In today’s fast-paced world, clear, concise, and credible communication is more vital than ever. Whether you’re applying for an apartment, seeking a loan, or navigating visa requirements, there’s a strong likelihood you’ll eventually need to provide official documentation of your earnings. This is where a well-crafted proof of income letter becomes indispensable – a formal document that validates your financial standing to external parties. Its purpose is straightforward: to offer an authoritative snapshot of your regular income, ensuring transparency and building trust with the recipient.

For individuals, small business owners, and human resources professionals alike, the creation of such a letter can often feel like a daunting task, fraught with the pressure of getting every detail precisely right. However, the process doesn’t have to be cumbersome. Utilizing a reliable proof of income letter template can streamline this essential task, ensuring accuracy, professionalism, and compliance with common expectations. It serves as a foundational tool, offering a structured approach to what could otherwise be a time-consuming and error-prone endeavor, ultimately benefiting anyone who needs to present their financial reality clearly and confidently.

The Imperative of Professional Correspondence

In an age dominated by digital interactions, the impact of a well-written and properly formatted letter remains profound. A professional letter, especially one concerning sensitive financial details, conveys an immediate sense of credibility and attention to detail. It speaks volumes about the sender’s professionalism and respect for the recipient, whether that’s a landlord, a bank, or an immigration officer. Conversely, a poorly constructed or error-ridden document can raise red flags, leading to delays, requests for additional information, or even outright rejection.

Beyond mere aesthetics, the structure and clarity of your correspondence dictate how effectively your message is received and understood. When you present a meticulously organized document, you minimize ambiguity and leave no room for misinterpretation of critical data. This is particularly crucial when discussing income, where precision can significantly influence the outcome of your application or request. A polished letter demonstrates that you take your obligations seriously, fostering trust and smoothing the path forward in various personal and professional dealings.

Advantages of a Standardized Document Framework

The decision to leverage a ready-made letter template, particularly for something as critical as financial verification, brings a multitude of benefits. Primarily, it offers an immediate solution to the common challenge of starting from a blank page. Instead of expending valuable time on layout and basic phrasing, you can focus directly on inputting the specific data required. This dramatically reduces the time commitment involved, allowing you to address other pressing tasks.

Moreover, a standardized document framework ensures consistency in presentation and content. It guarantees that all necessary components are included, minimizing the risk of omitting vital information that could lead to delays. For organizations, it promotes a unified brand image across all outgoing correspondence. For individuals, it provides confidence that their communication adheres to accepted professional standards. This inherent consistency, combined with error reduction, makes a proof of income letter template an invaluable asset for efficient and effective communication.

Adapting Your Letter for Diverse Requirements

While the core need for a proof of income letter template revolves around financial verification, the principles of a well-designed template extend to a broader spectrum of formal communication. The flexibility inherent in a robust template means it can be readily customized for various purposes or situations. For instance, the structural elements you’d find in a proof of income document—clear sender and recipient details, a specific subject line, logical body paragraphs, and a professional closing—are universal.

Imagine needing to draft a formal request for information, a recommendation for a colleague, or even a notice of a policy change. Each of these scenarios benefits from a structured approach that a versatile template provides. You can easily modify the internal content, tailoring the specific details and call to action while retaining the professional layout. For instance, in a job application cover letter, you’d substitute financial data with qualifications and career goals. This adaptability makes mastering one strong letter template an investment in efficient communication across many formal contexts, ensuring your message is always presented with clarity and professionalism, whether it’s for income verification or other critical correspondence.

