Managing rental properties, whether a single duplex or a vast portfolio of units, is a dynamic challenge that demands meticulous financial oversight. Without a clear financial roadmap, even the most promising real estate ventures can veer off course, leading to unexpected expenses, missed opportunities, and a significant drain on your time and resources. This is where a robust financial planning tool becomes not just helpful, but absolutely essential for sustainable success.

A well-crafted Property Management Budget Template acts as your financial compass, guiding every decision from routine maintenance to major capital improvements. It provides clarity on income streams, tracks operational costs, and helps forecast future financial health, transforming guesswork into strategic foresight. For landlords, property managers, and real estate investors alike, mastering your property’s finances through a structured budget is the cornerstone of profitability and long-term asset value.

A well-structured budget is more than just a list of numbers; it’s a strategic document that empowers you to make informed decisions, optimize cash flow, and ultimately enhance the profitability of your investments. It serves as an early warning system for potential financial challenges and highlights areas where efficiency can be improved or new revenue streams explored.

Why a Robust Budget is Your Property’s Best Friend

In the world of real estate, surprise costs are a constant threat. From sudden appliance breakdowns to unexpected tenant turnovers, these unbudgeted expenses can quickly erode your profit margins. An effective property budget template provides the foresight needed to anticipate these costs, allocate funds appropriately, and prevent minor issues from becoming major financial headaches. It shifts your approach from reactive problem-solving to proactive financial management.

Moreover, a comprehensive financial plan allows you to visualize your property’s financial trajectory over time. This long-term perspective is crucial for identifying trends, planning for growth, and making strategic investments that will increase your property’s value. It’s about building a stable financial foundation that supports your current operations while paving the way for future expansion and greater returns.

Key Elements of an Effective Property Budget

To truly gain control over your rental property finances, your budgeting tool must encompass all relevant income and expense categories. A detailed property budget template goes beyond basic rent collection and mortgage payments, diving deep into every financial facet of your asset. Understanding these components is the first step toward creating an accurate and actionable financial plan.

Income Streams

This section outlines all money flowing into your property. It’s typically straightforward but can include various sources beyond just rent.

- Rent Revenue: The primary income from tenants.

- Late Fees: Charges for overdue rent payments.

- Application Fees: Non-refundable fees from prospective tenants.

- Pet Fees/Rent: Additional charges for tenants with pets.

- Laundry Income: Revenue from coin-operated or card-operated laundry facilities.

- Parking Fees: Income from designated parking spaces.

- Utility Reimbursements: If tenants reimburse for utilities like water or trash.

Operating Expenses

These are the ongoing costs associated with running and maintaining your property. These can often be overlooked or underestimated.

- Mortgage Payments: Principal and interest on your property loan.

- Property Taxes: Annual or semi-annual taxes assessed by the local government.

- Insurance: Landlord insurance, liability insurance, flood insurance, etc.

- Utilities: Costs for common areas or vacant units (electricity, gas, water, sewer, trash).

- Maintenance & Repairs: Regular upkeep and unexpected repairs (plumbing, electrical, HVAC, landscaping, cleaning).

- Property Management Fees: If you hire a third-party management company.

- Vacancy Costs: Lost rent and utility costs during periods when units are empty.

- Marketing & Advertising: Expenses to find new tenants (online listings, signs).

- Legal & Accounting: Costs for eviction proceedings, lease drafting, or tax preparation.

- Pest Control: Regular treatments or emergency services.

- Supplies: Cleaning supplies, light bulbs, minor repair parts.

Capital Expenditures (CapEx)

These are significant costs for improvements or major repairs that add value to the property or extend its useful life, rather than just maintaining it. They are typically budgeted separately from operating expenses.

- Roof Replacement: A major structural update.

- HVAC System Upgrades: New furnaces or air conditioning units.

- Appliance Replacement: New refrigerators, stoves, dishwashers.

- Major Renovations: Kitchen or bathroom remodels.

- Exterior Painting: A significant aesthetic and protective upgrade.

Reserve Funds

Allocating money for future, unforeseen expenses or planned capital expenditures is crucial. This acts as a safety net.

- Emergency Fund: For unexpected, urgent repairs (e.g., burst pipes).

- CapEx Reserve: For planned long-term capital improvements.

How to Build and Customize Your Budget Template

While a general property budget template provides an excellent starting point, its true power lies in its customization to your specific portfolio and market conditions. Begin by gathering all your financial records from the past year – bank statements, utility bills, repair invoices, and rent rolls. This historical data is invaluable for establishing realistic baseline figures for your income and expenses.

