In the intricate dance of modern commerce and personal finance, commitments are made, and obligations are formed. While a handshake once sufficed in simpler times, today’s complex transactions demand a higher level of clarity and legal certainty. This is where a robust promise to pay agreement template becomes not just a convenience, but an indispensable tool for protecting interests, fostering trust, and ensuring accountability between parties. It serves as the bedrock for any arrangement where one party owes another money and a structured repayment plan is necessary.

Whether you’re a small business extending credit to a client, a financial institution outlining loan terms, or an individual formalizing a personal debt repayment, having a clear, legally sound document is paramount. This type of agreement provides a written record of the terms and conditions under which a debt will be repaid, leaving no room for ambiguity or misunderstanding. For anyone navigating the landscape of debt management, lending, or even settling disputes, leveraging a well-crafted template streamlines the process, saves valuable time, and significantly mitigates potential risks.

The Indispensable Role of Written Commitments Today

In an era defined by rapid information flow and increasing legal complexities, relying on verbal agreements is an invitation to dispute and potential financial loss. A written promise to pay agreement establishes a clear, undeniable record of mutual understanding and commitment. This clarity is crucial for both the party owed money (the creditor) and the party making the payment (the debtor), as it outlines specific expectations and consequences for non-compliance.

Beyond simply proving a debt exists, a formal document addresses the specifics of repayment, which are often the source of contention. It acts as a legal anchor, providing a concrete reference point if questions arise, or if enforcement actions become necessary. For businesses, it protects cash flow and assets, while for individuals, it can prevent strained relationships and provide a structured path to resolving financial obligations without unnecessary stress.

Leveraging a Standardized Framework for Protection and Efficiency

The primary benefit of utilizing a promise to pay agreement template is the inherent protection it offers to both the creditor and the debtor. For the creditor, it provides a legally enforceable document outlining the terms of repayment, interest, late fees, and default conditions, ensuring a clear path to recovery if payments are not made as agreed. This minimizes financial risk and provides peace of mind.

Conversely, for the debtor, the agreement clearly specifies the exact amount owed, the payment schedule, and any applicable interest or fees, preventing unexpected demands or changes to the terms. It offers a structured and manageable way to address a financial obligation, preventing escalating debt or misunderstandings. Furthermore, a template saves considerable time and resources that would otherwise be spent drafting a document from scratch, ensuring consistency and professionalism across all agreements.

Tailoring the Document for Diverse Needs

One of the most powerful features of a comprehensive promise to pay agreement template is its inherent adaptability. While the core structure remains consistent, the details can be extensively customized to suit a wide array of industries, personal situations, and specific financial arrangements. This flexibility makes it an invaluable asset for various stakeholders, from large corporations to small family businesses and individuals.

For instance, a template used for a business-to-business (B2B) installment plan might include clauses related to commercial warranties or specific product delivery milestones. In contrast, an agreement for a personal loan between family members might emphasize flexible repayment options and explicitly waive interest. Service-based businesses could integrate performance metrics or service delivery dates as conditions. By allowing for the adjustment of payment schedules, interest rates, collateral requirements, default conditions, and governing law, the template ensures that each agreement is uniquely suited to its purpose without requiring a complete redraft every time. This customization capability transforms a general document into a precise, legally sound instrument tailored to specific contractual demands.

Core Components of a Robust Payment Commitment

A truly effective promise to pay agreement template must contain several key sections to ensure its enforceability and clarity. These elements are the building blocks that define the nature of the debt and the terms of its repayment, leaving no stone unturned in establishing mutual understanding.

Here are the essential clauses every agreement should contain:

- Identification of Parties: Clearly state the full legal names and addresses of both the debtor (the party promising to pay) and the creditor (the party to whom payment is owed).

- Acknowledgement of Debt: Explicitly state the principal amount of the debt being acknowledged, often including its origin (e.g., unpaid invoice, personal loan, settlement amount).

- Payment Schedule: Detail the specific dates, amounts, and frequency of payments (e.g., weekly, monthly installments, lump sum).

- Interest Rate: If applicable, clearly state the annual interest rate, how it is calculated, and when it accrues.

- Late Payment Penalties: Outline any fees or additional interest that will be charged for missed or late payments.

- Default Clause: Define what constitutes a default (e.g., missing a payment, bankruptcy) and the consequences, such as the entire outstanding balance becoming immediately due and payable (acceleration clause).

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for legal compliance and dispute resolution.

- Waiver of Rights: Sometimes includes clauses where the debtor waives certain rights, such as notice of demand for payment.

- Entire Agreement Clause: States that the written document constitutes the complete and final agreement between the parties, superseding all prior oral or written communications.

- Severability Clause: Ensures that if any part of the agreement is found to be unenforceable, the remaining provisions remain valid and binding.

- Amendment Clause: Specifies the process for making future changes to the agreement, typically requiring written consent from both parties.

- Attorneys’ Fees: Stipulates whether the defaulting party will be responsible for the non-defaulting party’s legal fees in case of enforcement.

