Introduction

So, you’ve got a product or service to offer and you’ve made a sale. Congrats! Now comes the crucial part: getting paid. This is where a well-structured invoice comes in. Think of it as the official receipt and a clear record of the transaction for both you and your client.

The Essentials: What Every Invoice Should Include

A solid invoice, regardless of your industry, needs to have these key elements:

1. Your Business Information

Your Business Name and Logo: This is your brand identity. Make it prominent!

2. Client Information

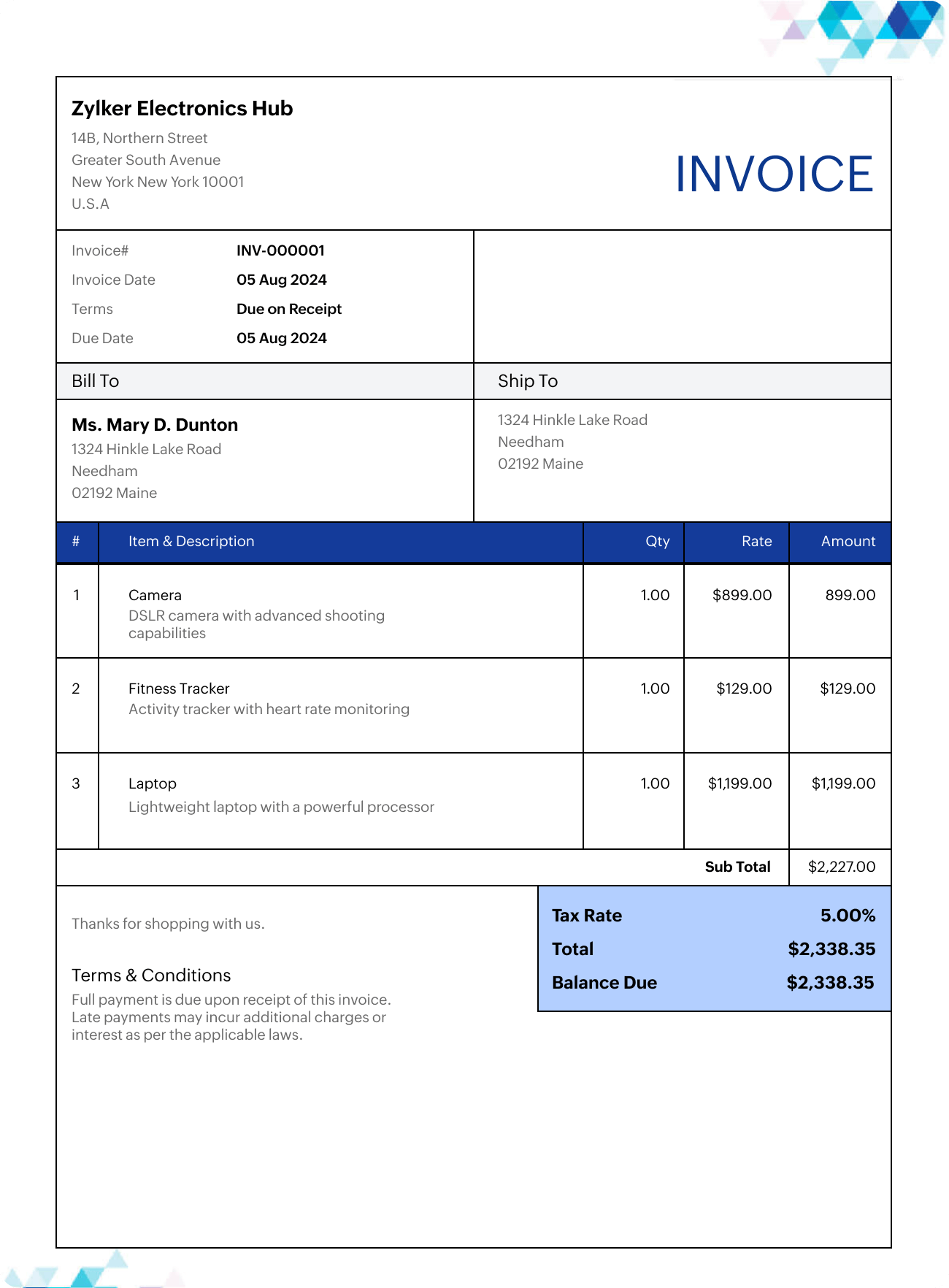

Image Source: zoho.com

Client Name and Company Name (if applicable): Be accurate to avoid any confusion.

3. Invoice Information

Invoice Number: Assign a unique number to each invoice for easy tracking.

4. Itemized List of Services or Products

Description: Clearly and concisely describe each item or service provided.

5. Payment Terms

Payment Methods: Specify the accepted payment methods (e.g., check, credit card, bank transfer).

6. Notes Section (Optional)

Tips for Creating Professional Invoices

Keep it Clean and Concise: Avoid clutter and use a professional and easy-to-read font.

Choosing an Invoicing Method

Paper Invoices: Traditional but can be time-consuming to create and track.

Example Invoice Format

Here’s a simple example of how an invoice might look:

[Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Your Website]

Invoice To:

[Client Name]

[Client Address]

[Client Phone Number]

[Client Email Address]

Invoice Number: [Invoice Number]

Invoice Date: [Date]

Due Date: [Date]

| Description | Quantity | Unit Price | Total |

|—|—|—|—|

| [Service 1] | [Quantity] | [Price] | [Total] |

| [Service 2] | [Quantity] | [Price] | [Total] |

| Subtotal | | | [Subtotal] |

| Tax (if applicable) | | | [Tax Amount] |

| Total | | | [Total Amount Due] |

Payment Terms: [Payment Terms]

Notes: [Any Notes]

[Your Company Logo]

Conclusion

A well-formatted invoice is more than just a piece of paper; it’s a crucial business document. By following these guidelines and utilizing the right tools, you can create professional invoices that get paid on time, maintain clear records, and build strong relationships with your clients.

FAQs

1. What is the best software for creating invoices?

There are many invoicing software options available, each with its own strengths. Some popular choices include QuickBooks, Xero, FreshBooks, and Invoice Ninja.

2. How often should I send invoices?

Generally, it’s best to send invoices as soon as possible after completing the work or delivering the goods.

3. What should I do if a client doesn’t pay their invoice on time?

Start by sending a polite reminder. If the payment is still not received, you may need to follow up with a phone call or send a formal letter. In some cases, you may need to consider taking legal action.

4. Can I use a free invoicing template?

Yes, there are many free invoice templates available online. You can find them on websites like Google Docs, Canva, and Microsoft Word.

5. Are there any legal requirements for invoices?

The specific legal requirements for invoices vary depending on your location and industry. It’s essential to research and comply with all applicable laws and regulations.

Disclaimer: This article provides general information and should not be considered legal or financial advice.

I hope this comprehensive guide helps you create professional and effective invoices for your business!

Invoice Bill Format