In the competitive landscapes of real estate, business acquisitions, and high-value transactions, the ability to quickly and clearly demonstrate financial capacity is not just an advantage—it’s often a necessity. Whether you’re making an offer on a commercial property, bidding for a significant contract, or proving your eligibility for an investor visa, a "proof of funds" letter serves as a crucial document. It’s a formal declaration from a financial institution, or sometimes a certified financial advisor, confirming the availability of specific funds to a particular individual or entity. This document acts as a verifiable statement, assuring a potential seller or business partner that you have the financial backing required to proceed with a proposed deal.

For professionals in business and communication, understanding the nuances of such critical correspondence is paramount. A well-crafted proof of funds letter template doesn’t just expedite a transaction; it builds trust, conveys professionalism, and minimizes misunderstandings. It’s an indispensable tool for entrepreneurs, investors, legal professionals, and anyone involved in significant financial dealings where financial credibility needs to be established upfront. Having a reliable, customizable format at your fingertips ensures that when the opportune moment arises, you can present your financial bona fides with confidence and clarity, without delays or errors that could jeopardize a deal.

Why Precision in Financial Correspondence Matters

In today’s fast-paced business environment, every piece of communication reflects on your professionalism and attention to detail. This holds especially true for documents affirming financial capability. A poorly written or sloppily formatted letter can raise immediate red flags, casting doubt on your credibility, even if your financial standing is impeccable. Recipients, whether they are real estate agents, business brokers, or government officials, expect clear, unambiguous, and formally presented documentation. The stakes are often high; a miscommunication in a proof of funds letter could lead to a lost opportunity, a delayed closing, or even legal complications.

Beyond mere presentation, the accuracy and comprehensive nature of the content are vital. This document isn’t just a formality; it’s a direct declaration of your financial readiness. Ensuring that all necessary details are included, correctly stated, and align with industry standards fosters confidence in the sender. It demonstrates that you understand the gravity of the transaction and are prepared to engage on professional terms. A meticulously prepared financial statement, therefore, isn’t just about showing money; it’s about showcasing your commitment, trustworthiness, and meticulous approach to significant ventures.

The Strategic Advantage of a Pre-Designed Format

The beauty of utilizing a ready-made proof of funds letter template lies in its inherent efficiency and reliability. Crafting such a document from scratch can be time-consuming, requiring careful consideration of structure, language, and legal implications. A template eliminates this initial hurdle, providing a robust framework that has been designed with best practices in mind. This means less time spent on drafting and more time focused on the strategic aspects of your deal. Moreover, using a template significantly reduces the risk of overlooking critical information or making formatting errors that could undermine the letter’s efficacy.

Furthermore, a template ensures consistency across all your financial correspondence. This is particularly beneficial for businesses or individuals who frequently engage in transactions requiring such documentation. Maintaining a uniform appearance and information structure enhances your professional image and reinforces your brand’s commitment to clarity and precision. It also streamlines the review process for the recipient, as they become accustomed to finding information in predictable places. Ultimately, a reliable template serves as a powerful asset, allowing you to react quickly to opportunities while maintaining the highest standards of professionalism.

Tailoring Your Financial Verification for Diverse Needs

While the core purpose of demonstrating available funds remains constant, the specific context can vary widely, necessitating careful personalization. A generic proof of funds letter template might provide a starting point, but it’s crucial to adapt its content and tone to suit the particular situation. For instance, a letter for a real estate purchase might emphasize liquid assets immediately accessible for a down payment, whereas one for a business acquisition might highlight broader capital reserves and investment accounts. The recipient’s specific requirements, often outlined in the deal’s preliminary stages, should guide your customization efforts.

Consider the audience: a private seller might appreciate a more direct and concise statement, while a large corporate entity or a government agency might require more extensive detail and formal language. The purpose of the funds should be clearly, but often generally, stated. For example, rather than specifying the exact property address, one might state "for the acquisition of real property" or "towards a business investment opportunity." This personalization ensures the letter is not just a generic statement but a highly relevant and impactful piece of communication tailored to the specific transaction at hand, boosting its effectiveness and reducing the need for follow-up inquiries.

