Navigating the complexities of personal finance can often feel like an uphill battle, especially when faced with monthly bills, unexpected expenses, and long-term financial goals. Many people grapple with the stress of not knowing where their money goes, feeling like they’re constantly running on a financial treadmill without making real progress. The dream of financial peace of mind—saving for a down payment, paying off debt, or simply having a comfortable emergency fund—often feels just out of reach, not because of a lack of income, but a lack of clear financial direction.

The good news is that achieving financial clarity doesn’t require a degree in economics or hours spent poring over dense spreadsheets. It starts with a simple, actionable plan. An Easy Household Budget Template is designed to demystify your money, transforming daunting numbers into an understandable roadmap for your financial future. It’s about empowering you to make informed decisions, track your progress, and ultimately, take control of your hard-earned money without the overwhelming feeling that usually accompanies traditional budgeting methods.

The Foundation of Financial Freedom

Budgeting is often mistakenly perceived as a restrictive exercise, a tool solely for cutting back and depriving oneself. In reality, a budget is your most powerful ally in achieving financial freedom. It acts as a spotlight, illuminating your income and expenses, allowing you to see exactly where your money flows each month. This clarity is the first crucial step toward making intentional choices, rather than letting money simply slip through your fingers.

Without a clear financial plan, it’s easy to fall into cycles of overspending or undersaving, leading to stress and missed opportunities. A well-structured, yet simple budgeting solution provides the framework needed to allocate funds towards your priorities, whether that’s building savings, paying down debt, or enjoying life’s experiences responsibly. It’s about smart money management, giving you the power to direct your resources toward what truly matters to you.

Why an Easy Household Budget Template is Your Financial Ally

The beauty of an Easy Household Budget Template lies in its simplicity and accessibility. Instead of starting from scratch with a blank page, you’re provided with a pre-designed framework that guides you through the essential components of your financial life. This removes the initial intimidation factor often associated with budgeting, making the process much more approachable.

Using a pre-formatted template means you don’t have to worry about setting up complex formulas or designing categories from the ground up. It offers a clear, intuitive layout that helps you quickly input your financial data, visualize your spending habits, and identify areas where adjustments can be made. This simple budgeting solution saves you time and mental energy, allowing you to focus on the insights rather than the setup. Ultimately, it transforms the abstract concept of money management into a tangible, actionable plan that supports your financial goals and reduces stress.

Unpacking the Essential Components of Your Budgeting Tool

An effective household budget tool, regardless of its simplicity, must capture the core elements of your financial life: what comes in, what goes out, and what’s left over. Understanding these components is key to constructing a budget that accurately reflects your reality and helps you make informed decisions. A good financial planning template breaks these down into manageable categories, making tracking straightforward.

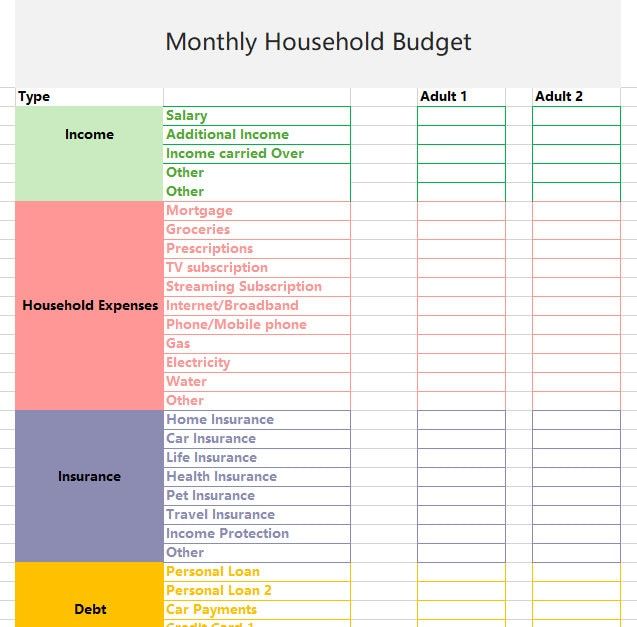

Here are the essential elements you’ll typically find in a comprehensive yet easy-to-use budget worksheet:

- Income Sources: This section captures all money flowing into your household. Include salaries, freelance income, benefits, investment dividends, and any other regular financial inflows.

- Fixed Expenses: These are costs that generally remain the same each month. Examples include rent or mortgage payments, loan installments (car, student), insurance premiums, and subscription services.

- Variable Expenses: These costs fluctuate month-to-month and often offer the most flexibility for adjustments. Think groceries, utilities (which can vary), transportation, dining out, and entertainment.

- Savings & Debt Repayment: Crucial categories for financial growth and stability. Dedicate specific line items for emergency savings, retirement contributions, and extra payments towards high-interest debts.

- Discretionary Spending: Money allocated for non-essential items or activities that bring joy, such as hobbies, personal care, or shopping. This is often where flexibility can be found.

- Tracking Mechanism: A space to record your actual spending against your planned budget. This comparison is vital for understanding where your money truly goes and for making necessary adjustments.

By organizing your finances into these clear categories, a simplified spending plan allows you to see a holistic picture of your financial health. It moves beyond just knowing your bank balance to understanding the intricate dance between your income and expenditures, providing the clarity needed to make strategic financial choices.

Getting Started: Making Your Financial Plan Work for You

Once you have your household budget template, the next step is to populate it with your financial data and put it into action. This process is more about honesty and consistency than it is about perfection. Remember, this is a tool designed to serve you, not to judge you.

