A rental receipt PDF is a digital document that serves as proof of payment for rent. It’s a crucial record for both landlords and tenants, offering a clear and concise record of rental transactions. This article will delve into the importance of rental receipts, how to create them, and best practices for both landlords and tenants.

Why are Rental Receipts Important?

Rental receipts offer numerous benefits for both landlords and tenants:

1. Proof of Payment

For landlords, a rental receipt provides irrefutable proof that rent has been received. This is essential for maintaining accurate financial records and avoiding disputes regarding unpaid rent.

2. Tax Purposes

Landlords can use rental receipts as documentation for income tax purposes, demonstrating rental income earned throughout the year.

3. Dispute Resolution

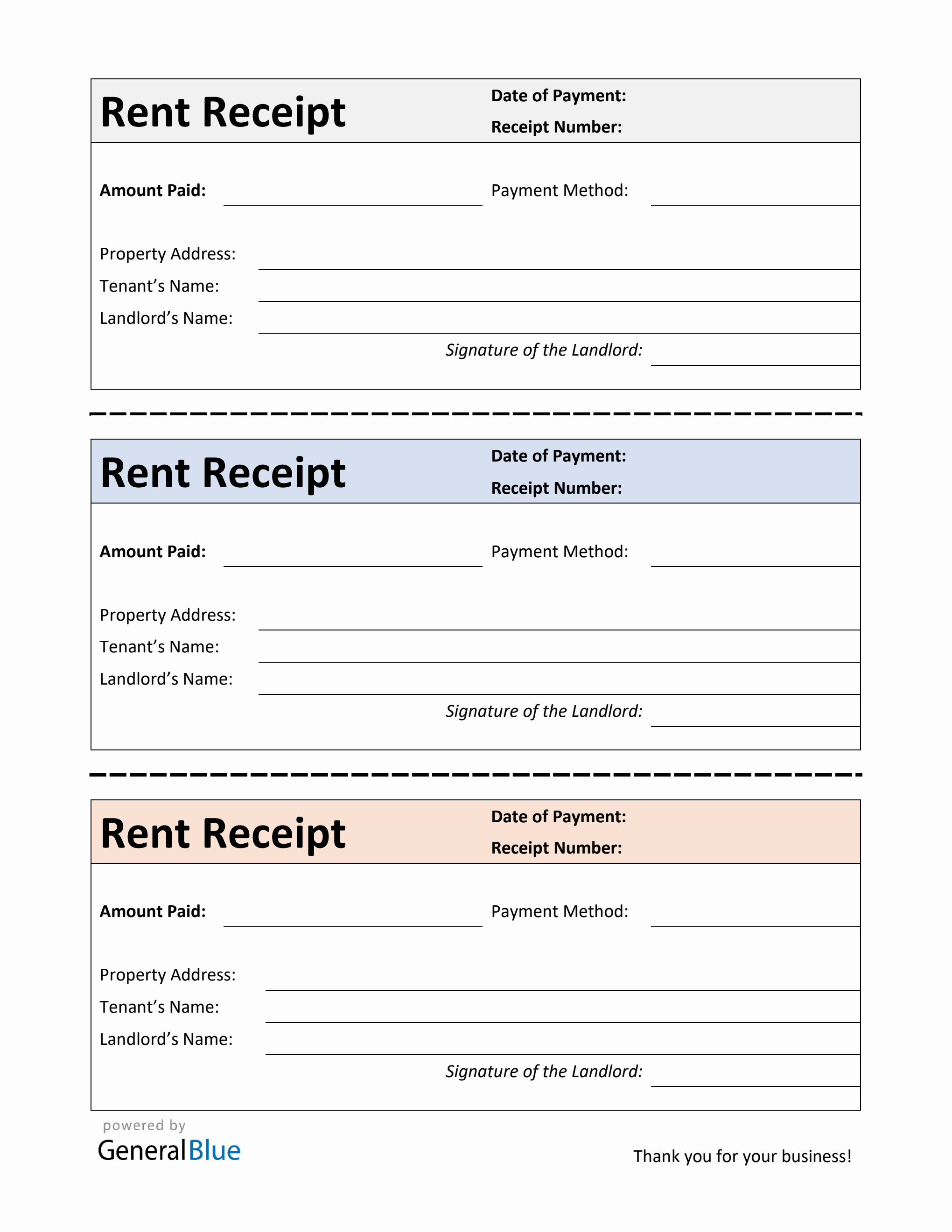

Image Source: generalblue.com

In case of disagreements between landlords and tenants regarding rent payments, a rental receipt can act as valuable evidence. It can help resolve disputes quickly and efficiently, preventing costly legal battles.

4. Record Keeping

Rental receipts contribute to a well-maintained record of all rental transactions. This history can be beneficial for both parties, providing a clear overview of payment dates, amounts, and any applicable late fees.

How to Create a Rental Receipt PDF

There are several ways to create a rental receipt PDF:

Use a Template: Numerous free and paid templates are available online. These templates often include essential information such as:

Best Practices for Landlords

Issue Receipts Promptly: Issue receipts immediately after receiving rent payments. This reinforces a professional and organized approach to property management.

Best Practices for Tenants

Request Receipts: Always request a receipt from your landlord after paying rent.

Conclusion

Rental receipt PDFs are invaluable documents for both landlords and tenants. They provide essential proof of payment, facilitate tax preparation, assist in dispute resolution, and contribute to accurate record-keeping. By following the best practices outlined in this article, both landlords and tenants can ensure smooth and hassle-free rental transactions.

FAQs

1. Can I create a rental receipt using a simple spreadsheet program like Excel?

2. Are digital rental receipts legally binding?

3. What happens if I lose my rental receipt?

4. Can I deduct the cost of printing rental receipts from my taxes?

5. Are there any specific legal requirements for rental receipts in my state/country?

Rental Receipt Pdf