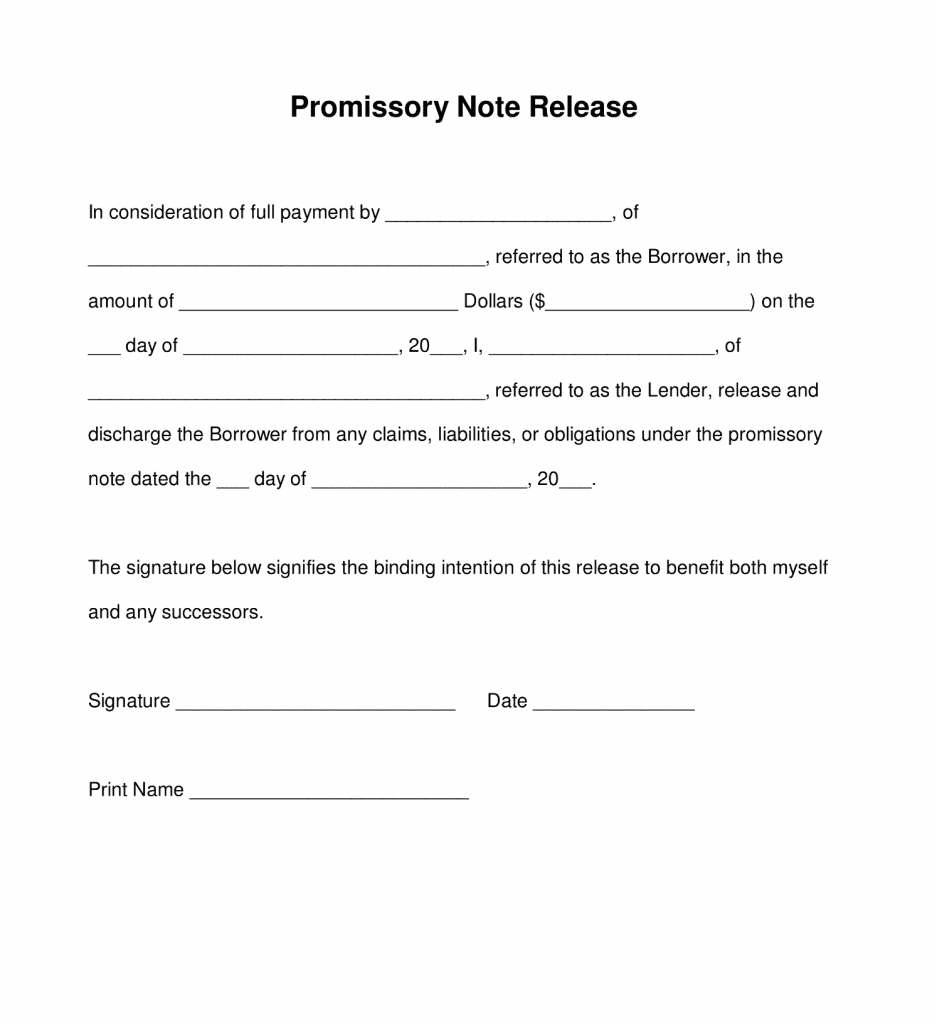

- Signatures: Spaces for the dated signatures of both the debtor and creditor, often with witness signatures or notarization for added legal weight.

Enhancing Readability and Usability for All Parties

Beyond the legal substance, the practical presentation of a promise to pay agreement template significantly impacts its effectiveness. A well-formatted document is not only easier to understand but also projects professionalism and reduces the likelihood of misunderstandings. Clear readability ensures that both parties fully comprehend their obligations and rights.

For optimal usability, consider the following practical tips. Use clear, concise language, avoiding overly technical jargon where simpler terms suffice. Organize the document with logical headings and subheadings, employing bullet points or numbered lists for complex details like payment schedules or default conditions. Ample white space around text blocks and between paragraphs improves visual flow, making the document less daunting. When creating a digital version, ensure it’s easily editable in common software (like Microsoft Word or Google Docs) while maintaining its structure. For print, use a legible font size and ensure margins are sufficient for binding or hole-punching. Including a clear table of contents, especially for longer documents, can further enhance navigation. Finally, ensure spaces for initials on each page, in addition to full signatures at the end, to confirm that all parties have reviewed and agreed to every provision.

In an environment where financial commitments drive much of our economic activity, a reliable promise to pay agreement template is more than just a document; it’s a strategic asset. It serves as a bulwark against potential disputes, offering a clear, structured framework for managing debt and ensuring all parties understand their roles and responsibilities. Its power lies not only in its legal enforceability but also in its ability to foster transparent communication and build trust.

By leveraging such a template, individuals and businesses alike can navigate the complexities of financial obligations with confidence and clarity. It provides a professional, time-saving solution that safeguards interests, minimizes risks, and ultimately strengthens the foundation of any financial arrangement. Investing in a robust promise to pay agreement template is, therefore, an investment in peace of mind and the secure, predictable execution of financial commitments.