurateurs to set realistic financial goals, allocate resources efficiently, and monitor performance against established benchmarks. It fosters financial discipline, helps in identifying areas of overspending, and uncovers opportunities for cost savings. Ultimately, a strong financial plan serves as a compass, guiding your restaurant towards greater stability and enhanced profitability, ensuring every decision is backed by sound financial reasoning.

Deconstructing the Essential Components of a Restaurant Operating Budget

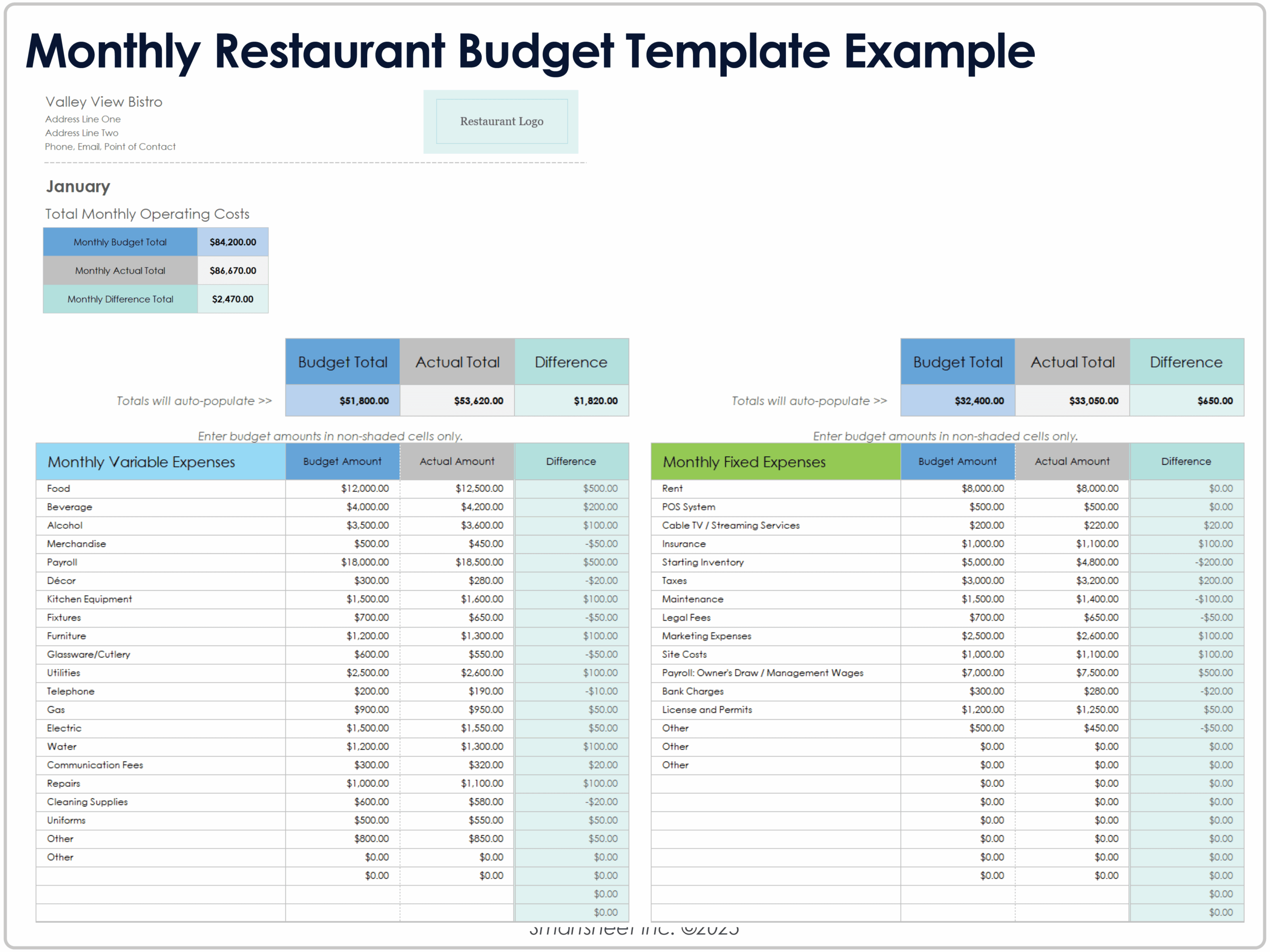

To truly harness the power of a financial blueprint, it’s crucial to understand what goes into it. An effective operating budget for a restaurant isn’t just a list of expenses; it’s a detailed projection of income and outgoings over a specific period, typically a month, quarter, or year. It covers every financial aspect of your operation, offering a holistic view of your fiscal health.

Revenue Projections: The Foundation

The starting point for any financial plan is understanding your potential income. This involves forecasting sales from all your revenue streams. Consider historical sales data, seasonal variations, planned marketing campaigns, menu changes, and local events that might impact customer traffic. Detailed projections should break down revenue by categories such as dine-in, takeout, delivery, catering, and even merchandise sales. Setting realistic, yet ambitious, revenue targets provides the benchmark against which all expenses will be measured.

Cost of Goods Sold (COGS): Your Biggest Variable

For a restaurant, COGS primarily refers to the cost of food and beverages directly used to create menu items. This is often the largest variable expense and requires meticulous tracking. An accurate financial model will account for ingredient costs, portion control, waste, spoilage, and inventory management. Understanding and optimizing your COGS is paramount to maintaining healthy profit margins, as even small fluctuations can significantly impact your bottom line.

Operating Expenses: Keeping the Doors Open

Beyond the ingredients themselves, numerous other costs contribute to keeping your restaurant running smoothly. These operating expenses, often categorized as fixed or variable, are essential to capture comprehensively in your budgeting framework.