Essential Elements of a Financial Verification Statement

Every effective financial verification letter, including a robust proof of funds letter template, must contain specific key components to be considered credible and complete. Omitting any of these could lead to delays or render the document ineffective. These elements ensure clarity, authenticity, and legal compliance.

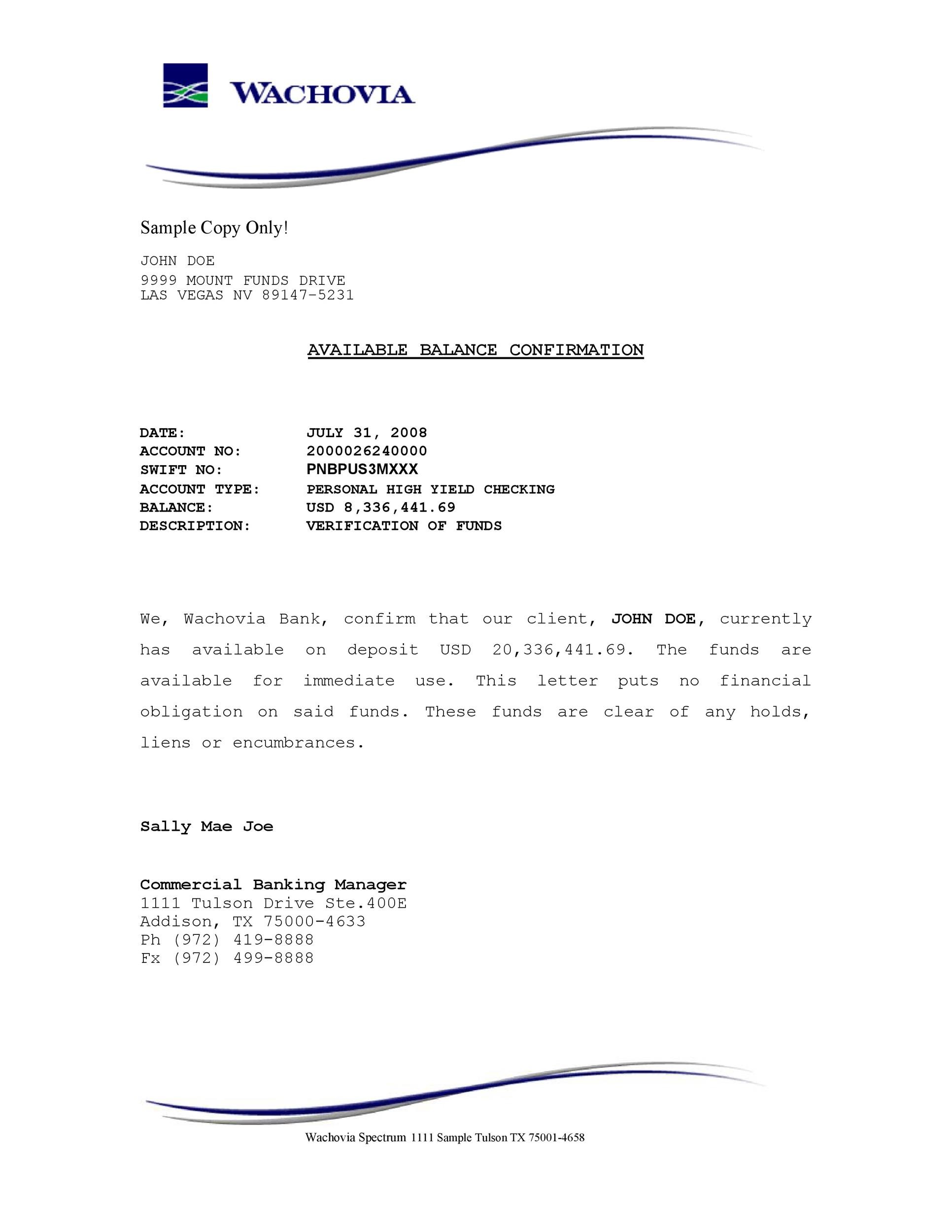

- Sender’s Contact Information: Full legal name of the individual or entity providing the proof, complete address, phone number, and email. If it’s from a financial institution, their official letterhead and branch contact details are crucial.

