In the fast-paced world of real estate, where deals can materialize and finalize within days, the clarity and precision of financial arrangements are paramount. Commissions represent the lifeblood of real estate professionals, yet their division can often be a source of confusion or, worse, contention if not explicitly defined. This is where a well-structured and legally sound real estate commission split agreement template becomes not just a convenience, but an absolute necessity.

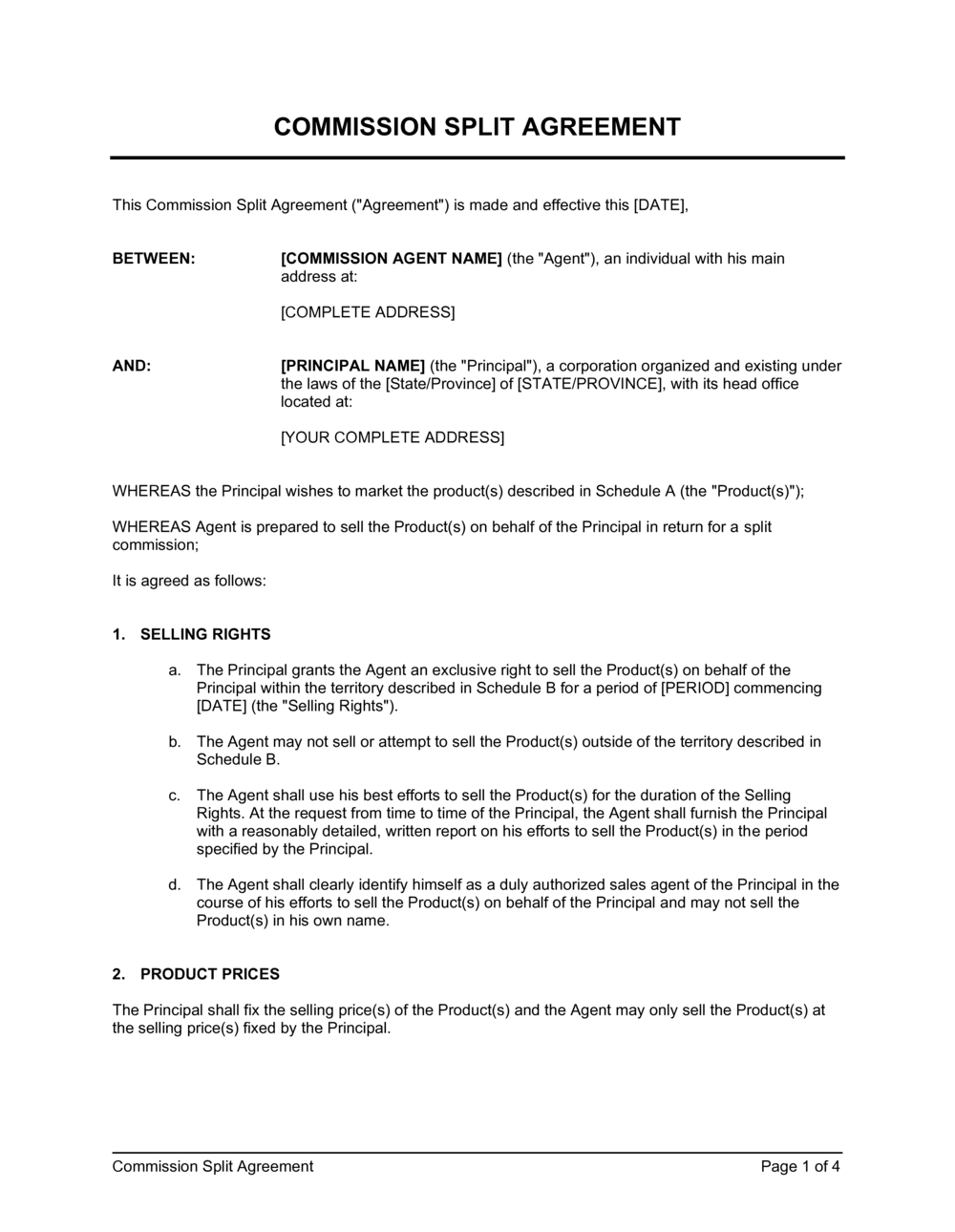

For brokers, agents, teams, and even co-brokering firms, having a standardized document that outlines the terms, conditions, and percentages of commission distribution provides a foundational layer of professionalism and trust. It serves as a crystal-clear roadmap for all parties involved, preempting misunderstandings and ensuring that every stakeholder understands their entitlement and obligations from the outset. Professionals operating in the business and legal documentation niche will immediately recognize the immense value this brings to maintaining smooth operations and mitigating risk.

The Indispensable Nature of Written Agreements Today

In an increasingly complex and litigious business environment, relying on verbal agreements or handshake deals in real estate is a significant gamble. Regulatory scrutiny is higher than ever, and financial transparency is a non-negotiable expectation from clients and industry bodies alike. A written agreement transcends memory lapses and differing interpretations, providing an immutable record of understanding.