Once you have a clear picture of your past financial performance, you can begin populating your budgeting tool. Don’t shy away from adjusting categories or adding new ones that are unique to your properties. For instance, if you manage a multi-family unit with shared amenities, you might need specific line items for pool maintenance or gym equipment. The goal is to create a financial model that accurately reflects your unique operational landscape.

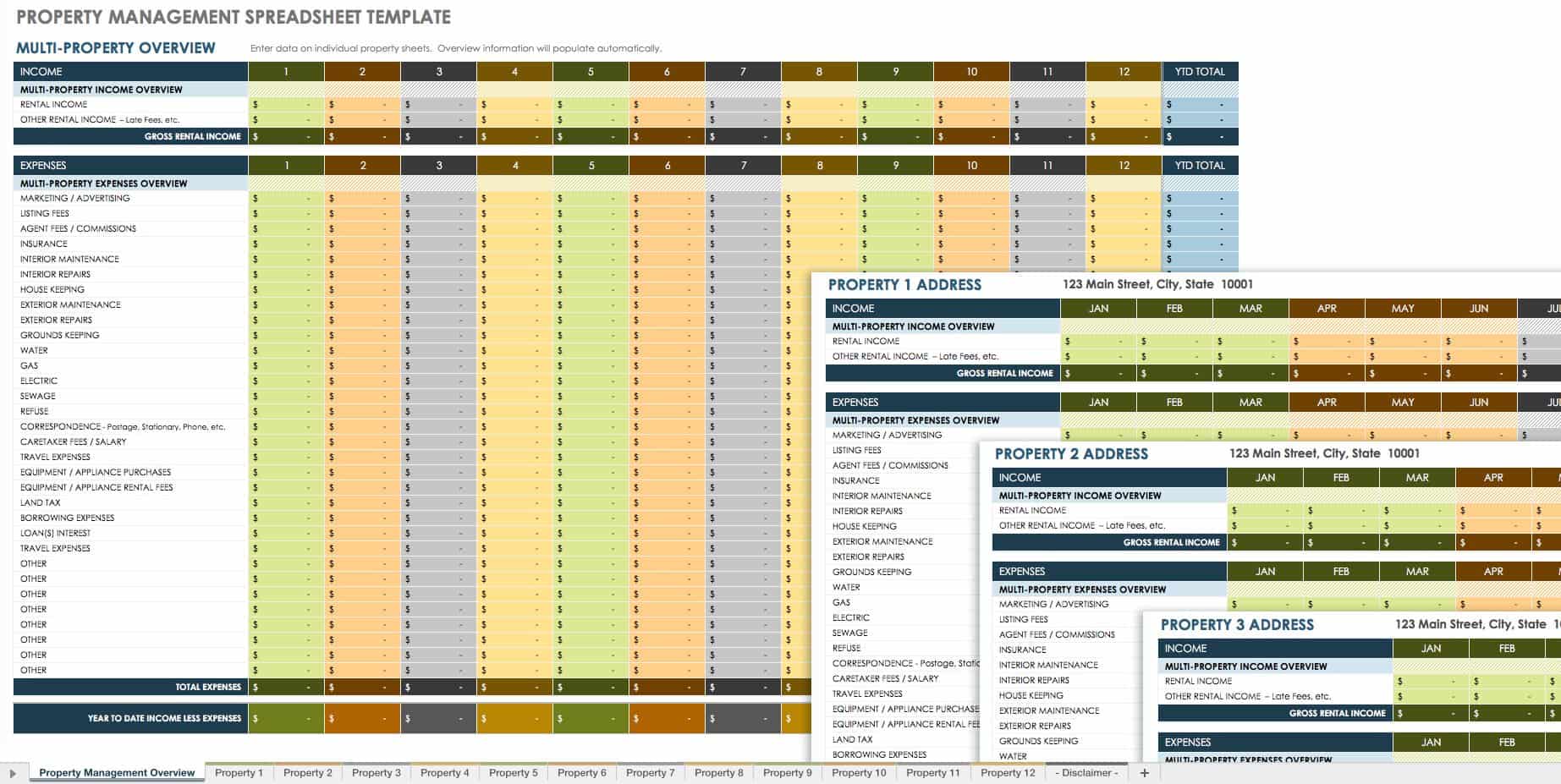

Consider the granularity of your budget. Some prefer a simple annual overview, while others benefit from a detailed monthly breakdown, allowing for closer tracking and more agile adjustments. For landlords managing multiple properties, it can be highly beneficial to create a separate financial plan for each asset, then consolidate them into a master portfolio budget. This approach helps in identifying underperforming properties and optimizing resource allocation across your entire portfolio.