- Date: The exact date the letter is issued. This is vital as financial standings can change, and the recipient needs to know the currency of the information.

- Recipient’s Contact Information: The full name and address of the individual or entity to whom the letter is addressed. Be precise to avoid misdirection.

- Clear Subject Line: A concise, descriptive subject line, such as "Proof of Funds for [Your Name/Company Name]" or "Financial Verification Letter."

- Formal Salutation: Address the recipient formally (e.g., "Dear Mr./Ms. [Last Name]," or "To Whom It May Concern," if the recipient is unknown).

- Statement of Funds: A clear, unambiguous declaration of the available funds, typically stating the amount in both numbers and words, and specifying the currency.

- Account Details (General): While specific account numbers are often omitted for security, the letter should confirm the funds are held in verifiable accounts (e.g., checking, savings, brokerage).

- Financial Institution Contact: If issued by a bank, it must include the bank’s official name, address, and the contact information of the branch or officer who can verify the funds.

- Purpose of Funds (Optional but Recommended): A brief, general statement indicating what the funds are intended for (e.g., "for the purchase of real estate," "to facilitate a business acquisition").

- Disclaimers/Limitations: Any necessary legal disclaimers regarding the funds’ availability (e.g., subject to prior sales, withdrawal, or investment performance).

- Official Signature: A handwritten or authorized digital signature of the financial institution representative or the individual/entity sending the letter, along with their printed name and title.

- Official Stamp/Seal: For letters from financial institutions, an official bank stamp or seal adds an extra layer of authenticity.

Ensuring each of these parts is accurately and professionally presented will lend significant weight to your financial verification.

Crafting Your Message: Tone, Layout, and Presentation

Beyond the raw data, how you present your proof of funds letter significantly influences its reception. The tone should consistently be professional, authoritative, and confident, yet always polite. Avoid overly casual language or colloquialisms. The goal is to convey reliability and seriousness of intent. Clarity is paramount; use straightforward language, eschewing jargon where simpler terms suffice, ensuring that the recipient can easily understand the statement without ambiguity. Conciseness is also key; while comprehensive, the letter should get straight to the point without unnecessary elaboration, respecting the recipient’s time.

Formatting and layout play a crucial role in readability and visual professionalism. Use a clean, uncluttered design with ample white space. Employ a standard, legible font (e.g., Arial, Calibri, Times New Roman) in a comfortable size (10-12 points). Headings and bullet points, as demonstrated here, can break up text and make information more digestible. For digital versions, ensure the document is saved as a PDF to preserve formatting and prevent unauthorized alterations. When a printable version is required, use high-quality paper, preferably letterhead, for a tangible sense of professionalism. Always proofread meticulously for any grammatical errors, typos, or inconsistencies before sending. The final presentation should reflect the importance of the financial information it contains, demonstrating your meticulousness and respect for the recipient.

The ability to quickly and effectively communicate financial readiness is a cornerstone of success in today’s demanding business environment. Leveraging a meticulously designed proof of funds letter template provides a distinct advantage, streamlining your communication process while upholding the highest standards of professionalism. It’s more than just a document; it’s a statement of capability, trustworthiness, and efficiency, allowing you to respond to opportunities with confidence and precision.

By integrating a polished, ready-to-use proof of funds letter template into your communication toolkit, you empower yourself to navigate complex financial transactions with greater ease and impact. It ensures that your financial declarations are always clear, credible, and consistent, solidifying your reputation as a reliable and serious player. This strategic approach ultimately saves valuable time, minimizes potential missteps, and positions you for successful outcomes in all your significant ventures.