In the dynamic landscape of modern finance, businesses constantly seek innovative funding solutions that align with their growth trajectories without disproportionately diluting equity. One such sophisticated instrument gaining traction is the profit participation loan. This hybrid debt-equity structure offers a compelling alternative for both emerging enterprises and established companies seeking capital, as well as for lenders aiming for returns beyond traditional interest rates. Understanding a profit participation loan agreement template is crucial for anyone navigating these complex financial arrangements.

This article delves into the intricacies of these agreements, offering a comprehensive guide for entrepreneurs, investors, legal professionals, and financial advisors. It aims to demystify the core components, highlight their strategic value, and provide insights into crafting a robust, legally sound document that protects all parties involved. Whether you’re a startup looking for non-dilutive capital or an investor seeking performance-based returns, a well-structured agreement is your indispensable foundation.

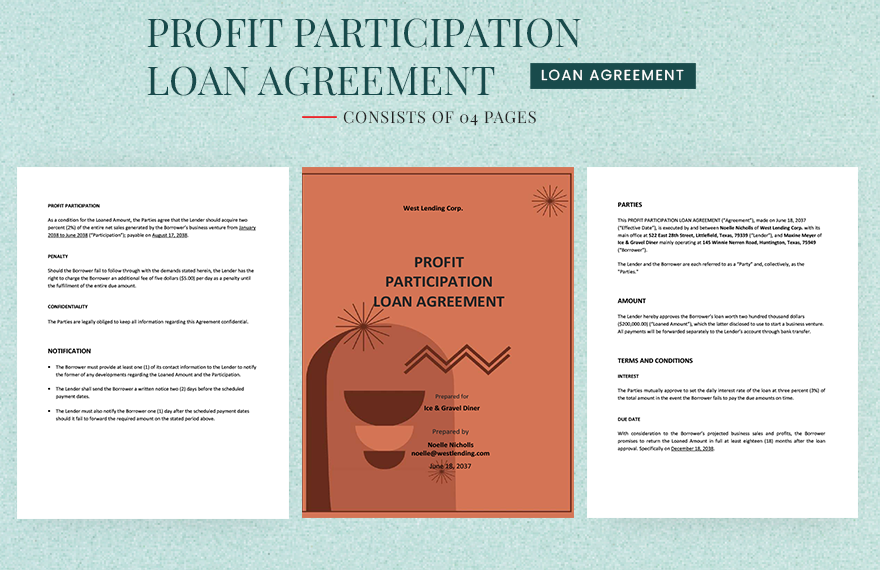

The Indispensable Value of a Formal Contract

In today’s fast-paced business environment, the importance of a clear, written agreement cannot be overstated. Verbal understandings, while seemingly convenient in their inception, invariably lead to ambiguity and potential disputes down the line. A formal contract serves as the definitive record of all agreed-upon terms, expectations, and obligations, providing a crucial framework for collaboration and recourse.

For sophisticated financial instruments like profit participation loans, where the lender’s return is tied to the borrower’s performance, precise definitions and stipulations are paramount. A meticulously drafted document mitigates misunderstandings, clarifies the mechanism for profit sharing, and establishes a clear path for resolution should disagreements arise. It underscores professionalism and provides a solid basis for any future legal or financial due diligence.

Benefits of a Structured Agreement Template

Leveraging a robust profit participation loan agreement template offers significant advantages for both borrowers and lenders. Firstly, it provides a foundational framework, saving considerable time and legal costs that would otherwise be spent drafting an agreement from scratch. This efficiency allows parties to focus more on the deal’s substance rather than its form.

Beyond mere convenience, a well-designed template ensures that critical legal and financial considerations are not overlooked. It acts as a checklist, guiding parties through essential clauses and protections, thereby reducing the risk of costly omissions. For borrowers, it clarifies the extent of the lender’s participation and any operational covenants. For lenders, it secures their right to share in the business’s success and defines protective measures in case of underperformance or default. The availability of such a template streamlines negotiations, fosters transparency, and ultimately contributes to a more secure and mutually beneficial financing relationship.

Tailoring the Document for Diverse Scenarios

While a core template provides an excellent starting point, its true value lies in its adaptability. The financial structures and operational realities of different industries and business stages vary significantly, necessitating a flexible approach to documentation. A profit participation loan agreement template can be customized to suit a wide array of industries, from high-growth tech startups and creative agencies to manufacturing firms and real estate ventures.

For instance, a tech company might define "profit" based on specific revenue milestones or SaaS subscription growth, while a real estate project might tie participation to gross rental income or sale proceeds. The template can be adjusted to reflect different repayment triggers, such as an acquisition, an IPO, or achieving certain profitability thresholds. It also allows for variations in participation rates, caps, and floors, enabling a bespoke fit for each unique deal. This flexibility ensures the agreement remains relevant and enforceable, regardless of the specific business model or market conditions.