Begin by gathering all your financial statements from the past month or two. This includes bank statements, credit card bills, pay stubs, and any receipts you’ve kept. Input your total monthly income into the designated section. Next, go through your bank and credit card statements to identify and list all your fixed expenses. These are often easy to pinpoint as they tend to be recurring, consistent charges. For variable expenses, estimate an amount based on your past spending. This initial estimate doesn’t have to be perfect; it’s a starting point that you can refine over time. The most critical step, however, is to consistently track your actual spending against your planned budget. This regular review allows you to spot discrepancies, understand your spending habits, and make necessary adjustments to ensure your financial roadmap keeps you on track.

Customizing Your Easy Household Budget Template

While a pre-designed template offers a fantastic starting point, your financial life is unique. The true power of an Easy Household Budget Template comes from its ability to be customized to fit your specific needs, goals, and lifestyle. Think of it as a flexible framework that you can adapt rather than a rigid set of rules.

You might find that the default categories don’t perfectly align with your spending. For instance, you may want to add a specific category for pet care, educational expenses, or a distinct “travel fund” if those are significant parts of your budget. Don’t hesitate to rename categories, add new ones, or even remove those that aren’t relevant to your situation. Adjusting the frequency of your budget review—perhaps weekly for variable expenses and monthly for overall analysis—can also make a big difference. The goal is to make your personal spending tracker feel like it was designed just for you. This personalization ensures that your financial management tool remains relevant and genuinely helpful as your life and financial situation evolve.

Tips for Long-Term Budgeting Success

Setting up your home financial plan is a great accomplishment, but consistent application is what truly leads to success. Here are some key tips to help you maintain momentum and achieve your financial aspirations:

- Be Realistic: Don’t set impossible goals. If you love your morning coffee, budget for it instead of cutting it out completely and feeling deprived. A sustainable budget is one you can stick to.

- Review Regularly: Make it a habit to check in with your budget at least once a week, and conduct a thorough review monthly. This allows you to catch issues early and celebrate progress.

- Embrace Imperfection: You’ll likely overspend in some categories and underspend in others. That’s okay! Budgeting is a learning process. Adjust as needed; it’s a living document.

- Automate Savings: Treat your savings like a non-negotiable bill. Set up automatic transfers to your savings or investment accounts each payday. This ensures you pay yourself first.

- Set Clear Goals: What are you budgeting for? A clear purpose, whether it’s a down payment, debt freedom, or a dream vacation, provides motivation and direction for your financial efforts.

- Communicate Openly: If you share finances with a partner or family, open and honest communication about money is vital. Discuss goals, spending habits, and any challenges together.

By incorporating these practices, your budgeting framework will become a powerful tool that not only tracks your money but also actively propels you toward your long-term financial objectives.

Frequently Asked Questions

How often should I update my budget?

While a comprehensive monthly review is essential, it’s highly beneficial to check in with your budget more frequently, especially for variable expenses. A quick weekly review can help you stay on track, compare actual spending to planned, and make minor adjustments before they become major issues. You should also update your budget whenever there are significant changes to your income or expenses, such as a new job, a major purchase, or a new recurring bill.

What if I consistently go over budget in certain categories?

Consistently overspending in a category isn’t a sign of failure, but rather an indicator that your initial estimates may have been unrealistic, or your spending habits in that area need attention. First, reassess if the allocated amount is truly enough. If not, consider reallocating funds from less critical categories. If it’s a spending habit, explore ways to reduce costs in that area, such as meal prepping to save on groceries or finding free entertainment options. The goal is to learn and adapt, not to feel guilty.

Is an Easy Household Budget Template suitable for debt repayment?

Absolutely. A well-constructed budget is one of the most effective tools for debt repayment. By clearly laying out your income and all your expenses, it helps you identify “extra” funds that can be aggressively applied to paying down debt. You can use your budget to implement strategies like the debt snowball or avalanche method, ensuring every extra dollar goes toward accelerating your path to debt freedom. It serves as a comprehensive money management guide, helping you allocate funds strategically.

Can I use this template if my income is irregular?

Yes, but it requires a slightly different approach. If your income varies, focus on budgeting based on your lowest expected monthly income. This ensures you can cover essential fixed expenses even in lean months. Any income received above this baseline can then be allocated to savings, debt repayment, or a “buffer fund” for future lean months. Averaging out your income over several months can also provide a more stable figure for planning. The key is to plan for the lean times and strategically allocate surpluses.

Where can I find a reliable household budget template?

Reliable household budget templates are widely available. Many financial planning websites offer free downloadable templates, often in spreadsheet formats like Excel or Google Sheets, which allow for easy customization. You can also find integrated templates within various budgeting apps. When choosing one, look for clarity, customization options, and categories that resonate with your financial structure. A simple Google search for “free easy household budget template” will yield numerous excellent options to get you started.

Taking control of your finances might seem like a monumental task, but with the right tools, it becomes an achievable and even empowering journey. An Easy Household Budget Template simplifies this process, providing a clear, structured path to understand your money, make deliberate choices, and align your spending with your financial aspirations. It’s not just about tracking numbers; it’s about gaining peace of mind and building a secure foundation for your future.

Don’t let financial uncertainty dictate your life. Embrace the clarity and control that a well-managed budget offers. By implementing a user-friendly financial roadmap, you equip yourself with the knowledge and power to navigate your financial landscape with confidence. The journey to financial freedom begins with a single, clear step—start with your budget today.

Taking this proactive step will not only relieve immediate financial stress but will also unlock opportunities for growth, savings, and the realization of your most important financial goals. Empower yourself with an easy-to-use spending plan and watch as your financial picture transforms from cloudy to crystal clear.