Essential Components of Any Formal Letter

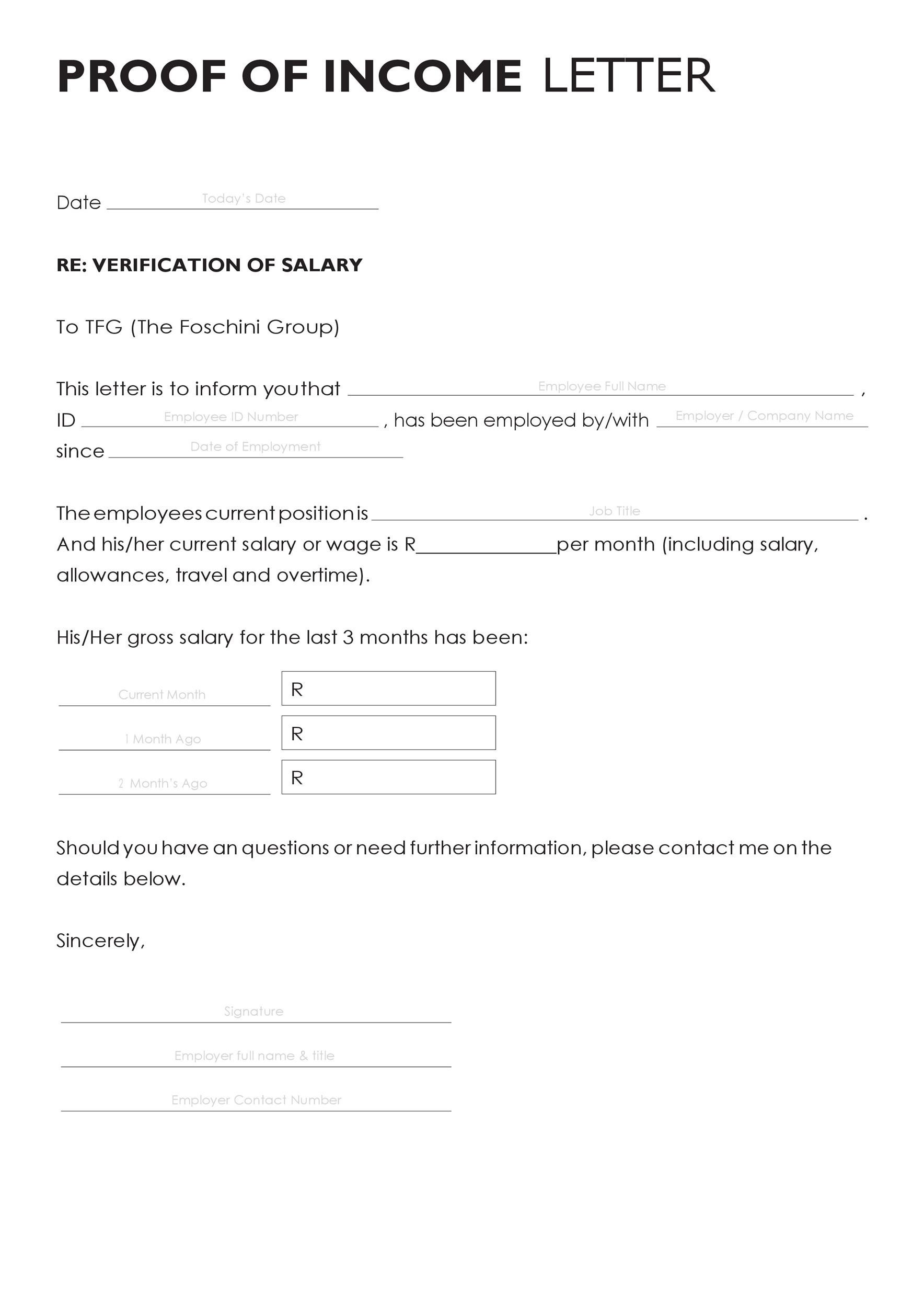

Regardless of its specific purpose, every effective formal letter, including a robust proof of income letter template, is built upon a foundation of key sections designed to convey information clearly and professionally. Ensuring each of these elements is present and correctly formatted is paramount for the recipient to easily understand and process your message.

- Sender’s Contact Information: This typically includes your full name, address, phone number, and email. For businesses, this would be the company name and address.

- Date: Crucial for context, indicating when the letter was written.