Key Components of a Comprehensive Agreement

A robust profit participation loan agreement must encompass several essential clauses to ensure clarity, enforceability, and protection for all parties. These elements form the backbone of the entire financial arrangement:

- Parties and Recitals: Clearly identify the borrower and the lender, along with a brief background explaining the purpose of the agreement.

- Loan Amount and Disbursement: Detail the principal amount of the loan, the currency, and the schedule or conditions under which funds will be disbursed.

- Repayment Terms: Specify the principal repayment schedule, whether fixed installments, balloon payments, or contingent on certain events.

- Interest: Outline any traditional interest component (fixed or variable rate), how it accrues, and when it is payable.

- Profit Participation Clause: This is the core of the agreement. It must explicitly define:

- "Profit" Definition: Crucially, specify what constitutes "profit" for the purpose of participation (e.g., net profit, gross revenue, EBITDA, specific project income). This definition should be precise and unambiguous.

- Calculation Methodology: Detail how the participation amount will be calculated (e.g., a percentage of defined profit, a tiered structure).

- Triggers and Frequency: When does participation activate, and how often will payments be made (monthly, quarterly, annually)?

- Caps and Floors: Any maximum or minimum participation amounts, or total return caps for the lender.

- Reporting Requirements: Borrower’s obligation to provide financial statements, reports, and other data necessary to calculate participation.

- Representations and Warranties: Statements of fact made by both parties, confirming their legal capacity, authority, and the accuracy of information provided.

- Covenants: Promises made by the borrower, such as affirmative covenants (e.g., maintaining insurance, providing financial reports) and negative covenants (e.g., not incurring additional debt beyond a certain threshold, not selling assets without consent).

- Events of Default and Remedies: Clearly define what constitutes a default (e.g., non-payment, breach of covenants) and the remedies available to the non-defaulting party, including acceleration of the loan.

- Confidentiality: Provisions ensuring the protection of sensitive business and financial information exchanged between the parties.

- Indemnification: Clauses specifying how losses or liabilities arising from certain events will be allocated between the parties.

- Governing Law and Jurisdiction: Identify the state or country whose laws will govern the interpretation and enforcement of the agreement, and the venue for dispute resolution.

- Notices: How formal communications between the parties should be delivered.

- Assignment: Conditions under which either party can assign their rights or obligations under the agreement to a third party.

- Miscellaneous Provisions: Boilerplate clauses such as entire agreement, severability, waiver, and amendments.

- Signatures: Spaces for authorized representatives of both parties to execute the agreement, often with a witness or notarization.

Ensuring a comprehensive profit participation loan agreement template covers all these bases is essential for preventing future disagreements and safeguarding the interests of both the borrower and the lender.

Practical Tips for Document Formatting and Usability

Beyond the legal substance, the practical presentation of a financial agreement significantly impacts its usability and readability. Whether for print or digital distribution, a well-formatted document enhances comprehension and professionalism. Start by employing clear, concise language, avoiding jargon where simpler terms suffice. When technical terms are necessary, ensure they are thoroughly defined in a dedicated "Definitions" section at the beginning of the document.

Use consistent headings and subheadings (<h2>, <h3>) to break up dense text and guide the reader through the various clauses. Employ bullet points or numbered lists for enumeration, such as outlining events of default or reporting requirements, as this improves scannability. For complex calculations or schedules, consider integrating appendices or exhibits, referencing them clearly within the main body of the text. Ensure adequate white space around text and between paragraphs to prevent an overwhelming appearance. For digital use, consider creating a navigable PDF with bookmarks, allowing users to quickly jump to specific sections. Finally, always include a version control mechanism, especially if the document undergoes multiple rounds of revisions, to ensure everyone is working from the latest iteration.

A Strategic Tool for Modern Finance

In an increasingly complex financial world, the strategic use of a profit participation loan agreement template offers an invaluable solution for securing innovative funding and structuring mutually beneficial investment opportunities. It empowers businesses to access capital without excessive equity dilution, while providing lenders with a mechanism to share in the growth and success of promising ventures. This approach fosters a partnership where both parties are intrinsically motivated by the borrower’s performance.

By providing a clear, comprehensive, and legally sound foundation, such a template minimizes potential disputes, clarifies expectations, and streamlines the entire negotiation and documentation process. It represents a significant time-saver and a crucial risk mitigation tool, allowing parties to focus their energy on executing business strategies and achieving financial objectives. Ultimately, embracing a well-crafted agreement is a mark of professional diligence, paving the way for successful collaborations and sustained growth in today’s competitive marketplace.