Leveraging Your Budget for Strategic Growth

A finely tuned financial plan is more than just a tracking mechanism; it’s a powerful instrument for strategic planning and growth. By regularly reviewing your property’s financial performance against your budget, you can identify areas for improvement and opportunities for increased revenue. For example, if you consistently see high maintenance costs in a particular category, it might signal the need for a capital investment to upgrade aging infrastructure, which could save money in the long run.

This proactive approach to financial management also enables you to forecast cash flow with greater accuracy, making it easier to plan for future acquisitions or expansion. Knowing your precise financial position allows you to confidently assess new investment opportunities, understanding their potential impact on your overall portfolio. It transforms guesswork into data-driven decision-making, fostering intelligent growth for your real estate investments.

Tips for Maintaining Budgetary Discipline

Creating a budget is only the first step; the real challenge lies in consistently adhering to it and making necessary adjustments. Regular review is paramount. Schedule a monthly or quarterly review of your actual income and expenses against your budgeted figures. This practice helps you catch discrepancies early and understand the “why” behind any variances.

- Regular Review: Compare actuals to budgeted figures monthly or quarterly.

- Categorize Everything: Ensure every transaction is assigned to the correct income or expense category for accurate tracking.

- Be Realistic: Avoid overly optimistic income projections or underestimating expenses. Always build in a contingency fund.

- Automate Where Possible: Use accounting software or online tools that can automatically pull bank transactions and help with categorization.

- Adjust & Adapt: Your financial plan is a living document. Be prepared to modify it as market conditions change, properties age, or new regulations emerge.

- Separate Finances: Keep property finances entirely separate from personal finances to avoid confusion and ensure clear tracking.

- Seek Professional Advice: For complex situations or tax implications, consult with a financial advisor or accountant.

Frequently Asked Questions

Why is a budget essential even for a single rental property?

Even a single property involves multiple income streams and expenses that, if not tracked, can quickly spiral out of control. A budget provides a clear financial picture, helps forecast cash flow, and ensures profitability by preventing unexpected costs from eroding your investment. It’s about proactive financial health, not just reactive damage control.

How often should I update my property’s financial plan?

While an annual budget sets the overarching financial goals, it’s highly recommended to review and update your detailed income and expense sheet at least monthly. This allows you to catch discrepancies early, make timely adjustments, and ensure your financial model remains accurate and relevant to current market conditions and property performance.

What’s the difference between operating expenses and capital expenditures in a budget?

Operating expenses are the ongoing costs of running and maintaining the property, like utilities, routine repairs, and property management fees. Capital expenditures, on the other hand, are significant investments that improve the property or extend its useful life, such as a new roof, HVAC system, or major renovations. Operating expenses are typically expensed annually, while CapEx is depreciated over a longer period for tax purposes and planned for with separate reserve funds.

Can this type of budgeting tool be used for commercial properties as well?

Absolutely. While the specific categories might differ (e.g., common area maintenance (CAM) fees for commercial tenants), the fundamental principles of tracking income, managing expenses, and planning for capital improvements remain the same. A well-designed financial model can be adapted to suit various types of real estate, from residential to commercial portfolios.

What if my property experiences an unexpected major expense?

This is precisely why a robust budget includes a reserve fund. By consistently allocating a portion of your income into an emergency or capital expenditure reserve, you create a financial buffer. When an unexpected major expense arises, you can draw from this fund without disrupting your overall cash flow or needing to scramble for funds, ensuring your investment remains stable.

Taking control of your property’s financial future doesn’t have to be an intimidating task. With the right Property Management Budget Template, you gain an invaluable tool for clarity, control, and confidence. It transforms the complexities of real estate finance into an organized, actionable plan, allowing you to focus on growth and tenant satisfaction rather than financial surprises.

Embrace the power of proactive financial management today. By meticulously tracking your income and expenses, planning for the future, and regularly reviewing your performance, you are not just managing a property; you are building a resilient, profitable real estate venture that stands the test of time. Start customizing your financial planning tool now and unlock the full potential of your investments.