- Labor Costs: Encompasses all employee wages, salaries, benefits (health insurance, paid time off), payroll taxes, and any related staffing expenses. This is often the second-largest cost center.

- Rent/Lease Payments: Your fixed monthly cost for your physical location.

- Utilities: Electricity, gas, water, internet, and waste disposal services. These can fluctuate based on usage and seasonality.

- Marketing & Advertising: Costs associated with promoting your restaurant, including social media ads, local print ads, website maintenance, and promotional events.

- Supplies: Non-food items crucial for operation, such as cleaning supplies, paper products, smallwares (cutlery, plates), and office supplies.

- Repairs & Maintenance: Funds allocated for keeping equipment in working order, minor property repairs, and routine upkeep of the premises.

- Administrative & Technology: Software subscriptions (POS systems, reservation platforms), accounting fees, legal services, and general office expenses.

- Insurance: Liability, property, workers’ compensation, and other necessary insurance policies.

- Licenses & Permits: Regular fees required to operate legally, including health permits, liquor licenses, and business registrations.

- Miscellaneous/Contingency: An essential buffer for unexpected expenses or minor operational costs that don’t fit neatly into other categories.

How to Effectively Utilize a Restaurant Budget Template

Having a budget framework is one thing; putting it to good use is another. The real value of a financial planning guide lies in its active implementation and ongoing review. It’s a living document that needs regular attention to remain relevant and effective.

Step-by-Step Implementation Guide

Here’s a practical approach to leveraging an operating budget for a restaurant:

- Gather Historical Data: Start by collecting all your past financial records, including profit and loss statements, sales reports, and expense receipts from the previous year or two. This data provides a realistic baseline for your projections.

- Define Your Goals: What do you want to achieve financially? Are you aiming for a specific profit margin, planning an expansion, or trying to reduce a particular cost? Clear goals will inform your budgeting decisions.

- Populate the Template: Input your historical data and future projections into your chosen restaurant financial planning tool. Be as detailed as possible, breaking down expenses into granular categories.

- Set Benchmarks and KPIs: Compare your budgeted figures against industry averages or your own past performance. Establish Key Performance Indicators (KPIs) like food cost percentage, labor cost percentage, and average check size to track progress.

- Regularly Review and Adjust: This is critical. Review your actual performance against your budget at least monthly. Identify variances, understand why they occurred, and make necessary adjustments to future projections or operational strategies.

- Communicate with Your Team: Share relevant aspects of the budget with your management team. Foster a culture of cost-consciousness and empower them to contribute to achieving financial goals, from managing inventory to optimizing staffing.

Leveraging Your Budget for Strategic Growth and Profitability

Beyond merely tracking expenses, a well-implemented operating budget becomes a powerful strategic asset. It shifts your perspective from reactive problem-solving to proactive decision-making. By regularly analyzing your financial performance against your budget, you gain invaluable insights that can drive growth and enhance profitability.

For instance, if your food cost consistently exceeds your budgeted percentage, your budget template highlights this discrepancy immediately. This prompts you to investigate—is it waste, theft, supplier price increases, or inefficient portioning? Similarly, if labor costs are too high, it might signal overstaffing during slower periods or a need to optimize scheduling. This detailed financial analysis allows you to pinpoint inefficiencies, negotiate better deals with suppliers, refine your menu engineering, and adjust pricing strategies. It equips you with the data needed to make tough but necessary decisions, ensuring your restaurant remains agile and competitive in a challenging market.

Frequently Asked Questions

What’s the ideal frequency for reviewing my restaurant’s budget?

For most restaurants, a monthly review is ideal. The restaurant industry is dynamic, and reviewing monthly allows you to catch significant variances quickly, make timely adjustments, and stay on track with your financial goals without being overwhelmed.

Can a small independent restaurant truly benefit from a detailed operating budget?

Absolutely, perhaps even more so. Small independent restaurants often operate on tighter margins with less financial buffer. A detailed financial model provides the crucial oversight needed to manage cash flow, identify cost-saving opportunities, and ensure the business remains viable.

How do I account for unexpected expenses in my financial plan?

It’s wise to include a “contingency fund” or “miscellaneous expenses” category within your budget. Allocate a small percentage (e.g., 2-5%) of your total expenses to this buffer. This helps absorb unforeseen costs like emergency equipment repairs or minor supply shortages without derailing your entire financial strategy.

What’s the difference between a cash flow statement and an operating budget?

An operating budget is a *plan* or a *forecast* of your expected revenues and expenses over a future period. A cash flow statement, on the other hand, is a *report* that tracks the actual movement of cash in and out of your business over a past period. Both are critical for financial health, but they serve different purposes: one plans the future, the other reports the past.

Where can I find a reliable restaurant financial planning tool?

Many resources offer assistance. You can find generic spreadsheet templates online, often for free or a small fee. Specialized restaurant accounting software and POS systems often include budgeting features. Industry associations and financial consultants specializing in hospitality can also provide valuable insights and custom tools tailored to your specific needs.

Embracing a systematic approach to your restaurant’s finances is not merely about managing costs; it’s about empowering your vision. A robust financial blueprint transforms guesswork into strategy, allowing you to move beyond day-to-day firefighting and focus on sustainable growth. It provides the clarity and control necessary to navigate the complexities of the restaurant world, making your operations more efficient and your business more resilient.

By diligently building and adhering to a well-structured operating budget, you equip your restaurant with the foresight needed to thrive. It’s an investment of time that pays dividends in profitability, stability, and peace of mind. Start today by taking control of your financial narrative and lay the groundwork for a successful and prosperous future for your culinary venture.