Such documentation is crucial for legal protection. Should a dispute arise over commission disbursement, the absence of a signed agreement leaves all parties vulnerable, often resulting in costly legal battles and damaged professional reputations. A meticulously drafted contract minimizes these risks by clearly articulating every relevant detail, leaving no room for ambiguity.

Core Advantages of a Standardized Document

Utilizing a pre-formatted real estate commission split agreement template offers a multitude of benefits that extend beyond mere legal compliance. Firstly, it significantly streamlines the process of establishing financial terms for each new transaction or team member. Instead of drafting a new document from scratch every time, professionals can leverage a proven framework, saving invaluable time and effort.

Beyond efficiency, a standardized template ensures consistency across all agreements, fostering fairness and predictability within an organization or between collaborating parties. It acts as a safety net, guaranteeing that all essential clauses, legal protections, and payment protocols are included, reducing the chance of overlooking critical details that could lead to future complications. This proactive approach supports robust internal governance and external partnerships.

Tailoring Agreements for Diverse Scenarios

While the core principles remain consistent, a well-designed agreement template is inherently flexible, allowing for extensive customization to fit a myriad of real estate scenarios. For instance, the splits might differ significantly between a residential sale and a commercial lease, or between a seasoned agent and a new licensee working under a mentor. The template can be adapted to specify varied percentages for buyer-side versus seller-side commissions.

Furthermore, it can accommodate complex team structures, outlining internal splits among team members, or specific referral arrangements between agents from different brokerages. Whether dealing with a flat fee, a tiered percentage system based on sales volume, or a specific arrangement for short-term rentals, the adaptable nature of a comprehensive commission agreement ensures all unique conditions are accurately reflected. This versatility makes the document an invaluable tool across the entire real estate spectrum.

Essential Components of a Robust Agreement

A comprehensive commission split agreement must contain several critical clauses to be effective and legally sound. These elements ensure that all potential contingencies are addressed and that the agreement serves its intended purpose of clear financial division.

- Identification of Parties: Clearly state the full legal names, addresses, and roles of all individuals or entities entering into the agreement (e.g., broker, agent, team leader, referral partner).

- Property/Transaction Details: Specify the property address, transaction type (sale, lease, referral), and relevant dates for which the commission split applies. This grounds the agreement to a specific deal.

- Commission Rate and Calculation: Precisely define the total commission rate for the transaction (e.g., a percentage of the sales price, a flat fee) and the method for its calculation.

- Split Percentages: Detail the exact percentage or fixed amount each party is entitled to receive from the gross or net commission. Ensure the percentages add up correctly.

- Payment Terms and Timing: Outline when and how the commission will be paid (e.g., upon closing, within X days of receipt by the brokerage), and who is responsible for disbursing funds.

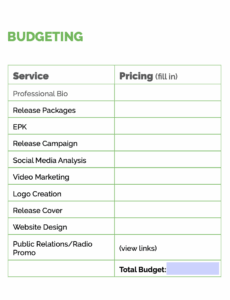

- Expenses and Deductions: Specify any transaction-related expenses (e.g., marketing costs, staging fees, E&O insurance) that will be deducted from the gross commission before the split, and how these deductions are allocated.

- Dispute Resolution: Include a clause outlining the process for resolving disagreements, such as mediation or arbitration, before resorting to litigation.

- Governing Law: State the jurisdiction whose laws will govern the interpretation and enforcement of the agreement (typically the state where the property is located or the brokerage operates).

- Termination Clauses: Define conditions under which the agreement may be terminated and how commissions on pending transactions will be handled post-termination.

- Confidentiality: If applicable, include provisions regarding the confidentiality of client information or proprietary business practices.

- Representations and Warranties: Standard legal statements where parties affirm their authority to enter the agreement and their compliance with relevant laws.

- Signatures: Spaces for all parties to sign and date the document, affirming their acceptance of the terms, often including witnesses or notarization for added legal weight.

Crafting for Clarity and Ease of Use

The efficacy of any legal document, including a real estate commission split agreement, hinges not only on its content but also on its presentation. For print or digital use, readability and usability are paramount. Employ clear, concise language, avoiding overly complex legal jargon where simpler terms suffice. The structure should be logical, with distinct headings and subheadings that guide the reader through each section effortlessly.

Visually, ample white space, a legible font, and consistent formatting enhance comprehension. Consider using bold text for key terms or figures to draw attention to critical information. For digital deployment, ensure the template is easily editable (e.g., a fillable PDF or a Word document), supporting e-signatures for streamlined execution. A user-friendly design minimizes potential errors during completion and ensures all parties can quickly grasp their rights and responsibilities.

In the dynamic real estate landscape, adopting a robust real estate commission split agreement template is more than a best practice—it’s an essential strategic move. It underpins professional relationships, ensures financial transparency, and acts as a crucial safeguard against disputes, providing a clear framework for every transaction. By standardizing this vital aspect of their business, real estate professionals can focus their energy on what they do best: closing deals and serving clients.

Ultimately, a high-quality real estate commission split agreement template offers peace of mind. It’s a proactive investment in clarity, efficiency, and legal protection that pays dividends by fostering trust, preventing costly misunderstandings, and streamlining the complex process of commission distribution for all parties involved in a real estate transaction.