- Recipient’s Contact Information: The full name, title, and address of the person or organization receiving the letter. Accuracy here is vital for direct delivery.

- Salutation: A professional greeting, typically "Dear Mr./Ms./Dr. [Last Name]" or "Dear [Title]," followed by a colon.

- Subject Line: A concise, clear statement of the letter’s purpose (e.g., "Proof of Income – [Your Name]"). This helps the recipient quickly categorize and prioritize the correspondence.

- Opening Paragraph: Briefly states the reason for the letter and immediately addresses the subject. For a proof of income letter, it would typically state that the letter serves as official documentation of your earnings.

- Body Paragraphs: This is where the main information is detailed. For income proof, this section would include specifics about employment status, income figures (salary, wages, commissions), frequency of pay, and the period covered. It might also include employer contact information for verification. Ensure clarity and provide only necessary, factual data.

- Closing Paragraph: Briefly reiterates the main point or offers further assistance. For a proof of income letter, this might invite the recipient to contact the sender for additional verification.

- Professional Closing: A formal closing such as "Sincerely," "Regards," or "Respectfully," followed by a comma.

- Signature: Your handwritten signature (for printed letters) or a digital signature.

- Typed Name: Your full typed name below the signature.

- Title/Position (Optional but Recommended): Your job title or position, especially if the letter is from an employer or certifying authority.

- Enclosures (Optional): If you are attaching supporting documents (e.g., pay stubs, W-2s), list them here as "Enclosures: [Number]" or "Enclosures: [List of documents]."

Mastering Presentation: Tone, Formatting, and Delivery

The effectiveness of any formal correspondence isn’t just about what you say, but also how you say it and how it looks. Achieving the right tone, employing appropriate formatting, and ensuring a professional presentation are critical, whether your document is destined for digital transmission or a printed page.

Tone: Maintain a professional, respectful, and objective tone throughout the letter. Avoid overly casual language, slang, or emotional expressions. The goal is to convey information clearly and confidently. For a proof of income, this means presenting factual data without embellishment or apology. Be concise and direct, ensuring every word contributes to the letter’s purpose.

Formatting:

- Font: Choose a clean, readable font like Arial, Calibri, or Times New Roman, typically in 10-12 point size.

- Spacing: Use single spacing for body paragraphs, with a double space between paragraphs.

- Margins: Standard margins (1-inch top, bottom, and sides) contribute to a balanced and professional layout.

- Alignment: Left-align all text.

- Clarity: Use short, focused paragraphs. Long blocks of text can be daunting and reduce readability. Headings or subheadings can be used within the body if the letter is particularly complex or lengthy, though typically not needed for a standard proof of income letter.

Presentation (Digital and Printable Versions):

- Digital: Always save and send your letter as a PDF. This preserves your formatting, prevents accidental edits, and ensures it looks the same on any device. Ensure the file name is professional and descriptive (e.g., "ProofOfIncome_JohnDoe_2023.pdf").

- Printable: If the letter is to be printed, use high-quality paper (e.g., 20-24 lb bond) for a substantial feel. Print on a laser printer for crisp text. Ensure your signature is clearly legible and in blue or black ink.

By paying meticulous attention to these details, you elevate your communication from a mere document to a powerful tool that leaves a lasting positive impression. A well-presented letter underscores your professionalism and ensures your important message receives the attention and respect it deserves.

In an era where efficiency and clear communication are paramount, the strategic use of a robust proof of income letter template stands out as an indispensable practice. It not only simplifies the often-complex task of financial verification but also significantly enhances the perception of your professionalism. By providing a ready-made structure, these templates empower individuals and organizations to produce polished, accurate, and credible documentation with minimal effort.

Embracing such a template means investing in a communication strategy that prioritizes precision, consistency, and professional presentation. It’s about saving valuable time while simultaneously upholding the highest standards of written correspondence. When you present a carefully constructed document, you convey respect for the recipient and confidence in your own information, facilitating smoother transactions and more successful outcomes in every facet of life where financial transparency is required.